Retard babble

Additionally, many foreign countries leverage the effectiveness of the U.S. dollar as a store of value by limiting the movements of their currencies with respect to the U.S. dollar – in other words, using it as an anchor currency. As Ilzetzki, Reinhart, and Rogoff (2020) highlight, the dollar's usage as an anchor currency has increased over the past two decades. They estimate that 50 percent of world GDP in 2015 was produced in countries whose currency is anchored to the U.S. dollar (not counting the United States itself).

4 In contrast, the share of world GDP anchored to the euro was only 5 percent (not counting the euro area itself). Moreover, since the end of the Ilzetzki et al. sample in 2015, this anchoring has changed little. One exception might be the re-anchoring of the Chinese renminbi from the U.S. dollar to a basket of currencies. However, the U.S. dollar and currencies anchored to the U.S. dollar comprise over 50 percent of this basket so the variation of the Chinese renminbi against the dollar has remained limited.

The U.S. dollar is dominant in international transactions and financial markets

The international role of a currency can also be measured by its usage as a medium of exchange. The dominance of the dollar internationally has been highlighted in several recent studies of the currency composition of global trade and international financial transactions. The U.S. dollar is overwhelmingly the world's most frequently used currency in global trade.

5 An estimate of the U.S. dollar share of global trade invoices is shown in Figure 5. Over the period 1999-2019, the dollar accounted for 96 percent of trade invoicing in the Americas, 74 percent in the Asia-Pacific region, and 79 percent in the rest of the world. The only exception is Europe, where the euro is dominant with 66 percent.6

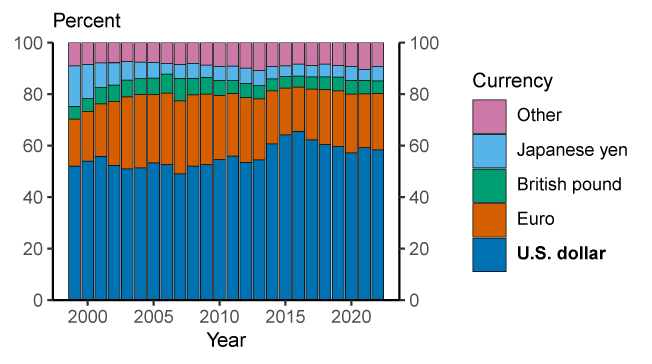

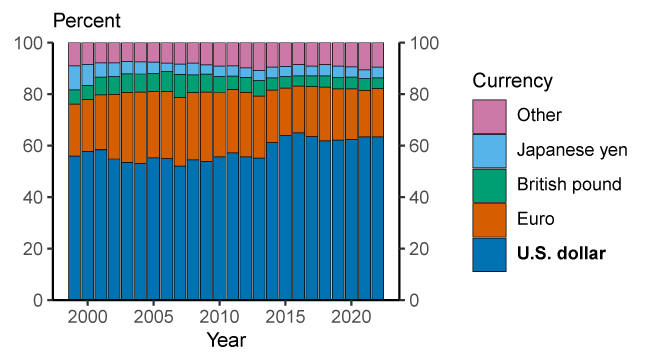

In part because of its dominant role as a medium of exchange, the U.S. dollar is also the dominant currency in international banking. As shown in Figure 6, about 60 percent of international and foreign currency claims (primarily loans) and liabilities (primarily deposits) are denominated in U.S. dollars. This share has remained relatively stable since 2000 and is well above that for the euro (about 20 percent).

Figure 6. Share of international and foreign currency banking claims and liabilities

6a. Claims

6b. Liabilities

Note: Share of banking claims and liabilities across national borders or denominated in a foreign currency. Banking claims and liabilities are defined as loans and deposits only, including repurchase agreements. Excludes claims on and liabilities to related banking offices and central banks. Also excludes intra-euro area cross-border claims and liabilities. At current exchange rates. Data are annual and extend from 1999 through 2022. Legend entries appear in graph order from top to bottom.

Source: BIS locational banking statistics; Board staff calculations.

Accessible version

The Federal Reserve Board of Governors in Washington DC.

www.federalreserve.gov