Already been debunked earlier in the thread

There are a few obvious reasons why the taxes the rich actually paid in the 1950s were so much lower than the confiscatory top rates that sat on the books. For one, the max tax rates on investment income were far lower than on wages and salaries, which gave a lot of wealthy individuals some relief. Tax avoidance may have also been a big problem. Moreover, there simply weren’t that many extraordinarily rich households. Those fabled 90 percent tax rates only bit at incomes over $200,000, the equivalent of more than $2 million in today’s dollars. As Greenberg notes, the tax may have only applied to 10,000 families. To Greenberg, the takeaway from this is simple: Progressives should stop fixating on the tax rates from 60 years ago. “All in all, the idea that high-income Americans in the 1950s paid much more of their income in taxes should be abandoned. The top 1 percent of Americans today do not face an unusually low tax burden, by historical standards.”

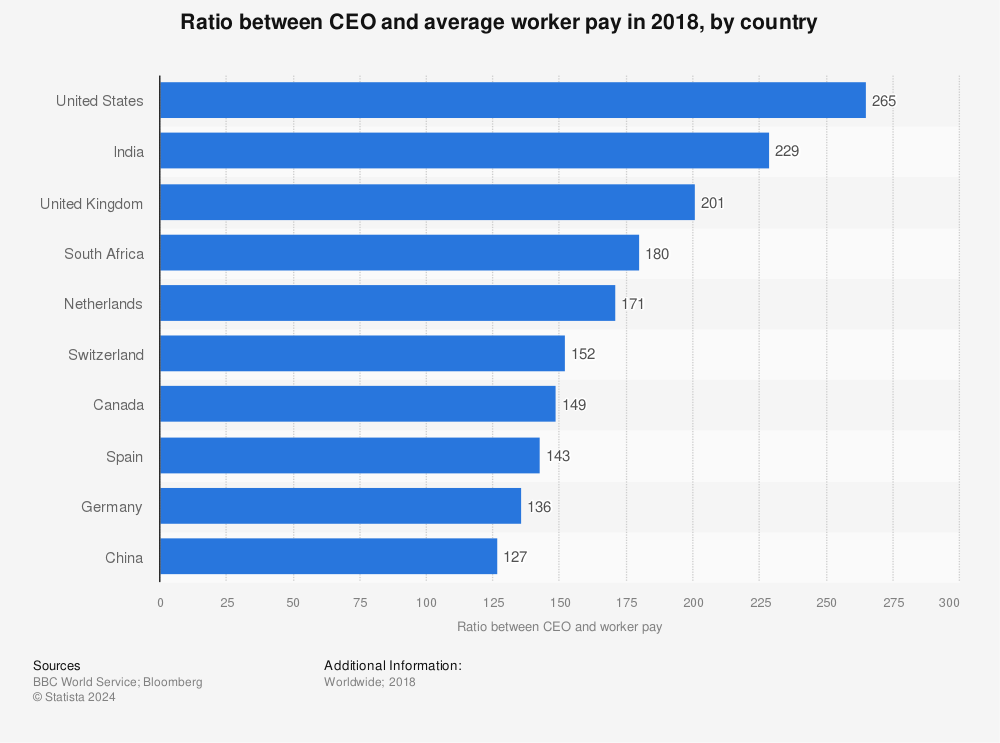

I’m not convinced. Effective tax rates on 1 percenters may not have fallen by half, as some on the left might be tempted to imagine. But they are down by about 6 percentage points at a time when the wealthy earn a vastly larger share of the national income. That drop represents a lot of money. Moreover, as Greenberg admits, tax rates on top 0.1 percent have fallen by about one-fifth since their 1950s heights. That rather severely undercuts the idea that taxes on the wealthy haven’t fallen “much.” Moreover, there may be reasons to support higher taxes beyond their ability to raise revenue. One popular theory among left-leaning intellectualsright now—advanced by Piketty, Saez, and their protegée Stefanie Stantcheva—is that high tax rates actually ease income inequality by discouraging CEOs and professionals from demanding exorbitantly high pay for their services.* In other words, thanks to high tax rates, people didn’t bother trying to get as rich. After all, there’s no point in bargaining for a giant bonus if the government is going to clip off most of it.

I wouldn’t say the theory has been accepted as a consensus fact at this point, but it’s certainly alive and being taken seriously. So the real tax rates rich Americans paid in the 1950s may not have been so stratospherically high as some progressives assume. But they also may have helped create a more egalitarian society. That seems worth considering.

Slate’s Use of Your Data

there needs to be MORE like her...

there needs to be MORE like her... The democratic party needs to get down or lay down...

The democratic party needs to get down or lay down...