Ten years after Xi Jinping announced his signature Belt and Road project, its goals and outcomes have evolved.

www.bbc.com

China's roads win hearts in South Asia - but at a cost

Share

IMAGE SOURCE,GETTY IMAGES

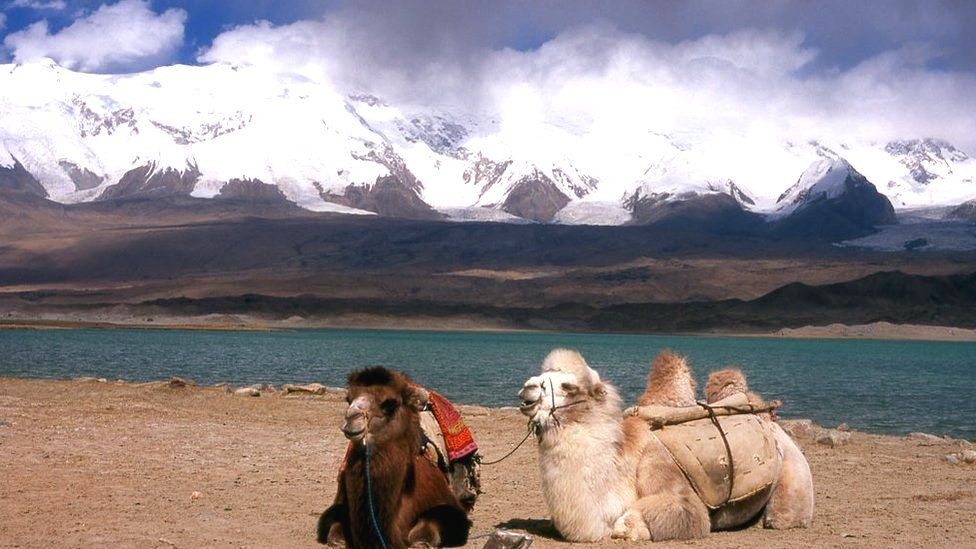

Image caption,

The Karakoram Highway is the highest paved road in the world connecting China and Pakistan at an altitude of 4,693 metres

By Suranjana Tewari

BBC News, Singapore

Khunjerab in Pakistan is a high-altitude desert, a region that is both dry and cold. Surrounded by towering mountains, pristine glaciers and alpine meadows, this rocky landscape is home to some of the world's highest peaks.

Snaking through it is a highly strategic road that connects China to Gwadar port on Pakistan's south-west coast.

The Silk Road route has been used for trade and travel for centuries, and in the last 10 years, it has become central to Beijing's Belt and Road Initiative (BRI).

Described as "one of the most ambitious infrastructure projects ever conceived", President Xi Jinping's vision to rebuild the ancient route heralded the construction of transport links across South Asia, in the process developing poorer countries and helping Beijing win allies abroad.

The West has long been wary of Beijing's moves - concerned these investments would actually help China develop a string of ports through the South China Sea, Arabian Sea and on to Africa to be used by its navy. China has denied this.

To date, more than 145 countries, accounting for almost 75% of the world's population and more than half of global GDP have signed up for the BRI.

The largest project so far is the China Pakistan Economic Corridor (CPEC) - $60bn (£49bn) was initially pledged to build a network of roads, railways and pipelines through this remote and rugged part of Pakistan.

The eventual plan was to connect to oil and gas pipelines from central Asia and the Middle East directly into western China, cutting out lengthy sea routes around South and South East Asia.

Developing this region of Pakistan made a lot of sense for China. It could act as a counterweight to long-time rival India, it offered a gateway to Afghanistan and the rare earths potentially buried there, and an opportunity to secure the porous border with its own restive Xinjiang region.

Corruption and delays

Although progress has been made, CPEC, like so many other BRI projects has been beset with corruption, delays and other issues, including environmental and security concerns. Gwadar port which was supposed to become a flagship facility, still lies empty, with no sign of cargo coming in or out.

This is the third in a series of stories that examines Chinese investment abroad 10 years after Xi Jinping launched the Belt and Road Initiative.

Read the first story about the shadowy Chinese firms that own chunks of Cambodia and the second story on Life in Laos: A country on the brink.

Much of that has to do with Pakistan's own economic problems. It was on the cusp of default earlier this year, plagued by high inflation, low growth and a weak currency. While textile workers were being laid off, and factories were shutting down because businesses couldn't afford raw materials or electricity, officials were struggling to pay for the imports needed to build CPEC infrastructure.

Eventually, the International Monetary Fund (IMF) approved a $3bn bailout programme in July. But Pakistan's external debt still stands at $100bn, with one third of it owed to China.

And Pakistan is not the only country that finds itself in this predicament.

China has become the largest creditor and a crucial source of investment for many developing countries since the BRI's inception and many of Pakistan's neighbours in South Asia are now finding themselves in the crosshairs as it evolves.

"Nepal, Sri Lanka and Bangladesh saw the BRI after 2013 as an opportunity to diversify options and attract much needed imports and investments to modernise their economies," said Constantino Xavier, fellow in Foreign Policy and Security Studies at the Centre for Social and Economic Progress in Delhi.

"Today, however, the grass is looking less green... in Nepal, China has begun to interfere in political affairs; in Sri Lanka, China has converted unsustainable infrastructure investments into long term leases impinging on sovereignty; and in Bangladesh it is becoming apparent that China's promised grants are in effect costly loans."

Playing by the rules

Beijing has transformed the way it assists these countries too.

One study found China spent $240bn bailing out 22 countries between 2008 and 2021.

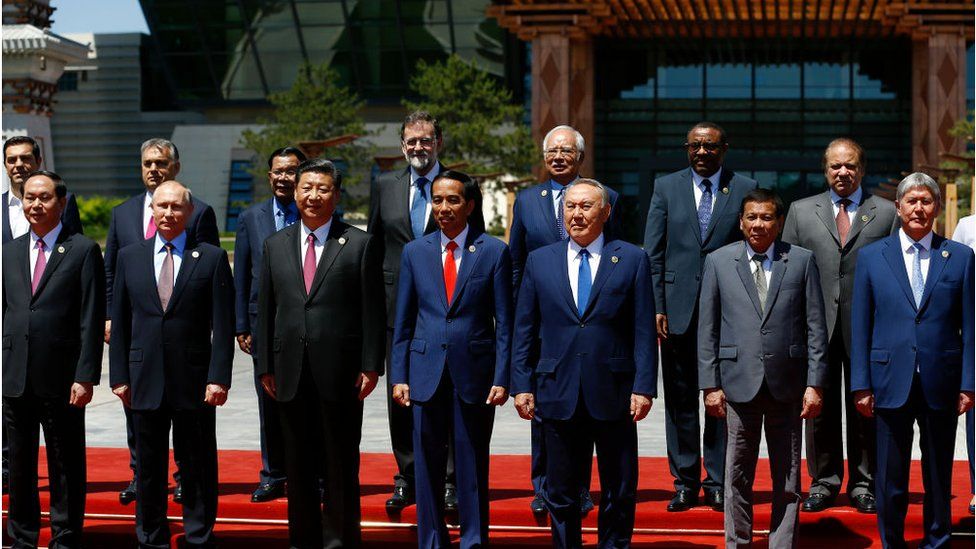

IMAGE SOURCE,GETTY IMAGES

Image caption,

Chinese President Xi Jinping (front, third from left) urged world leaders to reject protectionism at the last Belt and Road forum in 2017

"Beijing is ultimately trying to rescue its own banks. That's why it has gotten into the risky business of international bailout lending," said Carmen Reinhart, a former World Bank chief economist and one of the study's authors.

China rarely forgives debt, and is secretive about how much money it has loaned and on what terms. Experts say that makes it difficult to restructure debt when more than one international lender is involved.

What can happen in cases like Sri Lanka, which saw massive social unrest and political upheaval after it ran out of foreign reserves, is that countries get into a cycle of trying to pay back interest, which restricts the economic growth that would aid them with paying off the debt in the first place. When the money stops flowing in, people start losing their jobs, inflation spirals and crucial imports like food and fuel become unaffordable.

China has provided emergency loans and pushed back payment deadlines.

But despite criticism it is engaging in "debt trap diplomacy", an idea popularised by the Trump administration, where indebted governments offer creditor countries major assets as collateral, experts say this is not the case.

They add that there is no advantage for China of these foreign loans, because its banks are dangerously exposed to indebted real estate companies domestically.

China often plays a role in the economic woes of these countries but its loans are certainly not the only issue, says Ana Hirogashi, analyst at research lab Aid Data. Transparency around the loans is a problem she adds, but as in Sri Lanka, Beijing eventually comes to the table.

Sri Lanka has struck deals with creditors China and India, as part of an effort to restructure its debt and pave the way for the approval of the IMF's $2.9bn bailout package.

The question then presents itself: Why has China tied itself to countries with such poor economic fundamentals? Analysts point out for example, that if China truly wanted to develop Pakistan, it could have helped expand Karachi port, rather than invest in Gwadar.

"There's an element of opportunism and politics in Chinese investments. Bilateral political ties could be improved with recipient country governments," says Meia Nouwens, head of the China Programme at the International Institute for Strategic Studies (IISS).

"China uses this as an example to support its own narrative of being a leader of the Global South - a country that is supportive of developing countries and one that understands and responds to their needs."

China's deals are known for having fewer conditions and for completing in less time compared to commercial lenders. Multilateral organisations like the World Bank and International Monetary Fund (IMF) also take time and often attach social and environmental riders to their promises of aid.

"A lot of leaders in the Global South are contending with election cycles and need projects to complete fast with minimal policy conditions," says Ms Hirogashi.

The road ahead

Despite the successes and failures, analysts point out that the infrastructure that otherwise would not have been built will continue to lift the economic prospects of many developing nations, including in South Asia.

"China's BRI has spurred growth and development in South Asia, forcing India and other countries to find better and faster ways to deliver alternatives. The region is now an open field for geo-economic competition, where beyond China and India there are now many more other actors such as Japan or the European Union," Mr Xavier adds.

Last year for instance, the G7 announced a plan to boost investment in infrastructure in low and middle income countries. And on the side lines of the G20 summit this month, the India-Middle East-Europe Economic Corridor (IMEC), was announced which seeks to connect India with several Gulf countries and others in the Middle East and Europe through a trade corridor. The US is involved, with President Joe Biden saying there would be more such corridors to come.

China has become an "entrenched, resident economic and political actor across South Asian countries", according to Mr Xavier.

But with China's economy slowing down, another transition in the global order may be in the offing.

"As China shifts its growth model towards internal consumption, and there is less capital available to be deployed to South Asia, countries in the region are now rebalancing towards India, Japan, the United States, European Union and other traditional partners. This is apparent in Sri Lanka, where China has been largely missing in action after the country's financial default," Mr Xavier said.