Elon must be cash poor in millionaires sense.. like he got access to a few million on hand but think about it he wanted to cash out $56 billion dollars of stock lmaooo He’s a billionaire on paper but not liquid cash…

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

General Elon Musk Fukkery Thread

- Thread starter Armchair Militant

- Start date

More options

Who Replied?Hood Critic

The Power Circle

Having that much money on paper gives him access to unlimited credit though.Elon must be cash poor in millionaires sense.. like he got access to a few million on hand but think about it he wanted to cash out $56 billion dollars of stock lmaooo He’s a billionaire on paper but not liquid cash…

TrueHaving that much money on paper gives him access to unlimited credit though.

He already pledged most of if not all of his Tesla stock as collateral in loansHaving that much money on paper gives him access to unlimited credit though.

ADevilYouKhow

Rhyme Reason

Tesla Cybertruck costs more than, doesn't go as far as promised

Specs are finally available for the Cybertruck and the price is much higher than originally promised.

the cac mamba

Veteran

libs owned, or something

libs owned, or something

I asked ChatGPT of possible downsides of going from Delaware to Texas.

While there are potential advantages to moving from Delaware to Texas for incorporation, it's crucial to consider the downsides and challenges associated with such a move. Here are some potential drawbacks:

It's essential for businesses to conduct a thorough analysis of the potential downsides and weigh them against the perceived benefits before deciding to move from Delaware to Texas. Legal, financial, and strategic advice should be sought to make an informed decision that aligns with the company's long-term goals and objectives.

- Legal System Differences:

- Specialization: Delaware has a highly specialized legal system, particularly with its Court of Chancery, which deals specifically with business disputes. Moving to Texas may mean adapting to a different legal environment that may not have the same level of specialization in corporate law.

- Established Precedents:

- Legal Precedents: Delaware has a long history of legal precedents in corporate law, and its decisions often influence legal interpretations in other jurisdictions. Moving to Texas may mean the loss of reliance on these established precedents.

- Corporate Governance Tradition:

- Corporate Tradition: Delaware is considered the traditional home for many large corporations, and its legal framework is designed to provide flexibility in corporate governance. Companies that move from Delaware to Texas may need to adapt to a different corporate governance tradition.

- Market Perception:

- Investor Perception: Delaware incorporation is often seen as a positive signal to investors and stakeholders. Moving to Texas may impact the market perception of the company, especially if it's a well-established business with a history of Delaware incorporation.

- Transition Costs:

- Administrative and Legal Costs: Moving a business from one state to another involves administrative and legal costs. This includes updating legal documents, notifying stakeholders, and complying with the regulations of the new jurisdiction.

- Tax Implications:

- Tax Considerations: While Texas may offer advantages in terms of its tax structure, the transition itself may have tax implications. It's crucial to carefully evaluate the financial impact of the move and potential tax consequences.

- Court System Dynamics:

- Court System Differences: Texas has a comprehensive court system, but it may not have the same level of specialization as Delaware. Businesses involved in complex legal matters might find the Delaware Court of Chancery more advantageous.

- Industry Considerations:

- Industry Dynamics: Depending on the industry, some businesses may find that Delaware's legal and business environment better aligns with their needs. Industries with a heavy reliance on legal precedents or with specific regulatory considerations may be more comfortable in Delaware.

- Adaptation Period:

- Transition Challenges: Moving a business involves an adaptation period. Companies may need time to familiarize themselves with the legal and business landscape in Texas, potentially leading to temporary challenges.

libs owned, or something

He could have incorporated the company in Texas if he was one of the founders

He finally got a judge that actually holds him accountable as the fraud that he is and now he wants to run to Texas.I asked ChatGPT of possible downsides of going from Delaware to Texas.

How you going to say the public wants to incorporate the company in Texas when you actually were sued by the shareholders (public)?

Got emmmHe could have incorporated the company in Texas if he was one of the founders

Shareholders going to eventually bush him… But as far as him wanting the shareholders to vote to incorporate in Texas they are going to soundly reject that move..He finally got a judge that actually holds him accountable as the fraud that he is and now he wants to run to Texas.

How you going to say the public wants to incorporate the company in Texas when you actually were sued by the shareholders (public)?

Benefit of being in Delaware is that those shareholders dont have to pay his dumb ass $56 billion lmaoo

ADevilYouKhow

Rhyme Reason

Elon Musk bashed by heavy metal drummer who cost him $56 billion — Reuters

Elon Musk suffered one of the biggest legal losses in U.S. history this week when the Tesla CEO was stripped of his $56 billion pay package in a case brought by an unlikely opponent, a former heavy metal drummer.

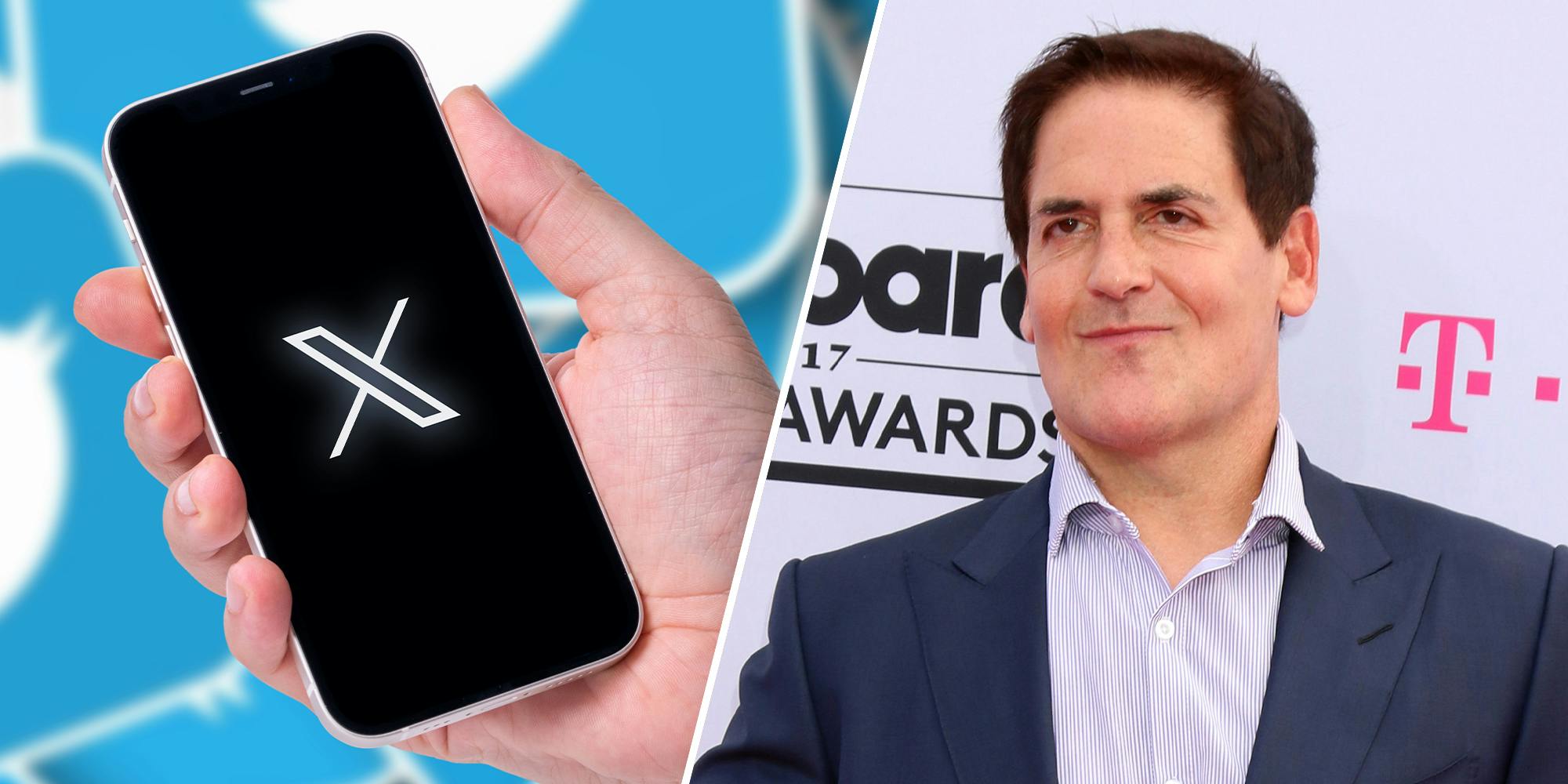

Mark Cuban says X is 'impossible' to use, shares barrage of daily antisemitism his account gets

Business mogul Mark Cuban is being bombarded on X with antisemitic remarks after coming out in support of DEI policies.

Yalcin Sonat/ShutterStock Kathy Hutchins/ShutterStock (Licensed)

Mark Cuban says X is ‘impossible’ to use, shares barrage of daily antisemitism his account gets

'It's nearly impossible to have a true discussion on X any longer.'

Mikael Thalen

Tech

Posted on Feb 1, 2024

Mark Cuban’s X account began reposting antisemitic remarks this week aimed at none other than himself, leading some to believe that his page had been hacked. But the reposts were actually made by Cuban in an effort to highlight the platform’s surge in anti-Jewish rhetoric.

“It was me,” Cuban confirmed to the Daily Dot.

Many of the reposts, which Cuban began sharing on Wednesday, attacked his Jewish heritage and accused him of attempting to subvert society.

“You guys [Jews] seem to have a genetic predisposition to subvert societies,” one user reposted by Cuban said. “Why? I have no idea, but even Jesus himself rebuked yall.”

Many of the accounts targeting Cuban appear to belong to Groypers, a term used to describe a loose group of white nationalist and far-right provocateurs often associated with prominent Holocaust denier Nick Fuentes.

“People are sick and tired of subversive Jews like yourself bleeding their countries dry,” another post aimed at Cuban said. “Do you think there’ll be safety for you in Israel when it all comes crashing down?”

Cuban in recent weeks has drawn the ire of conservatives and far-right activists due to his support for diversity, equity, and inclusion (DEI), a set of policies that aim to promote the representation and participation of different groups of individuals in business regardless of factors such as age, race, or ethnicity.

Cuban told the Daily Dot that the reposts represented only a small fraction of the hateful content he’s received on X, “the only platform” where he says he has experienced anti-Semitism.

“It’s nearly impossible to have a true discussion on X any longer,” Cuban said.

Under the ownership of Elon Musk, X has attempted to paint itself as a free speech haven. Yet Musk’s decision to reinstate numerous controversial accounts as well as his own promotion of what many see as antisemitic conspiracy theories has led to an exodus among advertisers.

And although he fired nearly all the employees tasked with moderating content, Musk this week announced that he would hire 100 full-time content enforcers after the platform was overrun with explicit AI-generated photos of pop star Taylor Swift.

As of Thursday morning, seemingly none of the accounts to target Cuban with antisemitic remarks have faced any disciplinary action from X.

“The craziest part of the whole thing on X is that the people I exposed are excited,” Cuban added, noting that the accounts appear emboldened instead of concerned that they may be suspended by X.

The Daily Dot attempted to reach X over email but was met with an automated response.

Elon Musk bashed by heavy metal drummer who cost him $56 billion — Reuters

Elon Musk suffered one of the biggest legal losses in U.S. history this week when the Tesla CEO was stripped of his $56 billion pay package in a case brought by an unlikely opponent, a former heavy metal drummer.apple.news

Richard Tornetta sued Musk in 2018, when the Pennsylvania resident held just nine shares of Tesla. The case eventually made its way to trial in late 2022 and on Tuesday a judge sided with Tornetta, voiding the enormous pay deal for being unfair to him and all his fellow Tesla shareholders.