You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Russia's Invasion of Ukraine (Official Thread)

- Thread starter newarkhiphop

- Start date

More options

Who Replied?Great interviews with frontline Ukrainian soldiers. Turn on closed captions.

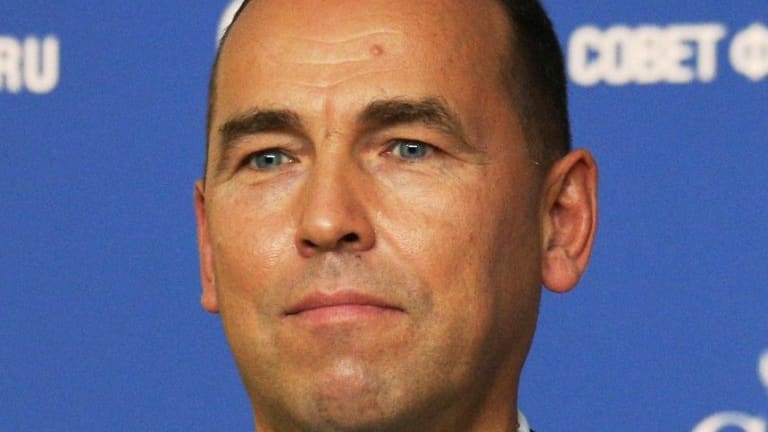

Putin Ally Blames Crisis on Rise of Black U.S. Music Stars

Despite pushing this bizarre racist theory, a senior Russian lawmaker claims the regional governor was being “more than politically correct.”

.S. Music Stars He Calls ‘Descendants of African American Slaves’

RACIST RANT

Despite pushing this bizarre racist theory, a senior Russian lawmaker claims the regional governor was being “more than politically correct.”

Allison Quinn

News Editor

Published Dec. 01, 2022 8:55AM ET

council.gov.ru/Wikimedia Commons

Listen to article3 minutes

https://policies.google.com/privacy

In a sign of the times for Vladimir Putin’s twisted Russian regime, a regional governor has been backed by the State Duma after saying the “descendants of African-American slaves” are to blame for the country’s growing crisis.

Vadim Shumkov, governor of the Kurgan region, said Russian society was collapsing—as exemplified by the rising rate of suicide and depression among young people—and it can all be traced back to the popularity of Black American stars in the music industry.

In a bizarre rant posted on his official Telegram channel, Shumkov described a gaping hole of emptiness at the center of Russian culture, which he argued was not the result of poverty, war, or rampant corruption, but “an underestimation of the importance of native national culture.”

“Many of our children… are already growing up without knowing or remembering their kindred tribe,” he lamented, claiming that they are instead “singing songs written by the descendants of African-American slaves, often playing the ape and imitating the habits and language, brimming with, frankly, second-rate quasi-cultural vulgarity. Clinging to this secondariness, being proud of it.”

“Hence the growth of overt spiritual emptiness, depression, suicides. The lack of meaning in life,” he wrote.

Though Shumkov did not mention Russia’s war against Ukraine as a possible reason for the bleak mood in the country, he went on to hint at a growing rift between ordinary Russians that he blamed on outside forces, claiming that a “neglect of native culture” has led to a biblical Cain and Abel situation, with brothers pitted against brothers by “foreign ‘well-wishers’” who see them as “expendable.”

While Shumkov’s remarks were simultaneously mocked and criticized on social media, the Russian State Duma found nothing offensive in his argument.

Alexander Sholokhov, the deputy chairman of the State Duma Committee on Culture, told local media there was nothing inflammatory in his comments because he’d used the term “African-American.”

“I think that depression is connected with the lack of ideology in our country,” Sholokhov said. “I disagree with [allegations of] incitement. He used the word African American. The governor acted more than politically correct, using literally the American version to designate this race, and besides… this same African-American culture occupies a significant part of show business and variety shows.”

WSJ News Exclusive | EU Asks Members to Set Russia Oil-Price Cap at $60

The price cap is the West’s attempt to squeeze the Kremlin’s oil revenues while keeping oil supplies steady and avoiding an increase in global energy prices.

EU Asks Members to Set Russia Oil-Price Cap at $60

Move is an attempt to squeeze the Kremlin’s oil revenues while keeping global supplies steady

Laurence NormanUpdated Dec. 1, 2022 at 8:29 am ET

The cap by the European Union’s executive body would set Russian crude prices significantly below the international benchmark, called Brent, which traded at about $88 a barrel Thursday.

If the EU agrees on the level, the Group of Seven nations need to sign off on it. The seven countries and Australia aim to have it in place by Monday.

The price cap is part of the West’s attempt to squeeze the Kremlin’s oil revenues while keeping global supplies steady and avoiding an increase in prices. It has been crafted as a way to try to allow Russian oil to sate global markets without Moscow getting the full benefit of its sale.

All 27 of the EU’s member states need to approve the cap, which would be reviewed every two months starting in mid-January, according to the proposal. But members have largely coalesced around a cap of $60 a barrel to such a degree that the commission believes it can get a deal at this level, the people said.

Russian crude trades at a significant discount to Brent, but since many buyers have shunned it altogether, price transparency has been more difficult. In some cases, Russian crude has traded well under $60 a barrel. Russia’s Urals crude fetched $48 a barrel when exported from the Baltic port of Primorsk on Wednesday, according to Argus Media, which assesses prices in commodity markets.

Senior officials from the bloc’s member states began discussing the proposal on Thursday afternoon. A decision is expected later Thursday, with the officials saying Polish officials requested time to check the commission’s plan with Warsaw.

Newsletter Sign-up

The 10-Point.

A personal, guided tour to the best scoops and stories every day in The Wall Street Journal.

Under the system, companies shipping Russian oil would still be able to access EU insurance and brokerage services if they sell the oil at or under the price-cap level.

In addition to the proposed cap, a separate EU embargo on Russian vessel-bound crude oil imports enters into force on Monday. U.S. officials had worried that the embargo, combined with the threat of cutting off EU insurance and other services for vessels shipping Russian oil, could send prices upward, generating fresh revenue for the Kremlin’s war efforts.

According to text of the EU proposal seen by The Wall Street Journal, at every review the level should be “at least 5% below the average market price for Russian oil and petroleum products.” The International Energy Agency will advise on the reference price.

EU ambassadors have spent hours negotiating over final approval of the price-cap level over the past week, but several EU officials have voiced doubts about the effectiveness of a mechanism whose price cap is currently above the price of some Russian oil exports.

The European Commission has proposed a price cap on Russian oil of $60 a barrel.Photo: stephanie lecocq/Shutterstock

Selecting the level of the price cap has required the U.S. and its allies to try to balance two goals: reducing Russia’s oil revenue while allowing the country to still sell its oil on global markets. Some Ukrainian and Eastern European officials favored a lower cap to cut off more of Russia’s revenue. The Biden administration, oil traders and financiers favored a higher cap that would still induce Russia to sell its oil at the capped price.

Russia has threatened to refuse to sell its oil at prices below the cap, a step that could take a sizable chunk of supplies off the market and raise prices globally. But last week, Kremlin spokesman Dmitry Peskov signaled there might be wiggle room in Moscow’s threats.

“It feels like they are just trying to make a decision for the sake of a decision. For the time being, we proceed from the directive of President Putin, that we will not supply oil and gas to those states that will introduce and join the ceiling. Of course, we must analyze everything before formulating a position,” Mr. Peskov said.

The U.S. Treasury Department, which has led efforts to craft the price cap, has said the West might lower it over time, with a senior official saying such adjustments could happen on a quarterly or semiannual basis.

Many Russian oil sales would likely be able to continue without complying with the new price cap, if Russia and its buyers in Asia and elsewhere use ships, insurance and financing outside the jurisdiction of the G-7. Traders say the cap could push Russian oil into the domain of the so-called shadow fleet of tankers that keep Iranian oil flowing in violation of U.S. sanctions.

Biden administration officials have said they are comfortable with Russia selling its oil outside of the cap. Using non-Western shipping, insurance and banking services would likely be more costly for Russia, they said.

Still, Moscow will face the EU’s separate embargo on all oil imports into the bloc. Traders say there are signs that Russia is struggling to find buyers for more than a million barrels of crude each day that are currently sold into the EU.

The EU’s Energy Shortage

A look at Europe’s energy crisis, prompted mainly by Russia’s cutback in supplies, selected by the editors

Write to Laurence Norman at laurence.norman@wsj.com

WSJ News Exclusive | EU Asks Members to Set Russia Oil-Price Cap at $60

The price cap is the West’s attempt to squeeze the Kremlin’s oil revenues while keeping oil supplies steady and avoiding an increase in global energy prices.www.wsj.com

EU Asks Members to Set Russia Oil-Price Cap at $60

Move is an attempt to squeeze the Kremlin’s oil revenues while keeping global supplies steady

Laurence NormanUpdated Dec. 1, 2022 at 8:29 am ET

The cap by the European Union’s executive body would set Russian crude prices significantly below the international benchmark, called Brent, which traded at about $88 a barrel Thursday.

If the EU agrees on the level, the Group of Seven nations need to sign off on it. The seven countries and Australia aim to have it in place by Monday.

The price cap is part of the West’s attempt to squeeze the Kremlin’s oil revenues while keeping global supplies steady and avoiding an increase in prices. It has been crafted as a way to try to allow Russian oil to sate global markets without Moscow getting the full benefit of its sale.

All 27 of the EU’s member states need to approve the cap, which would be reviewed every two months starting in mid-January, according to the proposal. But members have largely coalesced around a cap of $60 a barrel to such a degree that the commission believes it can get a deal at this level, the people said.

Russian crude trades at a significant discount to Brent, but since many buyers have shunned it altogether, price transparency has been more difficult. In some cases, Russian crude has traded well under $60 a barrel. Russia’s Urals crude fetched $48 a barrel when exported from the Baltic port of Primorsk on Wednesday, according to Argus Media, which assesses prices in commodity markets.

Senior officials from the bloc’s member states began discussing the proposal on Thursday afternoon. A decision is expected later Thursday, with the officials saying Polish officials requested time to check the commission’s plan with Warsaw.

Newsletter Sign-up

The 10-Point.

A personal, guided tour to the best scoops and stories every day in The Wall Street Journal.

Under the system, companies shipping Russian oil would still be able to access EU insurance and brokerage services if they sell the oil at or under the price-cap level.

In addition to the proposed cap, a separate EU embargo on Russian vessel-bound crude oil imports enters into force on Monday. U.S. officials had worried that the embargo, combined with the threat of cutting off EU insurance and other services for vessels shipping Russian oil, could send prices upward, generating fresh revenue for the Kremlin’s war efforts.

According to text of the EU proposal seen by The Wall Street Journal, at every review the level should be “at least 5% below the average market price for Russian oil and petroleum products.” The International Energy Agency will advise on the reference price.

EU ambassadors have spent hours negotiating over final approval of the price-cap level over the past week, but several EU officials have voiced doubts about the effectiveness of a mechanism whose price cap is currently above the price of some Russian oil exports.

The European Commission has proposed a price cap on Russian oil of $60 a barrel.Photo: stephanie lecocq/Shutterstock

Selecting the level of the price cap has required the U.S. and its allies to try to balance two goals: reducing Russia’s oil revenue while allowing the country to still sell its oil on global markets. Some Ukrainian and Eastern European officials favored a lower cap to cut off more of Russia’s revenue. The Biden administration, oil traders and financiers favored a higher cap that would still induce Russia to sell its oil at the capped price.

Russia has threatened to refuse to sell its oil at prices below the cap, a step that could take a sizable chunk of supplies off the market and raise prices globally. But last week, Kremlin spokesman Dmitry Peskov signaled there might be wiggle room in Moscow’s threats.

“It feels like they are just trying to make a decision for the sake of a decision. For the time being, we proceed from the directive of President Putin, that we will not supply oil and gas to those states that will introduce and join the ceiling. Of course, we must analyze everything before formulating a position,” Mr. Peskov said.

The U.S. Treasury Department, which has led efforts to craft the price cap, has said the West might lower it over time, with a senior official saying such adjustments could happen on a quarterly or semiannual basis.

Many Russian oil sales would likely be able to continue without complying with the new price cap, if Russia and its buyers in Asia and elsewhere use ships, insurance and financing outside the jurisdiction of the G-7. Traders say the cap could push Russian oil into the domain of the so-called shadow fleet of tankers that keep Iranian oil flowing in violation of U.S. sanctions.

Biden administration officials have said they are comfortable with Russia selling its oil outside of the cap. Using non-Western shipping, insurance and banking services would likely be more costly for Russia, they said.

Still, Moscow will face the EU’s separate embargo on all oil imports into the bloc. Traders say there are signs that Russia is struggling to find buyers for more than a million barrels of crude each day that are currently sold into the EU.

The EU’s Energy Shortage

A look at Europe’s energy crisis, prompted mainly by Russia’s cutback in supplies, selected by the editors

Write to Laurence Norman at laurence.norman@wsj.com

Yesterday's price is not today's price. Take it or leave it Ivehs.

Big Money BidenYesterday's price is not today's price. Take it or leave it Ivehs.

Long Live The Kane

Tyrant Titan

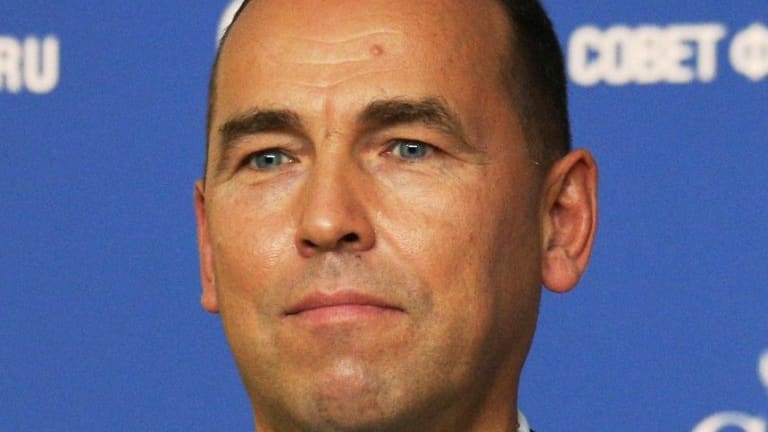

Putin Ally Blames Crisis on Rise of Black U.S. Music Stars

Despite pushing this bizarre racist theory, a senior Russian lawmaker claims the regional governor was being “more than politically correct.”www.thedailybeast.com

.S. Music Stars He Calls ‘Descendants of African American Slaves’

RACIST RANT

Despite pushing this bizarre racist theory, a senior Russian lawmaker claims the regional governor was being “more than politically correct.”

Allison Quinn

News Editor

Published Dec. 01, 2022 8:55AM ET

council.gov.ru/Wikimedia Commons

Listen to article3 minutes

Privacy Policy – Privacy & Terms – Google

In a sign of the times for Vladimir Putin’s twisted Russian regime, a regional governor has been backed by the State Duma after saying the “descendants of African-American slaves” are to blame for the country’s growing crisis.

Vadim Shumkov, governor of the Kurgan region, said Russian society was collapsing—as exemplified by the rising rate of suicide and depression among young people—and it can all be traced back to the popularity of Black American stars in the music industry.

In a bizarre rant posted on his official Telegram channel, Shumkov described a gaping hole of emptiness at the center of Russian culture, which he argued was not the result of poverty, war, or rampant corruption, but “an underestimation of the importance of native national culture.”

“Many of our children… are already growing up without knowing or remembering their kindred tribe,” he lamented, claiming that they are instead “singing songs written by the descendants of African-American slaves, often playing the ape and imitating the habits and language, brimming with, frankly, second-rate quasi-cultural vulgarity. Clinging to this secondariness, being proud of it.”

“Hence the growth of overt spiritual emptiness, depression, suicides. The lack of meaning in life,” he wrote.

Though Shumkov did not mention Russia’s war against Ukraine as a possible reason for the bleak mood in the country, he went on to hint at a growing rift between ordinary Russians that he blamed on outside forces, claiming that a “neglect of native culture” has led to a biblical Cain and Abel situation, with brothers pitted against brothers by “foreign ‘well-wishers’” who see them as “expendable.”

While Shumkov’s remarks were simultaneously mocked and criticized on social media, the Russian State Duma found nothing offensive in his argument.

Alexander Sholokhov, the deputy chairman of the State Duma Committee on Culture, told local media there was nothing inflammatory in his comments because he’d used the term “African-American.”

“I think that depression is connected with the lack of ideology in our country,” Sholokhov said. “I disagree with [allegations of] incitement. He used the word African American. The governor acted more than politically correct, using literally the American version to designate this race, and besides… this same African-American culture occupies a significant part of show business and variety shows.”

It’s hip hop’s fault even in Russia

ADevilYouKhow

Rhyme Reason

Biden has ‘no immediate plans’ to contact Putin

President Biden on Thursday said he has no plans to speak to Russian President Vladimir Putin unless it is to discuss ways for Putin to end his invasion of Ukraine. “I have no immediate plans…

Su-57 Felon To Enter Service With Elite Russian Air Force Unit

A historic unit in Russia's Far East will be first to receive Su-57 fighters, but until then, its Su-35s are fighting in the war in Ukraine.