10 Investing Lessons from 2020

Posted January 19, 2021 by

Nick Maggiulli

While many of us want to leave 2020 in the past (myself included), it was a year filled with investing lessons that will benefit us for decades to come. Below I have compiled a list of 10 such lessons that you can use to be a better investor in 2021 and beyond. Enjoy!

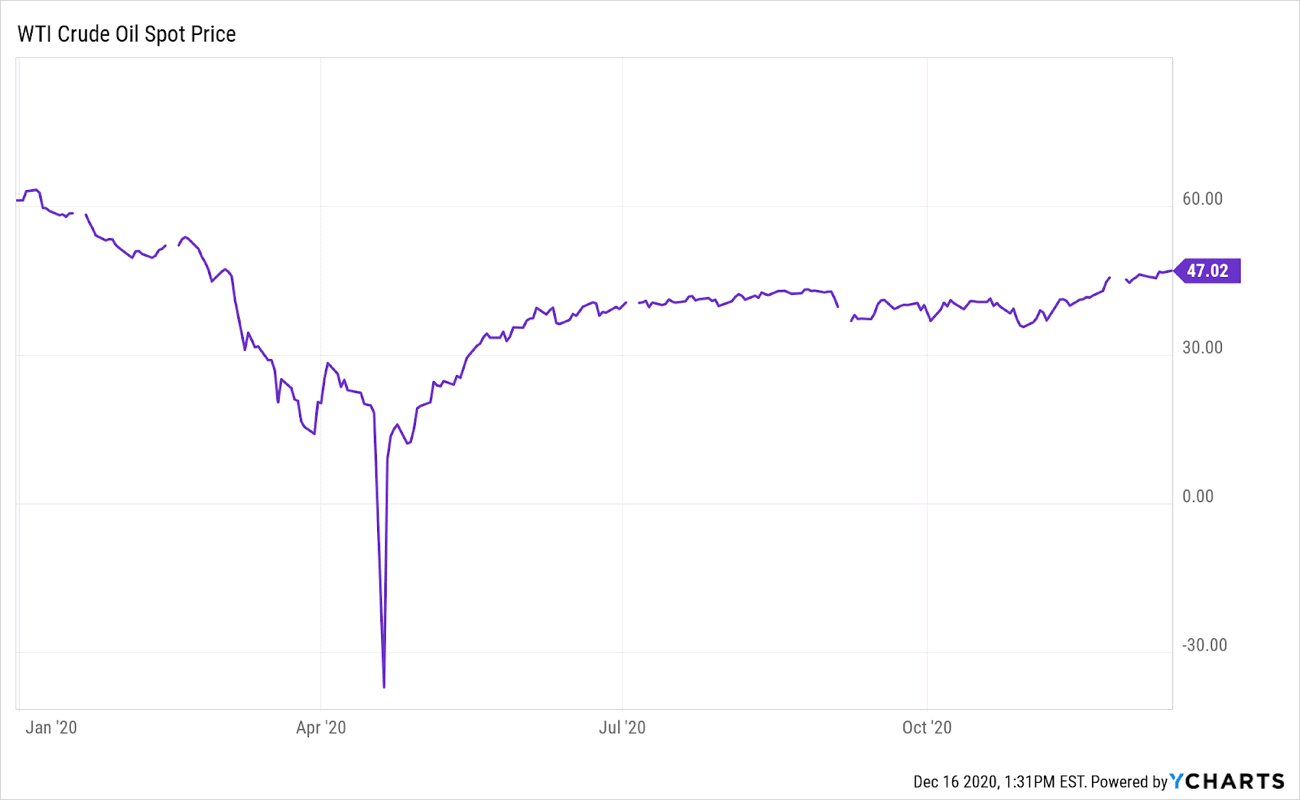

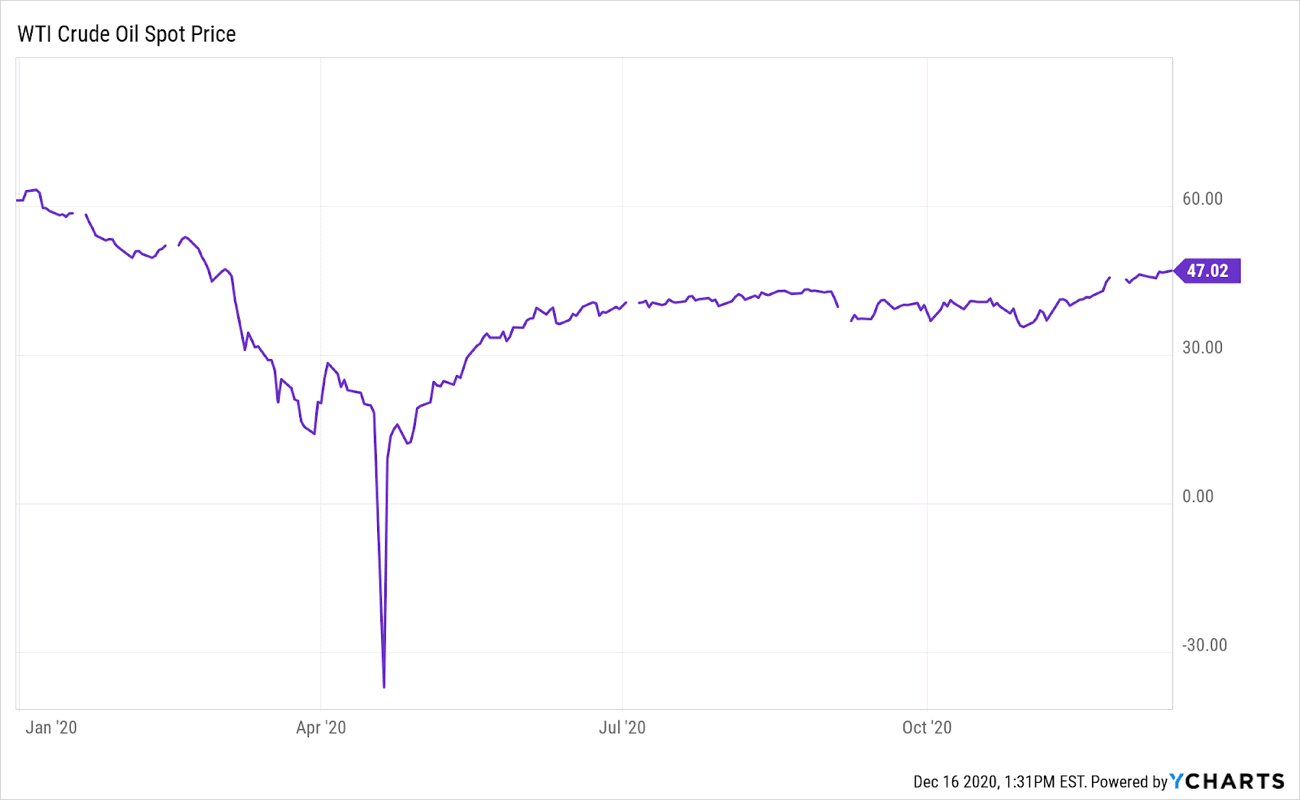

1. Prices can always go lower

Even when things seem like they can’t get any worse, sometimes they do. Energy traders discovered this truth the hard way when spot oil prices went negative for the first time ever:

I don’t think I ever remember FinTwit being more shocked by a single event. The lesson here is simple: even when you think the bottom is in, prices can always go lower. Sometimes you have to expect the unexpected.

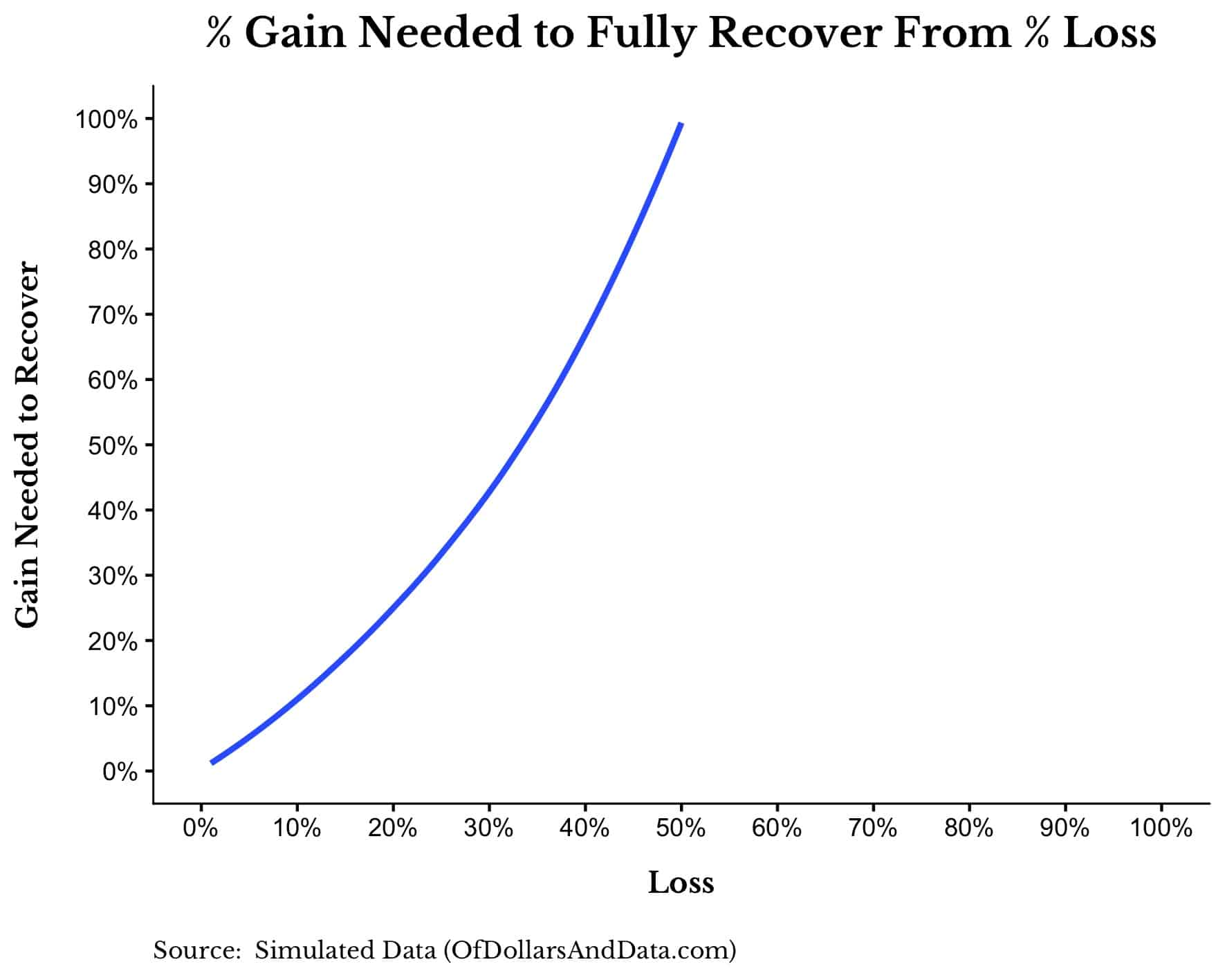

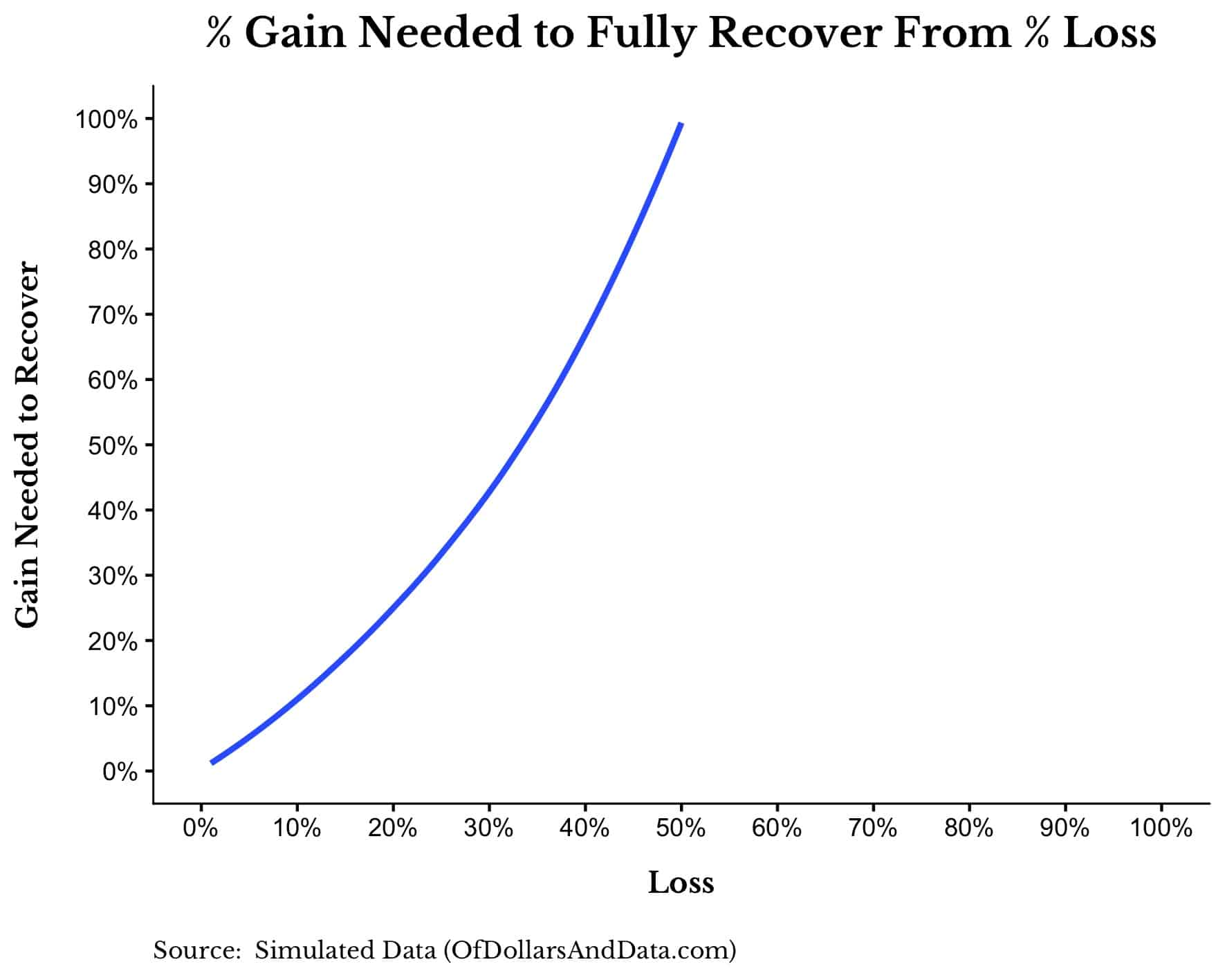

2. The bigger decline, the bigger the potential recovery

If equity markets demonstrated anything this year it was that large price declines have the potential for

even larger recoveries. Why?

It’s simple math. If a 20% drop in prices requires a 25% recovery to get back to even, then a 33% drop in prices requires a 50% recovery to get back to even, and so forth:

And since 2020 witnessed a 33% decline in the S&P 500 (from peak to trough), this means that the unexpectedly quick recovery was even better for those that got in near the bottom in late March. While no one could have predicted that such a recovery would follow, the fact that a recovery did follow meant huge gains for those who stayed the course.

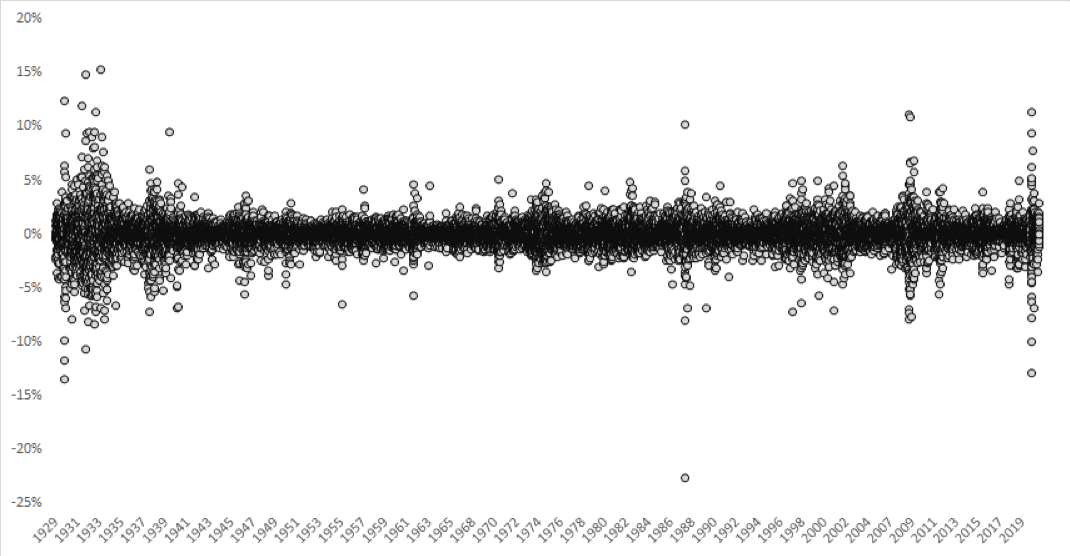

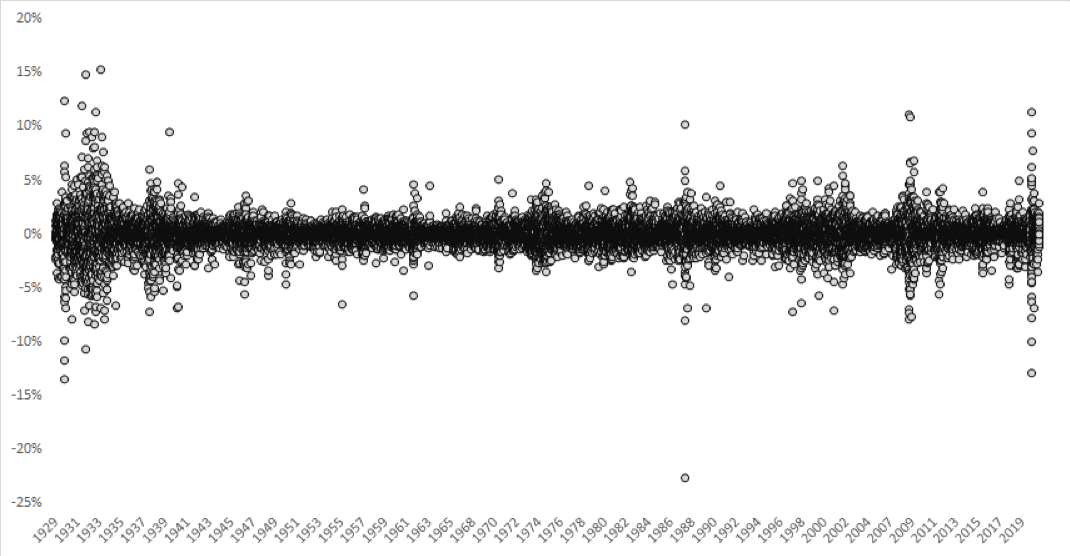

3. Volatility is alive and well

In case you forgot about volatility, 2020 was your wake up call. Looking at daily Dow returns going back to 1929, this year was one for the record books:

In addition to having two daily declines greater than 10%, March 2020 was also

the most volatile month in stock market history. This year was a reminder that the excess expected return of stocks over bonds sometimes comes with a cost.

4. Price is what someone else is willing to pay for something

2020 saw Bitcoin re-reach $20,000 a coin, Tesla exceed $600 Billion in market capitalization, and oil drop

below $0 a barrel. While none of these prices may make sense to some investors, they made sense to the person who bought them.

As long as markets exist, assets will always be priced based on what

someone else is willing to pay for them. This has never been more evident than the recent rise in valuations

among non-profitable tech companies. But as long as enough buyers are willing to pay such elevated prices, they will continue.

While such an occurrence may

seem like an easy short opportunity, it is anything but. As

the famous phrase goes:

The market can remain irrational longer than you can remain solvent.

Try to keep this in mind when investors look like they are losing theirs.

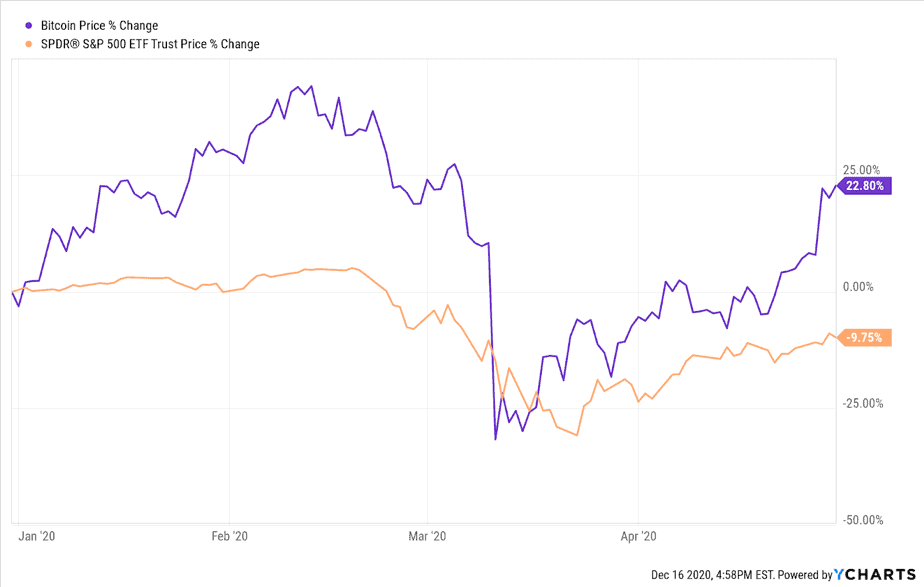

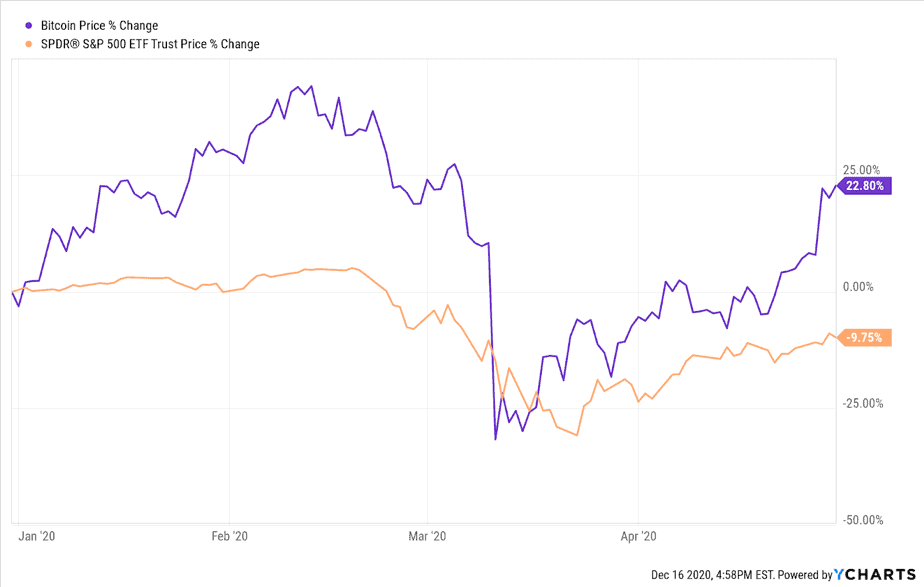

5. Bitcoin doesn’t behave like a safe haven

Despite what Bitcoin evangelists may have claimed in years prior, 2020 definitively proved that Bitcoin doesn’t perform well in chaotic markets. Like many other risk assets, Bitcoin’s price declined rapidly in March 2020:

And while I agree that Bitcoin

generally has a lower correlation with other risk assets during good times, this isn’t necessarily true

when there is blood in the streets. When the world was in peril, Bitcoin showed its true colors.

And though

I have changed my mind about some things related to Bitcoin, it’s proper classification as a risk asset is not one of them.

6. Markets often rhyme but rarely repeat

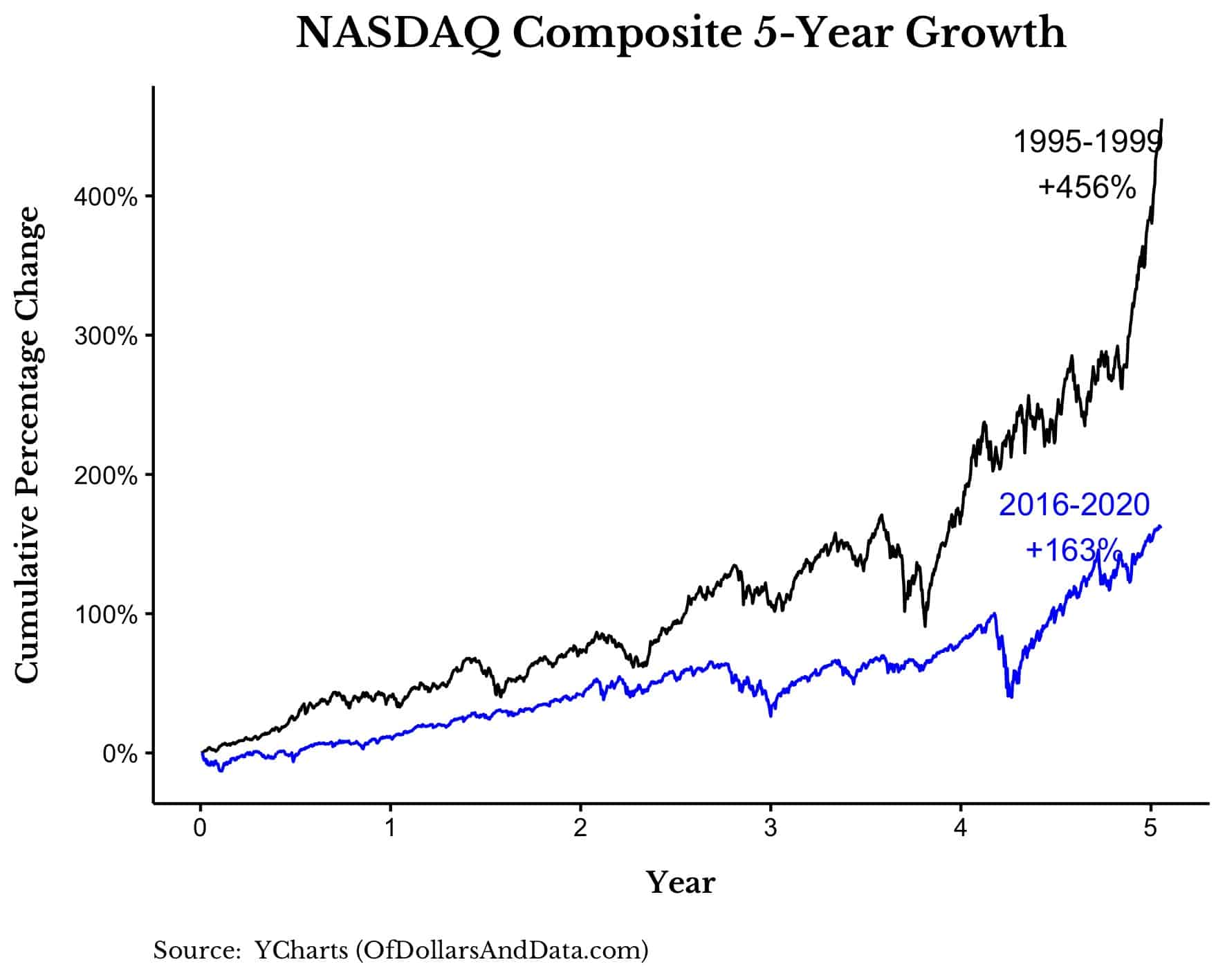

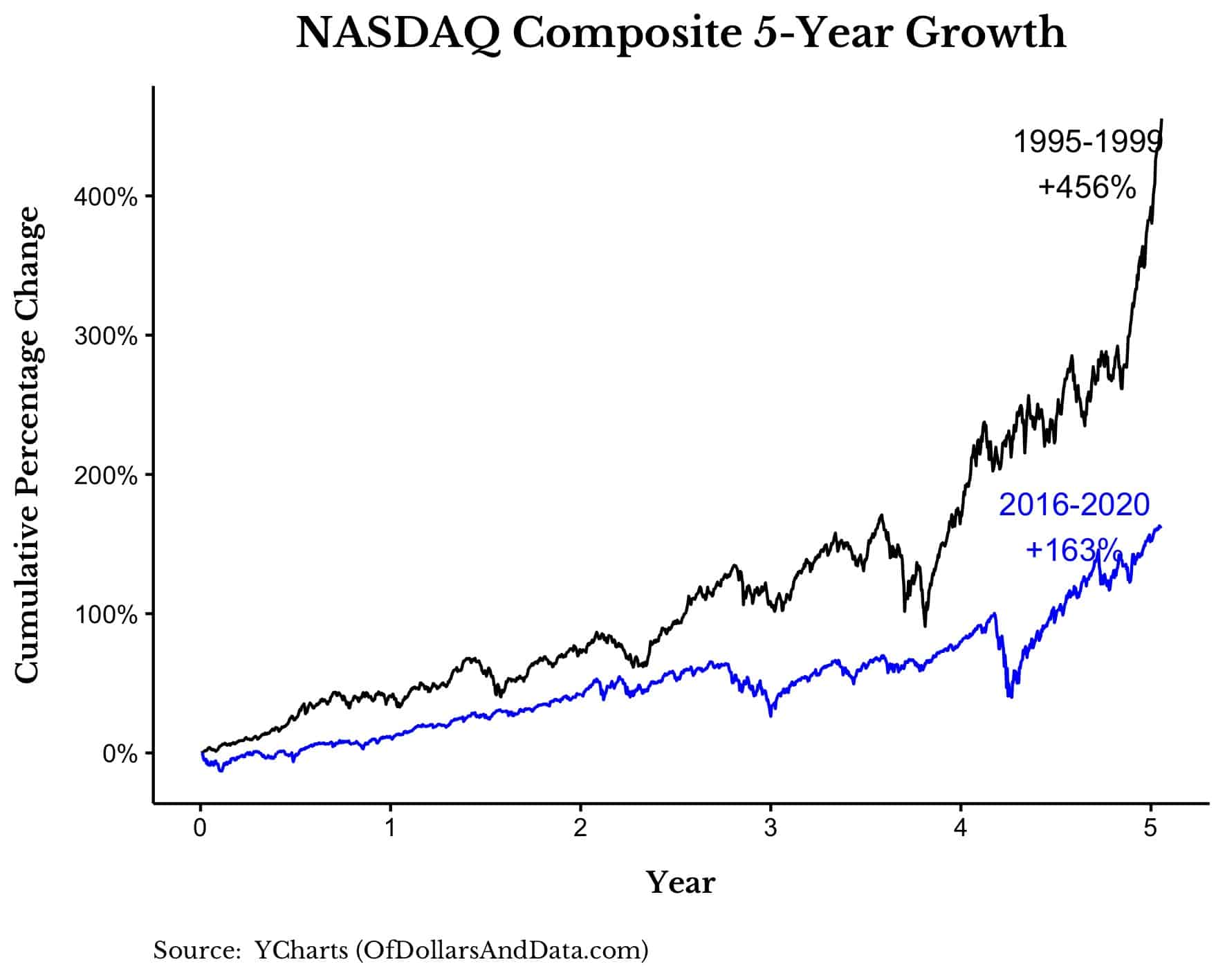

With the many eye-popping valuations of various technology IPOs in 2020, it can feel a bit reminiscent of 1999. And while stock prices might be high, 2020 is no 1999. Just take a look at the growth in the NASDAQ from 1995-1999 compared to 2016-2020 and you will see that it’s night and day:

This chart illustrates that there is a big difference between “bubble” and “BUBBLE.” As my colleague Michael Batnick

recently argued:

I don’t think the stock market is in a bubble, but it’s surrounded by them.

Though we aren’t in 1999, some investors definitely are. Markets often rhyme but rarely repeat.

7. Robinhood traders had limited impact on the stock market

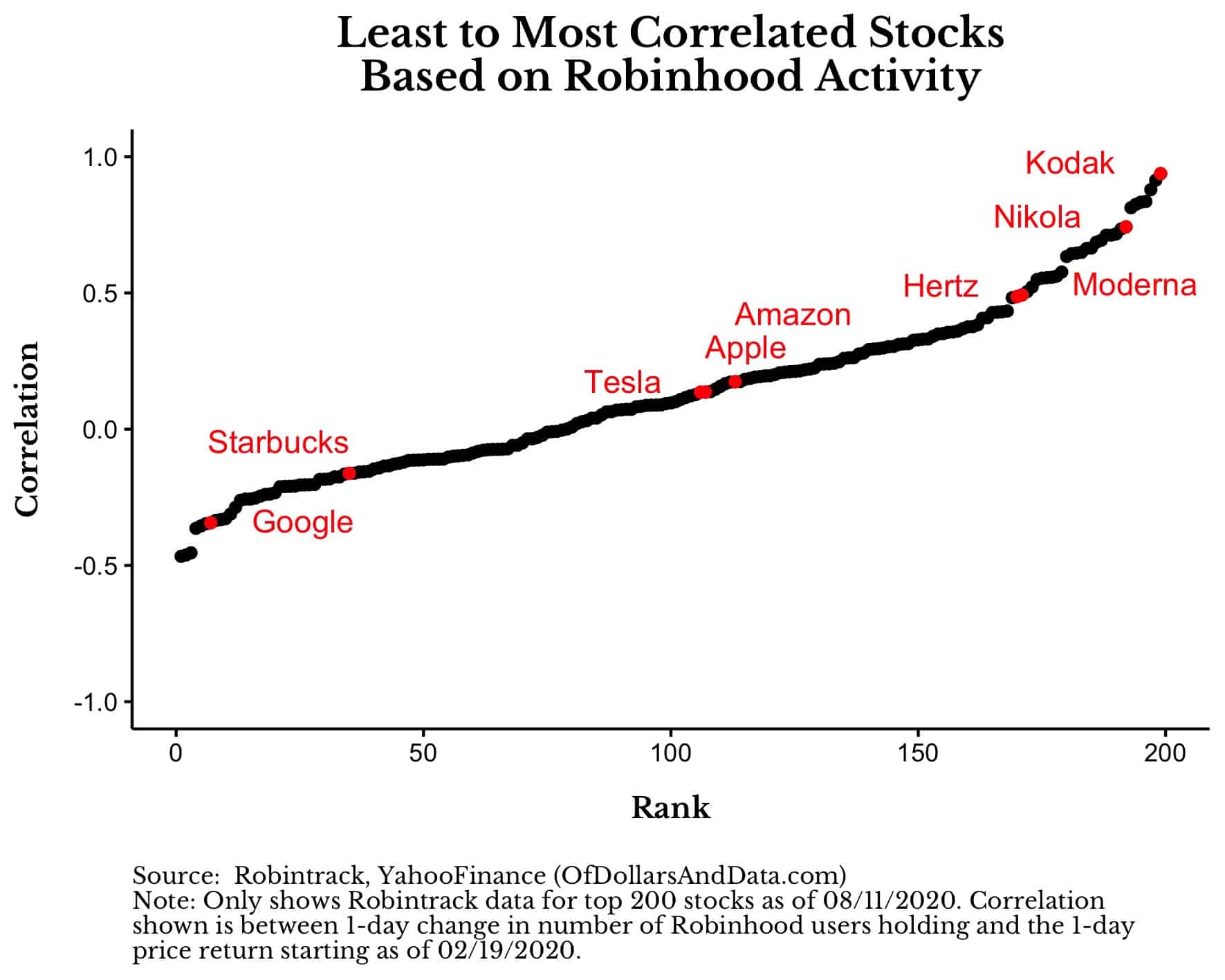

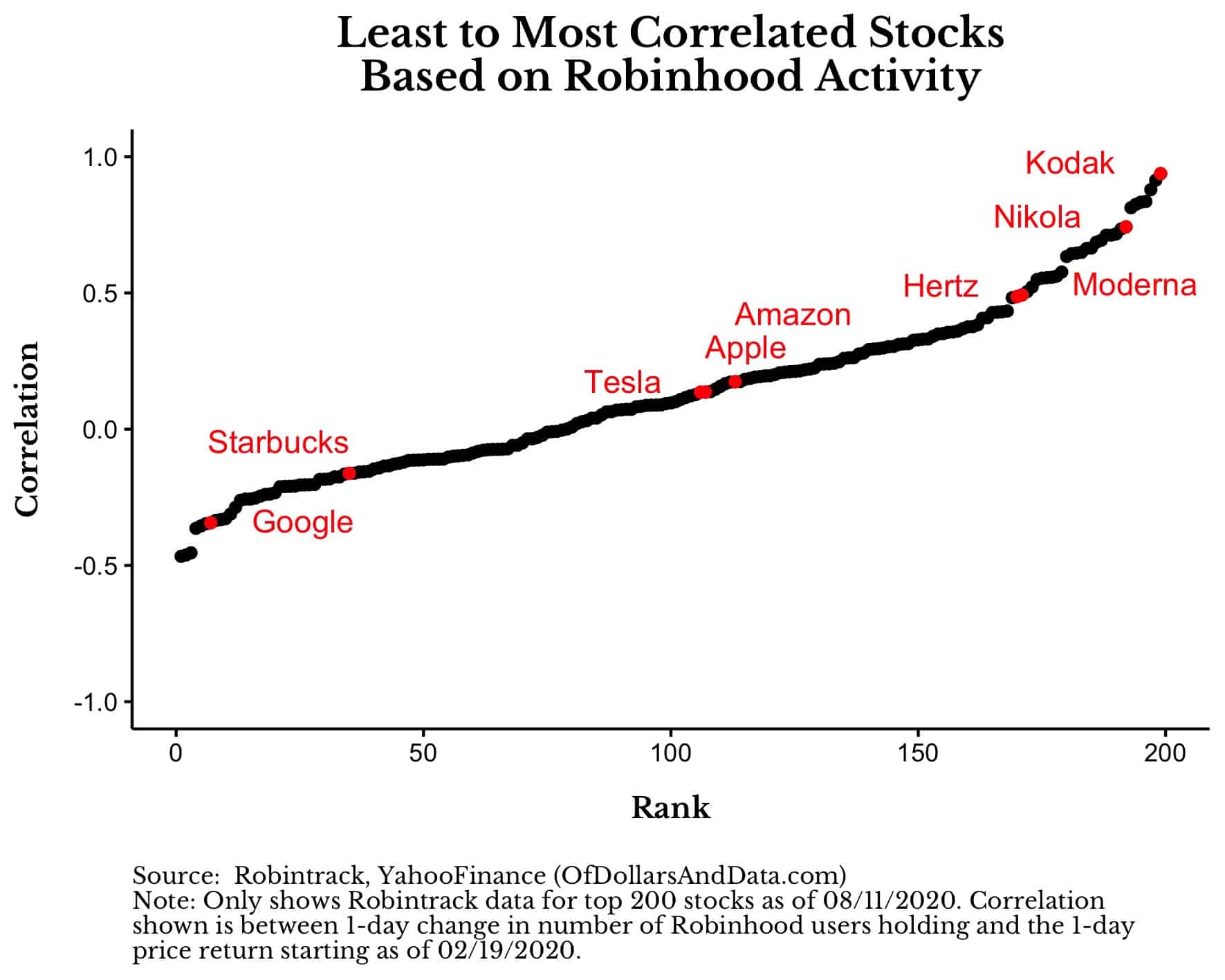

While many news headlines in 2020 insisted that traders on Robinhood were sending aggregate stock prices higher, there is little evidence for this claim. Most of the effect of Robinhood trading activity seems to be limited to individual stocks, particularly those that are smaller and have less trading volume. We can see this by examining the least to most correlated stocks based on Robinhood trading activity:

Those stocks with the highest correlation among Robinhood users were also some of the smaller, less liquid stocks of 2020. The biggest stocks saw little to no price impact based on how Robinhood users were trading. So while it is tempting to give Robinhood users all the credit for soaring stocks, the data suggests otherwise.

8. Markets aren’t always efficient

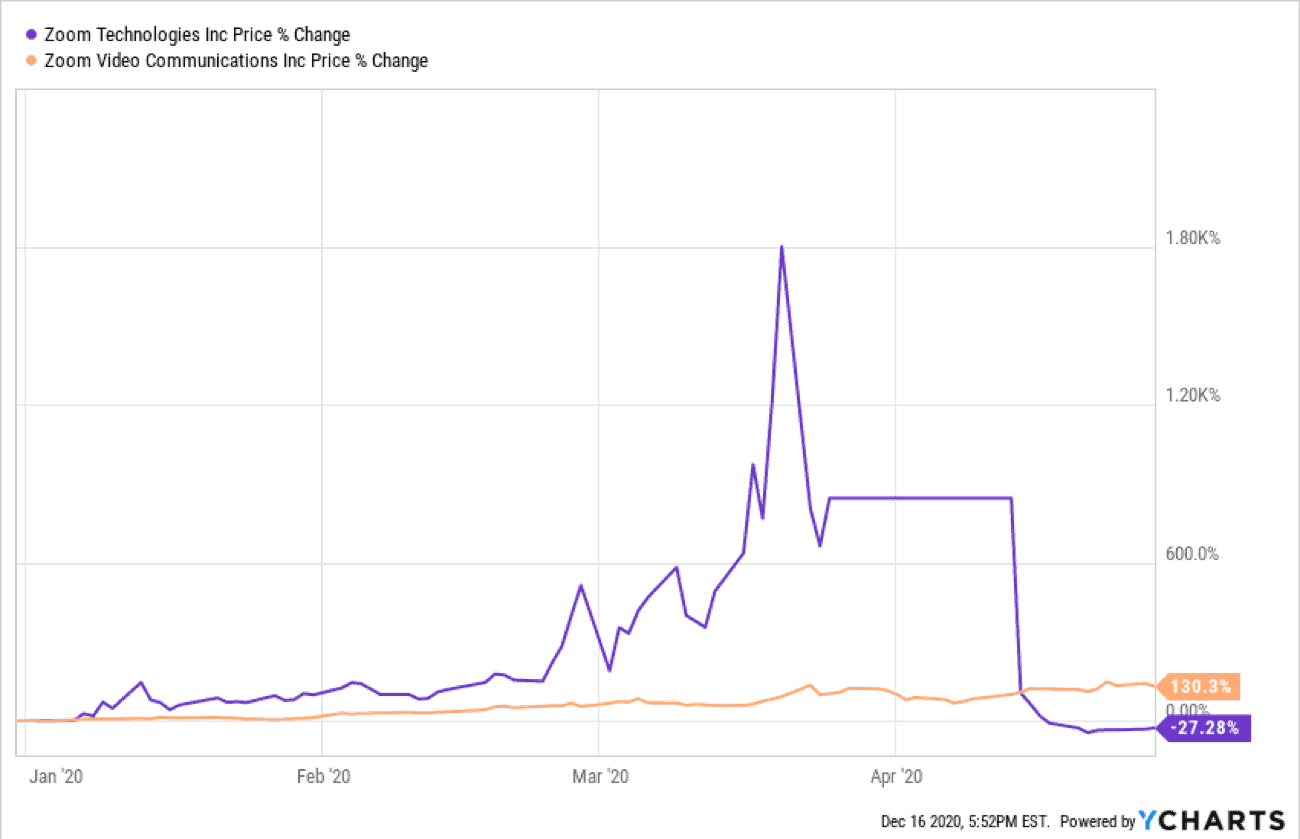

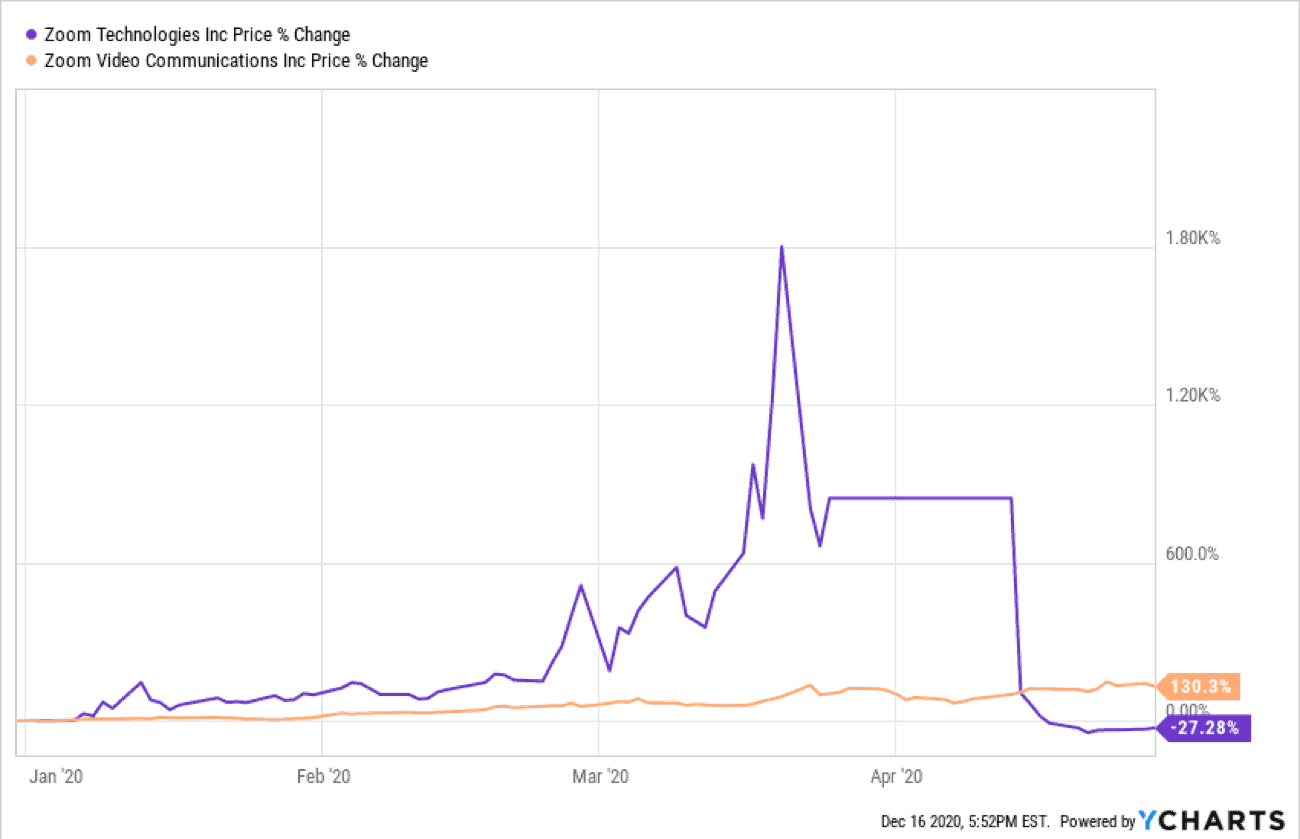

While most markets are efficient most of the time, it is entertaining to see when they act up. The best example of this from 2020 occurred when Zoom Technologies (“ZOOM”) saw its price increase by 1,800% from the beginning of the year through mid-March. The only problem? That’s not the right Zoom!

Zoom Video Communications, maker of the popular video conferencing software, trades under the ticker “ZM” not “ZOOM”:

Trading was halted for the incorrect Zoom once regulators realized what was going on. Since the halt, Zoom Technologies now trades under “ZTNO” and its price is now down over 25% from the beginning of 2020. Markets are usually efficient, but when they aren’t it can be quite the story.

9. Sometimes none of the rules apply

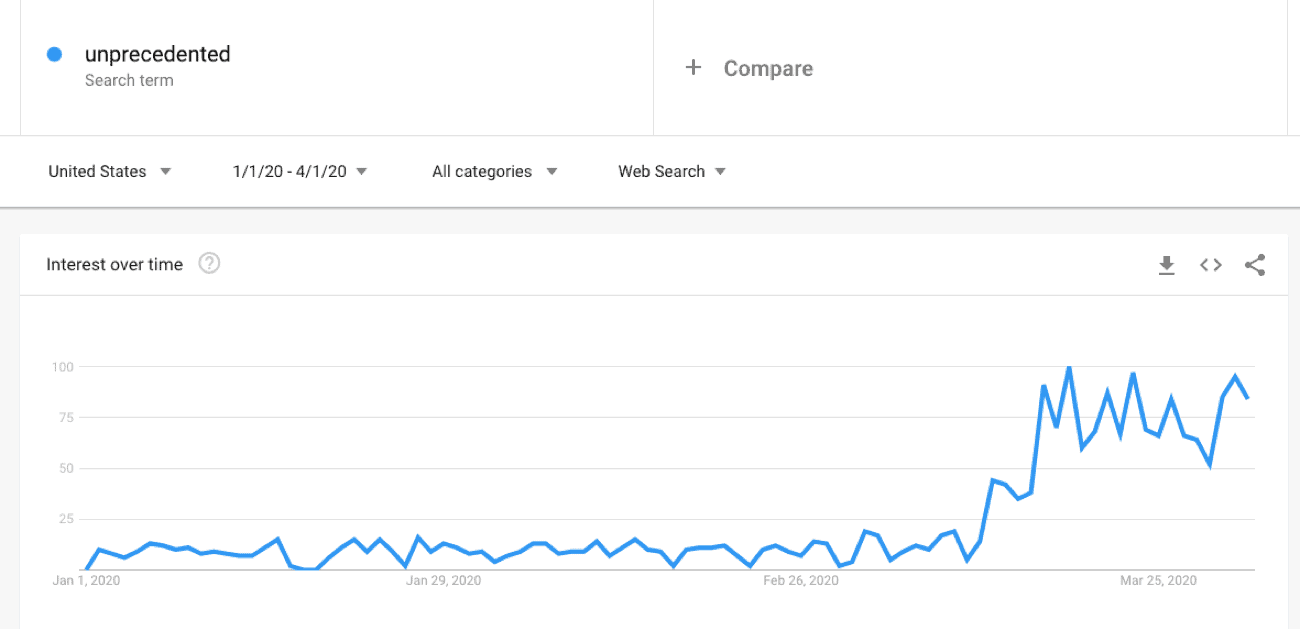

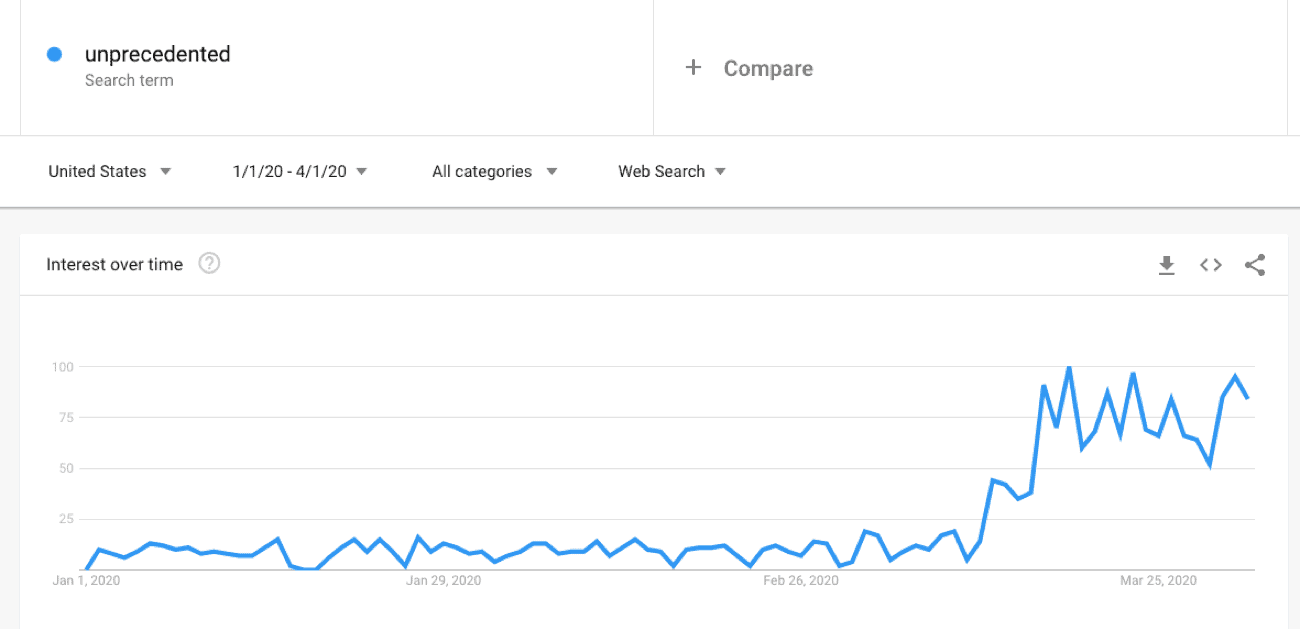

Though we would like to believe there is always a playbook to follow in markets, sometimes none of the rules apply. All the wit and wisdom in the world won’t always prepare you for what comes next. This is why the term “unprecedented” became the word of 2020:

So the next time you are in uncharted territory, be calm, relax, and remember that this too shall pass.

10. Nobody knows nothing

If 2020 taught me anything, it was what the late Jack Bogle was fond of saying, “Nobody knows nothing.” Of course, predicting the future is always hard, but 2020 illustrated to us just how difficult it can be. If you would’ve told me that U.S. stocks would

rise over 10% in the same year as a global pandemic, I wouldn’t have believed you. But that’s what makes markets so complex and mystifying, especially in 2020, a year unlike any other.

I hope you enjoyed this list and can put it to good use in the future. Happy investing and thank you for reading!

:rocket:

:rocket:

"you got in then ?!!?!"

"you got in then ?!!?!" . Money i got on the sideline so I can get more shares when cciv or ipof gets confirmed.

. Money i got on the sideline so I can get more shares when cciv or ipof gets confirmed.. Money i got on the sideline so I can get more shares when cciv or ipof gets confirmed.