Field Marshall Bradley

Veteran

No one has yet to mention the elephant in the room which is the annual contribution it will take to reach these numbers?

Hey ToneI'll take being called negative or troll or agent.

But, if this is going to be sticky--basically a get rich scheme. Atleast know the reality of this advice.

We really in here talking about "just save $20,000" like it's nothing.

This...

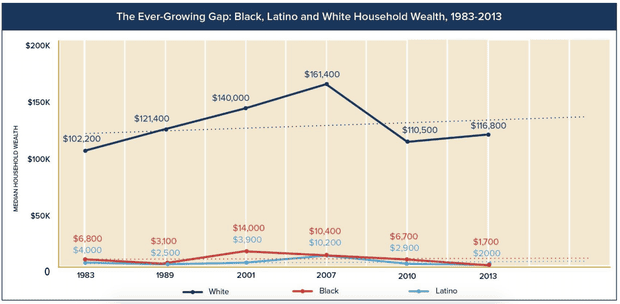

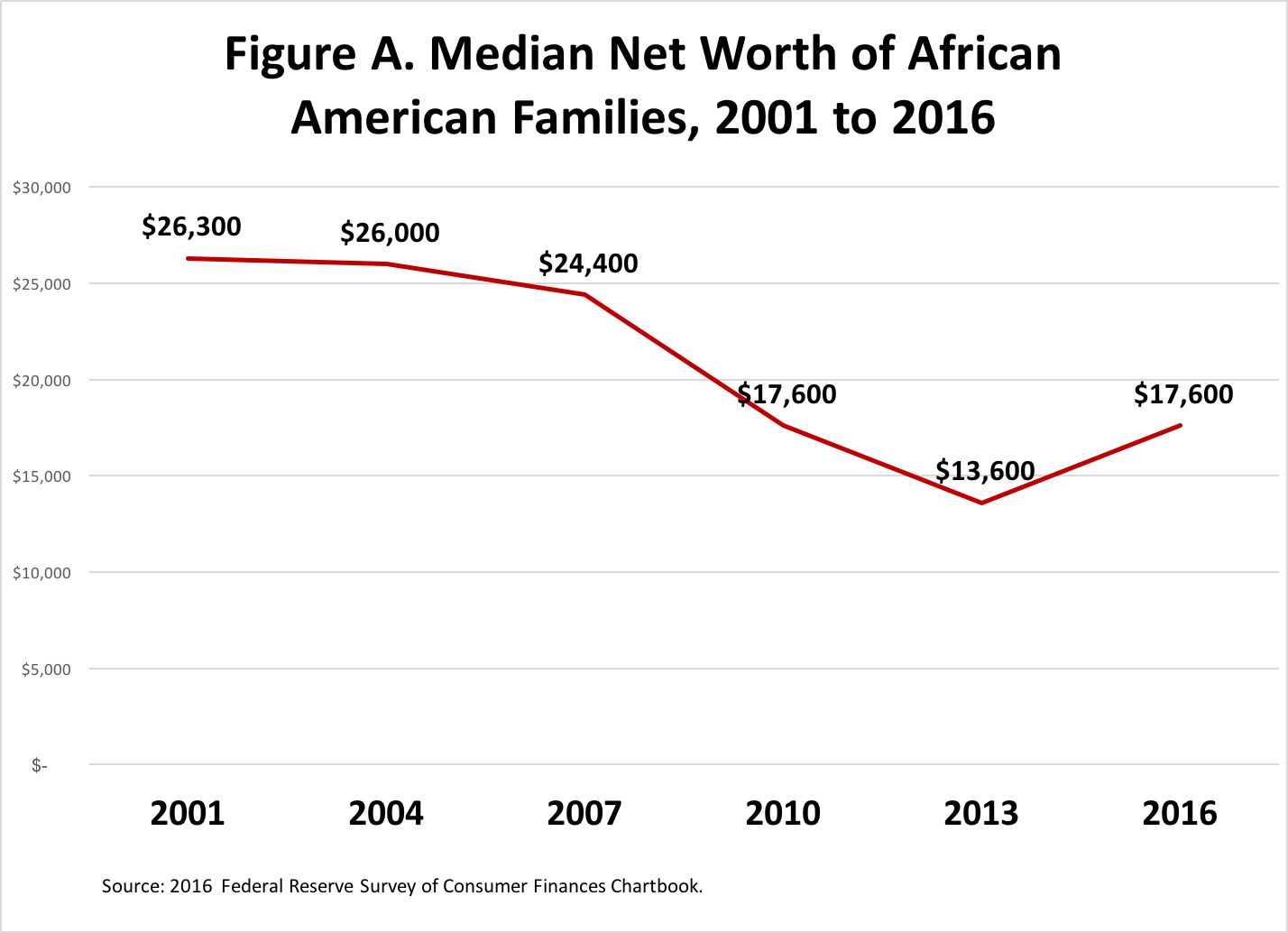

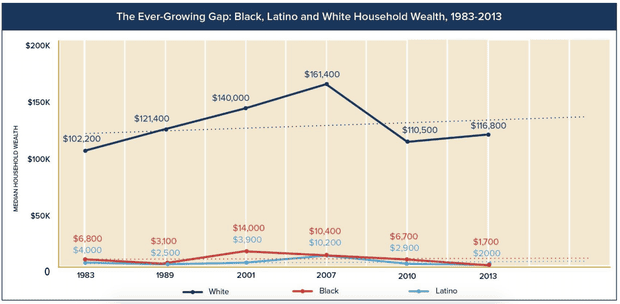

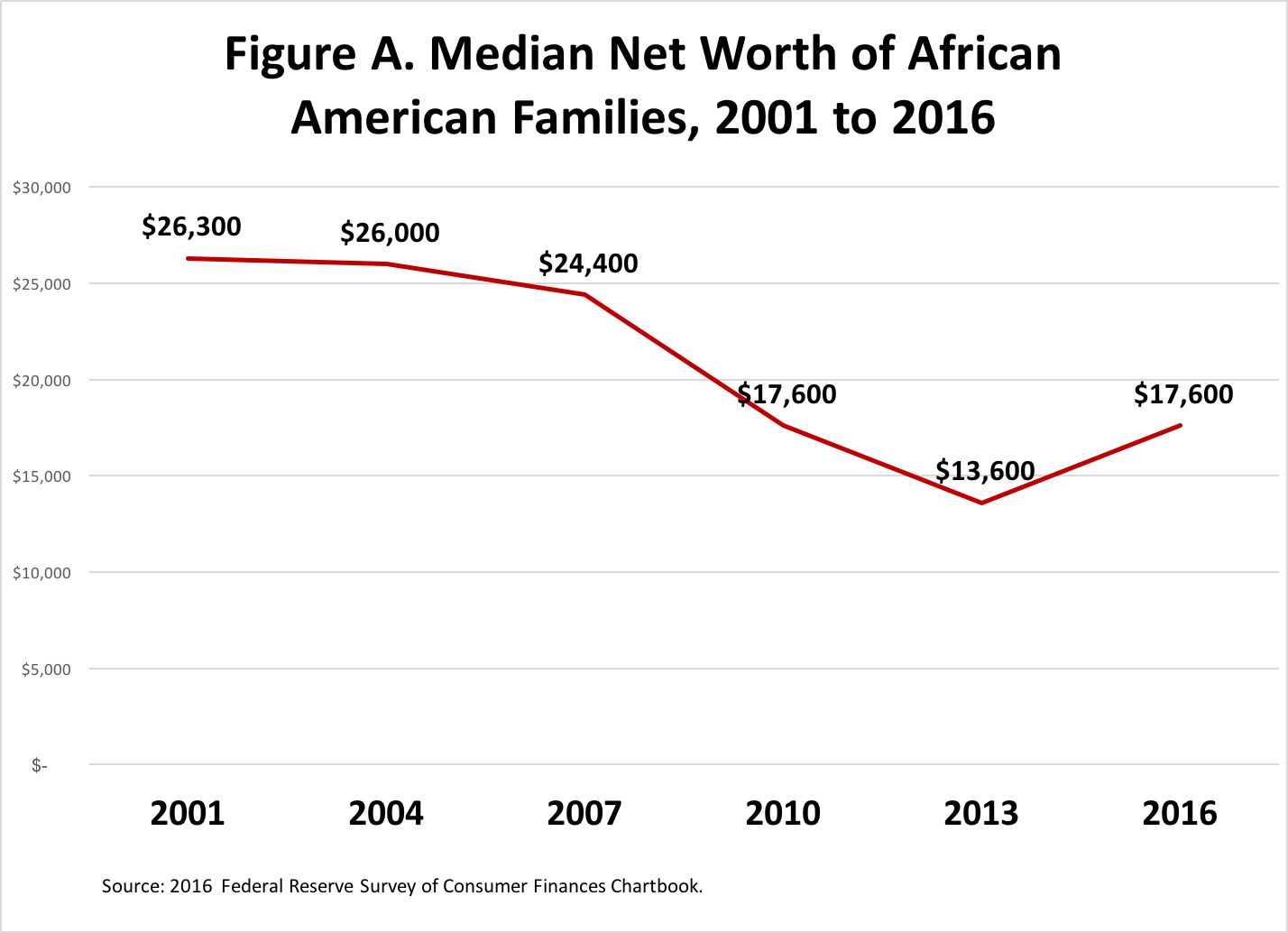

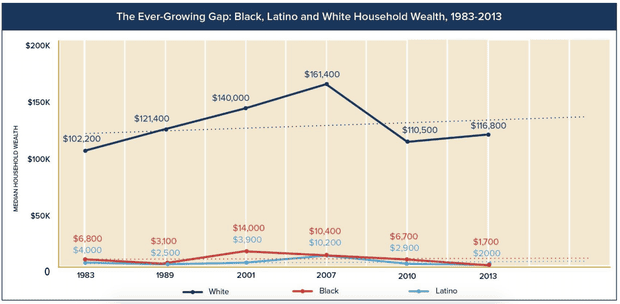

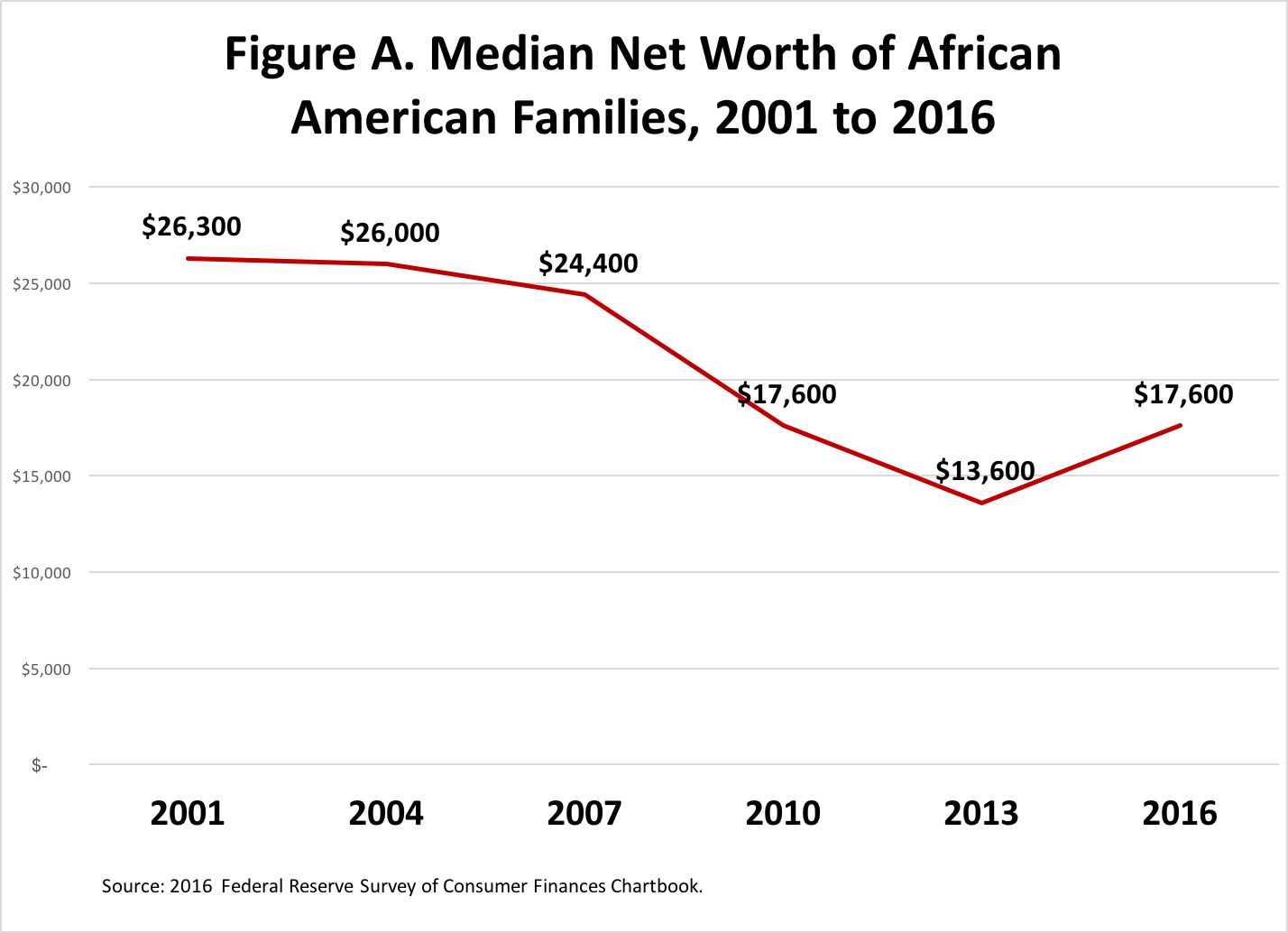

...is how you fix black American wealth. Not "flipping" a life insurance policy.

There talking about giving Latinos reparations over ICE and we supposed to tighten our belts.

This pisses me off.

This is fed data.

But breh you guys aren't telling me the deal. Would this do the same thing as in the OP? As in giving the beneficiary of your choice a stipend each year or whatever? You say "let it grow" but how much money and how many years does this involve?

for the first bolded: yes, you can include a beneficiary and hand the account over to them. they can do whatever they want with it. if they wanna take out x amount a month they can, if they wanna cash out then they can do that, if they wanna leave the money in the account to grow more then they can do that too.

for the second bolded: how much money and how many years is on you. let's say you get whole life insurance at age 30 and you pay $8,230 a year for $236,679. in 30 years that's 246,900 and the interest on life insurance is usually 3-5% (really low returns). you are better off putting that money into a roth ira and getting anywhere between 8-10% back. the math just adds up to not get whole life insurance.

life insurance isn't the best option to invest in and build wealth with.

-whole life insurance only makes sense for the rich who can afford the really high pay out and term insurance is for ppl who have new born kids.

OP is thinking on the right track, but Whole life is garbage. Can't believe people here are pushing that. Insurance agents are already shady as it is. Expensive as fukk, and should not be used as an "investment". Leave that to your 401k, Roth, IRAs, and real estate (flipping houses, or renting out). Those are the true ways to build wealth.

My neighbor is an insurance agent and even he thinks Whole Life is trash, but he doesn't mind selling them to cacs (since that's most of his customers), but he'll put everyone else on game.

Life insurance is not an investment, it should be only used to protect your family in case you die.

Article: The Truth About Life Insurance

The part of this I'll agree with is "Life Insurance is not an investment" - with the tone that you shouldn't be going to get Life Insurance with the idea that it will get you rich one day.

That said, I still maintain that Whole Life is the best of the Life Insurances.

In watching this video, the same drawbacks he said of Whole Life are the same drawbacks of the 401k - but everybody seems to love that...the idea of both of those products is that YOU'RE NOT SUPPOSED TO BE TAKING MONEY OUT OF THEM BEFORE THEY MATURE for them to be the most beneficial to you...

And again, Whole Life Insurance is only as expensive as the coverage you want to get. The rates for all insurance is based on a whole bunch of factors.

I'll take being called negative or troll or agent.

But, if this is going to be sticky--basically a get rich scheme. Atleast know the reality of this advice.

We really in here talking about "just save $20,000" like it's nothing.

This...

...is how you fix black American wealth. Not "flipping" a life insurance policy.

There talking about giving Latinos reparations over ICE and we supposed to tighten our belts.

This pisses me off.

This is fed data.

Just a little FYI when graphs and articles speak on "wealth" they aren't talking about wages but assets like the value of your Homes, land, etc and investments/savings which is what the OP is talking about so basically we are so behind in that category because we Aren't doing this type of stuff

Why don’t any of you wealth gap people run for office? Or does that actually require more than bytching online?I'll take being called negative or troll or agent.

But, if this is going to be sticky--basically a get rich scheme. Atleast know the reality of this advice.

We really in here talking about "just save $20,000" like it's nothing.

This...

...is how you fix black American wealth. Not "flipping" a life insurance policy.

There talking about giving Latinos reparations over ICE and we supposed to tighten our belts.

This pisses me off.

This is fed data.

Im good with stacking bread, had no debt (until a couple months ago, got a new car because of the distance of my current job) but stacking doesnt get you very close to creating a wealth engine. I need avenues to increase my sources of income outside of my job. Because unless you make a crazy annual salary it aint shyt.

Any advice on that @dark_magic?

There are people in this country who can spend $1 million a day for 300 years and you’re talking about generational wealth?

Has anyone ever thought that maybe the accumulation of that many resources is unnatural?

It doesn’t matter you could do it with term life too. Term life is always the better decision anyway. You would just renew the term life in 20 years or whatever if you are still young then do it again

What does inflation have to do with anything? Is $1 million in 100 years gonna be equal to $1 today?

that's bad advice

that's bad adviceCan you imagine the premium on a 50 year old trying to buy another 20 year policy?that's bad advice