Yahoo is part of the Yahoo family of brands.

Exclusivity Is Warner Bros. Discovery’s Huge Advantage in the Streaming Wars | Charts

Parrot Analytics

April 18, 2022·3 min read

Exclusive content could be Warner Bros. Discovery’s biggest advantage in the streaming wars.

A network’s power has always stemmed from exclusive content, but the value of exclusivity has shifted how teams may approach content in a streaming-first era. Warner Bros. Discovery, the newly merged company that now oversees three streaming services — HBO Max, Discovery+ and CNN+ — will gain rewards for its focus on keeping programming exclusively to its own services.

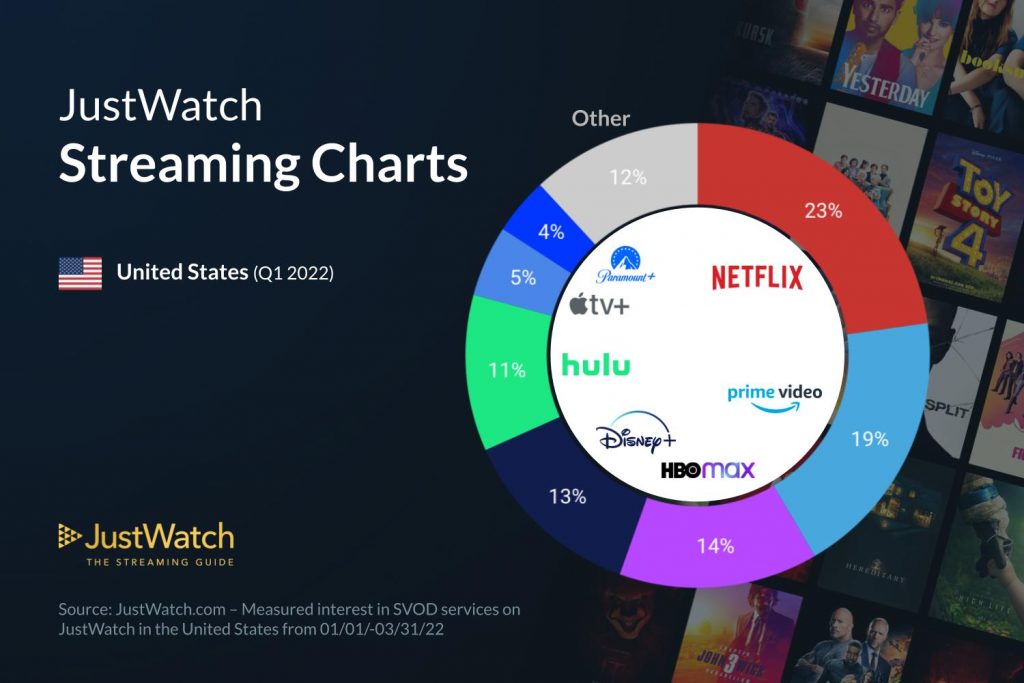

This chart demonstrates the type of demand streaming platforms have based on the series available, according to

Parrot Analytics‘ data, which takes into account consumer research data, streaming, downloads and social media, among other consumer engagement.

Demand for SVOD platforms by type of series: original, exclusive and non-exclusive licensed, U.S. Q1 2022 (Parrot Analytics)

Unsurprisingly, Netflix excels in original series (marked in red) — the company is spending north of $17 billion on content, the vast majority of which is on original series. Non-exclusive licensed content (in blue), such as “Law and Order: SVU” on Hulu, is important show to have but the risk of audience cannibalization (audiences who may watch the show on another platform) is higher because it’s not exclusive to Hulu.

But exclusive licensed content (in green) may be key to HBO Max and Discovery+ — instead of licensing out the majority of their past series, they’re available exclusively on the platforms they operate. The green line also contains demand for HBO originals, as opposed to HBO Max originals.

Combined with increasing demand for original series, a combined HBO Max and Discovery+ offering would provide two important facets of a successful streaming catalog: knowing what people are watching and owning that content.

With the Warner Bros. Discovery merger, there are now five companies that command 70% of all TV demand in the United States. Warner Bros. Discovery is the second largest, with a combined 18.3% of demand shares by series, and third for total platform demand shares across all streaming catalogs

haven't kept up with HBO shows since I stopped downloading. Wasn't legally available without taking a tv subscription before.

haven't kept up with HBO shows since I stopped downloading. Wasn't legally available without taking a tv subscription before.