source?Do you know nearly none of the wealthy paid the 90% tax right, dikkhead? Almost none.

.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Nearly 60% of Americans support increasing top marginal tax rate to 70% for incomes over $10M

- Thread starter FAH1223

- Start date

-

- Tags

- aoc tax policy tax rates

More options

Who Replied?You can’t base your entire platform on fighting the rich and revolutionizing the system but want to dress like Carrie Bradshaw in the process. She could’ve brought some shoes at Dress Barn and a $100 dress and gave that money to some homeless people. She gonna spend her entire career railing against the wealthy and by the end she’s gonna be one of them.

Alexandria Ocasio-Cortez and the Politics of a $3,000 Suit

When the castigating got traction, Ms. Ocasio-Cortez shot back at her critics, pointing out the obvious — that she did not buy the clothes she wore for the shoot. They were lent to the magazine for the purpose of taking pictures. The suit she wore came from Gabriela Hearst, an Uruguayan designer, whose sensibilities are not hostile to the Ocasio-Cortez brand — the line makes use of compostable plastics for packaging and one runway show was inspired by Angela Davis. Any progressive who might have feared that the candidate was capitulating to the wealthy could say, “Well, at least she is not in Chanel.”

you need to get your facts right

Alexandria Ocasio-Cortez and the Politics of a $3,000 Suit

When the castigating got traction, Ms. Ocasio-Cortez shot back at her critics, pointing out the obvious — that she did not buy the clothes she wore for the shoot. They were lent to the magazine for the purpose of taking pictures. The suit she wore came from Gabriela Hearst, an Uruguayan designer, whose sensibilities are not hostile to the Ocasio-Cortez brand — the line makes use of compostable plastics for packaging and one runway show was inspired by Angela Davis. Any progressive who might have feared that the candidate was capitulating to the wealthy could say, “Well, at least she is not in Chanel.”

you need to get your facts right

Why not borrow shoes from Target

It doesn’t change anything.

Bernie Sanders would look stupid if he was doing interviews in front of a Lambo regardless if it was rented or not. When his whole platform is railing against Wall Street. Stop being disingenuous because you like the broad.

Bernie definitely knows better...Why not borrow shoes from Target

It doesn’t change anything.

Bernie Sanders would look stupid if he was doing interviews in front of a Lambo regardless if it was rented or not. When his whole platform is railing against Wall Street. Stop being disingenuous because you like the broad.

Perception > Truth 90% of the time

GnauzBookOfRhymes

Superstar

the top marginal tax rate is shamefully low when you consider the sheer volume of tax shelters/avoidance schemes that are also available to high net worth individuals

source?

Slate’s Use of Your Data

Bernie Sanders, who I fukk with, and AOC, need to be more truthful when they bring up these arguments. The 90% tax existed on paper. Very few of the rich actually paid anything near that. Put yourself into the shoes of a rich person. Imagine you're rich. Would you EVER give up 90% of your money when you can easily and legally shelter it in numerous ways?

Serious question right now. Taxing high incomes at 70% is not gonna help her cause because the people she's targeting make an exorbitant amount of their money off investment income. If she really wants to hurt them, she has to propose raising the capital gains tax rate. She has to fukk with real estate tax law. She has to put controls on how much money can be moved overseas, which is what China is trying to do now with their citizens. She has to put controls on how trusts are used. So many loopholes. Which is why the 90% tax rate never came into play for most of the rich back when it was around. Almost no one paid that shyt. If anyone tries to fukk with the capital gains rate or any of those other things to actually effectively tax the rich, then yes, you will be depressing alot of those markets, as I said earlier. They'll just move their wealth elsewhere. To also avoid being disingenuous, the 90% tax kicked in at $200,000, which was equivalent of $2 million today so it was only a few people that law even targeted to begin with.

Serious question right now. Taxing high incomes at 70% is not gonna help her cause because the people she's targeting make an exorbitant amount of their money off investment income. If she really wants to hurt them, she has to propose raising the capital gains tax rate. She has to fukk with real estate tax law. She has to put controls on how much money can be moved overseas, which is what China is trying to do now with their citizens. She has to put controls on how trusts are used. So many loopholes. Which is why the 90% tax rate never came into play for most of the rich back when it was around. Almost no one paid that shyt. If anyone tries to fukk with the capital gains rate or any of those other things to actually effectively tax the rich, then yes, you will be depressing alot of those markets, as I said earlier. They'll just move their wealth elsewhere. To also avoid being disingenuous, the 90% tax kicked in at $200,000, which was equivalent of $2 million today so it was only a few people that law even targeted to begin with.

The 1% never paid anywhere near 90%

American progressives like to remember the mid–20th century as a time when the only thing higher than a Cadillac’s tail fin was the top marginal tax rate (which, during the Eisenhower years peaked above 90 percent for the very rich). Uncle Sam took 90 cents on the dollar off the highest incomes, and—as any good Bernie Sanders devotee will remind you—the economy thrived.

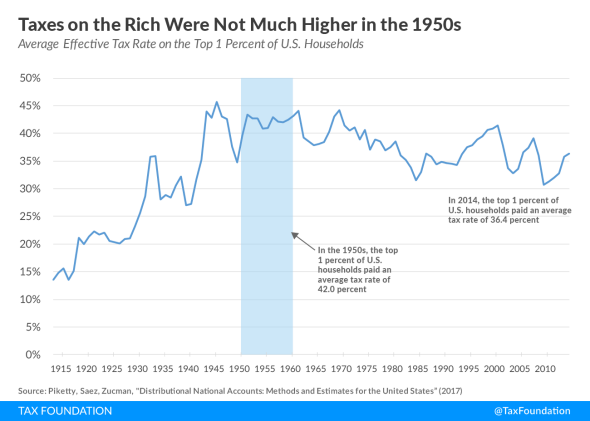

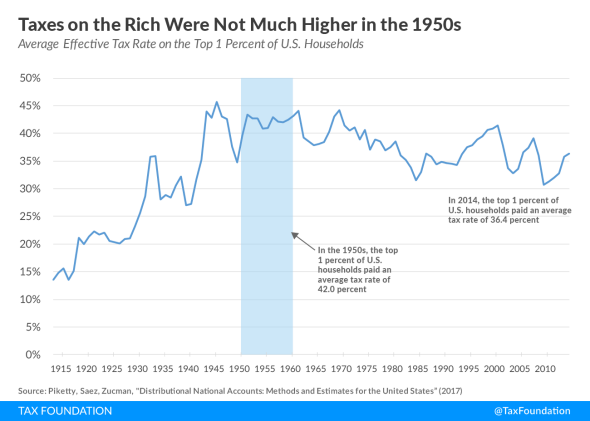

Conservatives, however, often try to push back on this version of history, pointing out that those staggeringly high tax rates existed mostly on paper; relatively few Americans actually paid them. Recently, the Tax Foundation’s Scott Greenberg went so far as to argue that “taxes on the rich were not that much higher” in the 1950s than today. Between 1950 and 1959, he notes, the highest earning 1 percent of Americans paid an effective tax rate of 42 percent. By 2014, it was only down to 36.4 percent—a substantial but by no means astronomical decline.

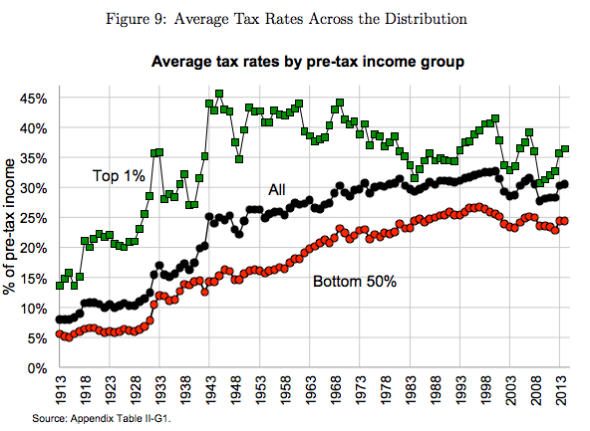

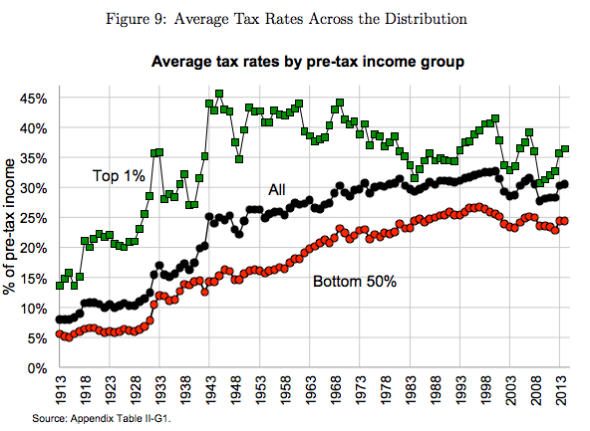

Greenberg is not pulling his numbers out of thin air. Rather, he’s drawing them directly from a recent paper by Thomas Piketty, Emmanuel Saez, and Gabriel Zucman in which the three economists—all well-loved by progressives—estimate the average tax rates Americans at different income levels have actually paid over time. Their historical measure includes federal, state, and local levies—including corporate, property, income, estate, sales, and payroll taxes. And lest you think Greenberg is misrepresenting anything, here’s Piketty & co.’s own graph (rates on rich folks are shown in green).

There are a few obvious reasons why the taxes the rich actually paid in the 1950s were so much lower than the confiscatory top rates that sat on the books. For one, the max tax rates on investment income were far lower than on wages and salaries, which gave a lot of wealthy individuals some relief. Tax avoidance may have also been a big problem. Moreover, there simply weren’t that many extraordinarily rich households. Those fabled 90 percent tax rates only bit at incomes over $200,000, the equivalent of more than $2 million in today’s dollars. As Greenberg notes, the tax may have only applied to 10,000 families.

To Greenberg, the takeaway from this is simple: Progressives should stop fixating on the tax rates from 60 years ago. “All in all, the idea that high-income Americans in the 1950s paid much more of their income in taxes should be abandoned. The top 1 percent of Americans today do not face an unusually low tax burden, by historical standards.

Prince.Skeletor

Don’t Be Like He-Man

Slate’s Use of Your Data

Bernie Sanders, who I fukk with, and AOC, need to be more truthful when they bring up these arguments. The 90% tax existed on paper. Very few of the rich actually paid anything near that. Put yourself into the shoes of a rich person. Imagine you're rich. Would you EVER give up 90% of your money when you can easily and legally shelter it in numerous ways?Serious question right now. Taxing high incomes at 70% is not gonna help her cause because the people she's targeting make an exorbitant amount of their money off investment income. If she really wants to hurt them, she has to propose raising the capital gains tax rate. She has to fukk with real estate tax law. She has to put controls on how much money can be moved overseas, which is what China is trying to do now with their citizens. She has to put controls on how trusts are used. So many loopholes. Which is why the 90% tax rate never came into play for most of the rich back when it was around. Almost no one paid that shyt. If anyone tries to fukk with the capital gains rate or any of those other things to actually effectively tax the rich, then yes, you will be depressing alot of those markets, as I said earlier. They'll just move their wealth elsewhere. To also avoid being disingenuous, the 90% tax kicked in at $200,000, which was equivalent of $2 million today so it was only a few people that law even targeted to begin with.

The 1% never paid anywhere near 90%

American progressives like to remember the mid–20th century as a time when the only thing higher than a Cadillac’s tail fin was the top marginal tax rate (which, during the Eisenhower years peaked above 90 percent for the very rich). Uncle Sam took 90 cents on the dollar off the highest incomes, and—as any good Bernie Sanders devotee will remind you—the economy thrived.

Conservatives, however, often try to push back on this version of history, pointing out that those staggeringly high tax rates existed mostly on paper; relatively few Americans actually paid them. Recently, the Tax Foundation’s Scott Greenberg went so far as to argue that “taxes on the rich were not that much higher” in the 1950s than today. Between 1950 and 1959, he notes, the highest earning 1 percent of Americans paid an effective tax rate of 42 percent. By 2014, it was only down to 36.4 percent—a substantial but by no means astronomical decline.

Greenberg is not pulling his numbers out of thin air. Rather, he’s drawing them directly from a recent paper by Thomas Piketty, Emmanuel Saez, and Gabriel Zucman in which the three economists—all well-loved by progressives—estimate the average tax rates Americans at different income levels have actually paid over time. Their historical measure includes federal, state, and local levies—including corporate, property, income, estate, sales, and payroll taxes. And lest you think Greenberg is misrepresenting anything, here’s Piketty & co.’s own graph (rates on rich folks are shown in green).

There are a few obvious reasons why the taxes the rich actually paid in the 1950s were so much lower than the confiscatory top rates that sat on the books. For one, the max tax rates on investment income were far lower than on wages and salaries, which gave a lot of wealthy individuals some relief. Tax avoidance may have also been a big problem. Moreover, there simply weren’t that many extraordinarily rich households. Those fabled 90 percent tax rates only bit at incomes over $200,000, the equivalent of more than $2 million in today’s dollars. As Greenberg notes, the tax may have only applied to 10,000 families.

To Greenberg, the takeaway from this is simple: Progressives should stop fixating on the tax rates from 60 years ago. “All in all, the idea that high-income Americans in the 1950s paid much more of their income in taxes should be abandoned. The top 1 percent of Americans today do not face an unusually low tax burden, by historical standards.

Are those graphs taxes paid by the rich in totality or are they graphs about percentages after a certain amount of money, like AOC wants it at 10M????

He doesn't understand the difference between effective and marginal

You don't even know what you're arguing. I'm trying to be nice to you. Adjusting for inflation, the cut off was two million per year for the top rate. Marginal tax rates are irrelevant if you're mad at people who are earning tens and tens of millions of dollars a year as they're far beyond the cut off for the high tax rate you want, jackass. Most of their earnings would be knee deep in 90% tax rate territory. The point is NONE of them ever paid it. Because they sheltered it in numerous ways. You're just smart enough to be dangerous with your stupidity.

You don't even know what you're arguing. I'm trying to be nice to you. Adjusting for inflation, the cut off was two million per year for the top rate. Marginal tax rates are irrelevant if you're mad at people who are earning tens and tens of millions of dollars a year as they're far beyond the cut off for the high tax rate you want, jackass. Most of their earnings would be knee deep in 90% tax rate territory. The point is NONE of them ever paid it. Because they sheltered it in numerous ways. You're just smart enough to be dangerous with your stupidity.

why are you assuming there is anger or a personal grudge in trying to adjust the tax rate?

Are you taking this discussion personally? or are we just discussing policy?

Slate’s Use of Your Data

Bernie Sanders, who I fukk with, and AOC, need to be more truthful when they bring up these arguments. The 90% tax existed on paper. Very few of the rich actually paid anything near that. Put yourself into the shoes of a rich person. Imagine you're rich. Would you EVER give up 90% of your money when you can easily and legally shelter it in numerous ways?Serious question right now. Taxing high incomes at 70% is not gonna help her cause because the people she's targeting make an exorbitant amount of their money off investment income. If she really wants to hurt them, she has to propose raising the capital gains tax rate.

there is something weird about how you're viewing this whole discussion

you are seeing this as some sort of fight with the intention to "hurt" and being "mad"....

why are you assuming there is anger or a personal grudge in trying to adjust the tax rate?

Are you taking this discussion personally? or are we just discussing policy?

Not angry. Listen. If someone made $10 million, they dont GAF that $2 million was taxed (which was the limit before) at a lower marginal rates. They would care that 75% of what was over that limit was taxed at 90%, which is why I said that your comment about marginal rates/effective rates are irrelevant. The people AOC wants to target are so far beyond that top rate...would be so deep into the red...that they would definitely find a million ways to shelter their income.

I agree with this, Close loopholes and lower the rate...the top marginal tax rate is shamefully low when you consider the sheer volume of tax shelters/avoidance schemes that are also available to high net worth individuals

Higher rates without loopholes just isn't doable... our govt. is bought and paid for.

I'm not conservative at all but even I don't agree with a 70% tax rate on anything over 10 million. That's absurd. The reason so many people do support it is because it wouldn't apply to them. How about making rich people actually pay the taxes they should instead of letting them duck them instead.