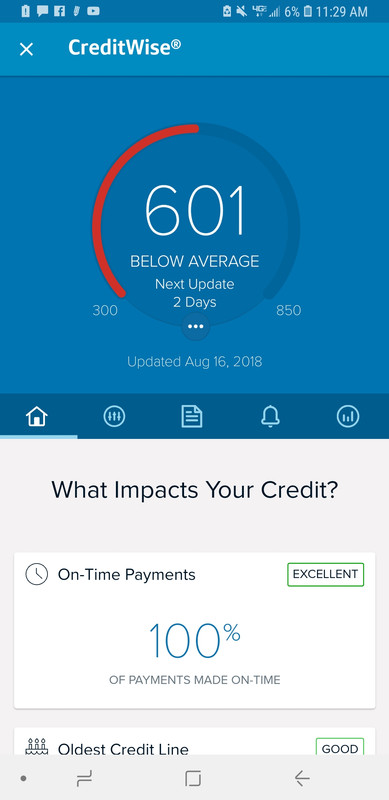

Your debt is excellent, but you need at least 2 more credit cards. With you having only one card, you are too easily exposed to utilization fluctuations. If you want the best rate on a house next year, you need to thicken your credit file. The highest credit scores come from a mix of credit types (credit cards, installment loans), age and responsible use. Get two BANK cards now (NOT store cards like Kohl’s or Sears and shyt) like Citi Double Cash, American Express Blue Everyday, or Chase Sapphire. Use them for the year and pay off before statement close every month and your score will be at mid to high 700s next year guaranteed. If you don’t have late pays, bankruptcies or anything like that, you are a shoe-in for those cards.

You can go to this link to see what cards you qualify for..you can apply based on that:

https://www.creditcards.com/cardmatch/

Here’s a link to all of the credit card companies’ pre-approval pages. Only a soft pull against credit (no impact) to check if you pre-qual:

View Your Pre-Approved & Pre-Qualified Credit Card Offers

good look my boy. Yea i was wondering why my shyt would drop so much points. Im a get two more credit cards when i put the money back on this card and my score jumps up.

good look my boy. Yea i was wondering why my shyt would drop so much points. Im a get two more credit cards when i put the money back on this card and my score jumps up.

. My debt utilization is too high

. My debt utilization is too high

Don't get caught up in debts, brehs

Don't get caught up in debts, brehs