You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

A Simple Way To Build Generational Wealth For Your Family While Alive

- Thread starter CASHAPP

- Start date

More options

Who Replied?I'll take being called negative or troll or agent.

But, if this is going to be sticky--basically a get rich scheme. Atleast know the reality of this advice.

We really in here talking about "just save $20,000" like it's nothing.

This...

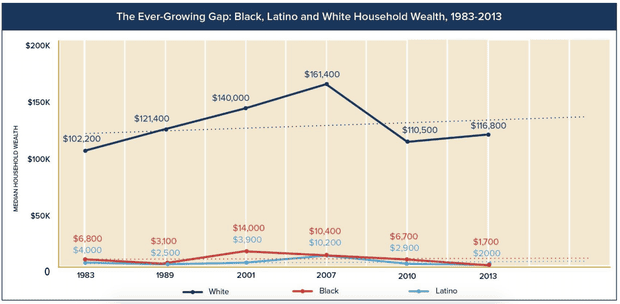

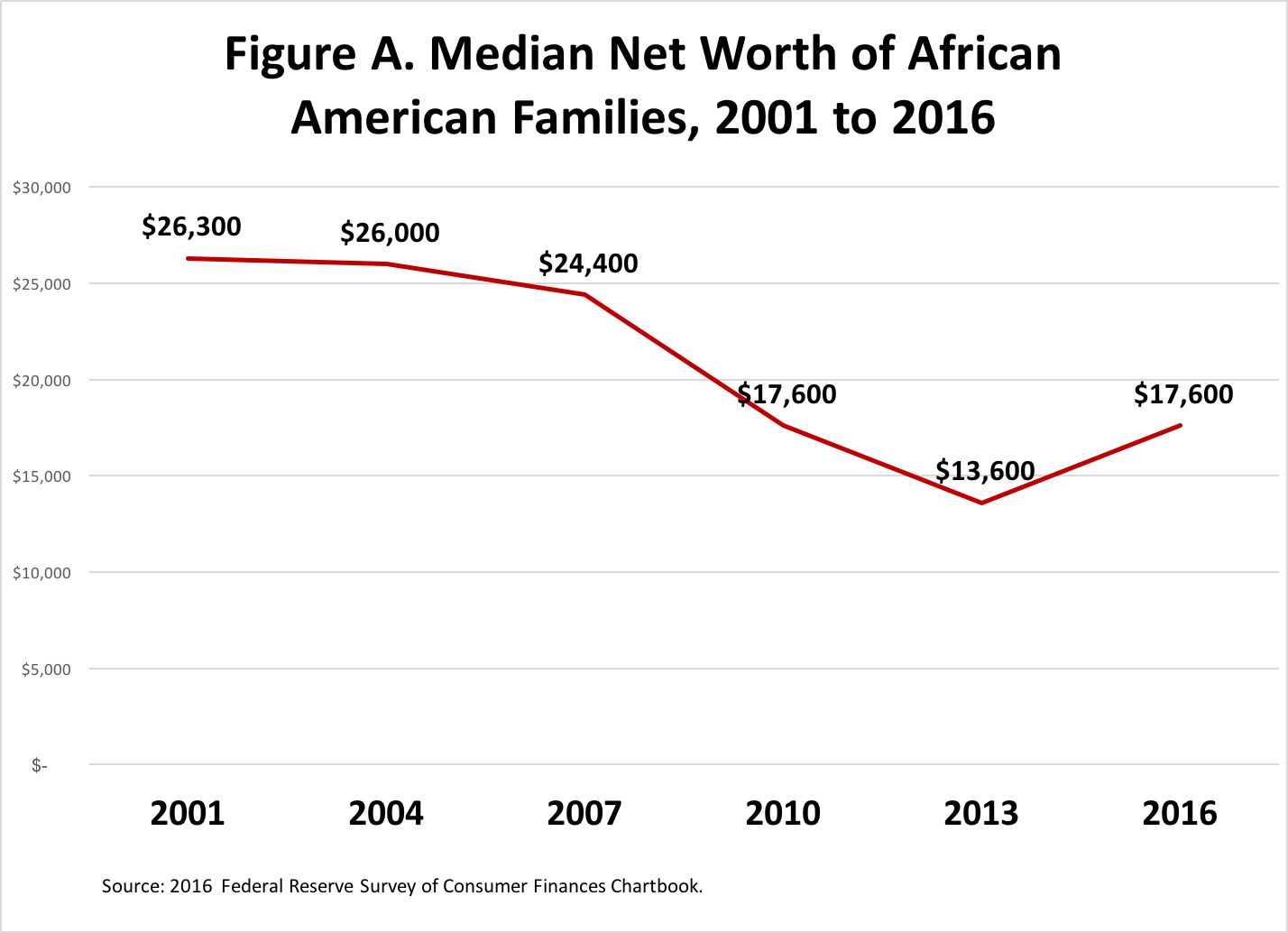

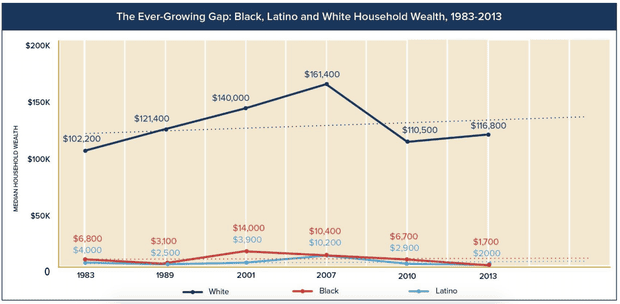

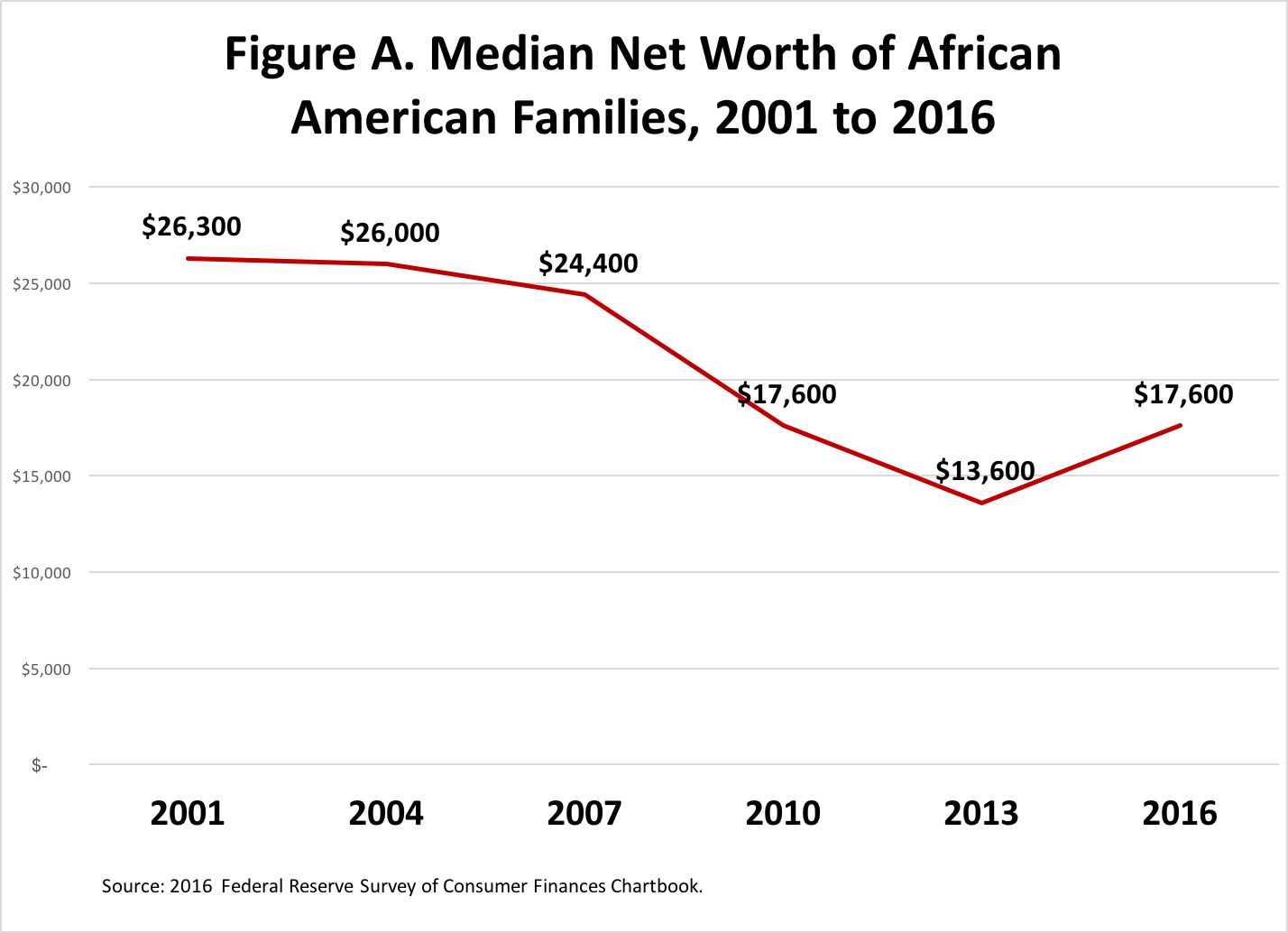

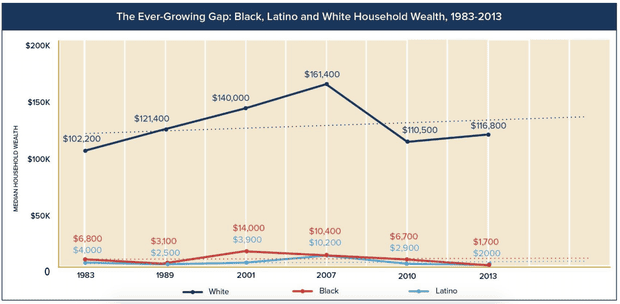

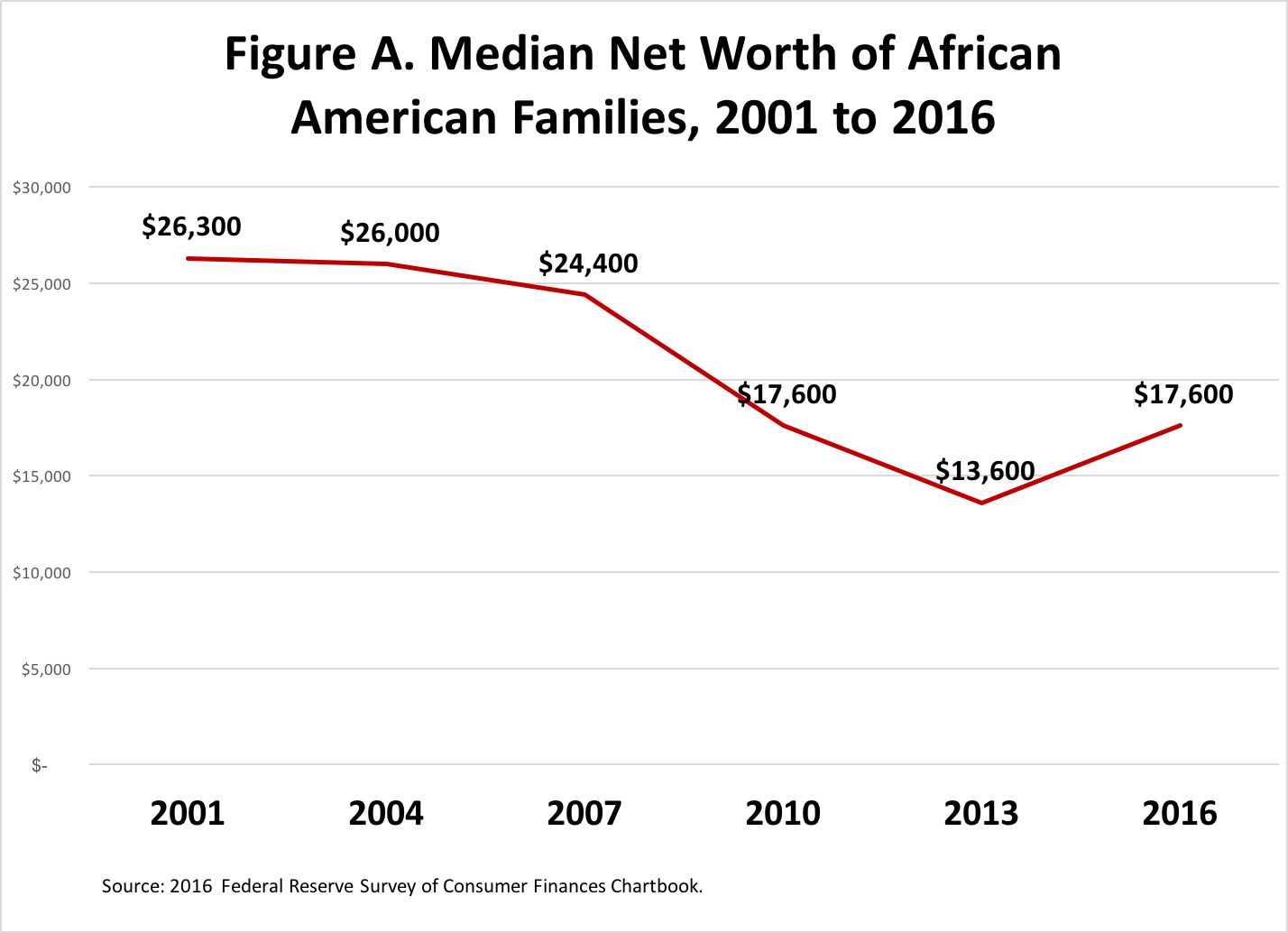

...is how you fix black American wealth. Not "flipping" a life insurance policy.

There talking about giving Latinos reparations over ICE and we supposed to tighten our belts.

This pisses me off.

This is fed data.

But, if this is going to be sticky--basically a get rich scheme. Atleast know the reality of this advice.

We really in here talking about "just save $20,000" like it's nothing.

This...

...is how you fix black American wealth. Not "flipping" a life insurance policy.

There talking about giving Latinos reparations over ICE and we supposed to tighten our belts.

This pisses me off.

This is fed data.

Being dead broke is the root of all evil.There are people in this country who can spend $1 million a day for 300 years and you’re talking about generational wealth?

Has anyone ever thought that maybe the accumulation of that many resources is unnatural?

Second to cacs hogging all the damn resources

ezrathegreat

Veteran

Thanks, Op

dark_magic

Pro

But, if this is going to be sticky--basically a get rich scheme. Atleast know the reality of this advice.

This is not a get rich quick scheme. This is a financing scheme. This is a banking paradigm.

This will take years along with steady payments (capitalization) for this tree to bloom.

We really in here talking about "just save $20,000" like it's nothing.

African-Americans have been a cash cow and financial boon for the United States, the several States, and Caucasians for the last 400 years.

African-Americans, in aggregate, spend $1.2 trillion dollars into the U.S. economy currently.

Are we saying we can't take a portion of those funds and redirect them back to ourselves capturing them within our own personal economies? I don't accept we don't have the money. Given the above, we more than have the money. We are too accustomed to giving them away to everyone else in consumption as well as forfeiting the interest those dollars can provide by way of financing. We shop, bank, spend, and finance with everyone else but ourselves.

All the statistics on how much African-Americans spend. Where are the statistics on how much we produce?

Redirection (of dollars) is the first step. The next steps are turnover and recapture. Increase in (cash) flow is always good. Having a place for those dollars to land is important. Do they land (store or bank) in such a way that it is profitable for others or is it profitable for you?

This...

...is how you fix black American wealth. Not "flipping" a life insurance policy.

There talking about giving Latinos reparations over ICE and we supposed to tighten our belts.

"Flipping" is a mis-characterization. That is real estate. This is financing. This is banking ultimately.

What we are discussing here is what each individual can do for themselves and their individual households using mediums currently available. This doesn't require any outside or government intervention. This requires de-programming from how we've been conditioned by various institutions throughout our life.

Last edited:

Freedman

Choppers For Karate Nggas

Just a little FYI when graphs and articles speak on "wealth" they aren't talking about wages but assets like the value of your Homes, land, etc and investments/savings which is what the OP is talking about so basically we are so behind in that category because we Aren't doing this type of stuffI'll take being called negative or troll or agent.

But, if this is going to be sticky--basically a get rich scheme. Atleast know the reality of this advice.

We really in here talking about "just save $20,000" like it's nothing.

This...

...is how you fix black American wealth. Not "flipping" a life insurance policy.

There talking about giving Latinos reparations over ICE and we supposed to tighten our belts.

This pisses me off.

This is fed data.

Last edited:

Amerikan Melanin

Veteran

You can do this in your parents names also or grandparents and be named as a beneficiary.

OP is thinking on the right track, but Whole life is garbage. Can't believe people here are pushing that. Insurance agents are already shady as it is. Expensive as fukk, and should not be used as an "investment". Leave that to your 401k, Roth, IRAs, and real estate (flipping houses, or renting out). Those are the true ways to build wealth.

My neighbor is an insurance agent and even he thinks Whole Life is trash, but he doesn't mind selling them to cacs (since that's most of his customers), but he'll put everyone else on game.

Life insurance is not an investment, it should be only used to protect your family in case you die.

Article: The Truth About Life Insurance

My neighbor is an insurance agent and even he thinks Whole Life is trash, but he doesn't mind selling them to cacs (since that's most of his customers), but he'll put everyone else on game.

Life insurance is not an investment, it should be only used to protect your family in case you die.

Article: The Truth About Life Insurance

1. Lack of discipline and overall affordability. This is a great idea but people have problems saving money. I don’t see them prioritizing a life insurance payment of hundreds of dollars if times get hard.Ok, let's sanity check this plan, OP. What are some reasons why this WOULDN'T work. Be objective. Somebody already mentioned inflation, what else?

2. Mindset. This idea is the advanced level of wealth building, it’s a lot of other things that need to be in place before this is a consideration.

3. Eligibility and affordability (again) A good number of black women are overweight, plus some men too, add in smoking or underlying medical conditions could render people ineligible or the rate will be ridiculous. If people already broke, this isn’t a feasible idea.

I think it’s a great idea, but not a black community wide solution, not just yet.

It's not expensive at all but you run the risk of being murdered and the money being fukked off to be able to build enough wealth to last multiple Generations. Also one million is not enough to generate this type of wealth OP is talking aboutHow much of premimums does it cost to maintain a million dollar policy?.

Nvm, did my own research , would never let my girl know shyt about that. Really not that expensive

@spaceXjamzZ

@dark_magic

My post was not to bang on the OP. My problem is the lack of context and fact that the thread was elevated to being sticky'd.

We already have a problem we're we come up with these schemes based on the idea our reality is that of the 1980's or "it's our fault we aren't discplined enough to succeed."

Ya'll saying stuff like 'well, that just wealth data, not income' and 'if you just keep up with the payments we'll be alright.'

Ya'll think income is as important as wealth in America 2018 and beyong?

I say this all the time on here; why do ppl get away with that (not putting "advice" in context--especially for our people) without actually understanding our plight in America, right NOW?

We're in an era were 25% of our young men can't find jobs. The nation's unemployment during the Great Depression was 25-28%. Labor is as undervalued as it's ever been in this country. Gordon Ramsey is not going to tell you that. You used to be able to get a job, a house, a car, life insurance and go to college. But, now Americas have $900 billion in

I'm not here to be advisarial, so, I'll stay out of this thread.

But, we're in trouble because, we think having two 2x4's in a river is enough to compete with people with a raft and four paddles.

I won't even address the idea that Black folks provide an "economic book" for anyone...you might start bringing up "spending power"

@dark_magic

My post was not to bang on the OP. My problem is the lack of context and fact that the thread was elevated to being sticky'd.

We already have a problem we're we come up with these schemes based on the idea our reality is that of the 1980's or "it's our fault we aren't discplined enough to succeed."

Ya'll saying stuff like 'well, that just wealth data, not income' and 'if you just keep up with the payments we'll be alright.'

Ya'll think income is as important as wealth in America 2018 and beyong?

I say this all the time on here; why do ppl get away with that (not putting "advice" in context--especially for our people) without actually understanding our plight in America, right NOW?

We're in an era were 25% of our young men can't find jobs. The nation's unemployment during the Great Depression was 25-28%. Labor is as undervalued as it's ever been in this country. Gordon Ramsey is not going to tell you that. You used to be able to get a job, a house, a car, life insurance and go to college. But, now Americas have $900 billion in

I'm not here to be advisarial, so, I'll stay out of this thread.

But, we're in trouble because, we think having two 2x4's in a river is enough to compete with people with a raft and four paddles.

I won't even address the idea that Black folks provide an "economic book" for anyone...you might start bringing up "spending power"

ahomeplateslugger

Superstar

don't ever get whole life insurance. the monthly cost is ridiculously high and the payout is very low. you're better off getting universal if you're gonna get insurance.

a bigger payout would be to deposit that money in an ira and let it grow. you'll get a bigger return for sure.

a bigger payout would be to deposit that money in an ira and let it grow. you'll get a bigger return for sure.

OP is thinking on the right track, but Whole life is garbage. Can't believe people here are pushing that. Insurance agents are already shady as it is. Expensive as fukk, and should not be used as an "investment". Leave that to your 401k, Roth, IRAs, and real estate (flipping houses, or renting out). Those are the true ways to build wealth.

My neighbor is an insurance agent and even he thinks Whole Life is trash, but he doesn't mind selling them to cacs (since that's most of his customers), but he'll put everyone else on game.

Life insurance is not an investment, it should be only used to protect your family in case you die.

Article: The Truth About Life Insurance

don’t forget I’m the one that came out the gate stanning term policy. I still believe it’s better but I need a way to have the it work because I’m not dying anytime soon so i want relatives to use this technique right away

don’t forget I’m the one that came out the gate stanning term policy. I still believe it’s better but I need a way to have the it work because I’m not dying anytime soon so i want relatives to use this technique right awayBut whole life is too damn expensive

don't ever get whole life insurance. the monthly cost is ridiculously high and the payout is very low. you're better off getting universal if you're gonna get insurance.

a bigger payout would be to deposit that money in an ira and let it grow. you'll get a bigger return for sure.

But breh you guys aren't telling me the deal. Would this do the same thing as in the OP? As in giving the beneficiary of your choice a stipend each year or whatever? You say "let it grow" but how much money and how many years does this involve?