Godless Socialist CEO

Superstar

Yes it's called pooling your money. The US pays a fraction along with their allies in the IMF. You claimed only Americans would pay. You were incorrect. Just take the L and move on. it works just like taxes, the people with the most resources should contribute the most.

Condescending posts like this add nothing to the conversation. You claim I don't know what I'm talking about but don't post correct information.

The burden of proof is on you, not me. I just think about things critically and deductively; something a lot of people on the coli, and the internet in general, don't do.

So let me spit game.

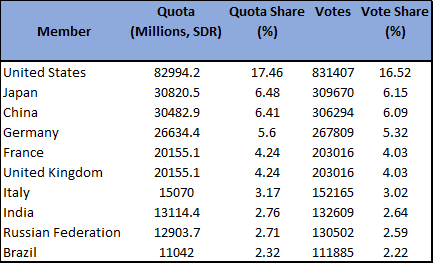

Of the 109 IMF members, the United States has the largest voting share. What this means, effectively, is that the US has veto power and moves its weight more than any other voting bloc.

The United States also contributes the highest amount of quotas to the IMF; sealing its proportional weight and therefor voting power. It has increased its quota commitment twice. It's the only country to do so; despite reserve and economic variability constraints. But then again, you can do what you want when the bank is in your backyard.

Add all of this to the fact that, much like the ineffectual United Nations, the IMF is located in the US. You realize how pro-American international policy the IMF actually is.

This isn't some blue versus red shyt in America. International policy and economics is a whole other level of bullshyt if you aren't American.

I'm also not the only one who thinks this:

"The impact of IMF loans has been widely debated. Opponents of the IMF argue that the loans enable member countries to pursue reckless domestic economic policies knowing that, if needed, the IMF will bail them out. This safety net, critics charge, delays needed reforms and creates long-term dependency."

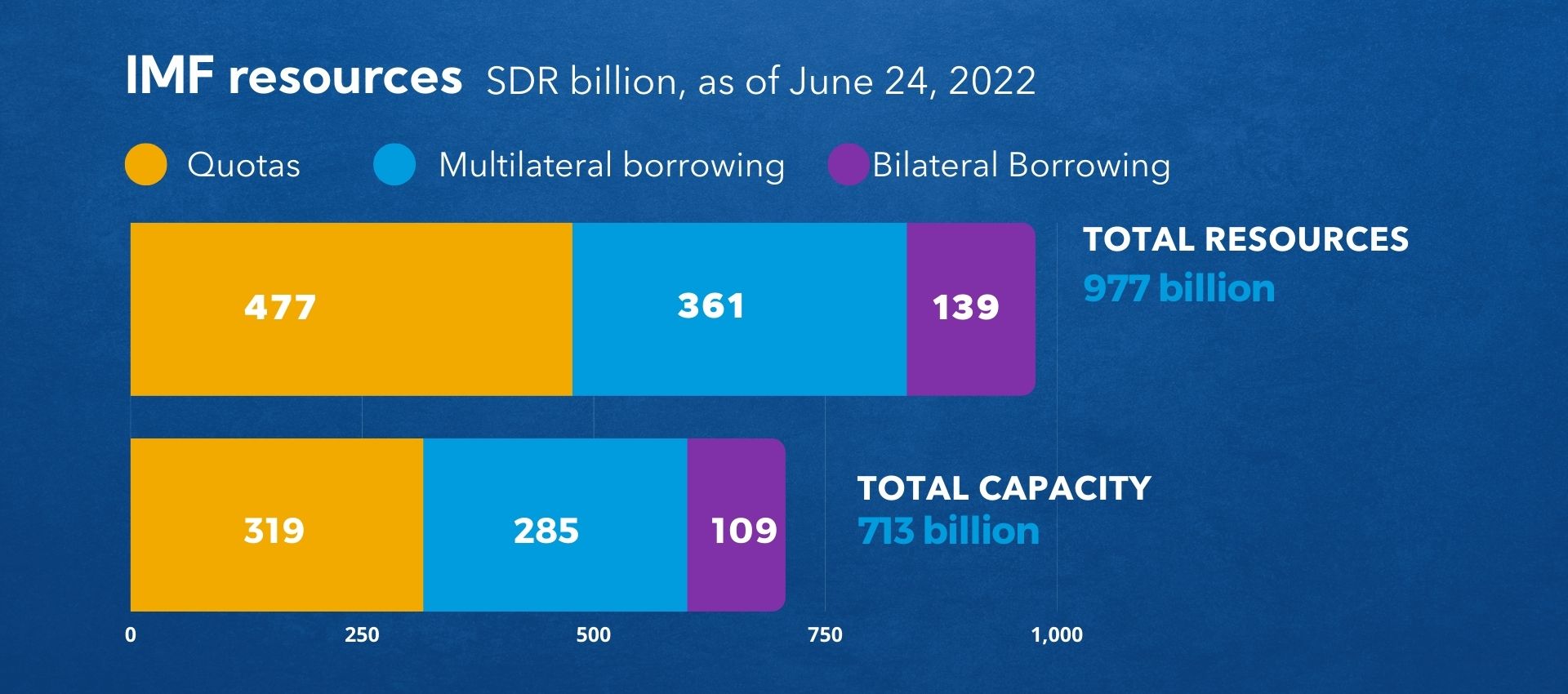

So as I said, the US has found a work around to get funds to Ukraine. The Biden admin knows how crazy it would look to have a financial crises and then send money to Europe while it's happening. It would practically hand the next election to the Republicans. That aside, the quotas will have to be paid back into the IMF...and such quotas are covered by tax payers via reserve tranche.

The International Monetary Fund (IMF) : an ABC – CADTM

In 2020, the World Bank (WB) and the IMF are 76 years old. These two international financial institutions (IFI), founded in 1944, are dominated by the USA and a few allied major powers who work to…www.cadtm.org

U.S. Participation in the International Monetary Fund (IMF): A Primer - AAF

Executive Summary The International Monetary Fund (IMF) was created in the wake of the Great Depression to promote stability in global financial markets. Nearly all countries are members of the IMF, but the United States is the largest cumulative contributor to the IMF at $155 billion and the...www.americanactionforum.org

International Monetary Fund - Globalization, Reforms, Criticism | Britannica

International Monetary Fund - Globalization, Reforms, Criticism: The impact of IMF loans has been widely debated. Opponents of the IMF argue that the loans enable member countries to pursue reckless domestic economic policies knowing that, if needed, the IMF will bail them out. This safety net...www.britannica.com

Where Does the IMF Get Its Money? The IMF gets its money through quotas and subscriptions from its member countries. These contributions are based on the size of the country's economy, making the U.S., with the world's largest economy, the largest contributor.