ogc163

Superstar

Written 3 weeks ago...

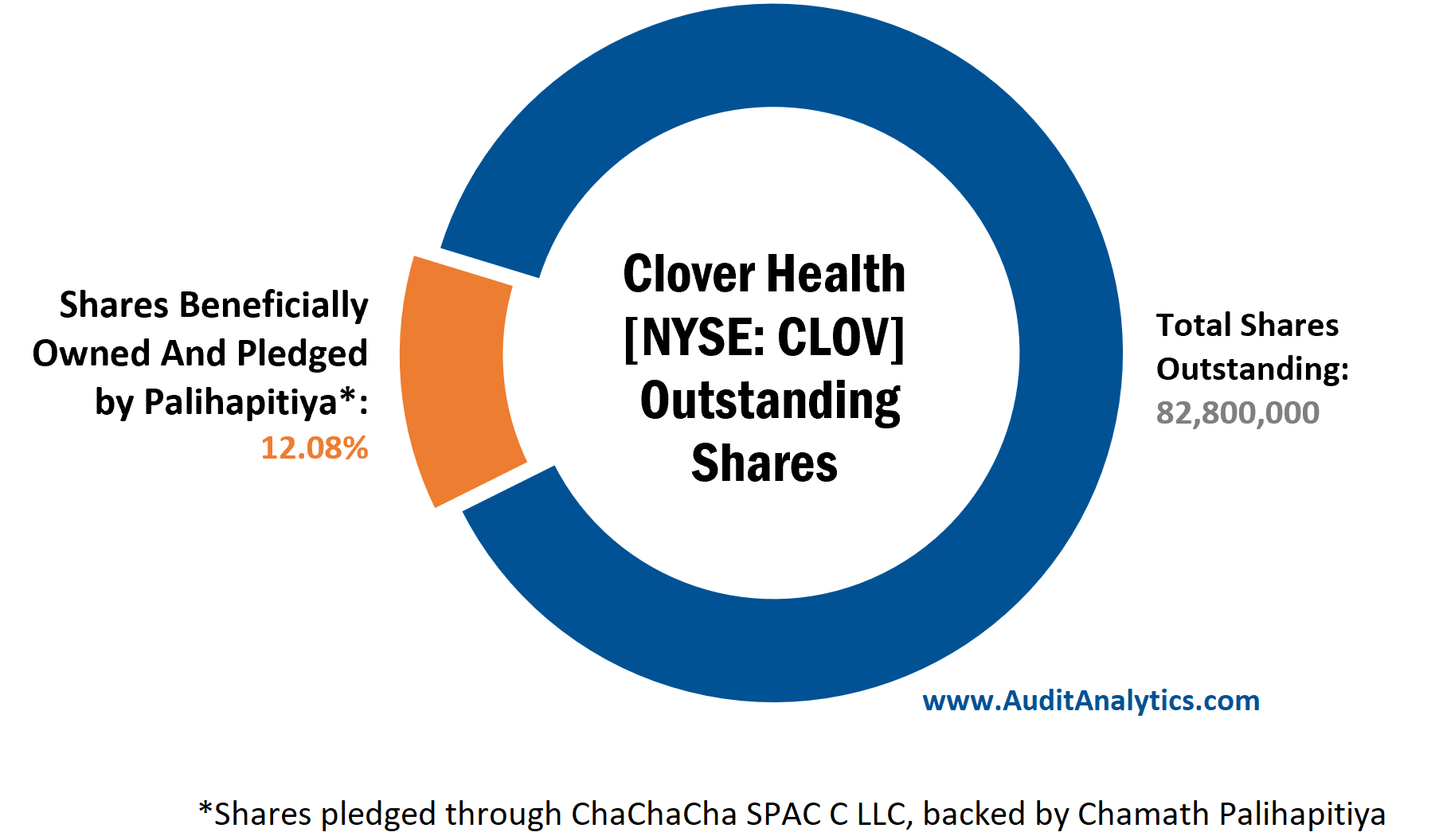

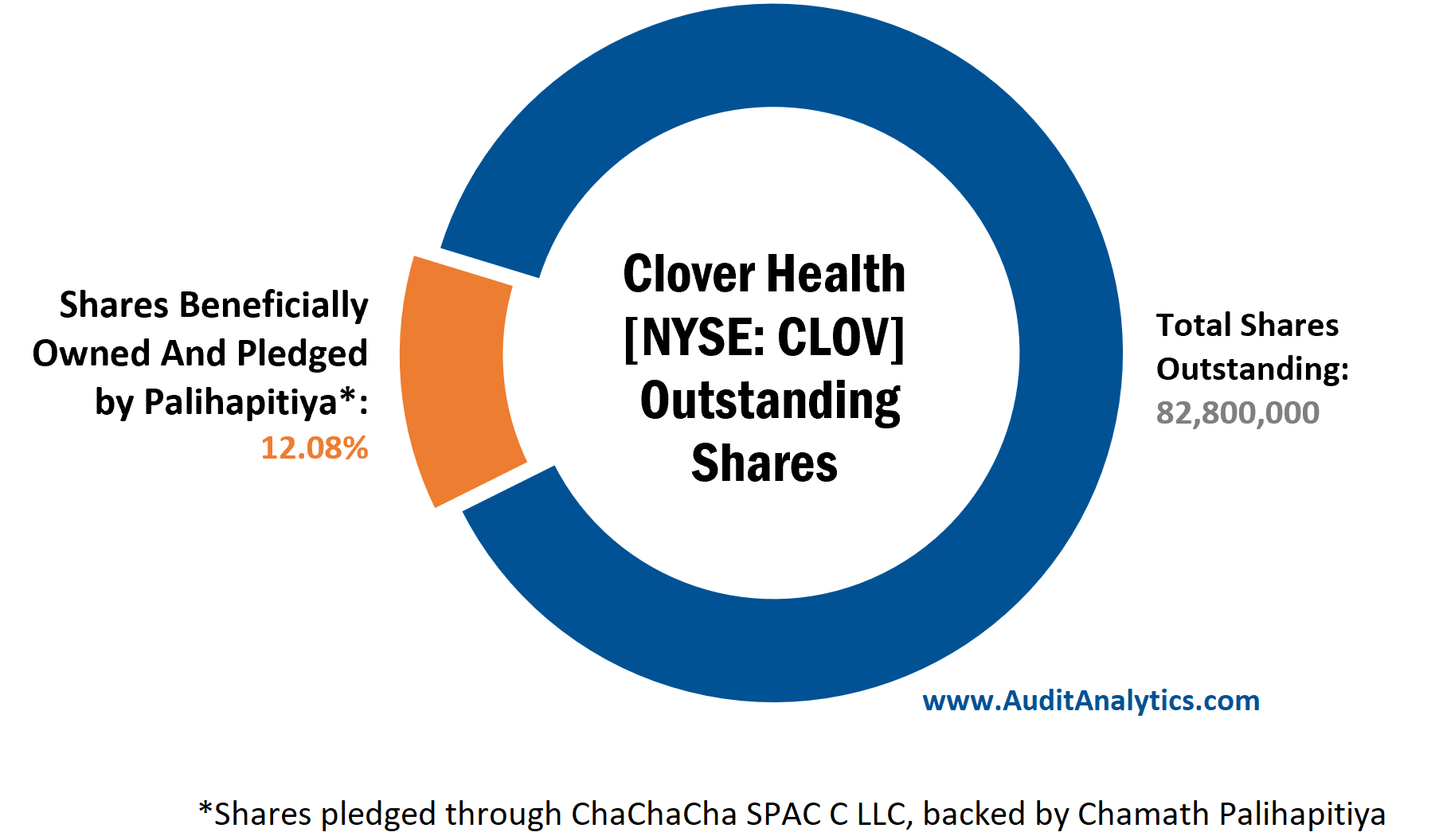

"As we have discussed, pledged securities present risks to corporate governance and share price. These are compounded for SPAC investors relying on the credibility SPAC sponsors and beneficial owners lend to already risky ventures. When these key investors pledge their ownership in a SPAC in exchange for financing, the risk associated with the SPAC investment is transferred to a financial institution...Pledged SPAC shares carry an increased risk of being exposed as unmet margin calls, as SPAC investments are often subject to share price volatility and are not guaranteed to be successful in the public market...Interestingly, all 10,000,000 of Clover Health shares beneficially owned by Palihapitiya – through ChaChaCha SPAC C LLC – have been pledged to Credit Suisse AG, New York Branch as collateral with respect to a loan agreement...Palihapitiya has pledged 100% of his shares that he directly beneficially owns in Virgin Galactic Holdings [NYSE: SPCE], another company taken public last year by a Palihapitiya-backed SPAC. This amounts to 2.95% of Virgin Galactic’s total shares outstanding – worth roughly $400 million. In the event of a default under the margin loan agreement for which the shares have been pledged as collateral, the holding party may foreclose upon any and all shares pledged and are entitled to seek recourse."

Pledged Securities in SPACs Pose Double Risk - Audit Analytics

"As we have discussed, pledged securities present risks to corporate governance and share price. These are compounded for SPAC investors relying on the credibility SPAC sponsors and beneficial owners lend to already risky ventures. When these key investors pledge their ownership in a SPAC in exchange for financing, the risk associated with the SPAC investment is transferred to a financial institution...Pledged SPAC shares carry an increased risk of being exposed as unmet margin calls, as SPAC investments are often subject to share price volatility and are not guaranteed to be successful in the public market...Interestingly, all 10,000,000 of Clover Health shares beneficially owned by Palihapitiya – through ChaChaCha SPAC C LLC – have been pledged to Credit Suisse AG, New York Branch as collateral with respect to a loan agreement...Palihapitiya has pledged 100% of his shares that he directly beneficially owns in Virgin Galactic Holdings [NYSE: SPCE], another company taken public last year by a Palihapitiya-backed SPAC. This amounts to 2.95% of Virgin Galactic’s total shares outstanding – worth roughly $400 million. In the event of a default under the margin loan agreement for which the shares have been pledged as collateral, the holding party may foreclose upon any and all shares pledged and are entitled to seek recourse."

Pledged Securities in SPACs Pose Double Risk - Audit Analytics