You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Credit Card Discussion Thread

- Thread starter Blackout

- Start date

More options

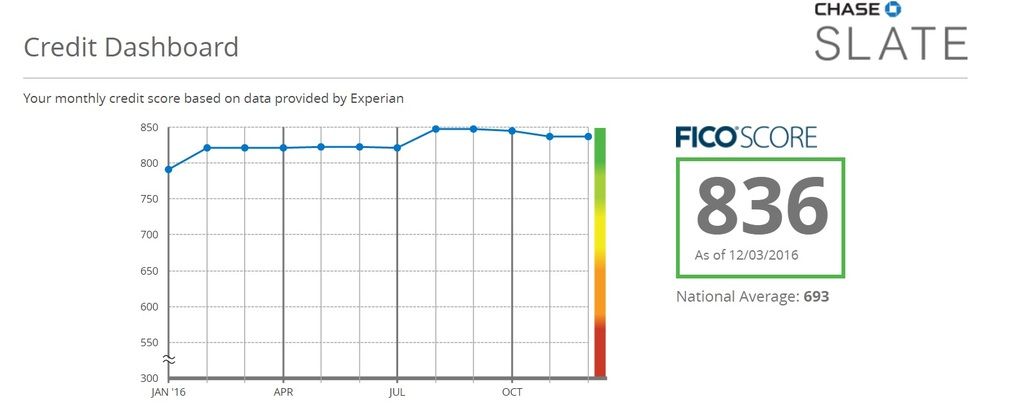

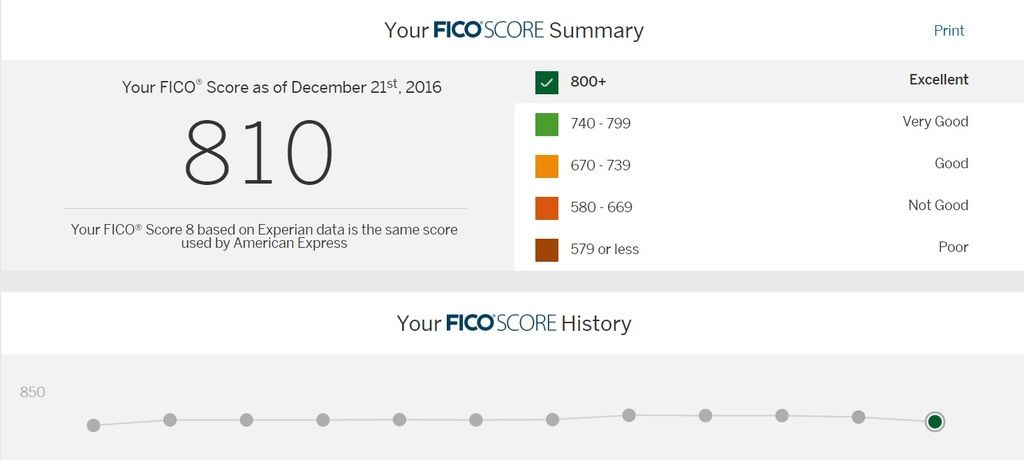

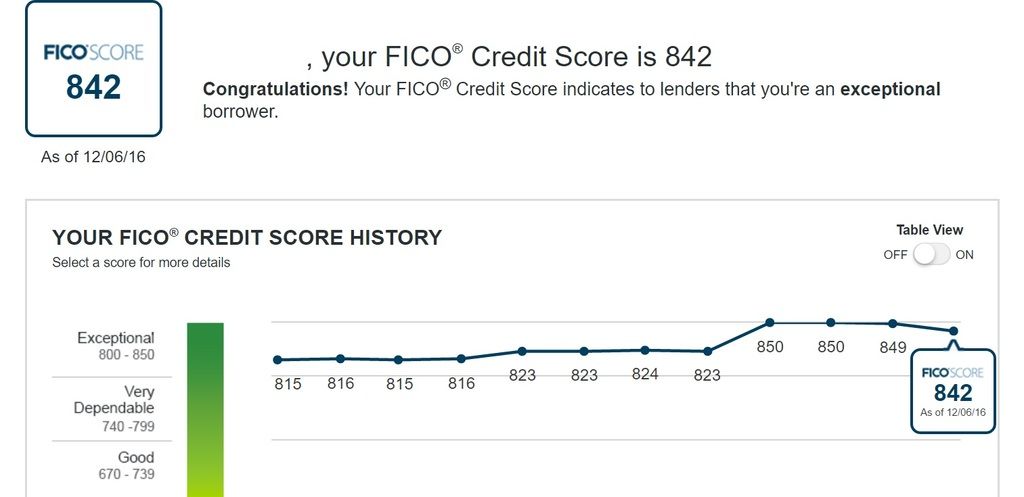

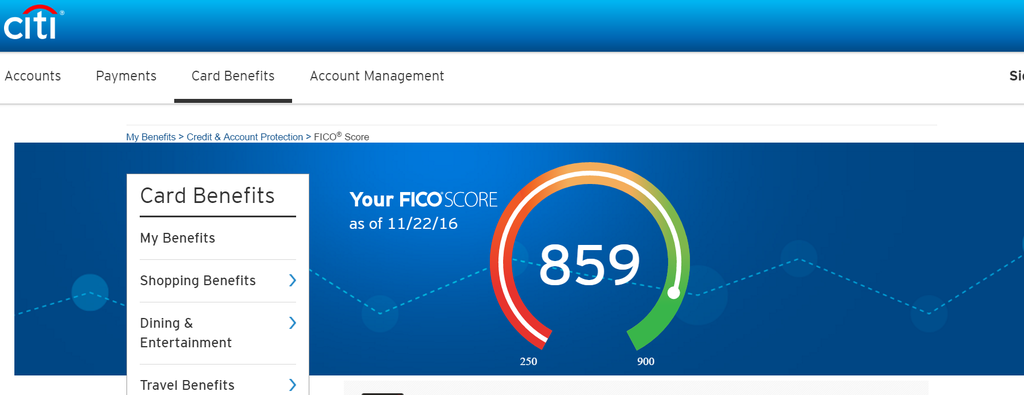

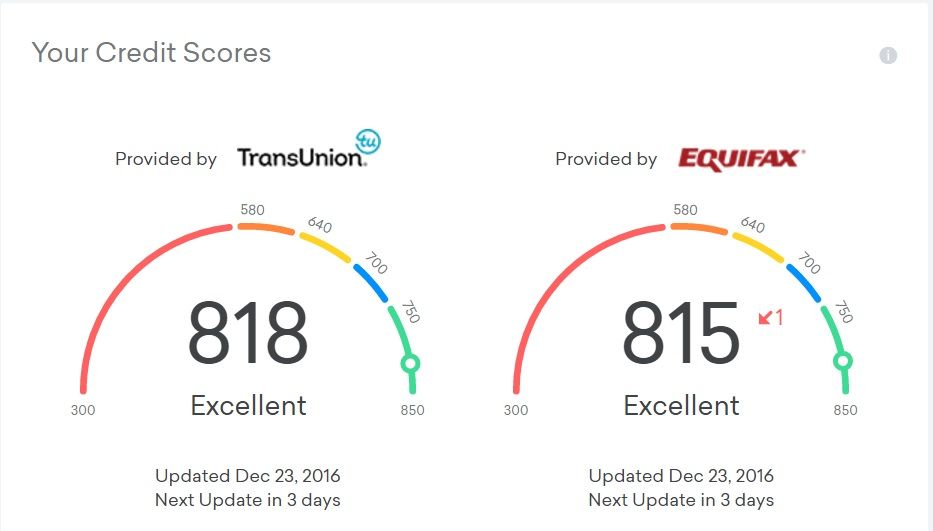

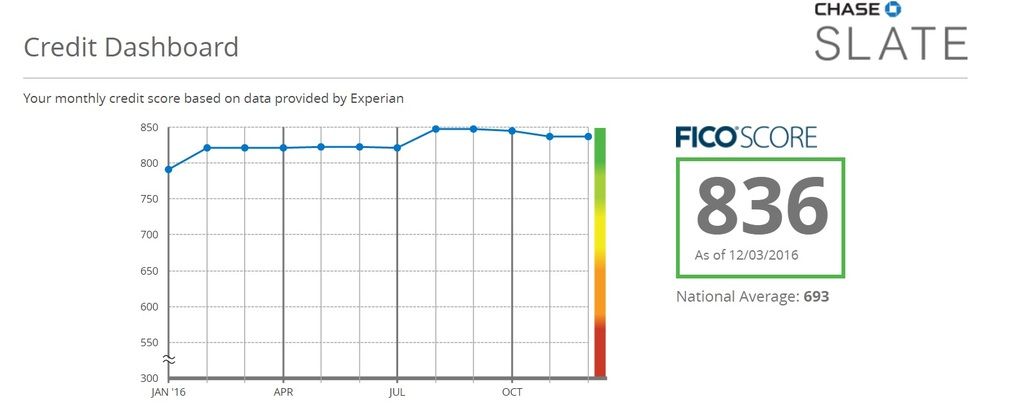

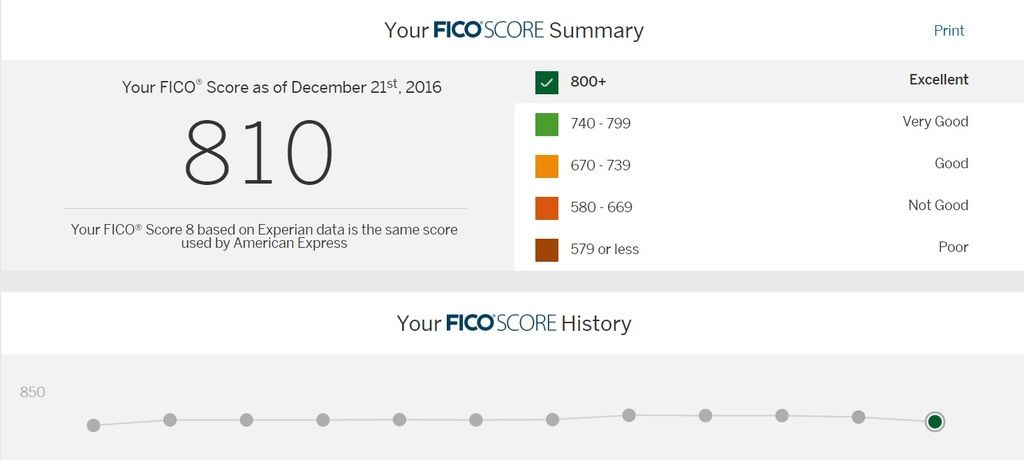

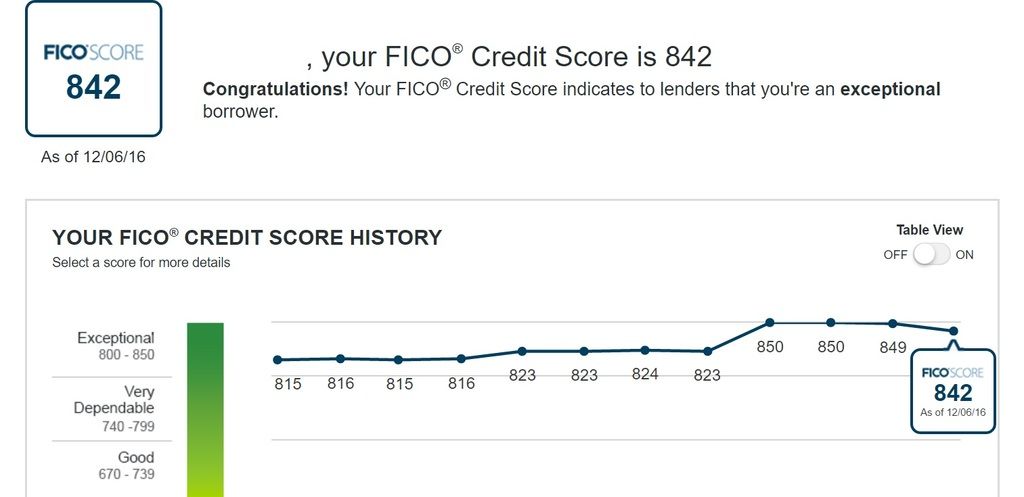

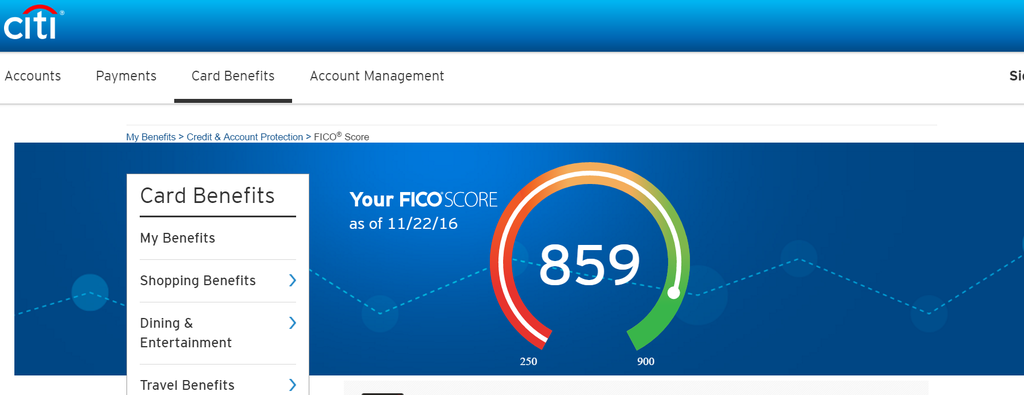

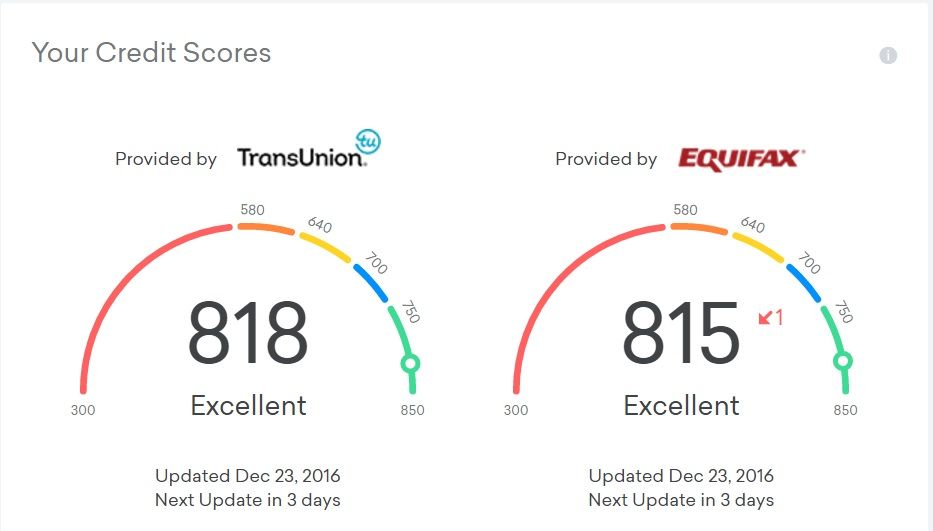

Who Replied?My shyt is all over the place It's consistently above 800 but some places report way higher than others. Also Credit Karma the last I listen isn't a real score lenders actually use last I heard and is inaccurate. My AAA insurance uses some other type of score that says I'm a 755.

You must have some great credit age or something. Highest I've gotten was around 780 I think. Right now I'm 730 - 750 because late last year I paid off my car loan which inadvertently DROPS your score. I've only focused on improving my credit the past two years so I think my oldest credit card account is just around that age.

My shyt is all over the place It's consistently above 800 but some places report way higher than others. Also Credit Karma the last I listen isn't a real score lenders actually use last I heard and is inaccurate. My AAA insurance uses some other type of score that says I'm a 755.

Yeah Credit Karma overstated my shyt a Lil too

My credit score is about to drop because I paid off my only installment loan that was 3 years old which was a debt consolidation loan. Back then I had a 650 score. Average age on my accounts is 7 years and I keep my utilization at 5% or under. I've had exactly 1 late payment reported my whole life and that was back when I was 18 and got my first card. Outside that I've never had a late payment and I had one debt sent to collections by a doctor's office last year which I didn't know about because they had an old mailing address. I went behind the debt collector's back and paid the office and they took the money. Then I played dumb when they called and told them I didn't know what they were talking about and that debt was paid. It never popped up on my report.You must have some great credit age or something. Highest I've gotten was around 780 I think. Right now I'm 730 - 750 because late last year I paid off my car loan which inadvertently DROPS your score. I've only focused on improving my credit the past two years so I think my oldest credit card account is just around that age.

When I was younger living at home my pops would open all my mail before I even saw it. He flipped out on me over that late payment from Capital One and drilled into me that at all cost you protect your credit and stay out of credit card debt. I did protect my credit my whole life after that but I had major issues on credit card debt. Just about 3 years ago I was sick of it. I got my debt down from $6000 and financially I wasn't as good as I am now so I got a debt consolidation loan from my credit union. They required all those accounts be closed and they mailed out the closure letters. Many of those accounts ignored the letters and stayed open but I quit using them.

Several months after that I opened a Chase Freedom, Discover It, and American Express Blue Cash Preferred. Those are all the cards I use now. My average credit age took a hit with all those new accounts. From then on I've been pretty clean on credit. I just paid that loan off and due to the nature of cash back cards only offering 1%-6% I pay all my cards off when they're due. I keep all those old cards open and use them once a year to keep them active but I really only use those three cards.

Several months after that I opened a Chase Freedom, Discover It, and American Express Blue Cash Preferred. Those are all the cards I use now. My average credit age took a hit with all those new accounts. From then on I've been pretty clean on credit. I just paid that loan off and due to the nature of cash back cards only offering 1%-6% I pay all my cards off when they're due. I keep all those old cards open and use them once a year to keep them active but I really only use those three cards.

HalfwayHandsome

A WALKING LICK #502C0MEUP

GOOD THREAD. IM TRYING MY BEST TO GET IN THE 800S. IM STUCK AT 745 MAYBE ITS BECAUSE MY INCOME I KEEP MY CARDS UNDER 7% UTILZATION. I HEARD CREDIT KARMA WASNT ACCURATE

Blackout

just your usual nerdy brotha

Credit Karma is the closest to accurate when you are talking about free sites. If you want more accurate you would have to use a paid site or have a card with free credit score check.GOOD THREAD. IM TRYING MY BEST TO GET IN THE 800S. IM STUCK AT 745 MAYBE ITS BECAUSE MY INCOME I KEEP MY CARDS UNDER 7% UTILZATION. I HEARD CREDIT KARMA WASNT ACCURATE

What's your total available credit looking like?

$36,500 or so between three credit cards.

sayyestothis

Free the guys

What's your total available credit looking like?

81414 if it's just credit cards you talking.

HalfwayHandsome

A WALKING LICK #502C0MEUP

Just credit cards.

I have $105K in available credit.

Nice.

If y'all want the Chase Sapphire Reserve there's a timeline on it to get the ridiculous 100,000 points if you spend $4,000 in three months

You have until Jan. 11 to apply for the card on JPMorgan Chase's website here Opens a New Window. . Or if you're willing to visit one of its branches, you can apply for a card in person at a Chase location at any time until March 12.

That's what's up. I'd check it out but I just checked out an American Express deal last week. They were running a promo with Amazon to get 20% back on $1000 or something like that. Plus a reward bonus and no annual fee. Waiting for the card to arrive.If y'all want the Chase Sapphire Reserve there's a timeline on it to get the ridiculous 100,000 points if you spend $4,000 in three months

Got that and a newegg.com card recently that I'll never use unless it's a current promotion going on since the interest is ridiculously high on the card.

So within the last two weeks or so I've raised my available credit by $4500. Good because it helps my credit utilization especially with me trying to get back on track after this holiday spending.

going take out a loan out my 401k in December 2017 and pay everything off i mean everthang

going take out a loan out my 401k in December 2017 and pay everything off i mean everthang