It works when you keep it simple and remain

unbiased. Technical analysis has predictive power on multiple timeframes. But again, the key is to keep it simple. The chart

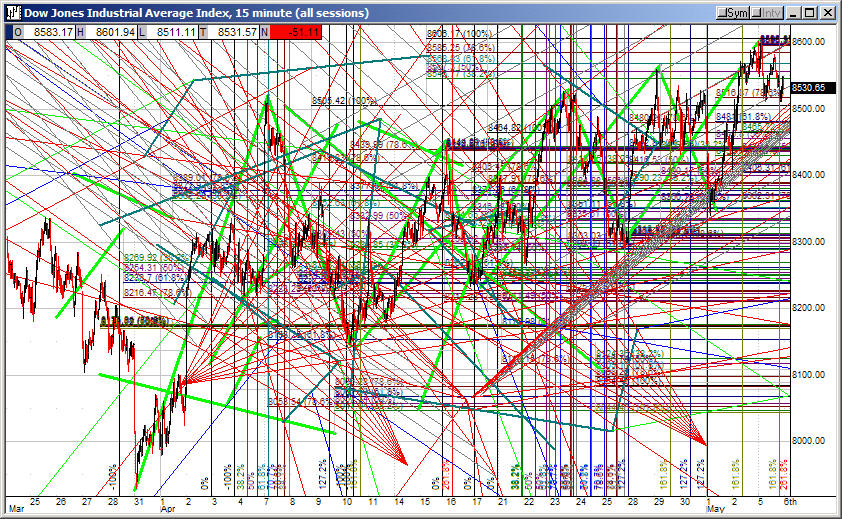

@Domingo Halliburton shared is funny because it is true. Some people just do too much with it. Less is more. Trendlines, support/resistance levels, Bollinger bands, Moving averages, MACD, RSI. Those are the most commonly used technical indicators. Anything more than that is entering the realm of analysis paralysis. Sometimes all you need is a simple trend line. The problem with relying solely on Technical Analysis is that you could make a bullish and bearish argument on the same chart. That's why, depending on your timeframe, it is smarter to pair technical analysis with fundamental analysis, sector performance, etc. On the other hand, some stocks pay no deference whatsoever to technical analysis or fundamental analysis and instead depend on hype and hope. Technical analysis can be applied to multiple time frames (short, intermediate, long term). So, if you're a day trader you can use technical analysis on 1 minute, 5 minute, 15 minute, and 60 minute charts to help you identify short term support/resistance levels, etc. If you're a swing trader or investor you can apply it to longer time frames like 60 min, daily, weekly, and monthly charts.

.

.

It works when you keep it simple and remain unbiased. Technical analysis has predictive power on multiple timeframes. But again, the key is to keep it simple. The chart

It works when you keep it simple and remain unbiased. Technical analysis has predictive power on multiple timeframes. But again, the key is to keep it simple. The chart