Damn 0 shares sold for a profit on Friday. No support in site...If you go back to their IPO date there were quite a few arguing about the prowess of a tech company, even though reality was right there.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boiler Room: The Official Stock Market Discussion

More options

Who Replied?Unfortunately, retail investors are going to continue ‘buying the dip’ on the way down from wealthy and institutional investors selling. What makes it even colder is traders and hedge funds are borrowing shares from long retail investors to short. And when it bottoms out, current and prospective retail investors will become disillusioned with the markets when that will be the best time to buy. Many will capitulate and sell out at the bottom fearing greater losses. Cold World.

You don't know what the bottom is so you deploy capital slowly. You determine the fair value of a company and buy as its under that value. Facebook has a forward P/E of 16 and almost $30 billion in free cash flow. It's selling way undervalued. The S&P500 P/E ratio is 34.5 so Facebook is selling for under half the S&P 500's P/E ratio. That's a buy.

this means generally - like if you set aside $250/month to buy stocks, you shouldn't decide to sit on that being scared to buy during the downturn, keep investing it in good companies, don't hold it until we're in recovery...now if you're the type to drop big sums of money in all at once, well yea, you'd get fukked buying right now, change your approach and DCA a bit at a time.

You say when it bottoms but that will only be known in hindsight. People need to research how to read a balance sheet, income statement, cash flow statement and learn how to at a basic level value a company.Unfortunately, retail investors are going to continue ‘buying the dip’ on the way down from wealthy and institutional investors selling. What makes it even colder is traders and hedge funds are borrowing shares from long retail investors to short. And when it bottoms out, current and prospective retail investors will become disillusioned with the markets when that will be the best time to buy. Many will capitulate and sell out at the bottom fearing greater losses. Cold World.

If I walk up to a retail investor and say I'll sell you a $1000 bill for $100 they'd take that offer because they understand the value. If I tell them I'll sell them a share of FB for $190 and it's got a 16 forward P/E if they don't understand the value of what they're buying and just looking at a falling price due to people panicking they gonna lose out on a deal.

You say when it bottoms but that will only be known in hindsight. People need to research how to read a balance sheet, income statement, cash flow statement and learn how to at a basic level value a company.

If I walk up to a retail investor and say I'll sell you a $1000 bill for $100 they'd take that offer because they understand the value. If I tell them I'll sell them a share of FB for $190 and it's got a 16 forward P/E if they don't understand the value of what they're buying and just looking at a falling price due to people panicking they gonna lose out on a deal.

That's true but market valuations since 2020 have been largely driven by the Fed injecting trillions into financial markets. Valuations have become detached from historical fair value multiples. Generally speaking indices bottom out when they've fallen 50-70% below their peaks. It's easier to determine when a stock is bottoming out by looking at market indexes.

Or just invest in index funds and call it a day. If they're not going to research.You say when it bottoms but that will only be known in hindsight. People need to research how to read a balance sheet, income statement, cash flow statement and learn how to at a basic level value a company.

I should have just done index funds. I was outperforming the market but now I'm drastically underperforming it.Or just invest in index funds and call it a day. If they're not going to research.

ABB Always be buying. The same people selling and talking about waiting all this our were gobbling these sticks up back when the market was overvalued. If you believed in the company and liked it then well you should love it now at a much better value.

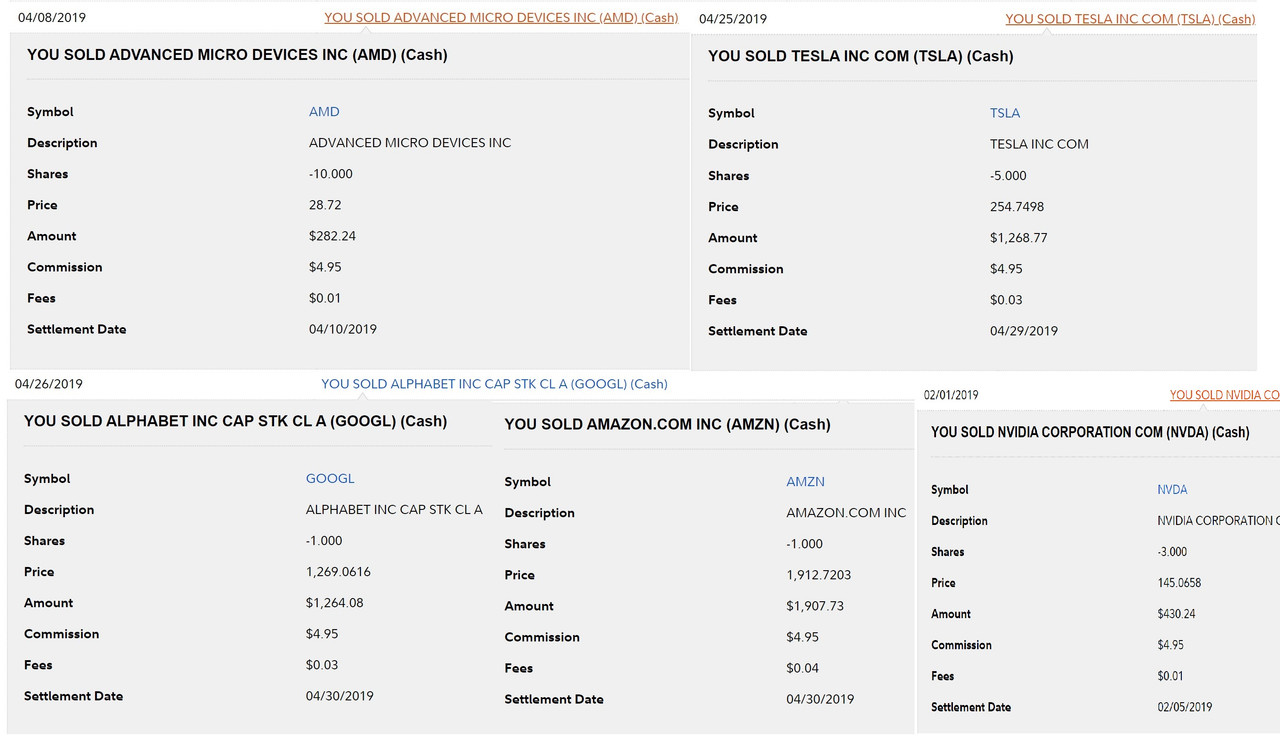

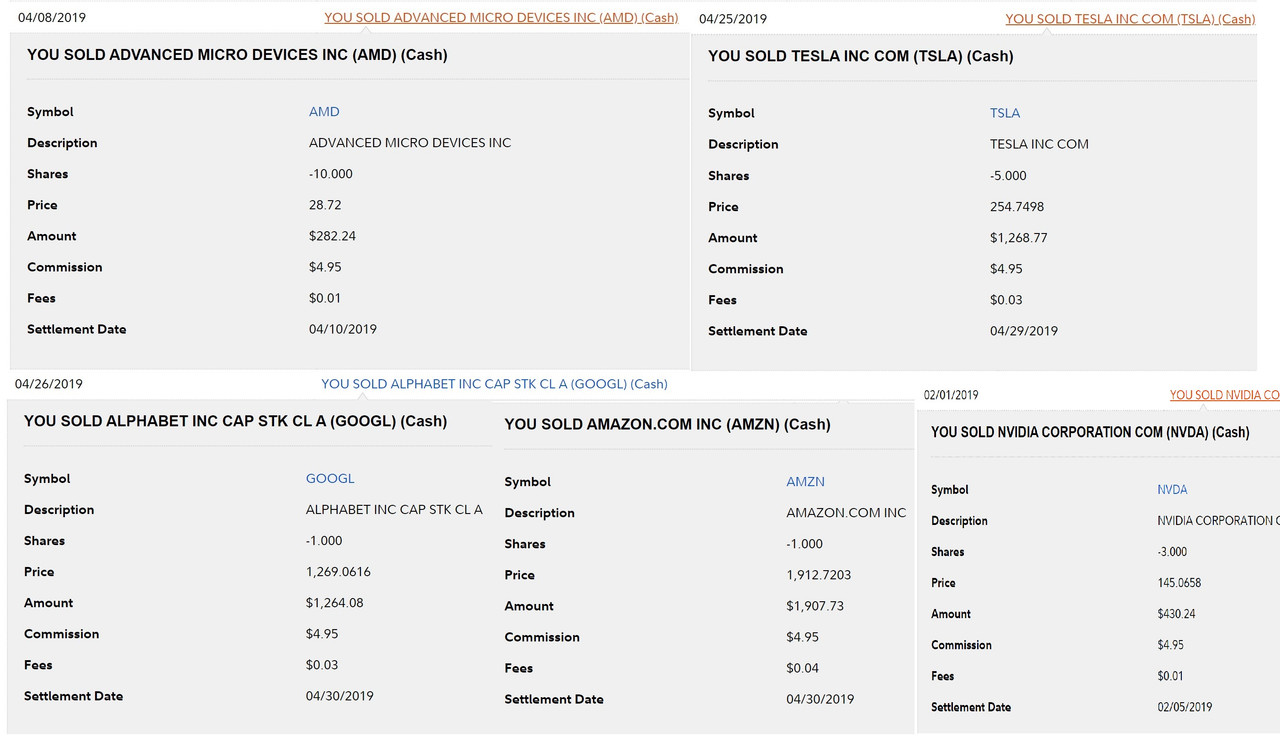

Watch how I blew up $25,903 worth of stock at a cost basis of $4607.35 To only walk away with $5153.06. Missed out on $20,749.94 in gains had I just held for a few years. That Tesla and Nvidia are both pre stock split. I was just starting out investing. AMD was the first stock purchase I made back in Jan 2019. A few months later I sold it. Moral of the story is don't sell good companies. Many of these companies were up far more than the numbers I used at today's prices.

Last edited:

Saysumthinfunnymike

VOTE!!!

People have a hard time deciding if their companies are trash or everything is trash. Right now most everything is trash. it's one of the better times to plan out a strategy and set and forget..

Will many of these plays get up to ATHs in the near future? No most won't probably especially high growth but if a company is a good one but down 50-65% from ATHs i mean it's not really time to sell.. it's time to buy. Unless the company was always ass..

Will many of these plays get up to ATHs in the near future? No most won't probably especially high growth but if a company is a good one but down 50-65% from ATHs i mean it's not really time to sell.. it's time to buy. Unless the company was always ass..

in 1999 Amazon fell 90% in that dot com crash took 10 years to recover. At times it was available for $10 a share. Those shares are worth $2900 today. I'd wait that long if I believed in a company seeing that.People have a hard time deciding if their companies are trash or everything is trash. Right now most everything is trash. it's one of the better times to plan out a strategy and set and forget..

Will many of these plays get up to ATHs in the near future? No most won't probably especially high growth but if a company is a good one but down 50-65% from ATHs i mean it's not really time to sell.. it's time to buy. Unless the company was always ass..

People could have bought $10,000 worth of Amazon shares and flipped that into almost $3 million dollars. fukk it buy $5000 worth of that lows and that's still almost $1.5 million in gains.

People just not thinking long term. They see a falling price and panic but really they need to be calm and roll with it. I can't lie I almost panicked out of Facebook when it fell but I just decided to sit on it a week and see how I felt and after that initial shock I feel like I'll take the chance on it so I kept it.

Those Tesla shares I sold yeah it was only 5 but those 5 would have been split into 25 and have at it's upper prices in the $1200 range per share been worth $30,000 for a $1500 purchase.

BlaxOps

Pro

Companies where the fundamentals haven't changed should be fine in the long run. The speculative plays, the ones where their entire evaluation is based on future earnings are the ones to use caution with.People have a hard time deciding if their companies are trash or everything is trash. Right now most everything is trash. it's one of the better times to plan out a strategy and set and forget..

Will many of these plays get up to ATHs in the near future? No most won't probably especially high growth but if a company is a good one but down 50-65% from ATHs i mean it's not really time to sell.. it's time to buy. Unless the company was always ass..