You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Renting and reinvesting the savings from renting, will outperform owning and building equity

- Thread starter Robbie3000

- Start date

More options

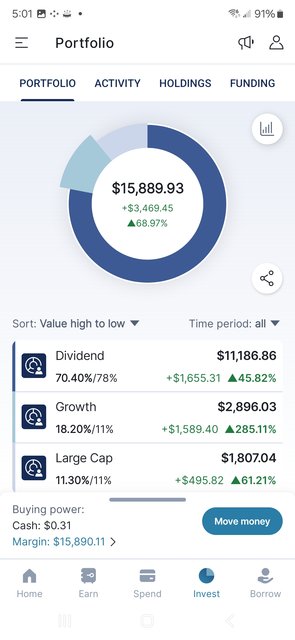

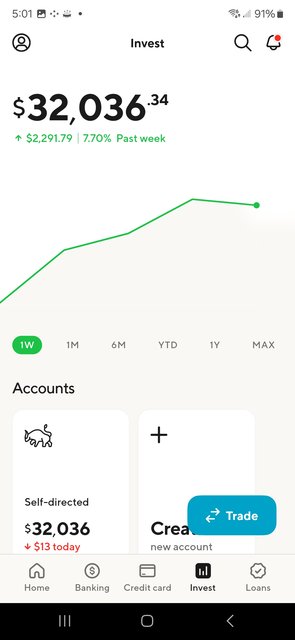

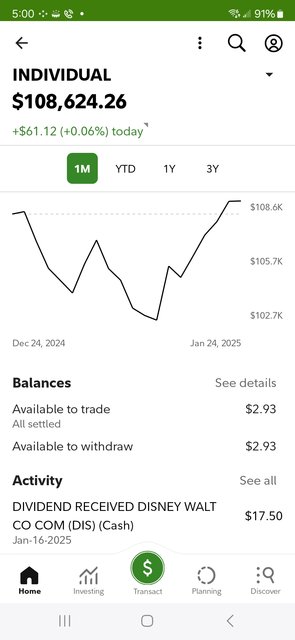

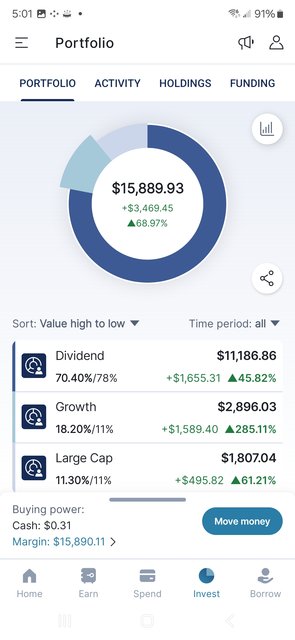

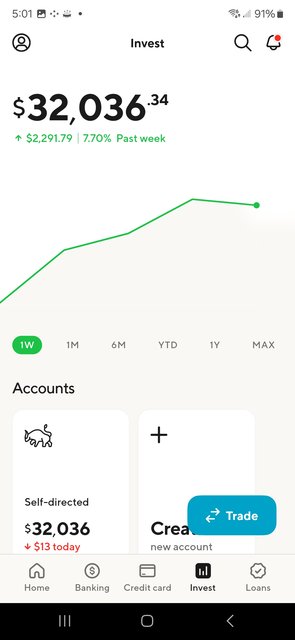

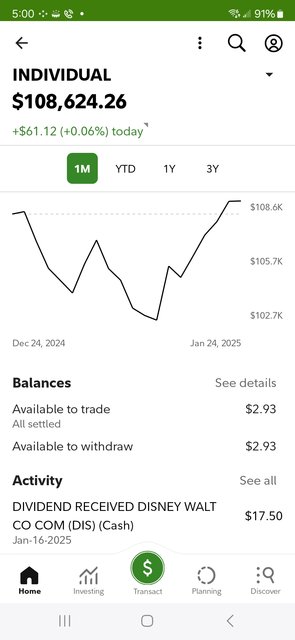

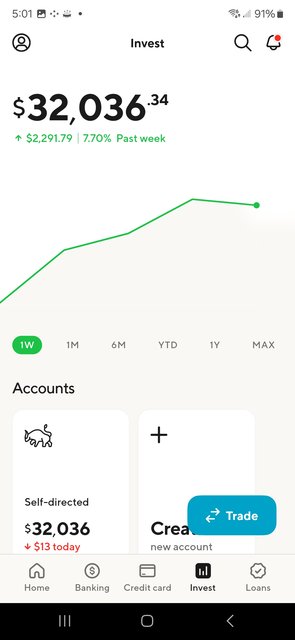

Who Replied?Imagine making the choice to not buy at 2019 prices and interest rates and investing the difference. I swear these dudes never show you screen shots of their investment accounts either.

If you bought a house in 2019 you’re up big time on equity.

Renting out of necessity is different than deciding to rent when you can afford a home.Y'all know good and well the average renter ain't investing like that

Time is undefeated.

With 2025's COL we still acting like the average renter has 6-Figures (or even 5 figures) in a Non-Employer supported investment account, or even sets $100 aside every month to invest? I can pull up to these luxury complexes and see nice cars parked with $500+ a month notes, apparently that's not a scam though.

If we're being honest a lot of renters are renting because they can't afford a house and not as a strategy.

I wouldn't do a $500 a month car note. I live well below my means. My car note is about $159 for 5 years but I treat it like it's $318 as I save a 2nd payment in a savings account. I am losing a percentage point to do so as the loan is 4.9 APR and the savings account is 3.8 used to be 4.2 but fed cuts.

I have no issue doing that.Imagine making the choice to not buy at 2019 prices and interest rates and investing the difference. I swear these dudes never show you screen shots of their investment accounts either.

Yep.If you bought a house in 2019 you’re up big time on equity.

This is such a retarded topic. If homeownership is out of reach for you in your city then it's not a choice of rent vs own, your choice is made for you. Cope however you want. I empathize that you can't own in your city, but quit with the smart dumb shyt and be a fukking adult about it. Gahdamn.

But if the above isn't you, and you could have bought a house in 2019 and stuck to the 30% rule....The person who is at your salary levels and bought a house in 2019 and stuck to the 30% rule is beating your ass financially. Like whupping the shyt out of you. It's not even close. Feel bad for this smart dumb take and letting these colibrehs who can't own houses in their city gas you and do better. Drop your friends IRL who fed you these talking points too. They're definitely holding you back. You coulda had a house for that price on 3.5% interest and you let these goofy mfs trick you outta that position.

Last edited:

Props for being over 100K my guyI have no issue doing that.

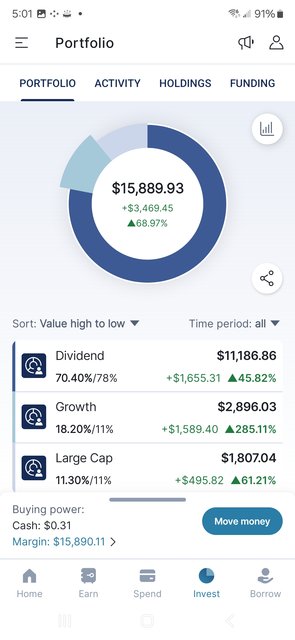

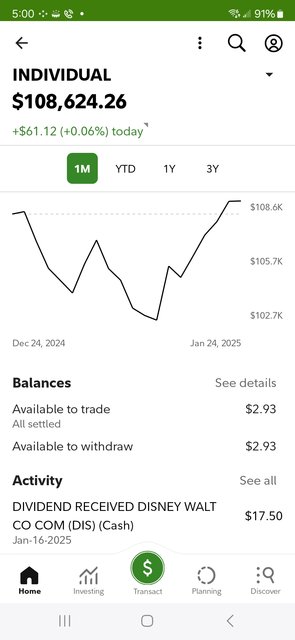

. Drop that Disney garbage tho. Might as well put that into QQQ or VOO or something

. Drop that Disney garbage tho. Might as well put that into QQQ or VOO or something

Last edited:

I was looking at a house and went into a purchase agreement for $168K in 2019. Ended up backing out due to not liking what the home inspection showed. That house is now worth $204K now according to Zillow. This is a lower cost of living area. At the same time the money I have invested in the same timeframe has grown 90%.Yep.

This is such a retarded topic. If homeownership is out of reach for you in your city then it's not a choice of rent vs own, your choice is made for you. Cope however you want. I empathize that you can't own in your city, but quit with the smart dumb shyt and be a fukking adult about it. Gahdamn.

But if the above isn't you, and you could have bought a house in 2019 and stuck to the 30% rule....The person who is at your salary levels and bought a house in 2019 and stuck to the 30% rule is beating your ass financially. Like whupping the shyt out of you. It's not even close. Feel bad for this smart dumb take and letting these colibrehs who can't own houses in their city gas you and do better. Drop your friends IRL who fed you these talking points too. They're definitely holding you back. You coulda had a house for that price on 3.5% interest and you let these goofy mfs trick you outta that position.

I may have zero equity in a home but the money I invested far outpaced the housing market here. I’m also sitting on about $60K in cash and adding for a down payment / closing cost on a home if I decide to jump in.

Brolic

High Value Poster

I don’t think that would be possible. There’s only so much juice you can squeeze out an orange.How about appreciation and equity?

Yall don’t have the same thoughts as far as investing in real estate though, right?

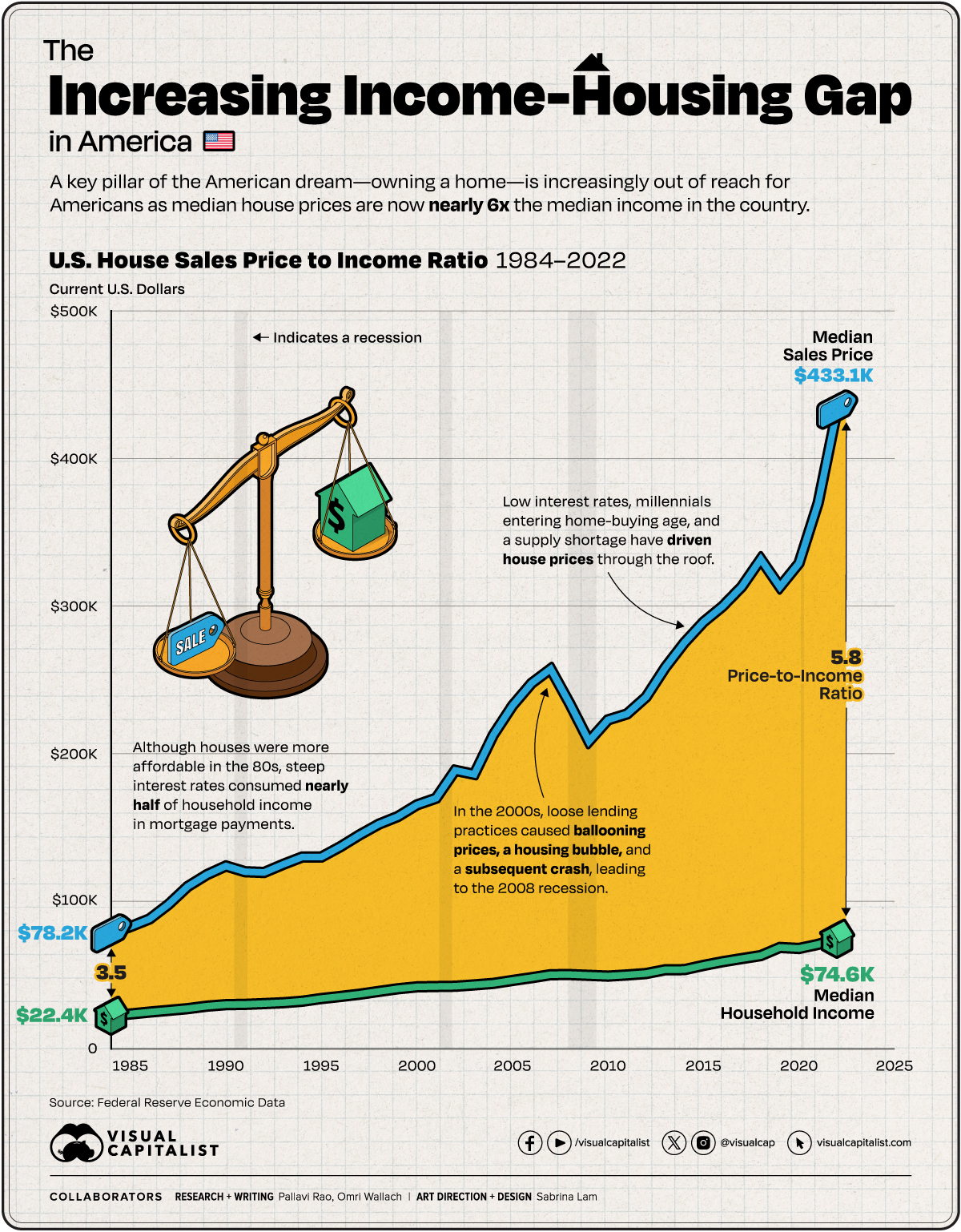

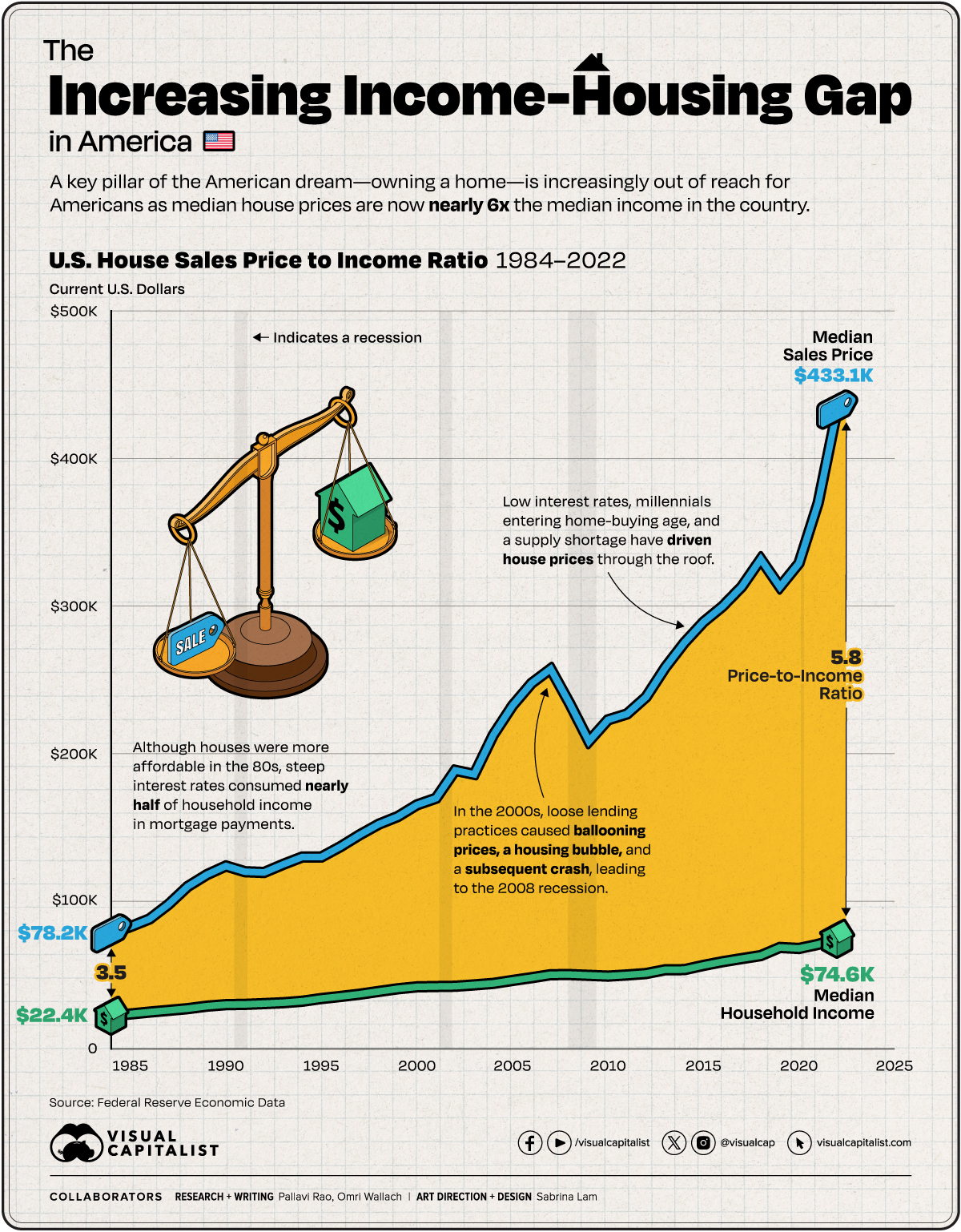

Won’t the average rent continue to increase too? In 10 years, we might see average rents of $4-5k a month…. 20 years it’ll be 8-10k possibly.

But your mortgage payment will remain $2000

If the price of housing, food, cars, and insurance keeps rising, but wages stay stagnant how will people pay for things? Companies can’t make profits if people are too broke to buy their goods.

We’re seeing that now with Stellantis. Jeeps, Rams, challengers, and chargers are just sitting in lots and not selling.

KnickstapeCity

RIP Big Dikk :wow: :mjcry:

I have no issue doing that.

You got a big investment account(s), breh

You got a big investment account(s), brehIt’s mostly about managing your emotions. The actual math is easy.Finances really is about juggling your money the best.

Understanding money is like a super power most dont master

skyrunner1

Superstar

Yea definitely depend on area, I have had property I was able to scoop up undervalue at 200k and now worth over 700 but even with that you the taxes and insurance going crazy, with stocks its not like that. Had a condo I picked up at like 30k but gutted and it paid for it self in a couple years, then condo building drop in county, they pass new laws and assessments was going crazyyy, I already saw writing on wall and got out of that one at first chance I got (now you have condo owners who in TOUGH spot and they cant sell because no one wants to buy a problem)..I was looking at a house and went into a purchase agreement for $168K in 2019. Ended up backing out due to not liking what the home inspection showed. That house is now worth $204K now according to Zillow. This is a lower cost of living area. At the same time the money I have invested in the same timeframe has grown 90%.

I may have zero equity in a home but the money I invested far outpaced the housing market here. I’m also sitting on about $60K in cash and adding for a down payment / closing cost on a home if I decide to jump in.

Much more passive with stocks and you dont got to worry about taxes and insurance going crazy or assessments and laws fukking up the play. But there are pros with buying property undervalued and forcing value by redeveloping and/or using leverage to multiple x your investment potential. Can get loans to make money do multiple backflips. Pros and cons to everything and good to have diversified investment but at end of day do what is best for you and tolerance

#BOTHSIDES

Superstar

I don’t think that would be possible. There’s only so much juice you can squeeze out an orange.

If the price of housing, food, cars, and insurance keeps rising, but wages stay stagnant how will people pay for things? Companies can’t make profits if people are too broke to buy their goods.

We’re seeing that now with Stellantis. Jeeps, Rams, challengers, and chargers are just sitting in lots and not selling.

So you think they’re-gonna freeze /cap housing prices…even though inflation exists?

Housing is a hedge against Inflation imo

Our parents and grand parents paid like $50-500 dollars for rent.

Brolic

High Value Poster

So you think they’re-gonna freeze /cap housing prices…even though inflation exists?

Housing is a hedge against Inflation imo

Our parents and grand parents paid like $50-500 dollars for rent.

Idk what will happen. I’m not a Coli economist

I just know it doesn’t make sense for everything to go up except wages. Something’s gonna break eventually.

I was looking at a house and went into a purchase agreement for $168K in 2019. Ended up backing out due to not liking what the home inspection showed. That house is now worth $204K now according to Zillow. This is a lower cost of living area. At the same time the money I have invested in the same timeframe has grown 90%.

I may have zero equity in a home but the money I invested far outpaced the housing market here. I’m also sitting on about $60K in cash and adding for a down payment / closing cost on a home if I decide to jump in.

So now instead of putting 20% down on a 168k house and paying 3.5% interest you're gonna put 60k down on a 204K house and pay 7% interest.

According to Zillow that 20% down on a 168K house on a 30 year mortgage is a monthly payment of about $787 on 1% property taxes and 3.5% interest

That 60,000 down on that same house that's 204K today on 1% property taxes and 7% interest is a monthly payment of about $1143.

The person that bought the house in 2019 for 168k now has the following over you:

36,000 in equity

6 years closer to paying off the house

$396 extra dollars a month to invest in the market + an extra $27,000 to put into the market.

Where did that 27,000 come from? That 27,000 came from you listening to coli brehs gas you about rent + invest so you waited 6 years to buy a house that you could of gotten for 168,000 and only had to put 33,000 down on to get a $787 monthly payment. So now instead of throwing 27,000 into the market like the person that got his in 2019 can, you're throwing that into that same house to get a $1143 monthly.

So now the guy that bought his house in 2019 has an extra 400 a month + 27,000 to invest in the stock vehicle .

He'll also finish paying off his house 6 years earlier than you and can now throw damn near $1,000 more a month into the market than you just by owning his house earlier and not listening to the goofball rent+invest colibrehs who are really just coping because they can't afford to own in their city. That 5 figure short term advantage you built up will melt away real quick. This dude is beating your ass financially my guy. I left the dollar amount that would be saved on interest out on purpose because I'm too lazy to find out how much extra cash this dude would also have in 30 years from paying at 2019 interest rate vs a 2025 interest rate. Just that alone beats anything you gained in the short term market investing advantage. And we're not going to talk about the taxes you will have to pay on those stocks as well. Breh it's not even close.

Last edited: