Domingo Halliburton

Handmade in USA

Paramount has biggest REIT IPO tomorrow

. Recovered 4 months of losses and then some.

. Recovered 4 months of losses and then some.what were some of your better performers. I also swung 20% points in past 2 months. Summer was rough, but fall got me feeling like a BOSS again!I've eaten so well the past couple of trading days. Recovered 4 months of losses and then some.

Frank Costanza: I'm back, babbyyyy!

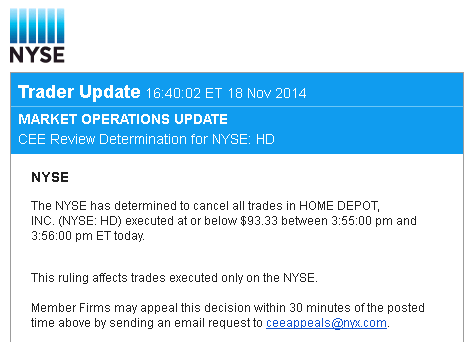

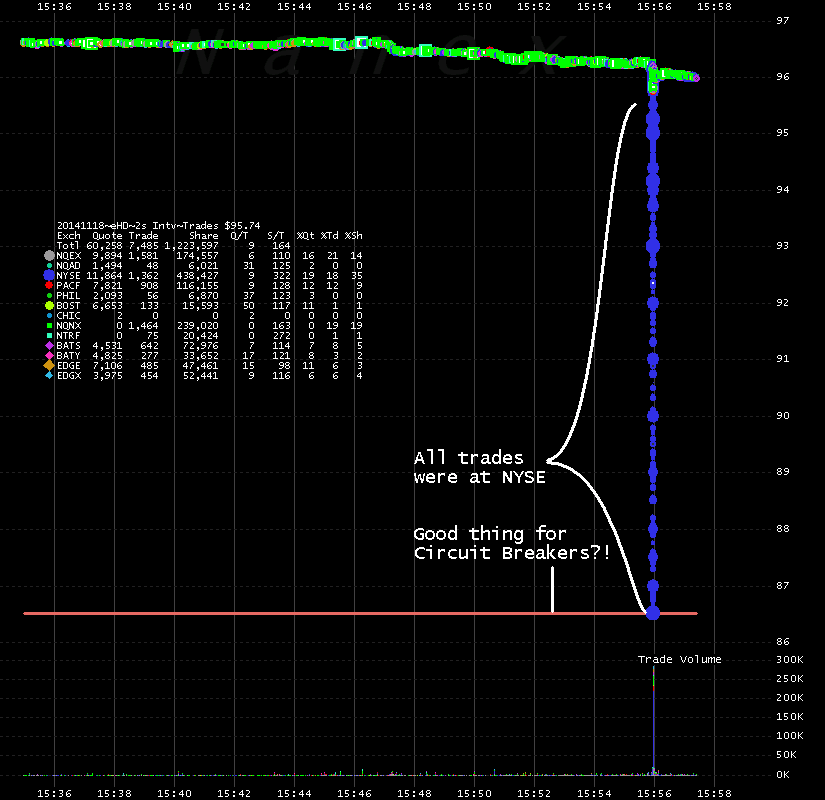

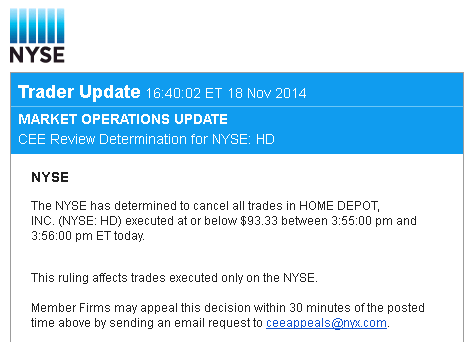

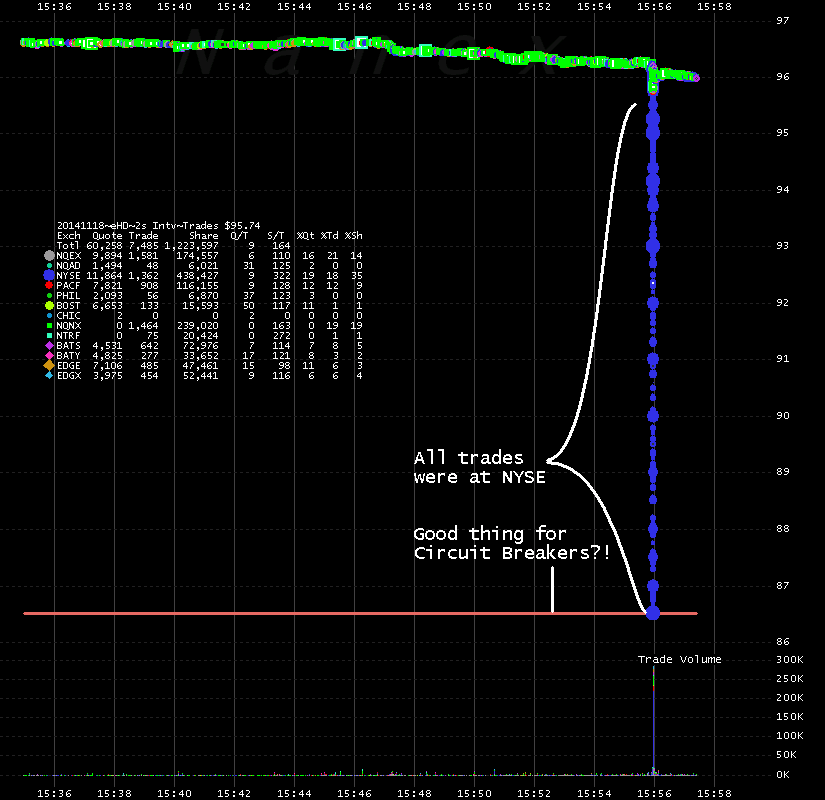

someone flash crashed Home Depot at 3:55 and the uptick rule went into effect. NYSE is looking into it

stock dropped 10% or $13 billion in market cap in seconds

what were some of your better performers. I also sung 20% points in past 4 months. Summer was rough, but fall got me feeling like a BOSS again!

CERE Q3 Conference Call this Thursday. These guys better have some updates on what they are going to do to increase equity for shareholders. I mean isn't that something you would want to address for a stock down 75% for the year?

The only PR those guys put out is in Portuguese.

The stock is being manipulated. Watch the Level 2 on any given day. If the price starts going up, you'll magically see a wall put up with a 130,000 share sell order that has almost no chance of filling. Someone wants the price down.

ECONOMIC REPORTS

Domestic economic reports scheduled for today include:

Housing starts for October at 8:30--consensus up 0.8% to 1.025M rate

Housing permits for October at 8:30--consensus up 0.9% to 1.04M rate

ANALYST RESEARCH

Upgrades

Almost Family (AFAM) upgraded to Neutral from Underperform at RW Baird

CF Industries (CF) upgraded to Outperform from Neutral at Credit Suisse

Columbia Sportswear (COLM) upgraded to Buy from Neutral at Citigroup

DSW (DSW) upgraded to Positive from Neutral at Susquehanna

LHC Group (LHCG) upgraded to Neutral from Underperform at RW Baird

Mosaic (MOS) upgraded to Positive from Neutral at Susquehanna

National Grid (NGG) upgraded to Hold from Sell at Deutsche Bank

Downgrades

Beacon Roofing (BECN) downgraded to Hold from Buy at KeyBanc

BlackBerry (BBRY) downgraded to Underweight from Equal Weight at Morgan Stanley

Consolidated Edison (ED) downgraded to Sell from Neutral at UBS

Denbury Resources (DNR) downgraded to Hold from Buy at Wunderlich

Pool Corp. (POOL) downgraded to Hold from Buy at KeyBanc

Synchronoss (SNCR) downgraded to Underperform from Neutral at RW Baird

Total System (TSS) downgraded to Sell from Neutral at Goldman

COMPANY NEWS

Darden (DRI) reported restructuring, CFO retirement, closure of aviation department

Colony Financial (CLNY) to acquire Cobalt Capital Industrial Real Estate for $1.6B

La-Z-Boy (LZB) raised quarterly dividend 33% to 8c per share

Barrick Gold (ABX) appointed Shaun Usmar as CFO Designate

Jack in the Box (JACK) set long-term annual SSS growth target of 2%-3%

PetSmart (PETM) forecast FY15 SSS growth in the low-single digits

Avon Products (AVP) announced actions to reduce costs including headcount reductions

EARNINGS

Companies that beat consensus earnings expectations last night and today include:

Lowe's (LOW), PetSmart (PETM), Leju (LEJU), Stage Stores (SSI), Staples (SPLS), China Distance Education (DL), Golub Capital (GBDC), La-Z-Boy (LZB), M/A-COM (MTSI), Jack in the Box (JACK), Vipshop (VIPS)

Companies that missed consensus earnings expectations include:

E-House (EJ), Nord Anglia (NORD), SQM (SQM), Xueda Education (XUE)

Companies that matched consensus earnings expectations include:

LightInTheBox (LITB)

Stage Stores (SSI) backs FY14 EPS view of $1.05-$1.15, consensus $1.01

Staples (SPLS) sees Q4 EPS 27c-32c, consensus 31c

Lowe's (LOW) sees FY14 EPS about $2.68, consensus $2.63

Jack in the Box (JACK) sees FY15 operating EPS $2.73-$2.88, consensus $2.81

NEWSPAPERS/WEBSITES

Sources: KKR (KKR), CD&R team up to take PetSmart (PETM) private, Reuters reports

NHTSA wants 'millions of vehicles' recalled due to Takata air bags, CNBC reports (TM, HMC, FIATY, F, GM, NSANY, VLKAY)

Ackman urges significant cost cuts at Zoetis (ZTS), Bloomberg reports

iPhone 7 (AAPL) could include 'biggest camera jump ever,' TheTechBlock reports

RadioShack (RSH) loan from Monarch off table, Bloomberg reports

Dollar General (DG) may have to sell over 4K stores for deal approval, NY Post says (FDO)

Wells Fargo (WFC), U.S. not as optimistic on settling mortgage suit, Reuters says

Investors should think about buying Home Depot (HD) dip, Barron's says

SYNDICATE

Amicus Therapeutics (FOLD) 13.85M share Secondary priced at $6.50

CorEnergy (CORR) 13M share Secondary priced at $6.80

Moelis (MC) 5.5M share Secondary priced at $31.75

Paramount Group (PGRE) 131M share IPO priced at $17.50

Receptos (RCPT) 3.6M share Secondary priced at $100.00

I am sure they pre-screen the questions by folks during the earning call. Is there a way to frame a question as such that asks about about stock price concerns?

Look at the Jan 15 Open Interest on ACHN Calls.

Over 25k at a $20 Strike Price. At $0.05 a contract, why not?

Cats would have to be beginners if they didn't know the power of options. Before Google started going down my cousin made about 20k on a 552 strike and the crazy thing is that was in about 2 days. Obviously it don't always happen like that but the potential from just learning and getting better at this is crazy. That's why when in other discussions and cats still talking that broke shyt and or the "man" holding them back I gotta hit them with theFor anybody wondering why options are worth it... here's my post from February of this year.

The $20 strike was at $0.05 a contract at that time and it last traded for $1.50 a contract.

You could have spent $500 in February and it'd be worth $15,000 today.

X

X . Money out here and people getting it why not us?

. Money out here and people getting it why not us?