You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

General Elon Musk Fukkery Thread

- Thread starter Armchair Militant

- Start date

More options

Who Replied?Wouldn't matter what business-related whitepaper I posted would just say it was cherry-picked!

lol - first you claimed there were "numerous studies", now when challenged you can't even link a single one? And want to refer to some business's self-serving white paper that isn't even reviewed?

It's easy to differentiate a cherry-picked paper from one that isn't. It just has to

a) Set the conditions before collecting the data, rather than after

b) Show the scenario holds for the general case chosen at random, and not just the ones purposely picked for the initial study.

I'm certain you can't show that, because the principle is just corporate claptrap. I already reviewed the research and couldn't find a single one that even tried to establish the general case. The evidence is as good as astrology.

ATVM loan program where Musk took the 400 million loan was paid off before the loan terms.

We said SUBSIDIES, not loans. You just proved me right when i said you didn't know the difference.

Twtter hasn’t been profitable for a very long

Bullshyt.

In the real world Twitter had over $500 million net revenue in the quarter before Musk announced his takeover. They also had net revenue every quarter of 2021, other than an $800 million settlement they had to pay out to shareholders based on misleading statements made by former executives back in 2014. ke many businesses they had a bad spring 2020 due to advertizers pulling everything when COVID hit, but then they were profitable again in the 3rd and 4th quarters. In 2018 and 2019 they had massive profits, over a billion both years.

So until Musk started fukking around and tanked their 2nd quarter profits from advertizers leaving, Twitter had been profitable 14 of the previous 17 quarters. And the ONLY quarters they hadn't been profitable were 2 quarters for the start of COVID and 1 quarter for the old lawsuit settlement.

If you looked at the latest quarter before Musk announced, or the previous year, or the previous 3 years, or the previous 5 years, Twitter is net profitable over every timeline.

X/Twitter quarterly net income 2022| Statista

In the last reported quarter, social network X/Twitter had a net loss of 270 million U.S.

Twitter’s long-term liabilities stood at 6.6 billion while long-term assets stood at 6.31 billion.

They were at a deficit due to their $270 million in losses after Musk's announcement. Before that they were above water, and likely would have grown even more so.

Whereas they now have MASSIVE debt obligations due to Musk.

What are you even trying to argue? That in your view Musk vastly overpaid for a shytty company that will likely lose money, destroyed its business model, and incurred huge debts in the process? And your praising him for that?

guess I should have followed your way should and told them don't worry you can find your way.

What does that even mean? What is "my way"? I just said your justifications for the bootlicking were bullshyt.

You call me arrogant but yet I am employing my people and helping them get money around the world

I employee people too, and do it without the bootlicking.

someone explain this to me

Spidey Man

Superstar

This whole thing is weird. Why is musk so focused on engineering? Twitter's issue (from an income or profit standpoint) is with the product itself.

He thinks he bought a company that makes a product, not a company that provides a service. He also doesn't seem to understand that to make money, you need to sell advertising, and you can't sell advertising if you have no sales department.

someone explain this to me

looks like it's a joke but a code review is where your colleagues read your code to make sure it's correct and follows whatever conventions the team follows. Elon called engineers into a code review session and this guy is claiming that he pulled up the CSS that's not his from some site to impress Elon and he didn't know any better.

Overall the whole thing is ridiculous. Even if you're an engineer it's hard to review code unless you're familiar with the language, team conventions, and the domain.

It's like Jeff Bezos coming going down to an Amazon warehouse and asking mechanics to show the work they are doing on engines and pretending to know what they're talking about.

Jesus H. Christ

I died for your sins

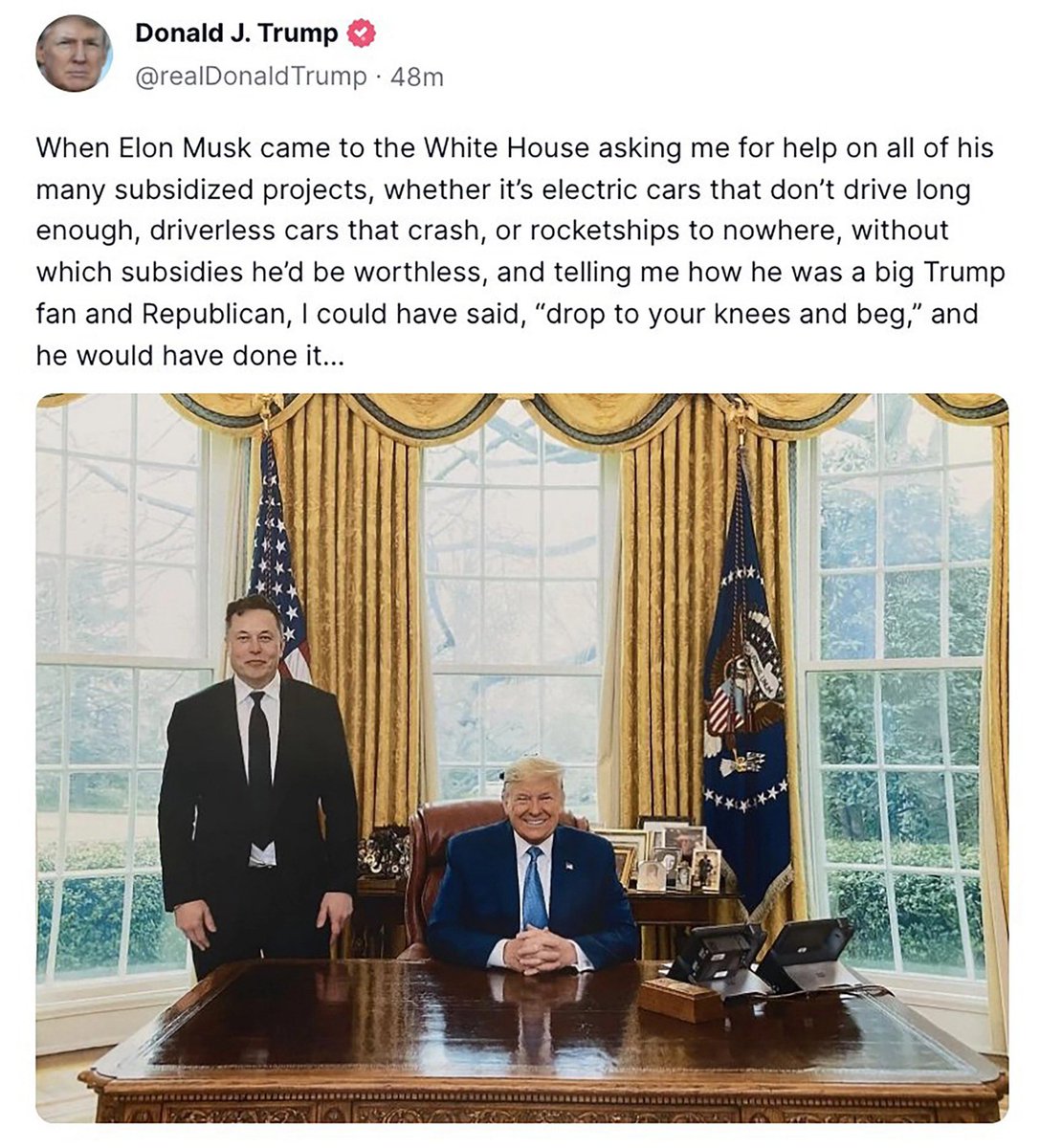

The filth and misinformation this fat pos was tweeting while in office....

Hood Critic

The Power Circle

It's a joke, mocking the fact that Elon doesn't understand the technology that actually runs the platform.someone explain this to me

Hood Critic

The Power Circle

The 80 20 rule (Pareto Principle) has been b*stardized by the business world for years to be twisted into something it originally wasn't. Its premise is to properly identify what should be prioritized in a system, those priorities (20%) accounting for the bulk of the output (80%). Prioritizing rocket booster/propulsion systems in space bound vehicles or AI in self driving cars is pretty common sense considering those are the products he's providing at his other companies.And the 80 20 rule sounds like a employer pro talking point in political discourse for the labor war between the people and corporations

80 20 doesn’t make any sense, in no shape or form can only 20 percent of people help a company grow or be productive

In my opinion you fukking up if you only relying on specific people to help your company, if you can’t train people then your business ain’t shyt

Elon is just a dude who had the capital to gamble on industries that didn’t have any competitors which he should get credit for cause it allows people to innovate, but all this dikk riding is unnecessary, I blame media for painting him as some super genius who invented some innovative technology that saved the world

Which is exactly why its ridiculous to compare to Twitter, like someone mentioned previously in the thread, it's a service where the users are the product. So if he was really employing the 80 20 rule, he'd be prioritizing the user experience instead of things like verification badges. That failed and he then pivoted to prioritizing the infrastructure, which was functional and now even less so. So not only is he losing needed revenue through the loss of advertisers but he's losing the user base because he's significantly degraded the user experience. And he's definitely lost a large chunk of his top performers (small %) who were making the largest impact.

So that shows either:

- The 80 20 rule isn't relevant to all business models

- Elon isn't as effective with implementing the 80 20 rule as some believe

- Elon is simply just reacting to whatever comes across his desk and has no real proactive plan for twitter

- People in support of him are spewing about the 80 20 to blindly throw cover for his current performance

- A little bit of all of the above

John Reena

Superstar

It must be great to be a rich white man. U can do ANYTHING

TheDarceKnight

Veteran

This shyt couldn't have been written by Donald himself, this is a straight up hit.

This shyt couldn't have been written by Donald himself, this is a straight up hit.