Nah breh. Tda won't let people trade it so I just completely forgot about it. They have news? I see its up 5 cents today@K-Deini you been watching decn

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boiler Room: The Official Stock Market Discussion

More options

Who Replied?Rickdogg44

RIP Charmander RIP Kobe

Any news they are expecting?FRSX might be leaving the station today brehs

Lets fight with those tryna bet against us on the market and not each other.

Saysumthinfunnymike

VOTE!!!

I'm here to talk about long term holds if anyone is interested. I dropped DKNG said it's a buy when it was around 20 and I dropped RTX as a buy when it was 50. I'm holding both.

It's not too late for those. There could also be some pullback.

Livongo is another I'm interested in but haven't pulled the trigger.

Later tonight I will drop my watchlist for growth stocks

It's not too late for those. There could also be some pullback.

Livongo is another I'm interested in but haven't pulled the trigger.

Later tonight I will drop my watchlist for growth stocks

i agree with the latest post, too much penny stock talk so ive been having to scroll through months back to find value posting about mid to aggressive growth stocks and good index funds to invest in but to each his own

decent day today and all these are blue chip stocks and tech ETFs

profit-6-22

decent day today and all these are blue chip stocks and tech ETFs

profit-6-22

Looking at M1 and gotta see how I want to play this.

I see this sample pie:

M1 Finance - Free Automated Investing

Which looks to be ultra aggressive with a 28% 5 year growth. My original plan was to split FAANG into 20% each and just let it be. Unless there are other large companies like those that will be better. Maybe Tesla? I feel like I can just stick with funds on my Fidelity IRA and use this for large company stocks at a percentage. I feel FAANG will give me decent long term growth tho.

I see this sample pie:

M1 Finance - Free Automated Investing

Which looks to be ultra aggressive with a 28% 5 year growth. My original plan was to split FAANG into 20% each and just let it be. Unless there are other large companies like those that will be better. Maybe Tesla? I feel like I can just stick with funds on my Fidelity IRA and use this for large company stocks at a percentage. I feel FAANG will give me decent long term growth tho.

indexing will get you 12% return. go look up 3 fund portfolio. it's called lazy portfolio. i used to do that. 50 domestic / 25 foreign / 25% bonds.

go look up compounding interest too. go find a compounding calculator. check the difference between $ when you invest for 20 years vs. 25 years vs. 30 years. shyt is crazy.

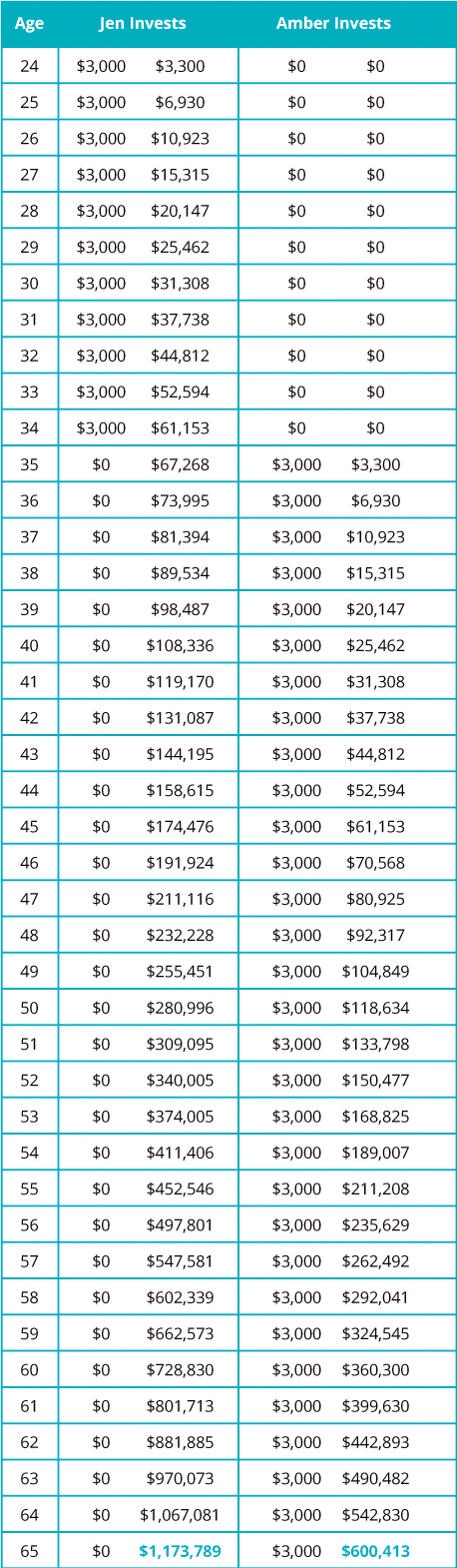

here is an example at 10% return

study this graph carefully. you will understand the power of compounding interest.

so the reason i mentioned 2-3mil is that i'm assuming my return to be 15% which is more than doable if you pick a right stock. and instead of $3000 like the above graph, you invest $6000 ($500 monthly)

you can be safe and do 3 fund portfolio for your 401k or IRA. if you do 3 fund portfolio for over 20 years it's pretty much guaranteed that you will beat the market. but it only makes sense if you do it long term. if not, build your own mutual fund. it's not a rocket science. there's so many damn good info out there that it's practically fool proof.

I still have more research to do but I have done some research. Just want to make sure I have it right.

3 fund portfolio means I basically invest in 3 different index funds: a domestic, international, and a bond one?

I can do all of this on TDA or am I safer doing this on Fidelity?

Also, that chart doesn’t make sense. Why would the first shorty only have to invest for 11 years and the other one would have to invest for like 30?

There is literally no difference except their ages. Why does the one who starts investing $3k per year at age 24 only have to do it till she’s 35 and just kick back and invest nothing then collect over 1 mill when she’ll 65, meanwhile the other one begins investing the same exact amount at the age of 35 but for some reason not only has to invest for 3x the amount of time, but gets half what the first girl got?

I appreciate the info breh

Confused bout that chart but all in all this is some valuable info.

Last edited:

I think you should create a thread for long term holds.I'm here to talk about long term holds if anyone is interested. I dropped DKNG said it's a buy when it was around 20 and I dropped RTX as a buy when it was 50. I'm holding both.

It's not too late for those. There could also be some pullback.

Livongo is another I'm interested in but haven't pulled the trigger.

Later tonight I will drop my watchlist for growth stocks

dora_da_destroyer

Master Baker

10 years of compound interest which is basically exponential growth.I still have more research to do but I have done some research. Just want to make sure I have it right.

3 fund portfolio means I basically invest in 3 different index funds: a domestic, international, and a bond one?

I can do all of this on TDA or am I safer doing this on Fidelity?

Also, that chart doesn’t make sense. Why would the first shorty only have to invest for 11 years and the other one would have to invest for like 30?

There is literally no difference except their ages. Why does the one who starts investing $3k per year at age 24 only have to do it till she’s 35 and just kick back and invest nothing then collect over 1 mill when she’ll 65, meanwhile the other one begins investing the same exact amount at the age of 35 but for some reason not only has to invest for 3x the amount of time, but gets half what the first girl got?

I appreciate the info breh

Confused bout that chart but all in all this is some valuable info.

3 threadsI think you should create a thread for long term holds.

1. For advanced traders

2. Penny stocks

3. Get them before they go too high (the highest gamble as you cna lose with no gain or leave with 2x, 3x, or more gains)

did you buy a few sets of shares? the total might have been in the green, but some of your shares were still in redbut i literally sold my shyt at a profit and it shows in my realized gains under the tax forms- ima have to call fidelity

i did it myself once, so trust me

its not fidelity

its not fidelityRickdogg44

RIP Charmander RIP Kobe

Saysumthinfunnymike

VOTE!!!

MLB some dumb motherfukkers lol. DKNG dropping some off their bs but they be aight

Kyle C. Barker

Migos VERZUZ Mahalia Jackson

Proshares ultrashort real estate

ETF: SRS

proshares ultrashort real estate - Google Search

ProShares ETFs: UltraShort Real Estate - Overview

Extra risky but it kicked ass back in 2008

It's a lotto ticket for sho