You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boiler Room: The Official Stock Market Discussion

More options

Who Replied?Another example of why you should stay away from Chinese companies... usually.

It always comes full circle.

I kicked myself for missing out on the WBAI IPO because I had a doctor appointment late November 2013. Opened at $20, briefly trickled into $18s and thought I made a good move, until it kept going up, up, up. Peaked at $54 a share a few months later.

Now the rumor is their license from the government is getting revoked and they're shutting down. Might be total BS, but nevertheless, closed today at $12.81.

You can make boatloads of money off Chinese companies, but the risk isn't worth it for me, unless there are LEAPS to hedge.

It always comes full circle.

I kicked myself for missing out on the WBAI IPO because I had a doctor appointment late November 2013. Opened at $20, briefly trickled into $18s and thought I made a good move, until it kept going up, up, up. Peaked at $54 a share a few months later.

Now the rumor is their license from the government is getting revoked and they're shutting down. Might be total BS, but nevertheless, closed today at $12.81.

You can make boatloads of money off Chinese companies, but the risk isn't worth it for me, unless there are LEAPS to hedge.

Domingo Halliburton

Handmade in USA

Yellen testifying today. Some speculation she'll say something hawkish. What's the dollar bid looking like?

on fireMight have to get some TSLA puts

will see if it can go up to 223-238 first

edit: EBay looking lkike its on the way down too

didnt even realize tesla was down big yesterday. i'm telling yall shyt heading to 175 soon. might take next earnings release to get there though

Domingo Halliburton

Handmade in USA

ECONOMIC REPORTS

Domestic economic reports scheduled for today include:

S&P Case-Shiller 20-city house price index for December at 9:00--consensus up 0.6%

Markit U.S. services PMI for February at 9:45--consensus 54.5

Federal Reserve Chair Janet Yellen Speech to be released at 10:00

Consumer confidence for February at 10:00--consensus 99.5

Richmond Fed manufacturing index for February at 10:00--consensus 6

ANALYST RESEARCH

Upgrades

Chegg (CHGG) upgraded to Outperform from Market Perform at BMO Capital

Coach (COH) upgraded to Outperform from Perform at Oppenheimer

DSW (DSW) upgraded to Buy from Neutral at Sterne Agee

Memorial Production (MEMP) upgraded to Overweight from Neutral at JPMorgan

Norwegian Cruise Line (NCLH) upgraded to Buy from Neutral at UBS

Peugeot (PUGOY) upgraded to Buy from Hold at Deutsche Bank

Downgrades

American Airlines (AAL) downgraded to Market Perform from Outperform at Cowen

Armstrong World (AWI) downgraded to Hold from Buy at KeyBanc

Basic Energy (BAS) downgraded to Outperform from Strong Buy at Raymond James

CSC (CSC) downgraded to Hold from Buy at Stifel

Chevron (CVX) downgraded to Perform from Outperform at Oppenheimer

Choice Hotels (CHH) downgraded to Underweight from Equal Weight at Barclays

Eni SpA (E) downgraded to Underperform from Hold at Jefferies

Fifth Street Asset (FSAM) downgraded to Neutral from Outperform at Credit Suisse

HSBC (HSBC) downgraded to Neutral from Buy at UBS

Home Loan Servicing (HLSS) downgraded to Neutral from Overweight at Piper Jaffray

Huntington Ingalls (HII) downgraded to Underperform from Neutral at Credit Suisse

Kayne Anderson (KED) downgraded to Hold from Buy at Stifel

Newmont Mining (NEM) downgraded to Neutral from Overweight at HSBC

Polypore (PPO) downgraded to Market Perform from Outperform at William Blair

Rosetta Resources (ROSE) downgraded to Hold from Buy at Topeka

Rosetta Resources (ROSE) downgraded to Market Perform from Outperform at BMO Capital

Rosetta Resources (ROSE) downgraded to Neutral from Buy at BofA/Merrill

Sprint (S) downgraded to Sell from Neutral at BTIG

Timmins Gold (TGD) downgraded to Sector Perform from Outperform at RBC Capital

Transocean Partners (RIGP) downgraded to Underweight from Equal Weight at Barclays

Vodafone (VOD) downgraded to Underperform from Neutral at BofA/Merrill

Williams Partners (WPZ) downgraded to Neutral from Buy at Citigroup

Williams (WMB) downgraded to Neutral from Buy at Citigroup

Initiations

BP Prudhoe Bay (BPT) initiated with an Underweight at JPMorgan

InfraREIT (HIFR) initiated with a Buy at Citigroup

InfraREIT (HIFR) initiated with an Outperform at RBC Capital

InfraREIT (HIFR) initiated with an Outperform at Wells Fargo

Interactive Intelligence (inin) initiated with a Market Perform at William Blair

Newtek Business Services (NEWT) initiated with a Market Perform at JMP Securities

Shake Shack (SHAK) initiated with a Buy at Stifel

Shake Shack (SHAK) initiated with a Hold at Jefferies

Shake Shack (SHAK) initiated with a Market Perform at William Blair

Shake Shack (SHAK) initiated with a Neutral at Goldman

Shake Shack (SHAK) initiated with a Neutral at JPMorgan

Shake Shack (SHAK) initiated with an Equal Weight at Barclays

Spark Therapeutics (ONCE) initiated with an Overweight at JPMorgan

TRACON Pharmaceuticals (TCON) initiated with a Buy at Stifel

TRACON Pharmaceuticals (TCON) initiated with an Outperform at Oppenheimer

COMPANY NEWS

Hitachi (HTHIY) confirmed acquisition of Finmeccanica's railway assets for EUR 773M

Philips (PHG) said it intends to separate Lighting business through IPO

Bob Chapek named Chairman, Walt Disney Parks and Resorts (DIS)

First Solar (FSLR), SunPower (SPWR) said they plan to partner to form joint YieldCo vehicle

WEDC to provide up to $9M in tax credits to Exact Sciences (EXAS)

Chegg (CHGG) announced an agreement in principle to establish a multi-year renewable agreement with Ingram Content Group

EARNINGS

Companies that beat consensus earnings expectations last night and today include:

Home Depot (HD), Carrizo Oil & Gas (CRZO), Pacira (PCRX), Integra LifeSciences (IART), ExlService (EXLS), United Therapeutics (UTHR), Gentherm (THRM), Chart Industries (GTLS), Toll Brothers (TOL), Agrium (AGU), Haverty Furniture (HVT), Hansen Medical (HNSN), Delek US (DK), Delek Logistics (DKL), Quad/Graphics (quad), Sun Hydraulics (SNHY), On Deck Capital (ONDK), AXT, Inc. (AXTI), ONEOK Partners (OKS), Invesco Mortgage (IVR), ONEOK (OKE), Kaman (KAMN), Chegg (CHGG), Nautilus (NLS), Five9 (FIVN), Depomed (DEPO), Continental Building (CBPX)

Companies that missed consensus earnings expectations include:

Sanderson Farms (SAFM), Westlake Chemical Partners (WLKP), Westlake Chemical (WLK), Stock Building Supply (STCK), INC Research (INCR), RCS Capital (RCAP), Alliant Energy (LNT), Rosetta Resources (ROSE), American Tower (AMT), Orchid Island Capital (ORC), Endurance (EIGI), Redwood Trust (RWT), PDL BioPharma (PDLI), Ophthotech (OPHT), Dillard's (DDS), Stifel Financial (SF), MDC Partners (MDCA), Express Scripts (ESRX)

Companies that matched consensus earnings expectations include:

Vitamin Shoppe (VSI), Donaldson (DCI), Seaspan (SSW), DealerTrack (TRAK), AtriCure (ATRC), Texas Roadhouse (TXRH)

NEWSPAPERS/WEBSITES

Eli Lilly (LLY) CEO states company is not for sale, Financial Times reports

Apple (AAPL) hiring chip, battery experts from Samsung (SSNLF), Korea Times reports

JPMorgan (JPM) plans to charge fees for deposits from large clients, WSJ reports

Banks probed for possible rigging of precious metals markets, WSJ reports (HSBC, BNS, BCS, CS, DB, GS, JPM, SCGLY, UBS)

SYNDICATE

BofI Holding (BOFI) files $50M at-the-market equity offering

Colfax (CFX) files automatic mixed securities shelf

Health Care REIT (HCN) files to sell 17M shares of common stock

Marin Software (MRIN) files to sell 1.56M shares of common stock for holders

National Retail Properties (NNN) files automatic mixed securities shelf

Opexa Therapeutics (OPXA) files to sell $63.3M in common stock and units

Q2 Holdings (QTWO) files to sell 4.56M shares of common stock

Real Goods Solar (RGSE) files to sell $3.5M of units

Spirit Airlines (SAVE) files mixed securities shelf, no amount given

Tallgrass Energy (TEP) files to sell 10M common units representing limited partners

Tenax Therapeutics (TENX) files $100M mixed securities shelf

Unisys (UIS) files automatic mixed securities shelf

Xencor (XNCR) files to sell 5.5M shares of common stock

deal on Greek bailout as well.

Futuristic Eskimo

All Star

I need to stop reading zero hedge completelydeal on Greek bailout as well.

Domingo Halliburton

Handmade in USA

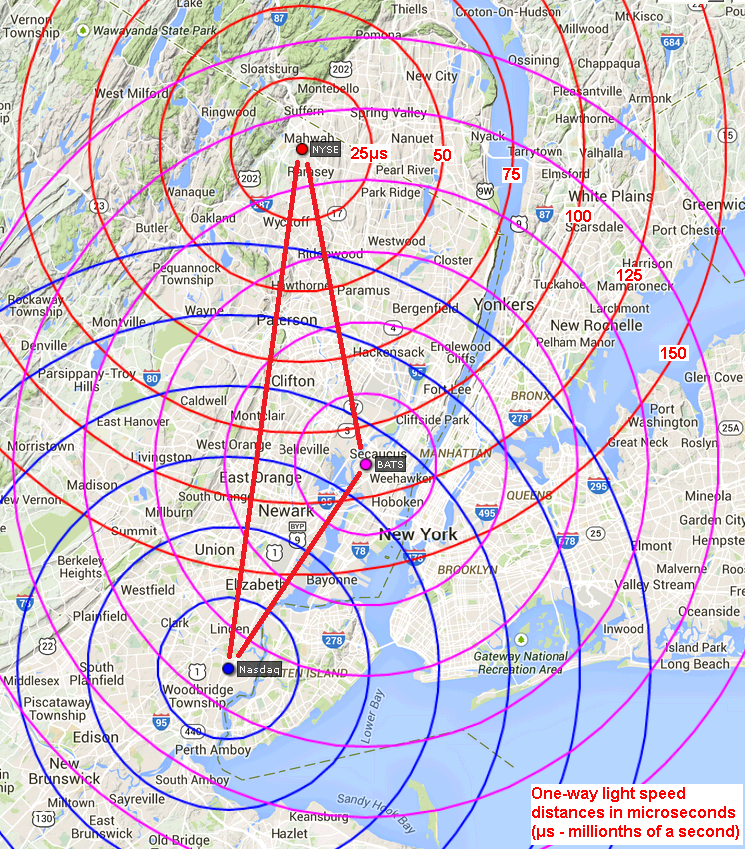

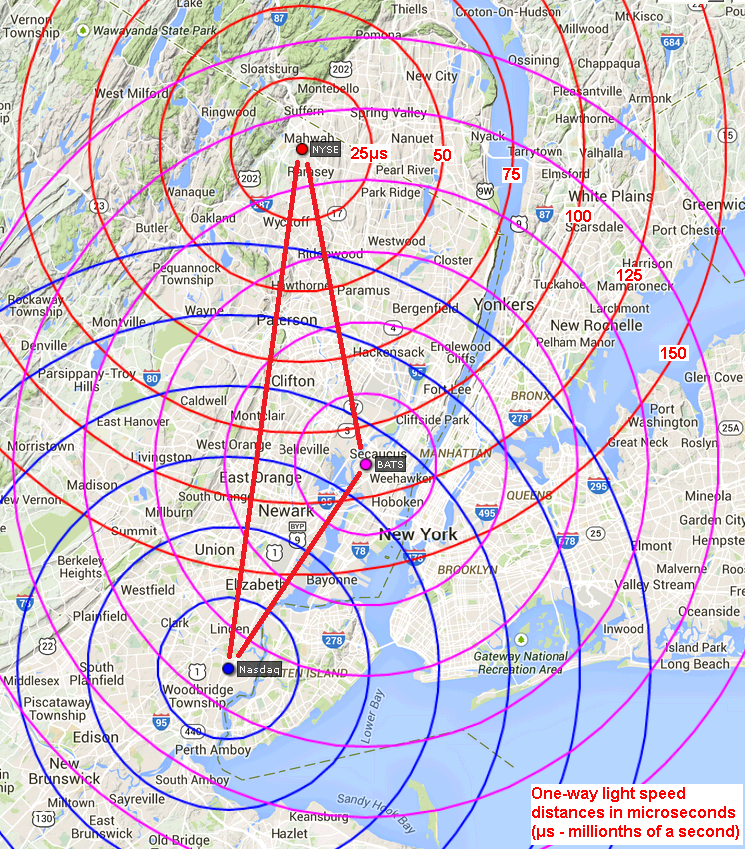

high speed traders turning to lasers instead of microwaves. Here's a couple that will be beaming 150 feet over New Yorkers heads to the NYSE data center:

Domingo Halliburton

Handmade in USA

I need to stop reading zero hedge completely

I haven't been keeping up with him as much, was he saying a deal wasn't going to happen?

Futuristic Eskimo

All Star

Basically. I figured the FX downside wasn't worth the reward so I exited my position.I haven't been keeping up with him as much, was he saying a deal wasn't going to happen?

Domingo Halliburton

Handmade in USA

Basically. I figured the FX downside wasn't worth the reward so I exited my position.

dude is a perma-bear and comes off as a conspiracy theorist. The thing is he seems to know what he's talking about, it just the way he conveys it sometimes. I don't know how you're that down on everything all the time. I saw some quote the other day from him it wasn't gold that lost its value its more a function of our flawed fiat currencies.

fukk it...selling my shyt ahead of 10AM and buying puts with a longer expiry

Considering how high we are probablistically I see a higher chance of the market heading down then up after whatever she says. Too much unneeded stress. Might bounce back up after some turbulence though. i guess well see

Considering how high we are probablistically I see a higher chance of the market heading down then up after whatever she says. Too much unneeded stress. Might bounce back up after some turbulence though. i guess well see

Last edited:

Futuristic Eskimo

All Star

Yea I tend to skip over his analysis and read the articles with actual analyst content more thoroughly. There's some good stuff on there but his mentality is infecting my decision making.dude is a perma-bear and comes off as a conspiracy theorist. The thing is he seems to know what he's talking about, it just the way he conveys it sometimes. I don't know how you're that down on everything all the time. I saw some quote the other day from him it wasn't gold that lost its value its more a function of our flawed fiat currencies.

the tension is killing me

getting a feeling that I shouldve stayed put (no pun intended)

March 20 2015 expiry

210 Puts for the SPY

3 contracts for a total of $750 USD

Willing to risk $150USD out of this. Lets see what happens.

getting a feeling that I shouldve stayed put (no pun intended)

March 20 2015 expiry

210 Puts for the SPY

3 contracts for a total of $750 USD

Willing to risk $150USD out of this. Lets see what happens.

Last edited: