Espn: "B-b-b-But Joe Mixon punched a drunk girl 4 years ago....."

Classy company

It's probably a better option than a 5 year restrictive covenant.I wonder if it was because of the exposure or were they living that lavish lifestyle with espn. 50% though? Begs the question how much some of these guys were making

BOMM is back...

Cheesus khristLooks edible

Still the champion?

ESPN is losing subscribers but it is still Disney’s cash machine

FOR a sports addict, a visit to ESPN’s 123-acre campus is like mainlining the product. In an industrial workspace connected by an array of cables and satellite dishes to live feeds from all over the world, employees of the channel crowd around monitors at 80 desks and watch games.

This is the world’s nerve-centre for highlights. The feeds show almost every sporting event that might be of interest, from cricket tests in India to football matches in Brazil to baseball games in Florida. ESPN’s staff watch everything so that viewers don’t have to, digitally tagging more than 1,000 of the day’s best plays to turn them into consumable clips on TVs, browsers and smartphones.

The campus embodies Disney’s hopes for the brand—the technology inside it has been expensively upgraded in recent years. The channel offers live sporting events, continuous sports news, game highlights and conversations about sport. By dominating televised sport, ESPN generates some $4bn in cash for its parent each year, over two-fifths of Disney’s profits.

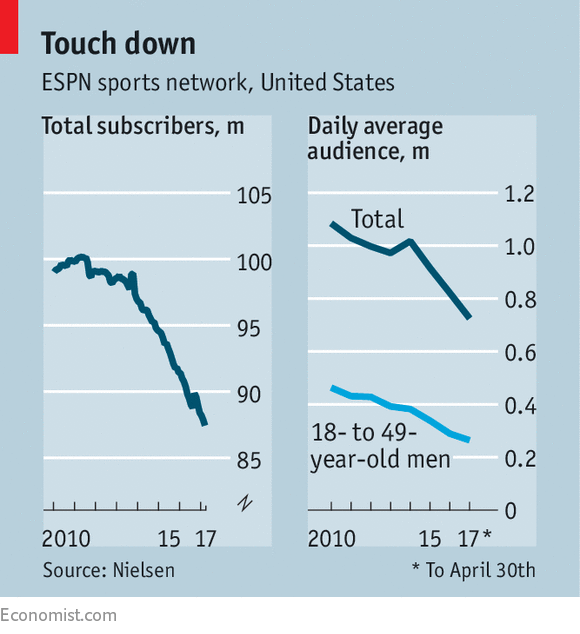

The problem, however, is that ever-fewer people are tuning in. The number of American homes paying to get ESPN has declined by more than 12m from a peak of 100m in 2011 (see chart). ESPN is not alone: consumers are broadly abandoning costly cable packages for online services from Netflix, Amazon and Hulu.

In the households that are still connected to ESPN, residents are watching less. Figures from Nielsen, which tracks TV viewership, show big declines in American audiences over this decade both for big sporting events and, especially, for news-and-highlight shows. The early-evening edition of SportsCenter, ESPN’s flagship show since 1979 and a touchstone of American sports culture in the 1990s, has lost almost half of its audience in the demographic segment of men aged 18 to 49, which is coveted by advertisers. These viewers make up 46% of the show’s audience (itself 77% male).

One reason is that viewers are sharing highlights using phones. ESPN makes many of these clips, but sports leagues and other networks also produce them. Fans film plenty of their own, capturing snippets from games they watch on their devices and posting them on social media. Some post clips of their TV sets at home; it is not uncommon to see Lionel Messi’s latest wonder-goal in such bootleg fashion.

In a cruel twist, however, the cost of rights to live games has shot up even though sport is attracting fewer viewers. That is because the decline in ratings for scripted dramas and comedies on cable has been still more calamitous. Viewers at home are watching their favourite shows on catch-up instead of when they air originally, or they are watching such entertainment on Netflix-like services. Networks and advertisers see live sports as one of the few examples of “appointment viewing” that still draws substantial audiences.

Some former employees at ESPN reckon that the network has taken this reasoning to the extreme and paid way over the odds for sports rights, including $1.9bn a year for 17 regular-season National Football League (NFL) games plus highlight rights, and over $600m a year for eight post-season college football games. The next time sports contracts are up—the NFL is due in 2021—they are expected to get even more expensive. Cash-rich tech firms want sport to enhance their internet services: Amazon recently agreed to pay $50m for the right to offer ten NFL games on its Prime video service.

As a result, an empire that has been expanding almost continuously since 1979, when ESPN was just a few men and a transponder, looks shaky. In 2017 its operating profit will probably be lower than last year’s. Some experts believe that profits will fall by a lot more over time. In April ESPN laid off about 100 people, including well-known journalists and on-air talent. Bob Iger, Disney’s boss, admits that the pay-TV system is “definitely challenged”.

That is why John Skipper, ESPN’s president, is improving the company’s digital services. Yet an ESPN-branded subscription streaming service, due to start later this year, has not allayed fears much; some worry it will speed the decline of cable TV without improving ESPN’s bottom line. The pace of “cord-cutting” caught the firm by surprise, critics say. “The question for me is, how much of this should they have seen coming?” says James Andrew Miller, author of a book on the network.

One argument is that ESPN misjudged the readiness of competitors to overpay for sports rights and, because of that, overpaid for them itself. If it had not splurged, it could have demanded smaller increases in its hefty subscriber fees in exchange for cable providers guaranteeing to sell more cable packages that include ESPN.

In the short term there is little cause for worry. Thanks largely to the high “affiliate” fees ESPN collects from pay-TV operators, its profits should start growing again from 2018. For the next five years at least, it should continue to be Disney’s cash cow. But after that, the rights’ costs will ratchet up again after deals expire. And the high affiliate fees look ever more precarious.

In 2011 ESPN was paid less than $5 per subscriber per month. This year it is being paid $7.86, according to Kagan, a research firm—meaning it collects $2.3bn more despite having 12m fewer subscribers. No other basic-cable channel commands even $2 a month from pay-TV operators, and most charge far less than a dollar. ESPN has been able to charge so much because it is crucially important to distributors as a “must-have” cable channel. But the high cost could be driving some pay-TV customers away. And if the fees were ever to go down, investors would run screaming.

That will be a growing concern as consumers turn to new, skinny bundles of TV channels being offered over the internet at low prices. YouTube recently announced it will be selling a live TV service, joining several other services offering TV packages for as little as $20-40 a month (a typical monthly cable bill in America is about $80-100). ESPN is being offered in almost all of these packages so far, which Mr Iger sees as a sign of the network’s resilience. ESPN gets paid at least the same fee, of $7.86 per subscriber, on the internet services. Mr Iger believes that as consumers continue to opt for cheaper packages of channels, it will be non-sports channels that will be left out.

Yet this is not a forgone conclusion. Recently some cable networks, including AMC, are said to have begun discussing an ultra-cheap non-sports bundle. Disney will fight that—it has commitments from pay-TV operators that ESPN must be included in a certain percentage of cable packages—but it portends a struggle over ESPN’s place in the future TV landscape.

At its headquarters, it is clear that the network is taking these challenges seriously. In an effort to retain viewers, ESPN is turning to shows driven more by personalities than by sports highlights. Examples include a revamp of its early-evening edition of SportsCenter, called SC6, with two bantering presenters.

Eventually Disney may have to be bolder still. ESPN could be marketed one day as a standalone internet service. Mr Iger says he thinks it can, if need be, become a “Netflix for sports”. Such an offering would have far fewer subscribers than it has now via cable, and thus would have to be much more expensive than Netflix—probably $20 or $30 a month.

Underestimating ESPN has been a mistake in the past. Its inception was a struggle; investors, lenders and commentators doubted the prospects of an all-sports network. In 1996, when Disney bought its 80% of ESPN as part of its purchase of ABC, a broadcast network, the sports network was an afterthought. Now, however awkwardly it sits with film studios, franchises and theme parks, its place in the Disney firmament is secure. ESPN may have muscled its way into many homes that no longer wish to pay for it, but a sizeable, hard core of fans is unlikely to kick the habit.

No they wouldn't. They'd be fighting an avenue they can't conquer, which is YouTube. That's why they and BET have specialized channels solely for videosBet and MTV would get better ratings if they showed music vids still instead Wayans Bros eps

looks like he took the paycutI see Amin back on tv

Dudes in here really talking about music videos on tv when you can watch it on YouTube

"W...w..what about live performances I miss those"

That can be live streamed on YouTube as well

She is on SC this morning showing off all the thigh meatWhere's the coli thread on Elle Duncan?That bytch is bad as fukk. She shyts on everyone on that station

Dudes in here really talking about music videos on tv when you can watch it on YouTube

"W...w..what about live performances I miss those"

That can be live streamed on YouTube as well

Dude, literally EVERYTHING Rob Dyrdek does on his show can be seen on the internet as well.

Dude, literally EVERYTHING Rob Dyrdek does on his show can be seen on the internet as well.