JPMorgan: Without More Softness in the Loonie, the Next Domino In Canada's Oil Patch Could Fall Soon

Oil sands shut-ins on deck.

Luke Kawa LJKawa

January 18, 2016 — 1:04 PM EST

The

beaten-down Canadian dollar has to fall even further to support real economic activity, according to JPMorgan, putting pressure on the Bank of Canada to cut its policy rate on Wednesday.

The collapse in oil prices has dealt a

serious blow to Canada's aggregate national wealth via a corresponding decline in the exchange rate. On a more micro level, the revenue generated per barrel of oil sold has obviously come down considerably for companies, but real activity remains solid.

"We'll make it up in volume!" has

been the order of the day among oil sands producers, and inasmuch as there has been acute pain, it's been borne by the oilfield services space.

For a look at how activity in the oil patch has been holding up, consider this: through October, non-conventional oil extraction industry output was up 1.6 percent year-over-year, while support activities for mining and oil and gas extraction have plunged nearly 47 percent.

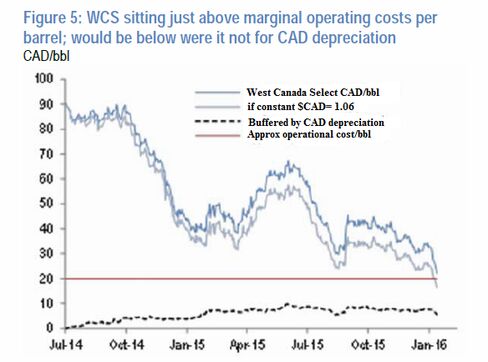

Canadian oil producers sell a product whose price is denominated in U.S. dollars, yet the majority of their costs (which have come under the knife considerably) are in local currency terms. On Monday morning, the front month futures contract for Western Canadian Select, a heavier blend of crude, traded at around $14.50 per barrel (U.S.). Thanks to the massive decline in the Canadian dollar, however, heavy oil producers would receive over $21 (Canadian) per barrel. That's how the exchange rate is acting to cushion the blow for these firms, and is thus helping to sustain output and employment.

But according to Daniel Hui, executive director of global FX strategy at JPMorgan, we've nearly reached a point at which further weakness in Canadian heavy crude prices, in local currency terms, will threaten the prolonged resilience in activity.

"CAD will continue weakening as the BoC cuts next week and as WCS prices threaten to fall below the cliff of marginal operational costs per barrel, where further declines could generate new spillovers and thus impact the FX less linearly," wrote Hui in a recent note to clients. "[W]ith West Canada Select (WCS) now sitting just a dollar above the average per-barrel operational cost of $20 (Canadian), the risk is that any further decline will cause a whole new host of spillovers including potential shutdown and retrenchment of energy extraction and exports (with its attendant growth and balance of payment effects) or the potential of highly leveraged companies running operational losses, and the more contagious financial impact that might have in Canada, with broader spillovers."

JPMorgan

Economists who believe the Bank of Canada should maintain its policy rate at 0.5 percent on Wednesday have cited the dramatic decline in the Canadian dollar as all the monetary accommodation needed for now, and raised concerns of a deterioration in consumer confidence and spending if the currency moves another sharp leg downwards. A rate cut, they caution, could do more harm than good.

But Hui believes the loonie isn't excessively weak in light of the drop in oil and other commodity prices as well as the two-year rate spread between Canadian and U.S. government bonds.

"[W]hile CAD is notably optically weak, continuing to plunge 14-year lows versus the dollar, neither pricing nor positioning is extreme; indeed we believe risks continue to be considerably skewed to the CAD weak-side in the near-term, and that conditions for better stabilization and recovery will only come at or after mid-year," the strategist wrote.

Separately, TD Chief Canada Macro Strategist David Tulk observed that a the Canadian dollar had fallen roughly as much in the six months prior to the surprise January 2015 rate cut as it has in the six months following July's reduction in the policy rate. A little less than one-fifth of the decline in oil prices passed was offset by the decline in the Canadian dollar during both spans.

"While the decline is not nearly as dramatic in dollar terms, current prices are approaching levels where existing production becomes uneconomic," wrote Tulk, espousing the same view as JPMorgan's Hui.

These analyses contradict the notion that the exchange rate has done a sufficient amount of the "heavy lifting" for Canada's central bank, and therefore no further monetary stimulus is needed.

Moreover, some of the recent depreciation is presumably tied to the rise in the implied odds of a rate cut from the Bank of Canada on Wednesday, and is therefore prone to a reversal in the event that Poloz & Co. do not deliver on market expectations.

Canadian oil sands projects typically have high upfront fixed costs, but relatively low operational costs. That's one factor, apart from the decline in the loonie and cost control exercised by companies, keeping oil sands production aloft.

However, Hui notes that we're in a period in which the oil market is oversupplied, and it is therefore reasonable to expect the market to be brought back into balance at least in part from

the shuttering of higher-cost production. One of the only ways Hui envisions Canadian production managing to avoid coming under the axe is if the currency is far more responsive to downward pressure in oil prices than it has been since crude began to fall in the second half of 2014.

"[O]ne of the few scenarios that would keep bitumen producers above marginal cost amid a further decline in global energy prices, is for CAD to depreciate substantially and at a much higher beta to oil price than has been the case in the past 18 months," he concludes.

If Canadian heavy crude production is curtailed because the decline in the loonie is insufficient to keep prices above the marginal cost of production, Hui thinks USD/CAD could break above 1.52 in response to the drop in activity.

JPMorgan: Without More Softness in the Loonie, the Next Domino In Canada's Oil Patch Could Fall Soon