You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Free marketeers/Ron Paul stans/PCTs being wrong on everything since 2008 thread

- Thread starter Dusty Bake Activate

- Start date

More options

Who Replied?Domingo Halliburton

Handmade in USA

Hey if you followed ron pauls bullshyt and bought a bunch of gold you would of made a killing....if you cashed out like 6 months ago.

Dusty Bake Activate

Fukk your corny debates

Poverty statistics indicate that our country is getting poorer.

Statistics indicate that we were losing 750,000 jobs per months at the height of the recession and we've had 36 straight months of consecutive private sector job growth despite inactive in Washington.

But the point of the thread is that a lot of Ron Paul stan-types made a series of apocalyptic predictions like the stock market doing a death spiral, third world levels of unemployment, severe food shortages in the U.S., hyperinflation, the dollar tanking, etc. being imminent that turned out to be patently false.

I don't deny that that is true.Also, the rising stock market has mostly benefitted the ultra rich, not the common man. More folks are working past 65 because their retirements are too little to live off of.

lol...well the U.S. is not the Weimar Republic. The Weimar Republic didn't hold the reserve currency of the world and $100 trillion bond market. The U.S. isn't reeling from a devastating military loss and being forced to pay huge reparations to rebuild the nations they went to war with under the Treaty of Versailles and having had all the powerful nations of the world stop lending to them. That's an absurd comparison.The one comparison regarding QE was to the Weimar Republic. In the 1920s/1930s, the Weimar Republic tried to print its way to prosperity. It failed miserably. QE didn't work for them, it actually made things worse.

QE for all its flaws (loading up the big banks who caused the recession with interest-free easy money, increasing income inequality) has "worked" thus far in the sense that is has stopped the bleeding, kept the economic system stable, held inflation in check, and kept the dollar strong.

I think a more robust fiscal stimulus and reprivatization of the big banks was needed, but since the situation in Washington will not allow for that, monetary stimulus is the only tool we had to keep our heads above water.

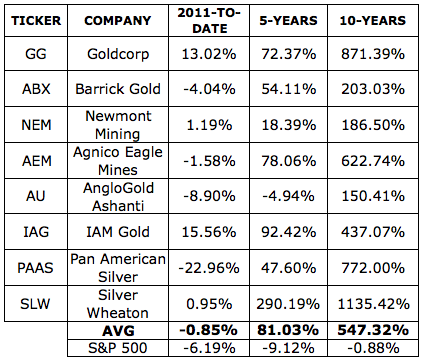

Word? How's the Ron Paul portfolio doing now?Ron Paul's portfolio has outperformed the stock market during this recovery.

A lot of portfolios outperformed the market. My fukking around on sharebuilder outperformed the S&P500. Of course people will flock to gold when you have economic instability and uncertainty and are in the throes of a financial collapse, but now it's tanking. Intelligent investors incorporated gold into their portfolio. That's why I loaded up on it and recently sold it with a 35% return. Only paranoid survivalist morons with don't tread on me flags on the their front porches put ALL their eggs in one gold basket. And Ron Paul and his stans on the sohh and the coli have still been wrong about everything.

88m3

Fast Money & Foreign Objects

why do the libertatirans think they're correct when there is no country they can base it off of and everyone dismisses them.

they certainly are persistant

why do the libertatirans think they're correct when there is no country they can base it off of and everyone dismisses them.

Cause this is America and the free market built the standard of living

Dusty Bake Activate

Fukk your corny debates

Gee I wonder which one of these gentlemen 1-starred the thread.

Domingo Halliburton

Handmade in USA

why do the libertatirans think they're correct when there is no country they can base it off of and everyone dismisses them.

These fringe movements like ows and tea party have grown because of the clowns we have as politicians now.

Dusty Bake Activate

Fukk your corny debates

Hate to  but I had to up it again. The sohh servers being dead can't save you nikkas.

but I had to up it again. The sohh servers being dead can't save you nikkas.

SPDR Gold Trust ETF Chart - Yahoo! Finance

http://www.smh.com.au/business/markets/gold-crash-heralds-return-of-king-dollar-20130416-2hwqi.html

but I had to up it again. The sohh servers being dead can't save you nikkas.

but I had to up it again. The sohh servers being dead can't save you nikkas.SPDR Gold Trust ETF Chart - Yahoo! Finance

http://www.smh.com.au/business/markets/gold-crash-heralds-return-of-king-dollar-20130416-2hwqi.html

When you look at history, there are a couple countries that have tried saving their economies by stimulating certain industries, saving companies through bailouts, or printing their way into progression.why do the libertatirans think they're correct when there is no country they can base it off of and everyone dismisses them.

Japan is a prime example of a country that tried to save it's economy by stimulating it and bailing out companies. Read up on the "lost decade", which recently turned into 2 lost decades.

In the 1920s, the Weimar Republic continuously printed money to buy up it's own debt. Their logic was that if there is a debt, then you could print money equal to that debt and just erase it like that. Sounds smart, right?

BUT if printing money was the solution, why doesn't the government print 3 million dollars for every man woman and child? That way we could all be rich and buy whatever we wanted and "stimulate" the economy with our buying power. But it doesn't work that way because that will only lead to inflation/hyperinflation.

And that's what happened to the Weimar Republic: hyperinflation. The cost of everything skyrocketed. Unfortunately that's what we're doing right now, printing a lot of money trying to buy up our own debt. Read up on QE3 (quantitative easing).

Here's some article you might find interesting

Lost decade for US Economy

Lost decade for the Economy

Still, despite X amount of months of private sector job growth, there hasn't been a huge decrease in the overall unemployment rate. We've basically had 8% unemployment for 4 years in a row. First time since the great depression, I believe.we've had 36 straight months of consecutive private sector job growth...Ron Paul stan-types made a series of apocalyptic predictions like the stock market doing a death spiral, third world levels of unemployment, severe food shortages in the U.S., hyperinflation, the dollar tanking, etc. being imminent that turned out to be patently false.

We are, however, reeling from 16 trillion dollar national debt, a 10 year war in Afghanistan, a decade of zero growth in employment, and God knows what else.lol...well the U.S. is not the Weimar Republic. The Weimar Republic didn't hold the reserve currency of the world and $100 trillion bond market. The U.S. isn't reeling from a devastating military loss and being forced to pay huge reparations to rebuild the nations they went to war with under the Treaty of Versailles and having had all the powerful nations of the world stop lending to them. That's an absurd comparison.

The point was that inflating your own currency to eat your own debt didn't work then, it's not working now. How much are you paying for a gallon of gasoline, gallon of milk, and a loaf of bread today, cost of a college education, then compare it to what it costs back in the 1920s? Inflation, man. Prices are not going down if you haven't noticed.

"Sept. 2012 to Feb. 2013"Word? How's the Ron Paul portfolio doing now?

@ you for even posting such a minute time span.

@ you for even posting such a minute time span.That's not even a long term chart on Gold's performance. Gold gained back 1% today, too.

Ron Paul first invested in gold in the early 1970s. He still made a killing with gold, using a longer period from 1999 to today.

Let's say RP first invested in gold In 1999, when gold was at $253/oz. As of today, gold is at $1,387.40. Do the math, and you get a 548% PROFIT, not loss ([1387*100]/253). NOW, go back and find the price of gold dating back to say 1972, when RP first invested in gold and insert that into the formula... RP has made a KILLING on bullion.

35% isn't even a huge profit compared to the 500% most people netted through early investments dating back to 1999/2000. I'm not dismissing it, but it's about 1/15th of what other investors made over a longer period, including RP.A lot of portfolios outperformed the market...That's why I loaded up on it and recently sold it with a 35% return.

Dusty Bake Activate

Fukk your corny debates

Table of Inflation Rates by Month and Year (1999-2013)

Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Ave

2013 1.6 2.0 1.5 1.1 1.4

2012 2.9 2.9 2.7 2.3 1.7 1.7 1.4 1.7 2.0 2.2 1.8 1.7 2.1

2011 1.6 2.1 2.7 3.2 3.6 3.6 3.6 3.8 3.9 3.5 3.4 3.0 3.2

2010 2.6 2.1 2.3 2.2 2.0 1.1 1.2 1.1 1.1 1.2 1.1 1.5 1.6

2009 0 0.2 -0.4 -0.7 -1.3 -1.4 -2.1 -1.5 -1.3 -0.2 1.8 2.7 -0.4

2008 4.3 4 4 3.9 4.2 5.0 5.6 5.4 4.9 3.7 1.1 0.1 3.8

Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Ave

2013 1.6 2.0 1.5 1.1 1.4

2012 2.9 2.9 2.7 2.3 1.7 1.7 1.4 1.7 2.0 2.2 1.8 1.7 2.1

2011 1.6 2.1 2.7 3.2 3.6 3.6 3.6 3.8 3.9 3.5 3.4 3.0 3.2

2010 2.6 2.1 2.3 2.2 2.0 1.1 1.2 1.1 1.1 1.2 1.1 1.5 1.6

2009 0 0.2 -0.4 -0.7 -1.3 -1.4 -2.1 -1.5 -1.3 -0.2 1.8 2.7 -0.4

2008 4.3 4 4 3.9 4.2 5.0 5.6 5.4 4.9 3.7 1.1 0.1 3.8

Scustin Trillberlake

Banned

Disgusting thread. Why don't more of you wipe your ass with the Constitution and Classical Liberalism.

Scust.

Scust.

Dusty Bake Activate

Fukk your corny debates

:sadpaul:

:timmyumad: