http://www.bloomberg.com/news/artic...ck-sales-by-major-shareholders-for-six-months

Me love you long time for real, China is on some blood in blood out sh*t

China’s securities regulator banned major shareholders, corporate executives and directors from selling stakes in listed companies for six months, its latest effort to stop the nation’s $3.5 trillion stock-market rout.

Investors with stakes exceeding 5 percent must maintain their positions, the China Securities Regulatory Commission said in a statement. The rule is intended to guard capital-market stability amid an “unreasonable plunge” in share prices, the CSRC said.

While China has already ordered government-owned institutions to maintain or boost their stock holdings, the CSRC’s directive expands the ban on sales to non-state companies and potentially foreign investors who own major stakes in mainland businesses. Regulators have unveiled market-boosting measures almost every night over the past 10 days, steps that have so far failed to revive investor confidence. Foreign traders sold Chinese shares at a record pace this week in part due concerns over the government’s meddling in markets.

“This is not something would happen in the U.S. or in any other developed market,”said Brian Jacobsen, who helps oversee $250 billion as the chief portfolio strategist at Wells Fargo Funds Management. “It does smell a little bit of desperation. But in China it’s a very unique system and they are taking unique steps to try to stop the drop.”

IPO Halt

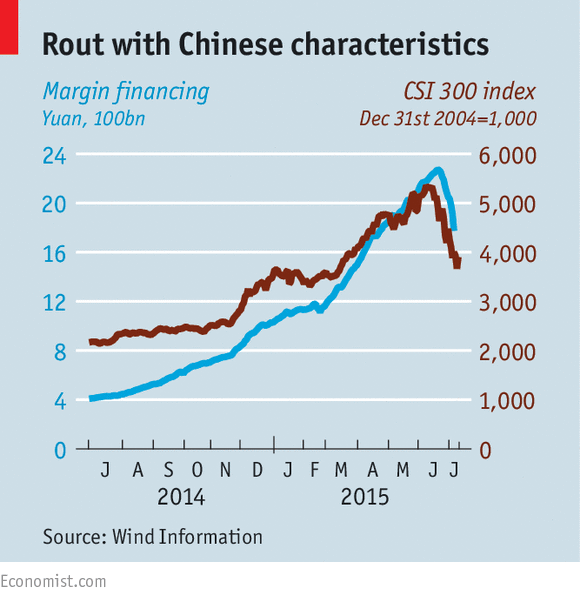

The Shanghai Composite Index slid 5.9 percent on Wednesday as official attempts to stop the selling, including measures to prop up small-cap stocks, were overshadowed by data showing an unprecedented liquidation of margin trades on Tuesday.

Chinese authorities have also suspended initial public offerings, restricted bearish bets via stock-index futures and encouraged financial firms to buy shares. In perhaps the most dramatic effort to prevent investors from selling, local exchanges have allowed at least 1,331 companies to halt trading in their shares.

As the Shanghai Composite’s record-breaking boom goes bust, President Xi Jinping’s government is intervening in an attempt to prevent falling stock prices from eroding confidence in his leadership. The moves have cast doubt on the ruling Communist Party’s pledge less than two years ago to give market forces a bigger role in the economy, part of its largest reform drive since the 1990s.

Intervention Risk

China isn’t the only market with a history of state intervention. During the Asian financial crisis in 1998, Hong Kong’s government bought shares worth $15 billion to prop up the market. In the U.S., the Securities and Exchange Commission temporarily banned short selling on some shares during the global financial crisis in 2008.

“It may have a small impact in short term, but like all market manipulation, there will be a price to be paid later,” Gregory Lesko, a money manager at Deltec Asset Management LLC in New York, said by e-mail. “I recall a slew of short selling bans during the financial crisis. Nothing saved the day.”

Under current mainland rules, a single foreign investor can own as much as 10 percent of a company’s issued shares, according to the Hong Kong stock exchange’s website. International funds have gained unprecedented access to the Shanghai market through an exchange link with Hong Kong that began in November, and authorities have said they’re planning a similar link with China’s smaller bourse in Shenzhen this year.

Selling Pressure

MSCI Inc., whose indexes are used to benchmark an estimated $9.5 trillion of assets, cited China’s capital controls as a reason why mainland shares were left out of its global equity gauges in June.

Foreign investors have sold a net 33.4 billion yuan ($5.4 billion) of Shanghai shares through the city’s exchange link in the past three days. China has allocated investment quotas of about $138 billion through its so-called QFII and RQFII programs for foreign money managers, which include BlackRock Inc. and HSBC Global Asset Management.

“The extent to which they can apply this to foreign ownership interest remains to be seen,” Jacobsen said. “But to me they are grasping the straws to find a way to stop the selling pressure.”

Me love you long time for real, China is on some blood in blood out sh*t