thernbroom

Superstar

When do we expect the alts to make a comeback?

All things considered, this aint sayin much. Look at this in a year or two once BSC has had more than an hour of operation.Just compare the amount of legitimate projects built on ETH compared to BSC.

Every single coin released on PCS is an inflationary farming shytcoin designed to allow the dev and his friends doing the marketing to dump on anyone who isn't one of the first 300 holders.

Uniswap has it's rugs (hell, I've been rugged a few times) but the ratio of legitimate projects that are good mid-long term holds vs rugs on Uni compared to PCS is not comparable. It is considerably cheaper to conduct a rug-pull on BSC compared to Uni, even when ETH fees were much lower than they are now.

Very few serious dev teams are building on BSC for a reason. The userbase is just not there and of the amount there is, only a small percentage would participate in governance or the community aside from shilling the latest "safe__" or "_oge" bag they're holding

This is not true. L2 has been around for more than a year. Although devs have just now started to build on top of it for the past year due to the issues of it being a 'child' chain it it will be the next step towards not only lower fees but faster transactions (along with the optimism rollups). Low fees and fast transactions are the only reason why BSC has gained traction.

Yes, people are priced out of DeFi due to the fees but to be honest; if you're worried about fees you aren't investing in the right projects. It's gotten to the point where I'm confident enough in my research that if I only invest $500 in something, the $60+ fee does not matter to me because I know I'll make 5x my initial investment within the next few weeks. You throw that money at PCS and you might as well be glued to your computer/phone screen because the dump is inevitable. There isn't even a reliable charting tool for BSC. Every project I've followed that has promised this has failed or is on the brink of failing due to such poor performance.

What does PCS have to do with keys? BSC is owned by Binance. If something ridiculous and downright unlikely were to happen to Binance, the tokens on PCS are worthless.

Let's not even get into how PCS is a literal fork of Uni, right down to the Github repo: pancakeswap/pancake-swap-interface

If Uni felt like fukking them over for a few hours all they would need to do is change the dependency for the token lists

Don't get me wrong, I hold BNB like most here do (long term for me) and have thrown a few at some BSC projects for a quick 2x-4x but I wouldn't dare hold anything there long term. There is probably two good mid-long term holds on BSC and that's JUP and CAKE. CAKE only because it is at the head of the ecosystem. JUP is an actual serious project, quite literally the only solid one I've seen on BSC and it existed on ETH long beforehand. It wasn't even built on BSC.

Just compare the amount of legitimate projects built on ETH compared to BSC.

At the end of the day serious dApp, NFT, and DeFi developers are building on ETH and not BSC. That won't change any time soon.

There are 3 options for ATOM imoThis 18.50 area is crucial for atom. Looking at weekly chart, hit ATH on week of 02/15 and also a low of 14.79 which it hasn't touched since. Closed at 21.63 but the next week it closed at 17.67. Went up the next week but then week of 03/08 it closed at 18.45. This week it dipped down to 16.47 which it hadn't seen that since end of February but its back around that 18.50 line. Hopefully on the weekly candle it stays around this area until the close on Sunday evening and then goes green for the next week. That 17.60 area looks like a decent support since the run up at start of year and hopefully 18.50 can do the same. Blockchain transfers coming in 3 days so hopefully everything goes according to plan.

This shyt took off todayAudius is an interesting project. It's been pumping, but the concept is pretty unique

Literally named the only two BSC coins I'm holding

You seem to be misunderstanding. I never said buy Fruitcake Coin. I just got done farming LTO and Zilliqa. I've bought BSC ALPHA, FIL, SFP, SXP... basically anything on Binance. The real solid projects on BSC like XVS, ALICE, and CTK are all on Binance. They're still building their ecosystem but the strength of BSC is in farming so that's what I go there for. Don't care about anything else.

When Ethereum has gas fees that are acceptable I'll farm there but that won't be until July at the earliest.

You're talking about fees in regards to holding, I'm talking about farming. You gotta make multiple transactions to approve smart contracts, supply/remove liquidity, harvest, etc.

It's at least 4 steps and pay that each time on a day gas is $180. On a good day it's $40-50. On BSC gas is consistently priced and all four steps will run you about $1-2 or even lower. Might cost me $1-2000 a week to farm on Ethereum making the amount of moves I make on BSC. I made like 8-10 transactions yesterday and never even looked at the fees. On Ethereum that's money gone down the drain that could've been used to make profits.

The reason Pancakeswap has passed Uniswap with a fraction of the projects listed is because of farming. Until L2 impacts farming it's not a factor for those after yield

There are 3 options for ATOM imo

1. If you zoom out, it looks like it’s consolidating right now before take off.

2. I wouldn’t be surprised if it forms an inverse head and shoulders first before take off either.

3. It shapes into an “M” mountain to the downside about 15.50 and then bounces to the sky

All things considered, this aint sayin much. Look at this in a year or two once BSC has had more than an hour of operation.

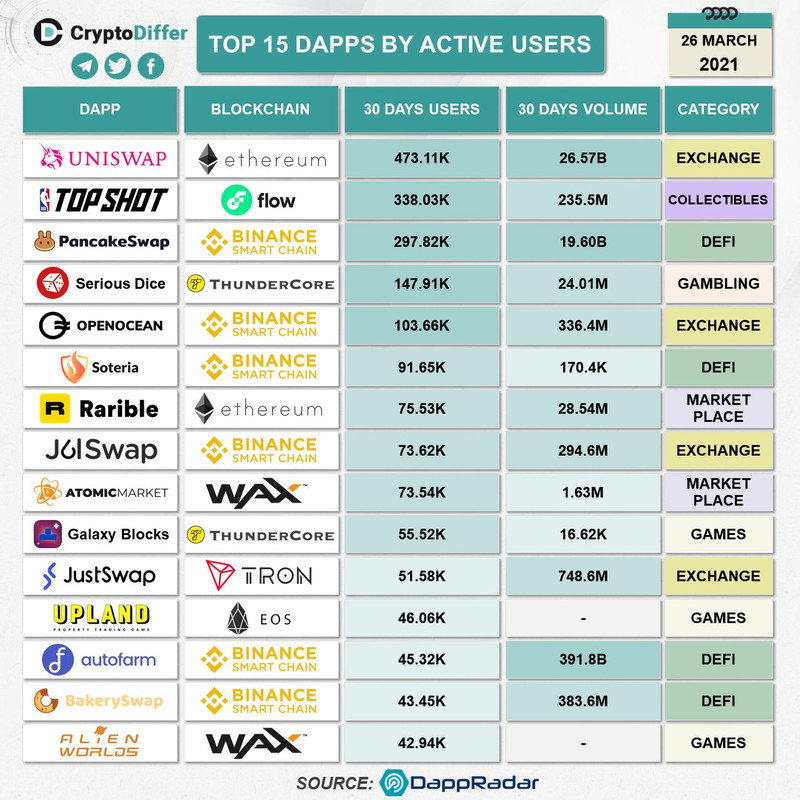

For how long it has been out here, the fact that it has Dapps in the top 20 in regards to usage that outnumber ETH speaks volumes.

Venus is already doing numbers similar to established projects like Maker and Aave.

I get the fact that some peeps dont like Binance for reasons but you cant ignore what its doing in the Defi space.

Curious what you think this means exactly?Centralized chaindefi

It means binance has too much control and is shady themselves, but it doesnt matter because no one cares about decentralization. It's all about bags pumpingCurious what you think this means exactly?