Online Shopping Is Growing, But Isn’t Creating Jobs

Internet sales are still rising briskly. Employment in the sector is not. Could our robot overlords be to blame?

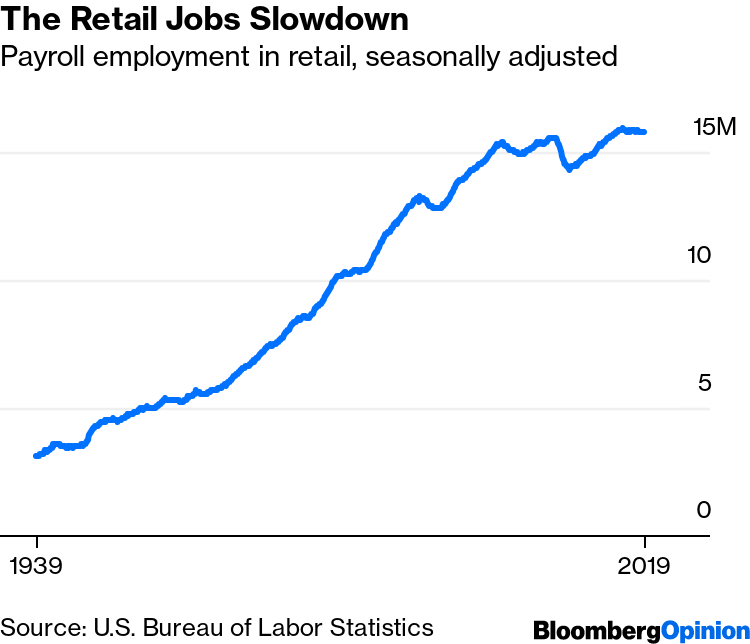

This has not been a great century for working in retail. The sector, which added about 5 million jobs from 1980 through the end of 2000, has added only 416,100 since. Since January 2017, retailers have shed 145,200 jobs even as overall employment growth has remained strong.

The obvious explanation here is the rise of online shopping. Nonstore retailers such as Amazon.com are included in the above retail employment totals, but with employment of 570,500 as of November they simply haven’t created enough jobs to make up for the stagnation in the rest of the sector. If you add in the warehouses where online retailers keep their products, as well as the couriers and messengers who deliver them, you do start to get somewhere — and can detect a pretty sharp acceleration in employment growth after 2009.

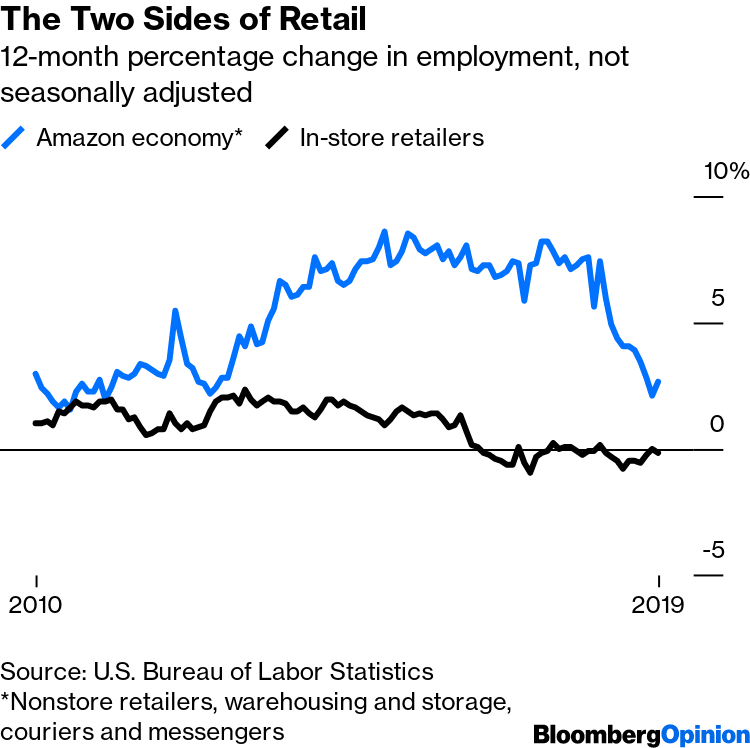

You may also detect a slowdown over the past year or so. To see it better, I’ve calculated 12-month employment growth for the three sectors shown above, as well as for the retail sector minus nonstore retailers.

In-store retail employment, after falling in 2017 and earlier this year, is basically flat. Employment in what I’ve dubbed the Amazon economy is, after nearly five years of 5% or higher annual growth, still rising but at a much slower pace. This is decidedly not because online retail is slowing down. That is, it did a little bit last year and early this year, but nonstore retail sales are now back to growing at a double-digit annual percentage pace.

So what is going on? It’s a little early to say. Economist Andrew Flowers of the Indeed Hiring Lab suggested in an email that part of the answer could simply be that online-retail-related jobs “don't scale at the same rate as brick-and-mortar retail positions do.” Because so much of their interaction with customers is virtual and automated, online retailers don’t necessarily need to keep adding employees as sales rise — and in fact the nonstore retail sector has seen a 1.4% employment decline over the past 12 months even as sales have gone up, and an 86% increase in real output per hour worked (aka labor productivity) from 2008 through 2018.

Delivering products to customers remains more labor intensive. Employment of couriers and messengers is up 5.2% over the past 12 months, and hiring of warehouse and storage workers is up 3%. But as of March 2018 the latter sector was adding jobs at a 13.3% annual pace, so its slowdown has been quite precipitous, and is the main driver of the overall slowdown in Amazon-economy job growth. One possibility is that a tighter labor market, coupled with advances in robotics, might be starting an acceleration in the automation of warehouse work. Labor productivity in the warehousing and storage sector actually fell 11% from 2008 through 2018. Don’t be surprised if the 2019 numbers (due out in May) show a rebound. If the overall job market remains strong, this may pass without much notice. If it doesn’t, talk of robots stealing jobs might just make a comeback. 1

- Yes, I realize that Democratic presidential candidate Andrew Yang has kept talking about this, but it's been a lonely crusade.