The stock is sliding, a cheaper electric car is deprioritized and the CEO is riling the workforce with his biggest layoffs yet.

www.bloomberg.com

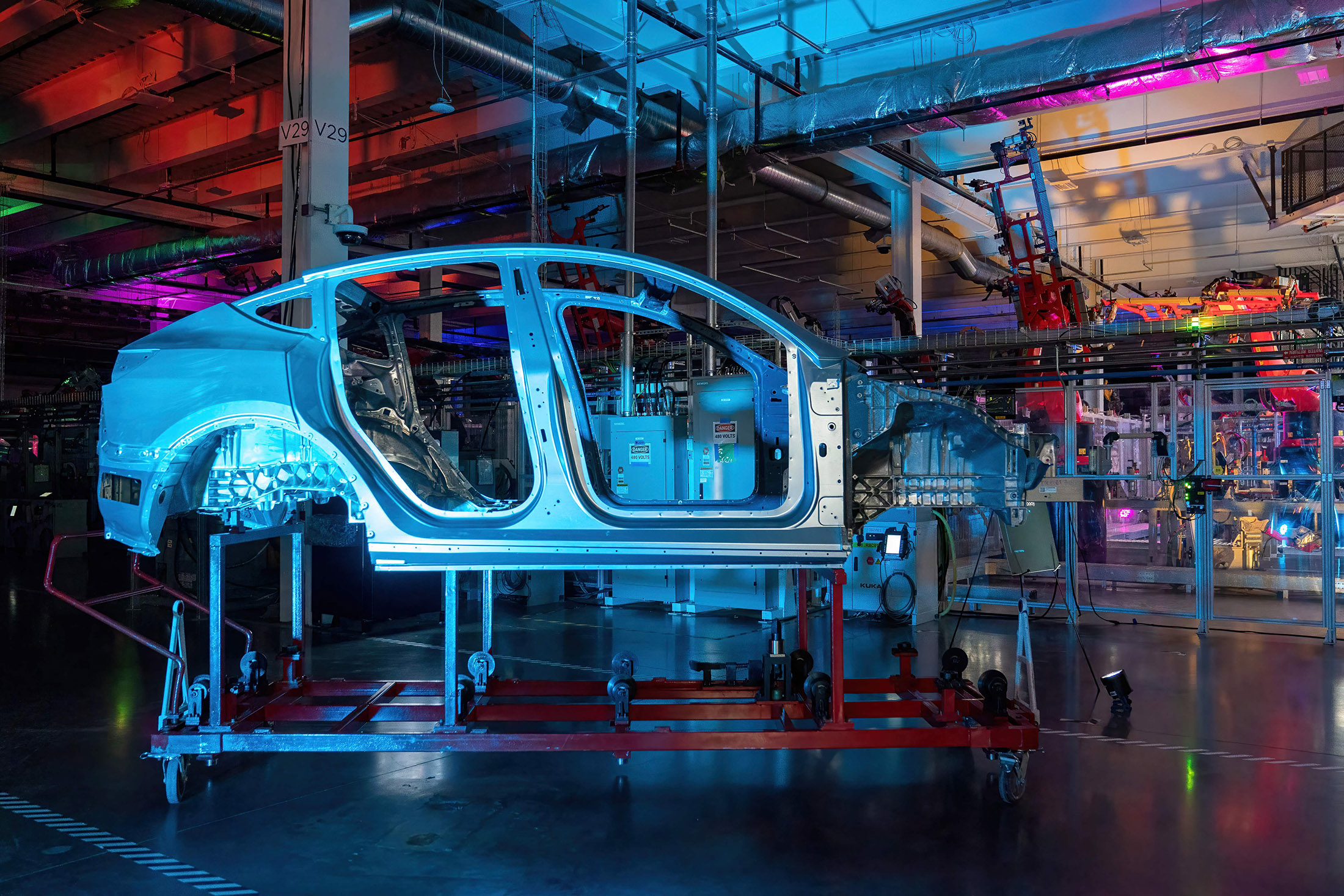

Elon Musk has signaled he’s gearing up for “wartime.”

Photographer: Joshua Lott/Getty Images

Industries

The Big Take

Elon Musk’s Robotaxi Dreams Plunge Tesla Into Chaos

The stock is sliding, a cheaper electric car is deprioritized and the CEO is riling the workforce with his biggest layoffs yet.

By

Edward Ludlow and

Dana Hull

April 21, 2024 at 4:00 PM EDT

Elon Musk’s underlings at Tesla Inc. are accustomed to chaos. It comes with the territory of working for a chief executive who sets exacting targets and often abruptly switches directions — whose biographer describes his more intense moods as “

demon mode.”

But even by Tesla standards, this year has been unruly. Its stock has slid more than 40% amid

slumping sales, confusing

product decisions and more

price cuts. Its once-dominant position in China’s EV market is

under assault. A visit with India’s Prime Minister Narendra Modi for an anticipated investment announcement was

called off at the last minute. All the while, the board has tried to revive a $56 billion payout to Musk that a judge voided in January, on the grounds that directors had acted as “

supine servants” to the CEO.

On Tuesday, Tesla is expected to report a 40% plunge in operating profit and its first revenue decline in four years. Musk has ordered up the company’s biggest

layoffs ever and staked its future on a next-generation, self-driving vehicle concept called the

robotaxi. People familiar with his directives, who asked not to be identified discussing internal deliberations, are unsettled by the changes the CEO wants to push through.

Tesla’s Sales Slide

Revenue is expected to drop for the first time in years

Source: Bloomberg data

Note: First quarter 2024 figure is a consensus estimate.

The idea of creating an autonomous taxi service has been kicking around Tesla for at least

eight years, but the company has yet to stand up much of the infrastructure it would need, nor has it secured regulatory approval to test such cars on public roads. For the moment, Musk has put off plans for a $25,000, mass-market vehicle that many Tesla

investors — and some insiders — are pushing for and believe is crucial to the carmaker’s future.

In the wake of media reports on the strategic shift, key managers including Drew Baglino, an 18-year company veteran who headed Tesla’s powertrain engineering and energy business, have

left.

Musk, 52, has steered Tesla out of many jams in the past. At $469 billion, the company is still valued at more than nine times the market capitalization of General Motors Co. or Ford Motor Co. But after losing almost $350 billion in market cap over four months, employees, investors and analysts alike are bewildered and second-guessing the company’s strategy.

“The stock will need to undergo a potentially painful transition in ownership base, with investors previously focused on Tesla’s EV volume and cost advantage potentially throwing in the towel,” Deutsche Bank analyst Emmanuel Rosner said last week, downgrading the shares from a buy and slashing his price target by more than a third.

Musk has said more than 10% of Tesla’s workforce will be laid off.Photographer: Ebrahim Noroozi/AP Photo

Musk has signaled on his social media network that the recent moves amount to activating

wartime CEO mode. He liked a post saying as much after sending a companywide email announcing that Tesla was cutting more than 10% of global headcount, which would mean eliminating at least 14,000 jobs.

The actual number of people ushered out may exceed 20,000, according to people familiar with the company’s planning. Musk’s reasoning, according to one person with direct knowledge of his edicts, was that Tesla should reduce headcount by 20% because its vehicle deliveries dropped by that amount from the fourth quarter to the first quarter.

For those still among Tesla’s ranks after this culling, Musk has radically altered the marching orders. The company is “going balls to the wall for autonomy,” he

declared last week. The robotaxi is now taking precedence over a cheaper car he first teased four years ago, both with respect to setting timelines for prototypes and arranging production capacity, one person familiar with the planning said.

Musk has talked a big game about autonomy for over a decade, and has convinced customers to pay thousands of dollars for a product Tesla has marketed as Full Self-Driving, or FSD. The name is a

misnomer — FSD requires constant supervision and doesn’t render vehicles autonomous — but Musk has repeatedly predicted it’s on the verge of measuring up to the branding. “I’m

the boy who cried FSD,” he said in July.

Tesla first introduced Autopilot in 2015.Photographer: David Paul Morris/Bloomberg

Musk and top engineers are particularly bullish about a major change in how FSD now works. Cameras placed around the company’s cars are taking in video and using this footage to dictate how the vehicle drives, instead of relying on software code. Ashok Elluswamy, a director of Tesla’s Autopilot program, wrote on X last month that this should lead to “

unprecedented progress.”

But optimism around FSD and Musk’s belief that this new approach could bring about robotaxis is clouding the future of Tesla’s $25,000 car project. People with knowledge of Tesla’s plans disputed the notion that the program has been canceled altogether. All along, the company has been pursuing a low-cost vehicle architecture that will underpin several different types of models, one of which would have no steering wheel or pedals.

While these people confirmed the robotaxi is being prioritized, one described the next-generation vehicle project as an effort to wring cost reductions out of components and production methods, then apply those innovations to cheaper iterations of the Model Y and Model 3, the company’s two most popular EVs. Teams are placing particular emphasis on bringing these cost savings to bear with the Model Y, the

best-selling vehicle in the world last year.

It’s unclear just how much solace this might be to investors who’ve been spooked by

reports that Tesla’s answer to affordable options like the Toyota Corolla has been scrapped entirely. Many are concerned that the only new model the company will offer to consumers in the half decade after the Model Y’s debut will be the Cybertruck, an expensive pickup that’s

difficult to build. Last week, the company

recalled the almost 3,900 trucks it’s sold to fix faulty accelerator pedals.

“Investors, particularly institutional ones, are losing patience,” said Bloomberg Intelligence analyst Steve Man. “The initial hype around Full Self-Driving and robotaxis has waned, and the pendulum has swung in the opposite direction.”

Musk has said Tesla may need 12 to 18 months to make Cybertrucks at high volume.Photographer: Kyle Grillot/Bloomberg

Reorienting Tesla around robotaxis is risky. While federal agencies have taken a permissive approach to regulating technology that has the potential to make roads safer, scrutiny at the state and local level has proven difficult to navigate.

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/25410274/Clipboard_04_20_2024_01.jpg)

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/25410279/tesla_recallprocedure.jpg)

Why are they riveting only ONE spot? Why not two to make it secure?

Why are they riveting only ONE spot? Why not two to make it secure?