You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Another Big Win For Putin!!!

- Thread starter 88m3

- Start date

-

- Tags

- putin russia vladimir world news

More options

Who Replied?Domingo Halliburton

Handmade in USA

Shades of 1998

Futuristic Eskimo

All Star

God damn that rate hike did almost nothing to stabilize the ruble around 60. Down big again

Domingo Halliburton

Handmade in USA

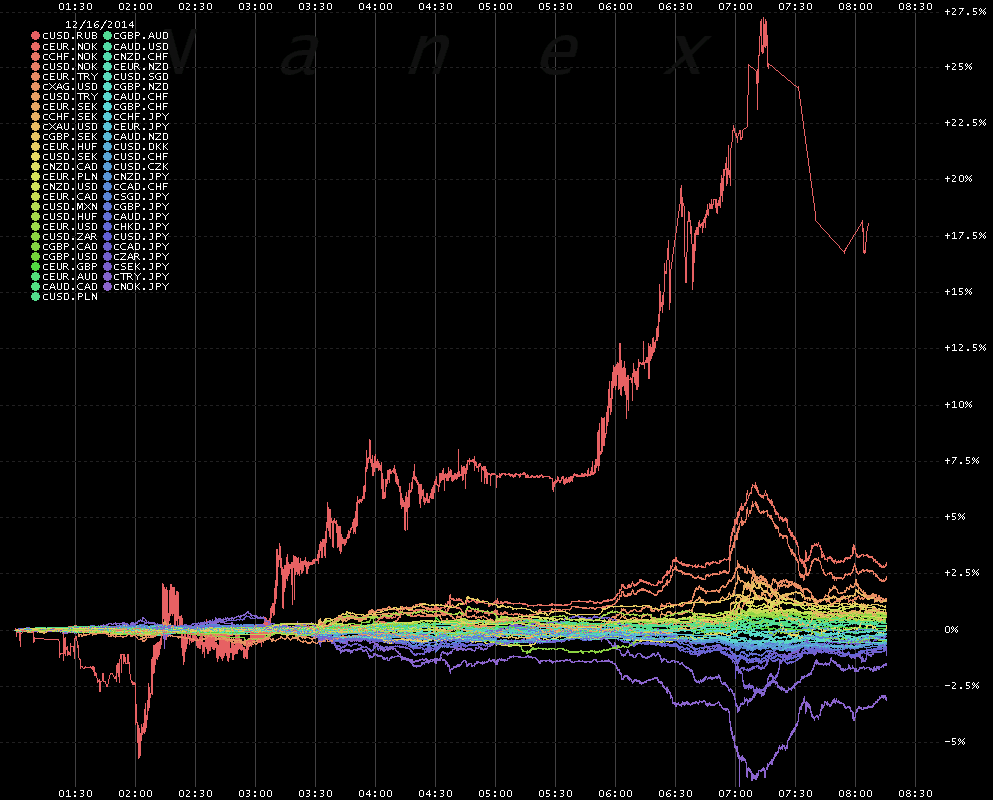

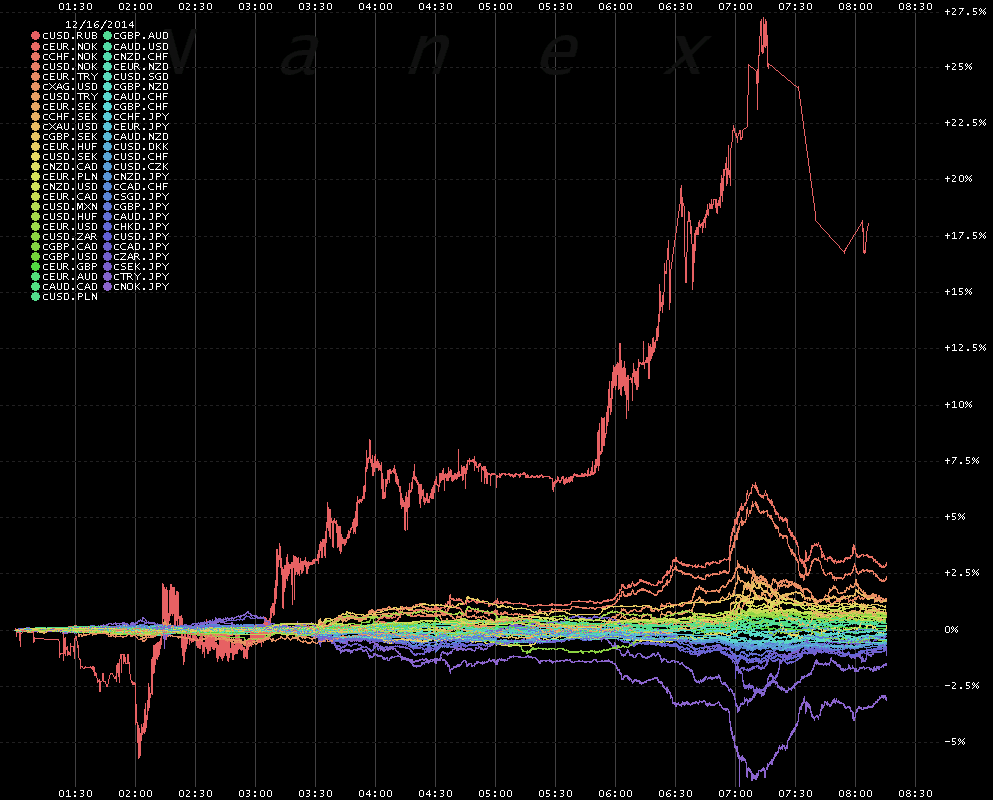

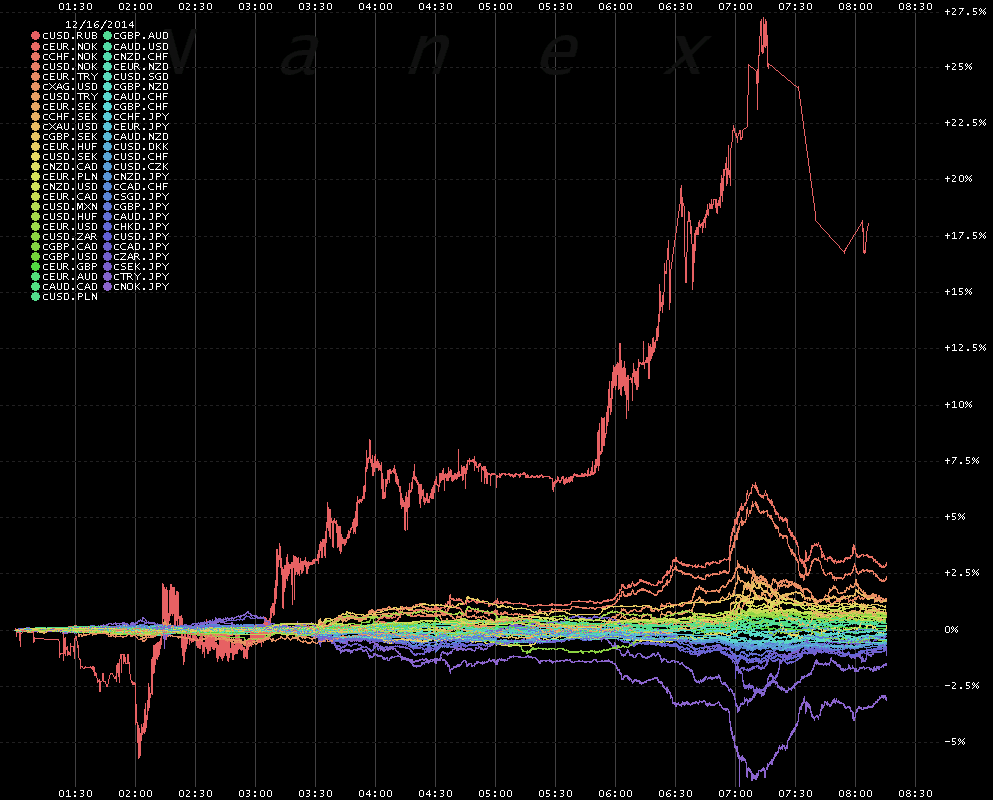

guess which line is the ruble

Futuristic Eskimo

All Star

5% contraction in gdp next year looking very likely at the moment. Emerging markets are a mess and the Fed hasn't even raised rates yet. It's going to get very ugly around the world. US equities look like the best option going forward.guess which line is the ruble

5% contraction in gdp next year looking very likely at the moment. Emerging markets are a mess and the Fed hasn't even raised rates yet. It's going to get very ugly around the world. US equities look like the best option going forward.

Japan in a 3rd recession, Britain stagnating, the EU is in an economic downturn

Invent Fractional Reserve banking and the dogma surrounding capital markets, brehs5% contraction in gdp next year looking very likely at the moment. Emerging markets are a mess and the Fed hasn't even raised rates yet. It's going to get very ugly around the world. US equities look like the best option going forward.

Hood Critic

The Power Circle

Marvel

Psalm 149:5-9

Looks like the elites are trying to stir up economic collapses, wars and unrest to get the NWO currency out there soon.

ExodusNirvana

Change is inevitable...

This is kinda painful to watch

What do you mean?

Futuristic Eskimo

All Star

Collapse of oil prices and the Russian Ruble

2014 DECEMBER 16

tags: Ruble Collapse

by Ian Welsh

These are the same thing. Russia sells oil to the world, and their currency is based on the price of oil. (It is for this same reason that the Canadian dollar has been sliding.)

Putin has been a competent leader for Russia in many ways, but the failure to diversify the economy from oil is his primary failure. You might say “corruption”, but resource economies are almost always corrupt. The only way to (somewhat) avoid it is to put the money away in a sovereign fund or the equivalent.

It is also important to not allow the currency to become a resource currency, because that crushes all other export businesses.

Why did the price of oil drop? There are a lot of theories, from screw-ups in the futures market, to increased supply and reduced demand, to intent to destroy Russia.

What is interesting is that OPEC (meaning, in this case, Saudi Arabia) has refused to do anything to stabilize oil prices and prevent the collapse.

Saudi Arabia needs higher oil prices, they have no economy other than oil of significance, but they also have more ability to handle oil price collapses. Saudi crude is cheap to produce, under $10/barrel. The profit may be less, but they are making a profit. A lot of Russian, American, Canadian and other oil is not profitable at low prices. Letting oil prices be low for a year or two will probably help Saudia Arabia more in the long run. Certainly it hurts their competitors more than it hurts them.

Many also believe that the US and Saudi Arabia are doing this deliberately to hurt Russia.

Of more fundamental interest is that China has been buying less and less commodities (not just oil, but metals like copper). China is the most important economy in the world now for hard commodity prices.

The Ruble collapse is going to hurt a lot of people, most especially the Europeans. Europe sells a lot of goods and services to Russia, and Russia is no longer going to be able to afford them.

For now, low oil prices will be good for the US, but the general commodity price drops are hammering many other countries, and that will lead to reduced demand globally. This isn’t a good thing, however much many Americans are enjoying Russia (and Putin”s woes.)

I will note also that Russians seem to be blaming the West for the collapse of the Ruble. That’s a good thing if they decide going supine will help them.

It’s not a good thing if they get angry about it and decide the West (meaning the US) is deliberately trying to destroy them.

http://www.ianwelsh.net/collapse-of-oil-prices-and-the-russian-ruble/

2014 DECEMBER 16

tags: Ruble Collapse

by Ian Welsh

These are the same thing. Russia sells oil to the world, and their currency is based on the price of oil. (It is for this same reason that the Canadian dollar has been sliding.)

Putin has been a competent leader for Russia in many ways, but the failure to diversify the economy from oil is his primary failure. You might say “corruption”, but resource economies are almost always corrupt. The only way to (somewhat) avoid it is to put the money away in a sovereign fund or the equivalent.

It is also important to not allow the currency to become a resource currency, because that crushes all other export businesses.

Why did the price of oil drop? There are a lot of theories, from screw-ups in the futures market, to increased supply and reduced demand, to intent to destroy Russia.

What is interesting is that OPEC (meaning, in this case, Saudi Arabia) has refused to do anything to stabilize oil prices and prevent the collapse.

Saudi Arabia needs higher oil prices, they have no economy other than oil of significance, but they also have more ability to handle oil price collapses. Saudi crude is cheap to produce, under $10/barrel. The profit may be less, but they are making a profit. A lot of Russian, American, Canadian and other oil is not profitable at low prices. Letting oil prices be low for a year or two will probably help Saudia Arabia more in the long run. Certainly it hurts their competitors more than it hurts them.

Many also believe that the US and Saudi Arabia are doing this deliberately to hurt Russia.

Of more fundamental interest is that China has been buying less and less commodities (not just oil, but metals like copper). China is the most important economy in the world now for hard commodity prices.

The Ruble collapse is going to hurt a lot of people, most especially the Europeans. Europe sells a lot of goods and services to Russia, and Russia is no longer going to be able to afford them.

For now, low oil prices will be good for the US, but the general commodity price drops are hammering many other countries, and that will lead to reduced demand globally. This isn’t a good thing, however much many Americans are enjoying Russia (and Putin”s woes.)

I will note also that Russians seem to be blaming the West for the collapse of the Ruble. That’s a good thing if they decide going supine will help them.

It’s not a good thing if they get angry about it and decide the West (meaning the US) is deliberately trying to destroy them.

http://www.ianwelsh.net/collapse-of-oil-prices-and-the-russian-ruble/

Lightstream Bakken Shale Offerings No Fire Sale: CEO

By Rebecca Penty Dec 16, 2014 4:50 PM ET

0 Comments Email Print

Save

2014MarMayJulSepNov2.505.007.50* Price chart for LIGHTSTREAM RESOURCES LTD. Click flags for important stories.LTS:CN1.31-0.09 -6.43%

Lightstream Resources Ltd. (LTS) put all its assets in the Canadian side of the Bakken shale for sale to cut debt as oil plummets. Chief Executive Officer John Wright says there’s no rush.

“We wouldn’t look to sell this on a fire sale basis,” Wright said of the offer announced yesterday, adding the company is allowing two years to close deals. “We’ve certainly had lots of offers in the door at different times, over the last couple of years.”

Lightstream is among energy producers grappling with a 48 percent slump in U.S. crude prices since June as rising North American supplies add to a glut from Saudi Arabia to Russia.

Wright sees as many as 20 potential buyers for light oil properties in Saskatchewan that Lightstream will seek to sell when oil prices rebound, he said.

Lightstream plans to lower spending next year by 61 percent and reduce its dividend 63 percent.

The company’s Bakken business, which produced the equivalent of 13,799 barrels a day in the third quarter, could sell for more than C$1 billion ($860 million) depending on oil prices, Kyle Preston, an analyst at National Bank Financial in Calgary, wrote in a note today. He called the Bakken sale a “last-ditch effort” to fix Lightstream’s balance sheet.

While Lightstream has a higher debt load than some peers, the company isn’t at risk of missing any payments and is in a good position to ride out lower oil prices that may last for at least a year, Wright said.

To contact the reporter on this story: Rebecca Penty in Calgary at rpenty@bloomberg.net

To contact the editors responsible for this story: Susan Warren at susanwarren@bloomberg.netCarlos Caminada, Will Wade

It begins