Six lessons to meditate to the Greek crisis serve some

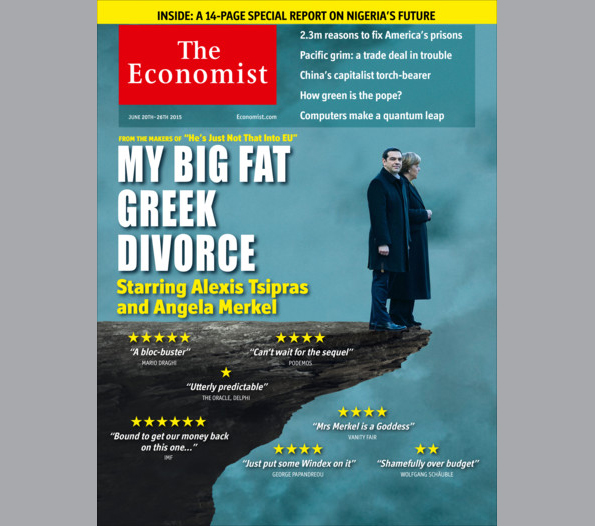

© AFP | Greek Prime Minister and German Chancellor, on 7 July in Brussels

Text by

Sylvain ATTAL

Last Updated: 07/13/2015

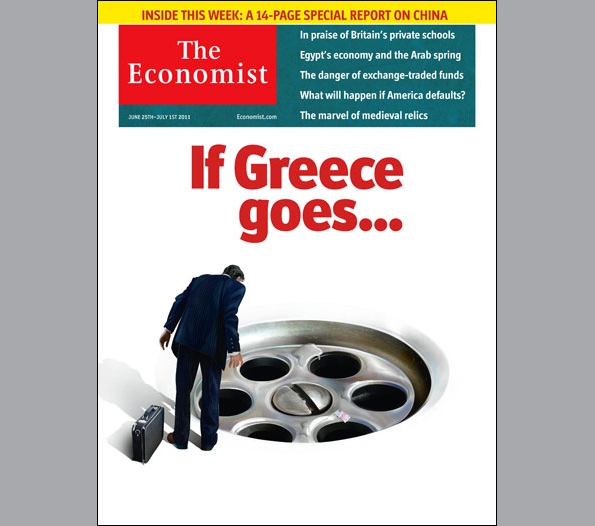

The worst was-apparently avoided with the compromise ripped Monday morning. For that this is not an umpteenth lame compromise, so try to hold some lessons from this new psychodrama that was nearly fatal to the euro.

First lesson: the crisis is not over

The agreement reached in extremis Monday morning is intended to prevent market panic at the prospect of a "Grexit" [Greek exit from the euro zone] openly planned (hoped?) By the German government. But this is a minimum agreement which aims to open new negotiations for a new aid package of just over 80 billion euros to Greece, completely asphyxiated. It must be subject to a number of national parliaments vote, in Greece, but also in countries who would like to push it out.

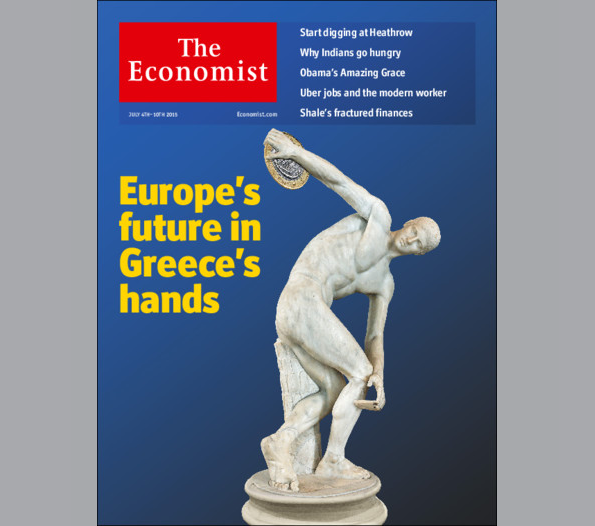

Second lesson: Greece and the euro area, United for better and for worse

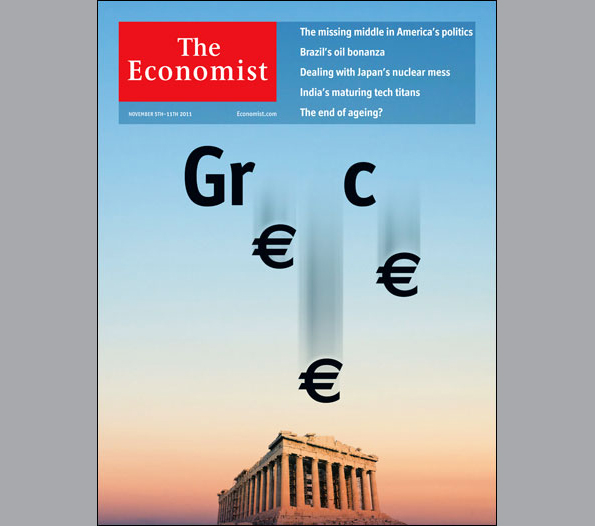

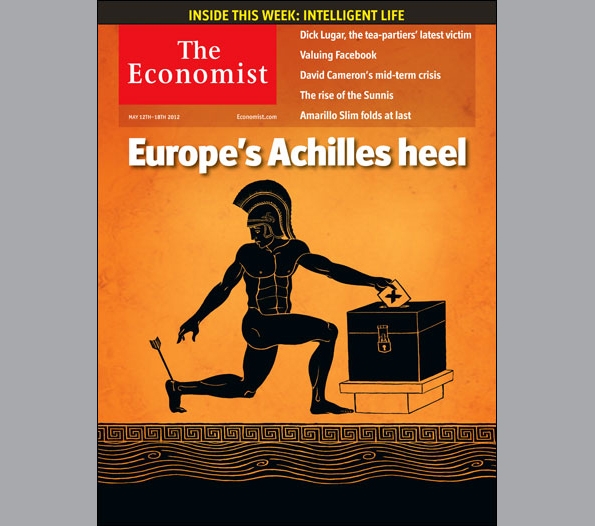

No possible divorce between Greece and the euro area. The line that has painfully away is that of those who believe that the output of a eurozone countries would not only be final but could irreparably noted that the Euro is a precarious construction and that in the future a country that experiences difficulties or which fails to accept austerity measures in its population would follow the same path.While a building dating from the Maastricht Treaty could collapse like a house of cards.

Third lesson: this crisis is not only that of Greece

This crisis is also that of the European currency. Without economic governance and new waivers of sovereignty, especially in tax matters, the euro will remain fragile. Without economic union, monetary union can not. Hopefully this time the Europeans decide to move to a new step towards a federal Europe. This agreement may be just another band-aid. But if Greece were to find itself in the same situation in six months or a year, there is a safe bet that the euro would not survive. Lesson Four:Alexis Tsipras and Syriza will have to pay the bill

Thanks to the work of the Conservative government of Antonis Samaras, Greece had returned to a primary fiscal balance (before debt service). Tsipras led to believe the Greeks flushed by the austerity that the time had come largesse leaving leave public spending on the rise, as if the country was not in debt up to my neck! Then with a "No" in the referendum Greek, the other 18 countries in the euro zone were to bow before the great Greek democracy. It was forgotten that they are also democracies. After this last wet cartridge, Tsipras was faced with the inevitable bankruptcy of his country. He had to give in this tussle part face stronger than him and will now have to answer these zigzags before his people.Not sure that this happens smoothly.

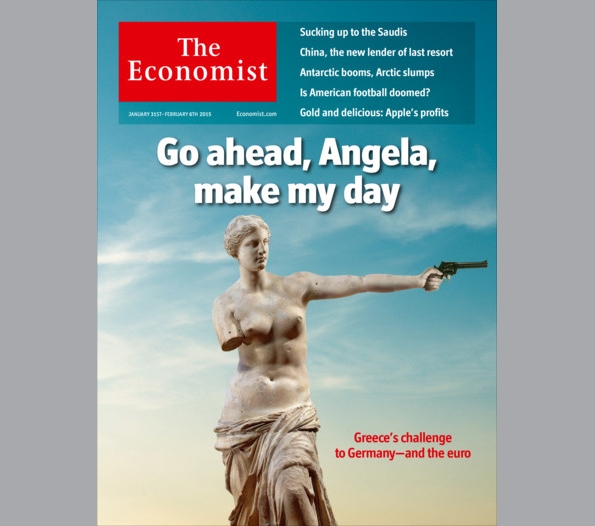

Lesson Five: The policy engine France

Virtually alone, France had decided to maintain at any cost (but not without reorientation of the Greek government) Greece in the euro area. As usual, she had the economic argument against it, but the political rationale for it. And like every great moment, she finally managed to get Germany to accept its arguments: firstly, it was necessary to give a sign of the political will of the Europeans to maintain their monetary union. The second time, that of setting economic coherence might come next. While it is urgent to put it (see Lesson 3) Sixth lesson: there is no "Club Med" in Europe.

This idea that Italy, Spain, or France would defend a model of governance impecunious lived. Paris defended a political ideal. Rome and Madrid have been as severe as Berlin towards procrastination of Athens. The Spaniards and Italians who have made many sacrifices would not have understood preferential treatment for Greece that also nobody was willing to give him. There was no question of encouraging populist movements Podemos type whose Tsipras became the hero. Only when it appeared that a number of North countries, after Germany sought to make an example of Greece they moved closer to the French position. They only sought to save the euro is irreversible construction, for fear that sooner or later we will show them to them as the output. While the Greeks meaning they would not accept a new bottomless pit.

http://www.france24.com/fr/20150713..._ref=partage_aef&aef_campaign_date=2015-07-13