dora_da_destroyer

Master Baker

what will fix this is lifting the income cap!

so each person will have to sue? i dont get what he means by "case by case"

Yeah. The government has student loan forgiveness for so many other reasons. In theory, Dept of Ed can just make another part of the application to ask how the pandemic affected you adversely and then proceed with forgiveness.They will probably have to create a whole agency and people will have to fill out paperwork. The process now is easy (and modern). They have all the records on hand so a computer could do it. This would mean that they would make it a process where a human goes over a file and makes a determination. To the point a system is in place where people could go out of default and get a paymentZ

It also means that people will have to resume payments in January. Before it can be forgive which will hurt people.

The only real counter to that is it would be nice if they increased the amount people can apply for. Like just say it and put the judges under pressure because even more could be forgiven if they drag this out.

Maybe people can sue the plaintiffs for causing injury for no forgiveness. Like Maryland or California wanting the debt relief to happen and then getting a blue circuit to grant the policy to go forward?what will fix this is lifting the income cap!

Yeah. The government has student loan forgiveness for so many other reasons. In theory, Dept of Ed can just make another part of the application to ask how the pandemic affected you adversely and then proceed with forgiveness.

The payment pause is gonna stay I think.

What would qualify as a hardship? Kinda closes millions of ppl outThey will probably have to create a whole agency and people will have to fill out paperwork. The process now is easy (and modern). They have all the records on hand so a computer could do it. This would mean that they would make it a process where a human goes over a file and makes a determination. To the point a system is in place where people could go out of default and get a paymentZ

It also means that people will have to resume payments in January. Before it can be forgive which will hurt people.

The only real counter to that is it would be nice if they increased the amount people can apply for. Like just say it and put the judges under pressure because even more could be forgiven if they drag this out.

Your asking me!? You’re supposed to have the answers here FAH, how do we get this across the finish line?Maybe people can sue the plaintiffs for causing injury for no forgiveness. Like Maryland or California wanting the debt relief to happen and then getting a blue circuit to grant the policy to go forward?

As others said Covid.... It would be a rubber stamp, and both costly and inefficient, but that is the stupid games the Republicans want to play.What would qualify as a hardship? Kinda closes millions of ppl out

Boycott Home fukking Depot

Your asking me!? You’re supposed to have the answers here FAH, how do we get this across the finish line?

@dora_da_destroyer ’s clarity on this issue has always been inspiring.@No1 yall ain't slick

This is the type of shyt that leads to Judicial reform. I think the SC snubs it but if they don’t add four more judges. It’s pretty clear they’ve loss their damn minds.Courts Use Increasingly Lawless Arguments to Block Student Debt Relief

In the latest ruling, the Eighth Circuit turned a non-plaintiff into a plaintiff.

Courts Use Increasingly Lawless Arguments to Block Student Debt Relief

In the latest ruling, the Eighth Circuit turned a non-plaintiff into a plaintiff.prospect.org

BY DAVID DAYEN

NOVEMBER 15, 2022

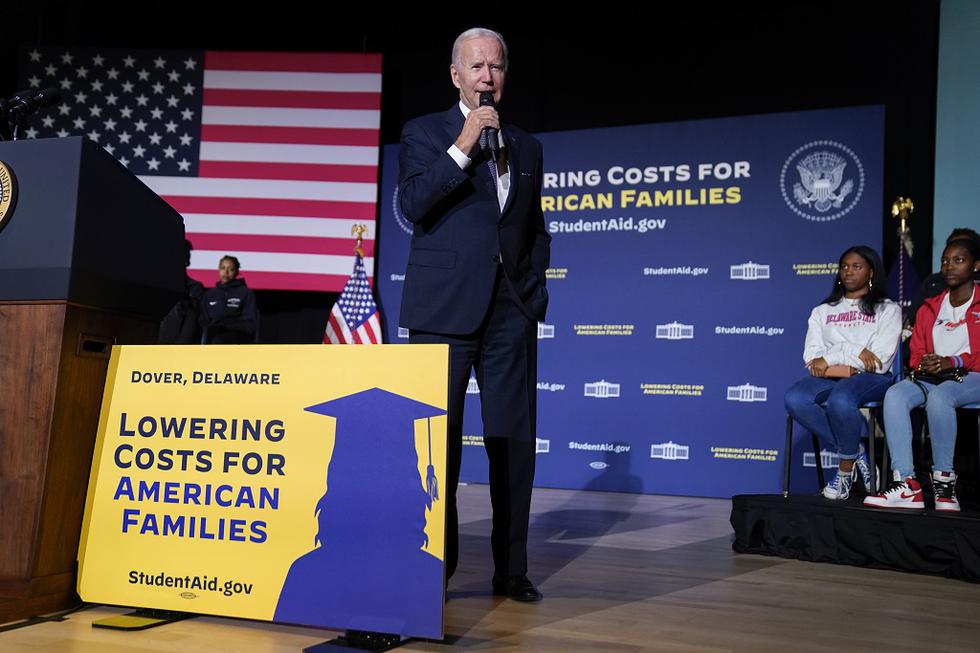

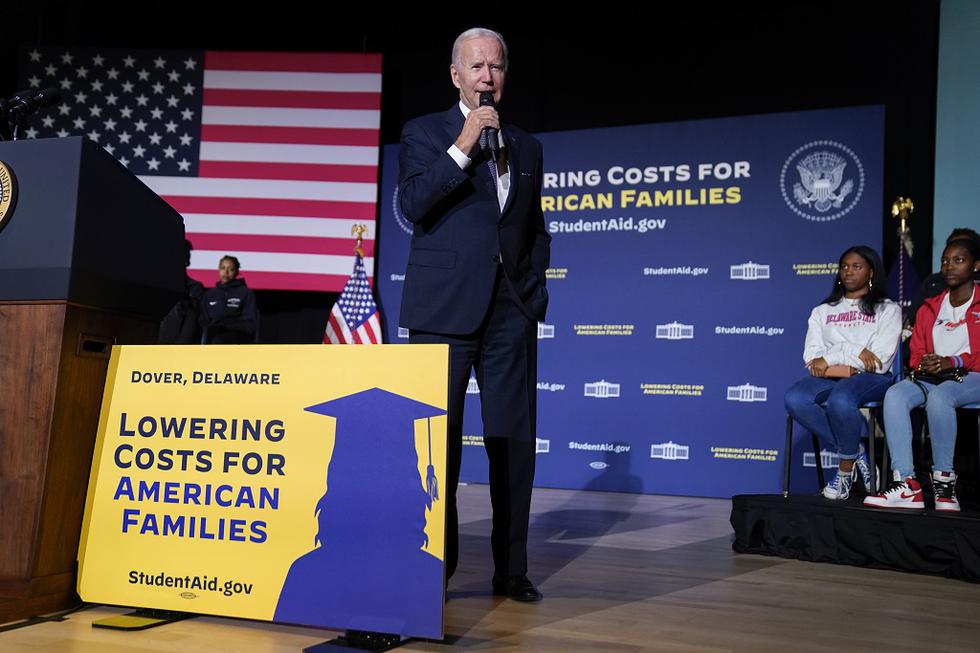

EVAN VUCCI/AP PHOTO

President Joe Biden speaks about student loan debt relief at Delaware State University, October 21, 2022, in Dover, Delaware.

On Monday, a three-judge panel of the Eighth Circuit Court of Appeals instituted an emergency injunction of President Biden’s student debt cancellation program. The verdict granted standing to sue to an alleged plaintiff which has said publicly and in writing that it had nothing to do with the lawsuit, and no relationship with the office that filed it. The ruling, in effect, turned a non-plaintiff into a plaintiff.

It’s the kind of decision that makes you wonder what the law is, and whether it matters what it says. But the conservative judiciary could see these same tactics used by determined plaintiffs with different priorities. This would force right-wing judges to come up with what amounts to two different legal systems, one for policies they like and another for policies they don’t, eating away at the increasingly unpopular system of judicial supremacy.

The Eighth Circuit’s ruling is not the only adverse one for Biden’s student debt program, which would cancel up to $20,000 in loan balances for tens of millions of borrowers. A federal judge in Texas last week struck down the Biden plan on behalf of two students who didn’t qualify for full debt relief. The plaintiffs argued they had standing to sue because they were unable to provide comment expressing their disapproval of the program. Judge Mark Pittman agreed, even though the law the administration is using to enact debt relief explicitly says it can waive the notice and comment period. Pittman even acknowledged that later in the same ruling.

That inanity was only mirrored by the Eighth Circuit’s six-page, unsigned decision on Monday. In it, the three judges, appointed by Presidents George W. Bush and Donald Trump, reversed a lower court, which had said that none of the six states that sued Biden and the Department of Education over the debt cancellation plan had jurisdiction to sue. The judges singled out one entity, a student loan servicer named the Missouri Higher Education Loan Authority (MOHELA).

MOHELA, which is called a “state instrumentality,” services loans for the federal government. The state uses MOHELA revenue to fund capital projects at state colleges, as well as a modicum of financial aid (less than $6 million per year). If federal loan balances are reduced through forgiveness, MOHELA will service fewer loans, and there will be less money to go to capital funding and scholarships, the plaintiffs in the case have argued. “Due to MOHELA’s financial obligations to the State treasury, the challenged student loan debt cancellation presents a threatened financial harm to the State of Missouri,” the judges wrote.

But in this case, MOHELA itself, in a letter responding to questions from Rep. Cori Bush (D-MO), explicitly said that its executives “were not involved with the decision” to file for a preliminary injunction this September. MOHELA added that it has no relationship with the Missouri attorney general’s office, which filed the suit, and that the documents the attorney general presented proving MOHELA’s potential financial harm from student debt cancellation had to be procured through formal sunshine law requests. Those have been the only communications between MOHELA and the AG’s office.

Asked whether MOHELA supports the lawsuit to block student debt relief, it answered: “MOHELA is faithfully fulfilling its obligations pursuant to its federal loan servicing contract.” It is possible that MOHELA is being cagey about this because, under California law, it could be liable for hundreds of billions of dollars in penalties for blocking student loan relief.

The Justice Department filed a brief informing the Eighth Circuit of MOHELA’s letter to Rep. Bush, so the judges should have been aware of its existence. Nevertheless, they ruled for MOHELA, the unwilling plaintiff. And under those terms, they instituted the injunction. None of the merits of the case were discussed at all, with the judges merely saying that they are “substantial.”

THESE PECULIAR DECISIONS have thrown the Biden administration’s plans into doubt. It has stopped collecting applications for debt relief, after 26 million applied. Debtor advocates have proposed several options going forward.

One argument all along has been that the administration’s legal complications are tied up with the program’s contours. Means-testing the relief required an application process and slowed things down enough for opponents to fund lawsuits and find courts willing to overturn the program. Plus, the administration used the HEROES Act of 2003 as its authority for debt forgiveness, a limited program that, it’s reasonable to suggest, was not intended for this type of mass relief.

Compromise and settlement authority from the Higher Education Act, under this theory, is a much more robust option, allowing for cancellation of debt by fiat. Astra Taylor, one of the leaders of the activist group Debt Collective, argued in The Guardian Monday that “Biden could knock the legs out from under these cynical lawsuits tomorrow by extinguishing all federal student loans immediately and permanently using compromise and settlement authority.”

A potential complication to this is that the Education Department in 2016 amended implementing regulations for compromise and settlement that Justice Department lawyers have argued narrow its potential use. The new rules, according to DOJ lawyers with the Office of Legal Counsel (OLC), make it so that the authority could only be used if the cost of collecting debt exceeded what the agency could expect to collect. Other experts have looked at these regulations and said they do not prevent the secretary of education from canceling debt, but the OLC hasn’t seen it the same way.

The regulations would take 18 months to change through administrative procedure. Of course, it took Biden more than 18 months to decide what course of action to take on student debt cancellation. The administration could have provided regulatory clarity and cancelled debt en masse in less time than it took to come up with a new authority and a cumbersome application process.

This would have served the dual purpose of speeding up the whole process. Determining debt cancellation unconstitutional right before national elections, and taking relief away from 26 million borrowers, would have been another stark display of judicial control of government. On the off chance that it got past the judiciary, Biden would have given a tangible benefit to tens of millions of borrowers.

Because of the uncertainty of cancellation, several groups are arguing to extend the payment pause, which is due to expire at the end of the year. The pause has been in place for nearly three years without legal challenge. That would prevent financial stress in a time of high inflation and dwindling discretionary income.

But given the outlandish nature of the judicial rulings, another more operatic option looms down the road. If plaintiffs can make up any story to justify standing to block federal programs they disfavor, they surely will. Liberal activists have plenty of problems with endless wars, climate pollution, and dozens of other issues. It’s plausible that violations of congressional war powers or the right to clean air and water exist from these activities. Liberal plaintiffs never had a hook to bring cases before, but they could simply say they have standing to sue because they never got to comment on the federal actions, or because some related entity will be harmed if the plans go through.

These precedents from the student debt rulings are being set, and they amount to sticks of dynamite for would-be litigants. Liberals can forum-shop too, and move these cases through the system. If nothing else, it would force the conservative higher courts to spend lots of time fending off cases. It would likely yield rulings where the courts would say that notice-and-comment standing claims are fine for conservative activists but not for liberal ones.

The judiciary’s legitimacy is already at a low ebb; making up different sets of rules depending on the plaintiff would nosedive that even further. This legitimacy, while it seemingly doesn’t matter to unelected elites in robes, clearly had an impact on the 2022 elections. And in U.S. history, when the judiciary has been seen as a cancer on American life, it has often changed course, like the Lochner Court during the New Deal.

Whatever the strategy, the Biden administration will need to rebut charges that they conned young voters by offering debt relief before the election, only to have it taken away by the courts, as they knew it would be. They have at least a few ways to prove that conspiratorial belief wrong.

Unfortunately, you need the House to pass judicial seat additions. Dems can only confirm more judges next two years by keeping the Senate.This is the type of shyt that leads to Judicial reform. I think the SC snubs it but if they don’t add four more judges. It’s pretty clear they’ve loss their damn minds.