You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2024 U.S. Presidential General Election Thread

- Thread starter FAH1223

- Start date

More options

Who Replied?The_Dread_Dormammu

All Star

Reminds me of homie locked in The Bushes who is constantly posting and talking to himself…

The axe murderer

For I am death and I ride on a pale horse

Saysumthinfunnymike

VOTE!!!

Well in fairness.... you heard Trump. "Everyone knows us already..."

The axe murderer

For I am death and I ride on a pale horse

Mandem in a self made prison likeReminds me of homie locked in The Bushes who is constantly posting and talking to himself…

Theres absolutely an administrative burden, Instead of these employers withholding taxes from all wages they will not have only withhold wages from a portion. Most restaurants are small business they do not have the ability to add to the additional overhead to track this. You’re risking a lot of severs underpaying their taxes when all of this gets screwed upthis is nonsense. In 2024 restaurants for the most part are giving employees paychecks. The tips are tracked, taxed etc. folks aren’t walking home with 500 dollars in their pockets these days, but instead weekly paychecks.

There’s no administrative burden by not taxing cash tips. They just don’t report it. Every thing else remains the same.

btw, any change in tax law comes with extra administrative burden, you set up systems and processes to account for something and any change da,n near guarantees fukk ups. Look at how many people and companies screwed up the new w4

Respectfully, you don’t know what you’re talking about.Theres absolutely an administrative burden, Instead of these employers withholding taxes from all wages they will not have only withhold wages from a portion. Most restaurants are small business they do not have the ability to add to the additional overhead to track this. You’re risking a lot of severs underpaying their taxes when all of this gets screwed up

Just say you think it’s unfair which is clear to everyone

Busby

Real name no gimmicks..

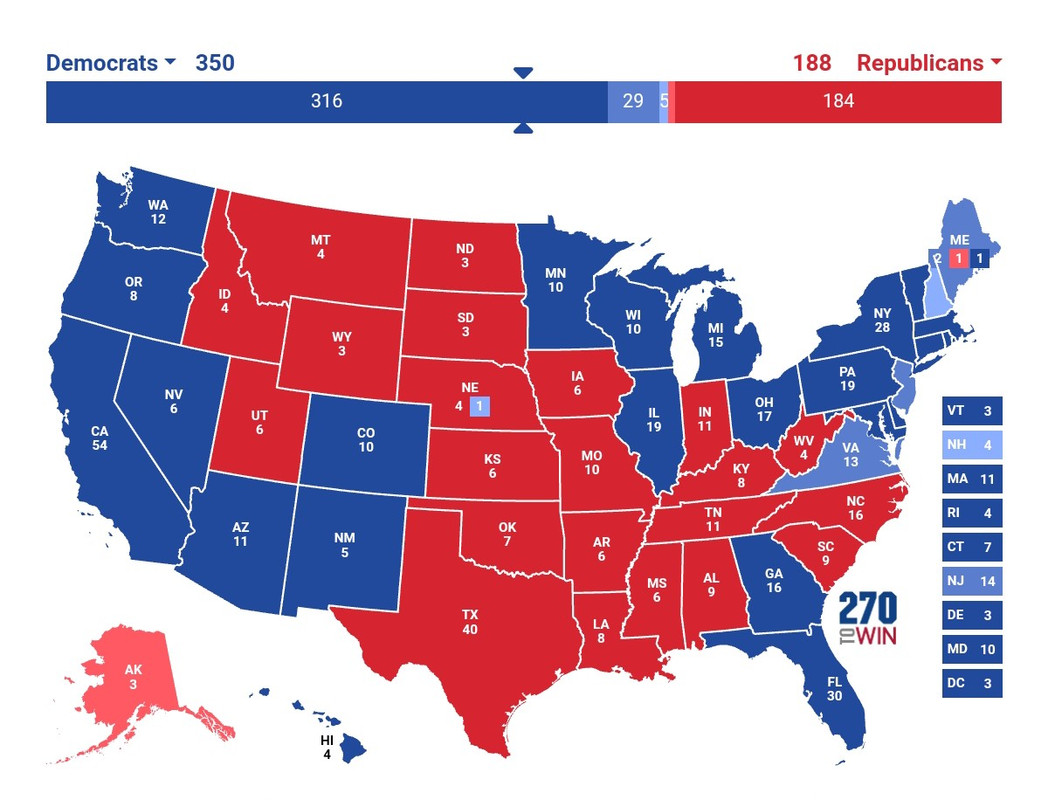

I honestly feel this is how it’s gonna look. Might be one of them Obama elections…Trump is gone keep acting a fool/doing dumb shyt and have the election looking like this on November 5th:

Hopefully

Ok bruh. Please explain how payroll systems meant to withhold taxes on all wage paid to an employee….get switched to not withholding taxes on certain income not come with increased administrative burden?Respectfully, you don’t know what you’re talking about.

and ultimately the tax payer will have to file all this correctly on their tax return

the juice is not worth the squeeze. You’re better off just giving servers a refundable tax credit

Yall remember on the Wire when Mayor Royce shaved off his goatee when Carcetti had him against the ropes?

That’s where we are in this campaign.

That’s where we are in this campaign.

You’re arguing that payroll software can’t be updated to adjust for laws?Ok bruh. Please explain how payroll systems meant to withhold taxes on all wage paid to an employee….get switched to not withholding taxes on certain income not come with increased administrative burden?

and ultimately the tax payer will have to file all this correctly on their tax return

the juice is not worth the squeeze. You’re better off just giving servers a refundable tax credit

The same payroll software that has accounted for min wage threshold adjustments for over 2 decades?

You don’t get it man. There’s no universal payroll system. Most restaurants are small businesses. All this law will do is cause tax trouble for everyone.You’re arguing that payroll software can’t be updated to adjust for laws?

just let servers claim a refundable tax credit and kim