The income needed to comfortably afford a home is up 80% since 2020, while median income has risen 23% in that time.

Home shoppers today need to make more than $106,000 to comfortably afford a home. That is 80% more than in January 2020, showing how the math has changed for hopeful buyers, who are more often

partnering with friends and family or

“house hacking” their way to homeownership.

Housing costs have soared over the past four years

A monthly mortgage payment on a typical U.S. home has nearly doubled since January 2020, up 96.4% to $2,188 (assuming a 10% down payment).

Home values have risen 42.4% in that time, with the typical U.S. home now

worth about $343,000. Mortgage rates ended

January 2020 near 3.5%, keeping the cost of a home affordable for most households that could manage the down payment. At the time of this analysis, mortgage rates were about 6.6%.

Wages have not kept up

In 2020, a household earning $59,000 annually could comfortably afford the monthly mortgage on a typical U.S. home, spending no more than 30% of its income with a 10% down payment. That was below the U.S. median income of about $66,000, meaning more than half of American households had the financial means to afford homeownership.

Now, the roughly $106,500 needed to comfortably afford the mortgage payment on a typical home is well above what a typical U.S. household earns each year, estimated at about $81,000.

Buyers are teaming up, “house hacking,” and moving to more affordable areas

For a household making the median income, it would take almost

8.5 years before they would have enough saved to put 10% down on a typical U.S. home, about a year longer than it would have in 2020. It’s no wonder, then, that

half of first-time buyers say at least part of their down payment came from a gift or loan from family or friends.

With the cost of a mortgage rising, most millennial and Gen Z buyers say

the ability to rent out all or part of a home for extra cash is very or extremely important. Cobuying with a friend or relative is another way to help with affordability, something

21% of last year’s buyers reported doing.

Long-distance movers are also targeting less expensive and less competitive metros.

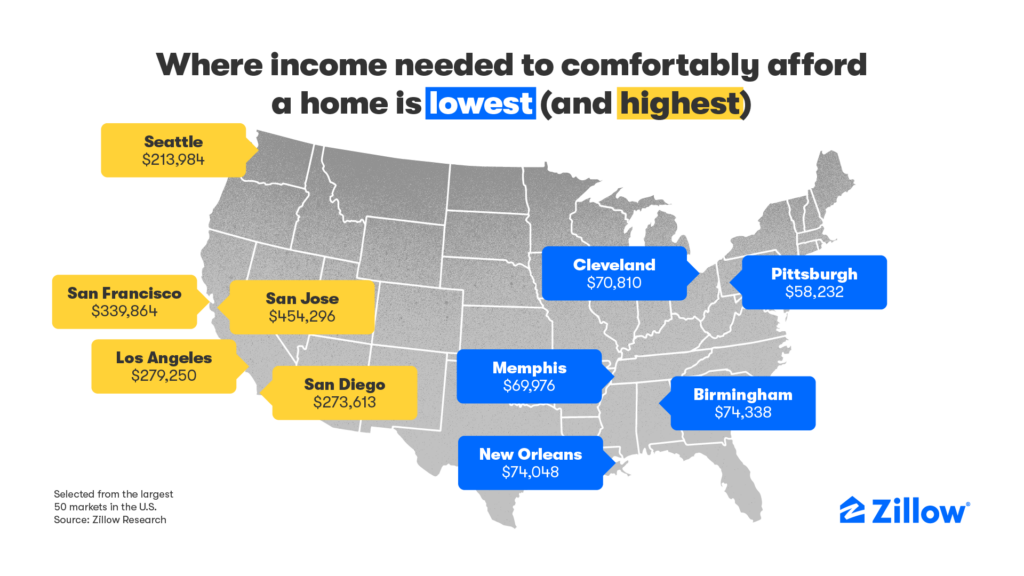

Where a home is most and least affordable

Metro areas where a buyer could comfortably afford a typical home with the lowest income are Pittsburgh ($58,232 income needed to afford a home), Memphis ($69,976), Cleveland ($70,810), New Orleans ($74,048) and Birmingham ($74,338). The only major metros where a typical home is affordable to a household making the median income are Pittsburgh, St. Louis and Detroit.

There are seven markets among major metros where a household’s income must be $200,000 or more to comfortably afford a typical home. The top four are in California: San Jose ($454,296), San Francisco ($339,864), Los Angeles ($279,250) and San Diego ($273,613). Seattle ($213,984), the New York City metro area ($213,615) and Boston ($205,253) complete the list.

Methodology

Quarterly median household income is taken from the American Community Survey (ACS) and Moody’s Analytics through 2022. Present-day estimates use quarterly changes in the Employment Cost Index provided by the Bureau of Labor Statistics (BLS) to chain ACS income to the current day.

Years to save for a 10% down payment is the number of years it would take the median household to save for a 10% down payment on a typical home in their metro, assuming a 5% annual savings rate.

Income needed to afford a home with 10% down is defined as the income needed to afford the total monthly payment on the typical home. The total monthly payment is based on the monthly mortgage payment, insurance, property taxes, and annual maintenance costs of the home.

The income needed to comfortably afford a home is up 80% since 2020, while median income has risen 23% in that time.

www.zillow.com

, fukk it. So long as there's Internet and planes, we'll be good.

, fukk it. So long as there's Internet and planes, we'll be good.