You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Russia's Invasion of Ukraine (Official Thread)

- Thread starter newarkhiphop

- Start date

More options

Who Replied?Domingo Halliburton

Handmade in USA

not sure if it's possible on that scale even if the stocks are trading at significant discounts

@Domingo Halliburton

They can't change the numbers but they can certainly come in and start buying and create a floor. China does it all the time.

Neo. The Only. The One.

THE ONE

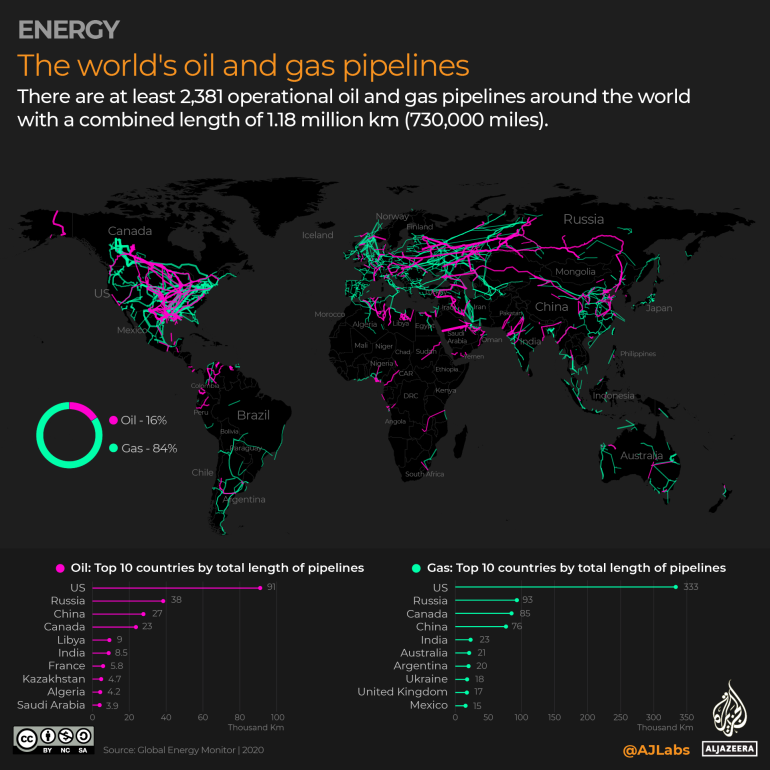

Sobering. There's going to be a bit of pain to wean off Russia.

In this low attention span age, things will get dicey once the war is over in terms of public opinion.

After Ukraine, how will the world replace Russia’s oil products?

In this low attention span age, things will get dicey once the war is over in terms of public opinion.

After Ukraine, how will the world replace Russia’s oil products?

At the same time, a report produced by the International Energy Agency (IEA) underlined just how limited the options are for any economy seeking to replace Russian crude and other oil products.

It says global oil demand is projected to be nearly 100m barrels per day (bpd) this year, lower than previously forecast because of the shock to global growth caused by the war in Ukraine. Russia produces about 10m bpd and exports about half of that plus about 3m bpd of oil products. It is unclear, however, how much of that supply might now be at stake.

The IEA thinks that at least 1.5m bpd of oil and 1m bpd of oil products are likely to be lost from Russia, from April until at least the end of the year, as buyers either reject supplies voluntarily or do so to avoid breaching sanctions. It says: “These losses could deepen should bans or public censure accelerate.”

“In reality, no one country can plug the hole that Russia would leave in the market in the event of a global ban,” says Sophie Udubasceanu, global crude oil expert at energy market analysts ICIS. So where can the world try to source anything up to 5m extra barrels of oil a day?

why don't nations make their ICBM's stealth?

on the topic of whether or not the Russians would launch a nuke:

Of the top of my head... Cost? Also don't a lot have complex defense systems?why don't nations make their ICBM's stealth?

Last edited: