You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boiler Room: The Official Stock Market Discussion

More options

Who Replied?Futuristic Eskimo

All Star

I might. Got out of my EZU trade a few minutes ago. Have some money floating around to play with. Still contemplating those crude puts. If WTI bounces over $50 today, I think im gonna take the plunge.

Domingo Halliburton

Handmade in USA

who is AMSGP? hasn't traded a share today and has somehow tripped markets halts over 20 times.

FinesseKing

Banned

I got in at .18 and I sold on friday.CERE cookin'

Domingo Halliburton

Handmade in USA

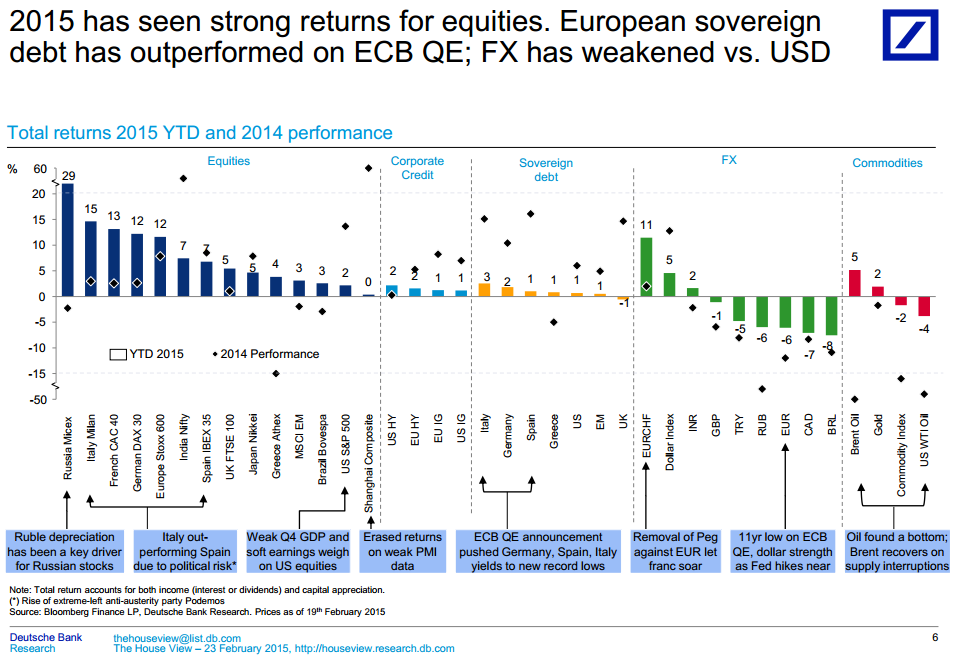

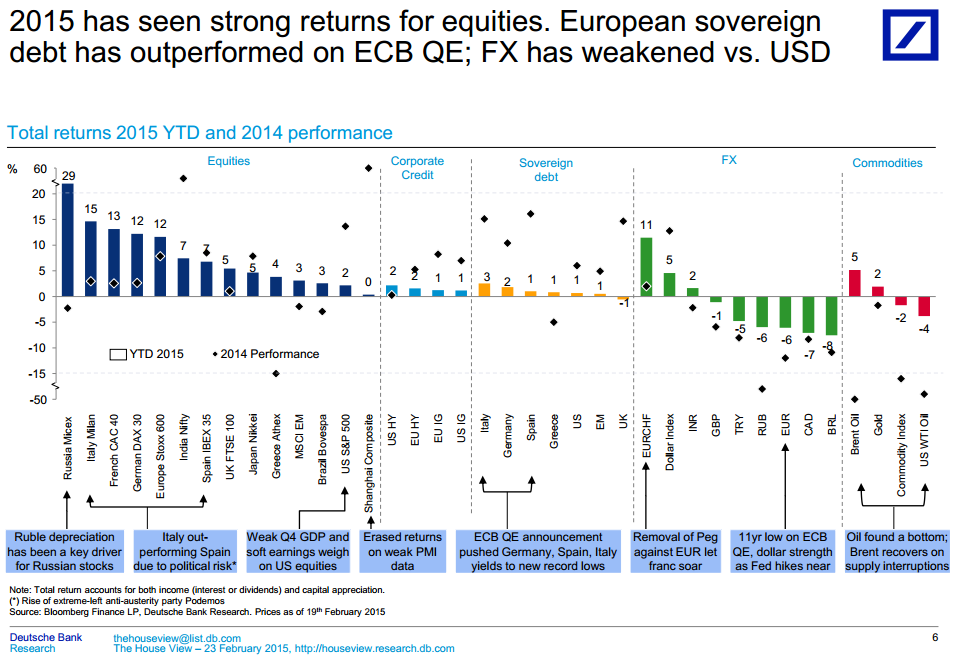

from Deutsche Bank:

4k on quickly expiring options?

Unhedged, you're either swimming in money or ballsy as fukk.

Neither breh, just took an unnecessarily big risk, cuz I was pissed at not getting BA calls and 200%ing it up that day, so I went 4 x too big on this TWTR trade and fukked up.

Here's my half-baked opinion... so you're at $0.37 per contract right now. Down almost 50%, I'm assuming you paid around $0.74 per contract and bought about 55 contracts.

Your breakeven is $51.74. I don't know of any tangible company catalysts that would push up TWTR by the end of next week, so I'm just looking at technicals and analyzing the overall market.

The markets might not correct by next week, so if they go a little higher, you have some hope, but they are due for a correction. Overbought as fukk. When the markets are declining, absent any TWTR news, TWTR will probably fall too.

TWTR indicators are all also pointing to some sort of near-term correction. I like Stochastics indicators and it's not looking great. Way up there and while it doesn't look ready for an immediate drop and could keep going sideways or slightly higher, it's ready for a drop.

You can never predict the technicals with 100% accuracy. Just decent guides, but everything looks like TWTR is ready to dump a few bucks. TWTR could conceivably move higher and even above $51.74 by next week, especially on some unforeseen news...

But uhhh

That time value is going to kill you, so if there isn't a good move by Monday, I'd cut out because your $0.37 option will probably be worth about $0.32 by Monday and rapidly declining. If there's a decent move, then you have to assess if you should take the loss or keep praying.

Take the haircut and get the fukk out

I'm pretty sure its a safe assumption twitter is riskier than the market....just hope the market goes up and it carries twtr....still 51 is a tall order at this point....

i always hated twitter....they can't justify their share price...ive been bearish since the IPO practically.....sort through this thread and look up my posts from the twitter ipo

Funny thing is, i've always hated TWTR too, and I've read your thoughts on it too..Just a stupid fukkin risk

Stocks move too sporadically for me to bet with anything less than a month of expiry. A week simply isnt enough.

Put in a stop order to risk maybe $300 more. The wknd alone will kill a good amount of that though

edit: TWTR is overbought, its moving averages are far below.

WORD the fukk up, sadly. But there is no upward resistance until like 53.

I can see it touching 55 before next earnings release but one week is too risky. See what happens monday. The market in my opinion is close to a top so i can see it getting dragged down. You might have to bite the bullet and sell. Of course once you sell...itll probably go up cause thats how this shyt works. But that doesnt necessarily make it a bad trade.

Exactly what happened..LOL

Greatly appreciate y'all inputs. Should've just cut that bytch at the lil rally in the AM and moved on. HUGE lesson learned..SMH...

My starting capital down to 3 k from 6 k all thanks to this one fukkin stupid ass trade...

Never agaaaaain, word to Ja Rule.

If any of you got a nice bottom trade in mind, with potential for a double up within a week or so, hook a breh uP. Just a stock that is, and with a tight ass STOPLOSS. smh

FinesseKing

Banned

I can't find a definite answer to this question online but how do people find these obscure small cap stocks?Was thinking about getting into BIOC.

Up 85% today

I can't find a definite answer to this question online but how do people find these obscure small cap stocks?

iHub

I can't find a definite answer to this question online but how do people find these obscure small cap stocks?

I just watch IPOs and most of them eventually tumble, so I just put them on my watchlist and wait for an entry point. BIOC came to market a year or so ago.

Domingo Halliburton

Handmade in USA

Greatly appreciate y'all inputs. Should've just cut that bytch at the lil rally in the AM and moved on. HUGE lesson learned..SMH...

My starting capital down to 3 k from 6 k all thanks to this one fukkin stupid ass trade...

Never agaaaaain, word to Ja Rule.

If any of you got a nice bottom trade in mind, with potential for a double up within a week or so, hook a breh uP. Just a stock that is, and with a tight ass STOPLOSS. smh

It happens breh. I would definitely say place stops. a couple years ago in the beginning of 2013 the market had run like 15% up so I bought a bunch of VIX calls thinking the market would go down and volatility would pick up. I got killed on that trade. Volatility never picked up and the market was up another like 15% on the year.

Domingo Halliburton

Handmade in USA

Stifel going to buy Stern Agee?

Domingo Halliburton

Handmade in USA

holy shyt, look at this guy...he had 80% of the $4.3 billion he manages in one stock at the end of 2014. that stock is JD.com. latest filings haven't come out yet so it may have changed.

http://hedgemind.com/hedge-fund-portfolios/Lei-Zhang

http://hedgemind.com/hedge-fund-portfolios/Lei-Zhang