You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Credit Report/Score Thread

- Thread starter Earnings

- Start date

More options

Who Replied?Got 656 on equifax and 691 on quizzle so somewhere in the middle i guess. My car payments last year and a half I'm sure have helped. Looks like on time payments hurt me some. At 94%, but working on raising it. Using less than 20% of available credit tho. Should get a new quizzle score in a few weeks so I should be in the 700s.

I have 2 credit cards and I put myself as an authorized user on 2 of my grandma's high limit cards to give me a lengthier credit history. The utilization on all are less than 40% which makes my score look real good.

I have some negative debt from the young and dumb days that will fall off soon and some other stuff that needs disputing.

I'm hoping that in the next 3-4yrs I can have the credit and funds to do a 15yr mortgage on a 250k loan and have it paid off in 10. By the time I turn 40 I want to be debt free or at least have minimal (a few revolving accts, maybe an auto loan).

I have some negative debt from the young and dumb days that will fall off soon and some other stuff that needs disputing.

I'm hoping that in the next 3-4yrs I can have the credit and funds to do a 15yr mortgage on a 250k loan and have it paid off in 10. By the time I turn 40 I want to be debt free or at least have minimal (a few revolving accts, maybe an auto loan).

Won't help. 1.5 years ago a chick totaled my car with 8 grand left to pay on it and 2 years ago my apartment got broke into. I'll be in high premium hell for a while.call them and have them do a credit review, they should offer it at least once a year.

Hiesenberg

Pro

Last credit application said 726. My credit card account says 696. I'm 24 with a HS diploma. I've bought and sold a house. With a 726 I was denied a loan for a boat and had to take out a 401k loan. Loans on boats are hardest to get.

Right now I have

2 credit cards

ATV loan

Auto loan

401K loan

Internet bill

Phone bill

Bed bill

My strategy was max credit cards ($500) when I started and pay off immediately. Now both companies have upped my line around 3k

Right now I have

2 credit cards

ATV loan

Auto loan

401K loan

Internet bill

Phone bill

Bed bill

My strategy was max credit cards ($500) when I started and pay off immediately. Now both companies have upped my line around 3k

Never do a 401k loan. It's just bad business.Last credit application said 726. My credit card account says 696. I'm 24 with a HS diploma. I've bought and sold a house. With a 726 I was denied a loan for a boat and had to take out a 401k loan. Loans on boats are hardest to get.

Right now I have

2 credit cards

ATV loan

Auto loan

401K loan

Internet bill

Phone bill

Bed bill

My strategy was max credit cards ($500) when I started and pay off immediately. Now both companies have upped my line around 3k

got a tax lien and 2 student loans that defaulted and got sold from collection company to collection company.

feels like my shyt been in the 650s forever.

feels like my shyt been in the 650s forever.

HookersandIceCream

#TeamOrange

got a tax lien and 2 student loans that defaulted and got sold from collection company to collection company.

feels like my shyt been in the 650s forever.

With those three big negatives im surprised your score is still decent

nomoreneveragain

Superstar

Just got a Discover it Card, they said my FICO score is 686

Another 5-6 more years of payments before I'm high 700's

Another 5-6 more years of payments before I'm high 700's

In less than 3 years I went from a lower score than you to a 793. I think it's been closer to 2 and a half years.Just got a Discover it Card, they said my FICO score is 686

Another 5-6 more years of payments before I'm high 700's

It doesn't take that long. Stop getting new cards and pay down what you have.Just got a Discover it Card, they said my FICO score is 686

Another 5-6 more years of payments before I'm high 700's

HookersandIceCream

#TeamOrange

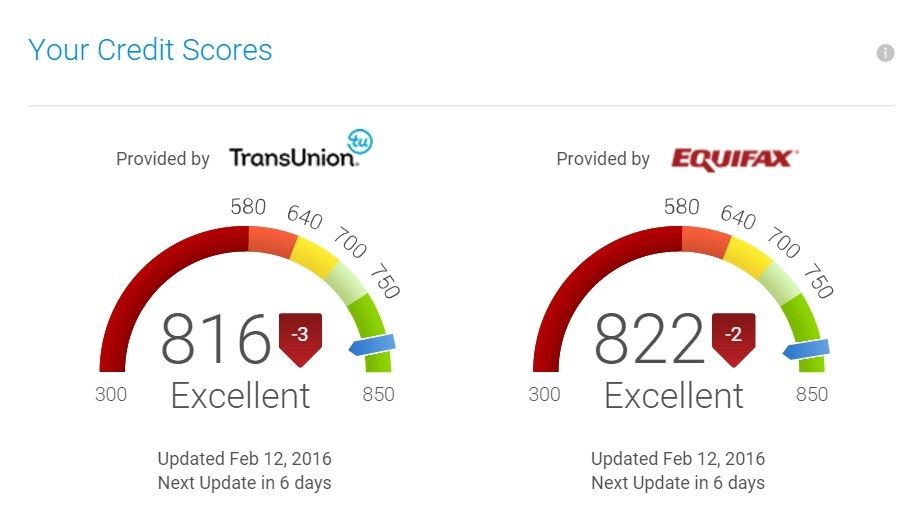

Just took a look at my scores on Credit KarmaWhat the hell do you have to do to get to 850?

Anything over 750 and your in top tier credit score