Eating the intra-African trade pudding: Uganda, South Africa top as neighbours drive Kenya’s tourism recovery

25 FEB 2016 18:32BLOOMBERG, M&G AFRICA WRITER

100

Proving Africa will reap from trading with itself, vacationers from Rwanda, Burundi, DRC and Ethiopia have shored up Kenya's tourism

Oscar-winning Kenyan actress Lupita Nyong'o who is also Wild Aid's Global Elephant Ambassador. The country's tourism, recently hit by terrorism, has seen a healthy growth in local visitors. (Photo/MagicalKenya).

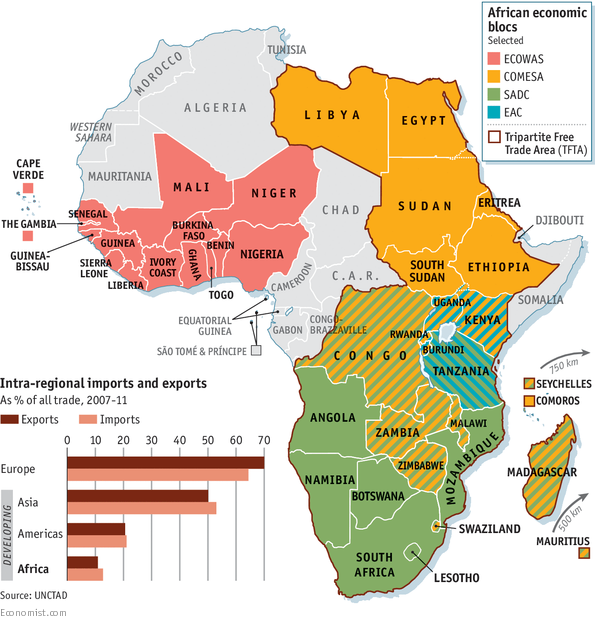

LAST year, to much fanfare, 26 African nations signed off on a free-trade ‘super bloc’ that seeks to improve the absurdly low levels of intra-regional trade on the continent, at the Egyptian seaside resort of Sharm el-Sheikh.

In the same city at the Africa 2016 Forum last weekend, African Development Bank (AfDB) president Akinwumi Adesina painted a picture of just how insufficient trade with other African countries is.

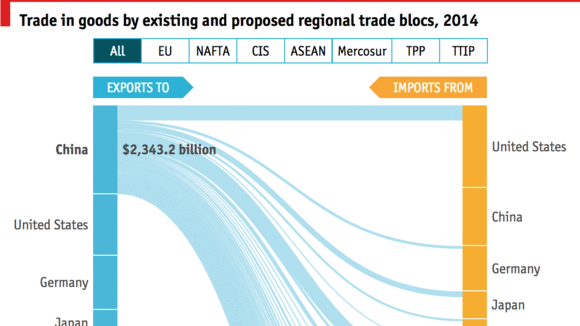

African trade represents just 2% of the global total, and intra-African trade makes up 12% of the continent’s activity, compared to 60% in Europe and 35% in Asia.

“This is not acceptable,” Adesina said.

He added that AfDB will continue to invest heavily in regional infrastructure, especially rail, transnational highways, power interconnections, ICT, air and maritime transport, reducing the bottlenecks that cost the region billions in inefficiencies and lost opportunities.

While tariffs on the continent are high—according to the United Nations Conference on Trade and Development (UNCTAD) an African company making sales on the continent would pay more than three times the 2.5% average tariff rate elsewhere - non-tariff barriers tend to wreak more damage than levies.

Despite an abundance of trade blocs on the continent—17 at the moment—their poor internal workings has led potential benefits such as comparative advantage trading to be erased by red-tape heavy protectionist approaches.

African countries have also kept the same export-geared infrastructure, leaving the continent vulnerable to global market shifts.

Trade in services

One promising way of solving this is seen as ramping up regional trade in services—a model that has contributed to the booming growth in many Asian countries.

It may be already happening and could herald exciting possibilities.

The number of tourists visiting Kenya from neighbouring countries has increased over the past few months as the East African nation set off on promotions around the region to make up for dwindling numbers from its traditional source markets in Europe.

While tourists arriving at the nation’s two main airports dropped by 13% to 748,771 last year, the decline was less steep than the previous year’s reduction of 28%, according to the country’s statistics agency. Visitors have shied away from going on world-renowned safaris in the country or lounging on its white sandy beaches after a series of deadly attacks by al-Shabaab Islamists in the past few years.

The government targets annual tourist arrivals of 10 million in about a decade’s time. Visitor numbers are expected to rise now that France, the US and Britain have lifted travel bans to the country, which will allow tour operators to market the destination once again.

East African holidaymakers staying at Amani Tiwi Beach Resort on the Indian Ocean Coast more than doubled in the past three months, General Manager Aditya Mata said in Kwale County, at the Kenyan coast. “Forty five to 50% of our visitors have been from Kenya and the rest of the East African countries,” he said.

Bed occupancy improved to 85%, compared with 50% a year earlier, he said.

Diani Reef Beach Hotel in the same county received vacationers from Rwanda, Burundi, Democratic Republic of Congo and Ethiopia in the past six months, according to Chief Executive Officer Titus Kangangi. “Even Nigeria, which is a first for me,” he said. “I would put the number of regional visitors at around 10-15%, excluding Kenyans. It’s very good, it’s looking up.”

Carriers such as Ethiopian Airlines and RwandAir now have flights to the coastal resort city of Mombasa.

While cash remittances and agricultural exports have relegated tourism to third place in the hierarchy of leading foreign exchange sources, the industry is still key for the economy. As many as one million Kenyans depend on it for their livelihoods at the coast.

Regional visitors account for a third of arrivals with Uganda the second highest source market after South Africa, acting Kenya Tourism Board Chief Executive Jacinta Nzioka Mbithi said by e-mail.

It is perhaps no surprise that the East African Community bloc is seen as the regional grouping that has made the most trade gains on the continent.

If such chains continue to grow, concerns about external market performance could soon be a flash in the pan as the continent’s future growth is powered from within.

Eating the intra-African trade pudding: Uganda, South Africa top as neighbours drive Kenya’s tourism recovery

25 FEB 2016 18:32BLOOMBERG, M&G AFRICA WRITER

100

Proving Africa will reap from trading with itself, vacationers from Rwanda, Burundi, DRC and Ethiopia have shored up Kenya's tourism

Oscar-winning Kenyan actress Lupita Nyong'o who is also Wild Aid's Global Elephant Ambassador. The country's tourism, recently hit by terrorism, has seen a healthy growth in local visitors. (Photo/MagicalKenya).

LAST year, to much fanfare, 26 African nations signed off on a free-trade ‘super bloc’ that seeks to improve the absurdly low levels of intra-regional trade on the continent, at the Egyptian seaside resort of Sharm el-Sheikh.

In the same city at the Africa 2016 Forum last weekend, African Development Bank (AfDB) president Akinwumi Adesina painted a picture of just how insufficient trade with other African countries is.

African trade represents just 2% of the global total, and intra-African trade makes up 12% of the continent’s activity, compared to 60% in Europe and 35% in Asia.

“This is not acceptable,” Adesina said.

He added that AfDB will continue to invest heavily in regional infrastructure, especially rail, transnational highways, power interconnections, ICT, air and maritime transport, reducing the bottlenecks that cost the region billions in inefficiencies and lost opportunities.

While tariffs on the continent are high—according to the United Nations Conference on Trade and Development (UNCTAD) an African company making sales on the continent would pay more than three times the 2.5% average tariff rate elsewhere - non-tariff barriers tend to wreak more damage than levies.

Despite an abundance of trade blocs on the continent—17 at the moment—their poor internal workings has led potential benefits such as comparative advantage trading to be erased by red-tape heavy protectionist approaches.

African countries have also kept the same export-geared infrastructure, leaving the continent vulnerable to global market shifts.

Trade in services

One promising way of solving this is seen as ramping up regional trade in services—a model that has contributed to the booming growth in many Asian countries.

It may be already happening and could herald exciting possibilities.

The number of tourists visiting Kenya from neighbouring countries has increased over the past few months as the East African nation set off on promotions around the region to make up for dwindling numbers from its traditional source markets in Europe.

While tourists arriving at the nation’s two main airports dropped by 13% to 748,771 last year, the decline was less steep than the previous year’s reduction of 28%, according to the country’s statistics agency. Visitors have shied away from going on world-renowned safaris in the country or lounging on its white sandy beaches after a series of deadly attacks by al-Shabaab Islamists in the past few years.

The government targets annual tourist arrivals of 10 million in about a decade’s time. Visitor numbers are expected to rise now that France, the US and Britain have lifted travel bans to the country, which will allow tour operators to market the destination once again.

East African holidaymakers staying at Amani Tiwi Beach Resort on the Indian Ocean Coast more than doubled in the past three months, General Manager Aditya Mata said in Kwale County, at the Kenyan coast. “Forty five to 50% of our visitors have been from Kenya and the rest of the East African countries,” he said.

Bed occupancy improved to 85%, compared with 50% a year earlier, he said.

Diani Reef Beach Hotel in the same county received vacationers from Rwanda, Burundi, Democratic Republic of Congo and Ethiopia in the past six months, according to Chief Executive Officer Titus Kangangi. “Even Nigeria, which is a first for me,” he said. “I would put the number of regional visitors at around 10-15%, excluding Kenyans. It’s very good, it’s looking up.”

Carriers such as Ethiopian Airlines and RwandAir now have flights to the coastal resort city of Mombasa.

While cash remittances and agricultural exports have relegated tourism to third place in the hierarchy of leading foreign exchange sources, the industry is still key for the economy. As many as one million Kenyans depend on it for their livelihoods at the coast.

Regional visitors account for a third of arrivals with Uganda the second highest source market after South Africa, acting Kenya Tourism Board Chief Executive Jacinta Nzioka Mbithi said by e-mail.

It is perhaps no surprise that the East African Community bloc is seen as the regional grouping that has made the most trade gains on the continent.

If such chains continue to grow, concerns about external market performance could soon be a flash in the pan as the continent’s future growth is powered from within.

Eating the intra-African trade pudding: Uganda, South Africa top as neighbours drive Kenya’s tourism recovery