m1 gangs

here are some tips yall.

1. return you see next to 'gain' is a money weighed return. it's not an actual return.

from reddit

2. Take advantage of turbo tax integration.

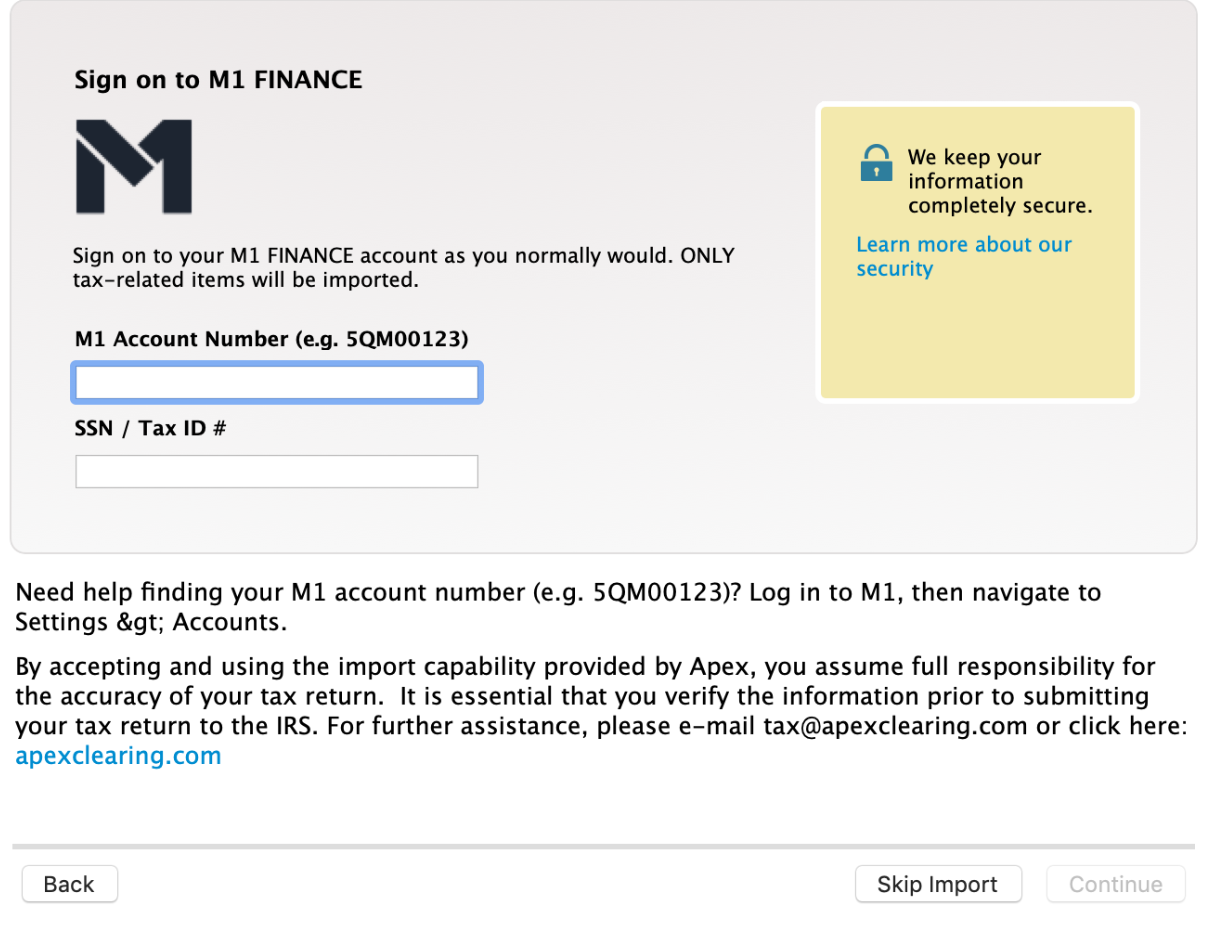

M1 Integration with Turbo Tax

3. Try not to rebalance too frequently which will create unnecessary taxable events.

4. Keep cash 10-15%.

this is very important if you are actively managing your portfolio. you always need $ ready to be invested. but not necessary if you arent.

here are some tips yall.

1. return you see next to 'gain' is a money weighed return. it's not an actual return.

from reddit

Money weighted returns means that its keeping track of the amount of returns in relation to the amount of money you made those returns with at the time. I think its by far the most accurate way to gauge returns.

Think about the alternative for a minute. You could double 5k to 10k and you're at 100% returns. Then if you deposited 10k new into your account all of a sudden you are at 25% returns? You just hurt the returns of your portfolio by depositing new money? Does that make sense?

Money weighted just keeps a running average of your returns in relation to the amount of money you had at the time. So that each new deposit doesn't diminish previous returns.

2. Take advantage of turbo tax integration.

M1 Integration with Turbo Tax

M1 Finance Instructions:

Prior to visiting the TurboTax website - you must first find your M1 account number(s). If you have more than one account number, you will need to go through this process and the TurboTax process for each account.

To find your M1 Account Number:

- Log into your M1 account and click the "Menu" button and then click "Settings".

- One you get to that screen - click the "Account" tab and you will see your account below.

TurboTax Instructions:

To import into Turbo Tax:

- Start a new return from the "File" menu while in Turbo Tax

- On the next screen you will need to enter “M1 Finance” into the field “I’m looking for”. Select “M1 Finance” and then press “Continue”.

- You will then be presented with a login screen. Your log in credentials will be the following:

- Login: Your M1 Account Number

- Password: Your Social Security Number

3. Try not to rebalance too frequently which will create unnecessary taxable events.

Rebalancing restores an investment portfolio to your original target allocations.

As prices of securities change over time, your initial target allocations may drift, which may result in a portfolio that no longer aligns with your risk profile or investing style. Rebalancing allows you to reallocate funds to keep your portfolio in line with your accepted risk tolerance and financial goals.

Please keep in mind that any time you rebalance your portfolio you may initiate a series of buy and sell securities transactions. Sales of securities may carry tax implications which you should consider before making the decision to rebalance your portfolio.

4. Keep cash 10-15%.

this is very important if you are actively managing your portfolio. you always need $ ready to be invested. but not necessary if you arent.

I think the hype around it will at least get me some profit, but being realistic about Fisker though. Does he know what he's doing? Has he made some real moves? Is he a scammer.

I think the hype around it will at least get me some profit, but being realistic about Fisker though. Does he know what he's doing? Has he made some real moves? Is he a scammer.