You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

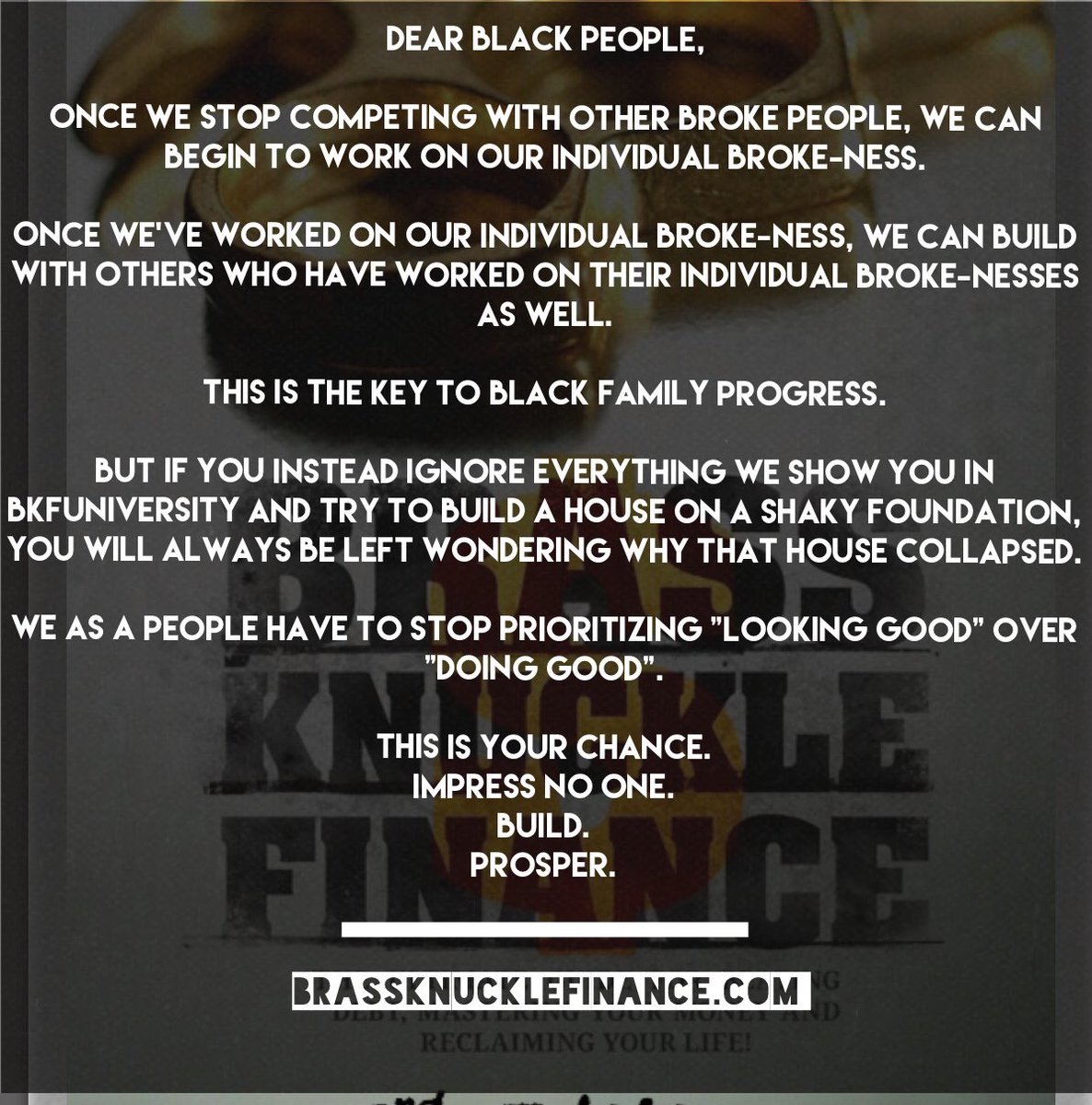

Brass Knuckle Finance (How to get out of debt, invest your money, and start a business)

- Thread starter Responsible Allen Iverson

- Start date

More options

Who Replied?Sub for later

Kenyan West

lazy fba philly nikka,

Just bought the ebook. 5 bucks.

5StarElite

All Star

Just got a new gig. I'm about to start taking five hundred outta each check, throwing it into a seperated account and trying not to touch it.

Quick question for those who have read the book.

Is it just guidelines or is he does he tell you what to do or what moves to make?

Financially I've made some simple moves that increased my style of living tenfold. Basically I paid off 10 gs of debt (credit cards) then I modified my credit card and debit card game to where it financially makes sense to spend money by earning cash back. Then I've split my paycheck into a couple different accounts so some I'll never touch other gains interest and the rest is checking. Then I buy in bulk therefore I never have to go to the store unless I need something absolutely fresh and then it's a beeline in , grab what I need and out.

Every dollar counts. I'm not month to month on anything. Basically by bulking my accounts for instance my power bill was at zero I paid $200 credit got Cashback bonus on it too, the next bill comes it's $103, I autopsy $100 every month regardless and minimum due if it's more. Basically I never end up late and since my power fluctuates after 5-6 months, tone it down to $50 bucks regardless or minimum due. Now when summer comes I'm spending more but I always have money and I'm adding a little more to pad it. Therefore if I have an emergency I can cancel the auto pay and not "pay" for a couple months if needed.

Pay the car insurance for 6 months or a year and save a fortune. Keep in mind any money I spend regardless I get Cashback bonuses at the end of the month.

When I buy in bulk I split it up, toiletries and food. I probably spend 600 a year maybe less on toiletries soap, toothpaste, paper towels, garbage bags, deodorant, dishwasher soap, hand soap and laundry detergent. If I didn't use name brands I could easily save more but I'm fancy. It's just me and my girl. So I don't know how it would work with family (kids) and shyt.

I learned the game from some books and some people who do lil things like buy and spend their. Cashback rewards in a way that really benefits them as in free groceries because you have an extra $200 from rewards.

Is it just guidelines or is he does he tell you what to do or what moves to make?

Financially I've made some simple moves that increased my style of living tenfold. Basically I paid off 10 gs of debt (credit cards) then I modified my credit card and debit card game to where it financially makes sense to spend money by earning cash back. Then I've split my paycheck into a couple different accounts so some I'll never touch other gains interest and the rest is checking. Then I buy in bulk therefore I never have to go to the store unless I need something absolutely fresh and then it's a beeline in , grab what I need and out.

Every dollar counts. I'm not month to month on anything. Basically by bulking my accounts for instance my power bill was at zero I paid $200 credit got Cashback bonus on it too, the next bill comes it's $103, I autopsy $100 every month regardless and minimum due if it's more. Basically I never end up late and since my power fluctuates after 5-6 months, tone it down to $50 bucks regardless or minimum due. Now when summer comes I'm spending more but I always have money and I'm adding a little more to pad it. Therefore if I have an emergency I can cancel the auto pay and not "pay" for a couple months if needed.

Pay the car insurance for 6 months or a year and save a fortune. Keep in mind any money I spend regardless I get Cashback bonuses at the end of the month.

When I buy in bulk I split it up, toiletries and food. I probably spend 600 a year maybe less on toiletries soap, toothpaste, paper towels, garbage bags, deodorant, dishwasher soap, hand soap and laundry detergent. If I didn't use name brands I could easily save more but I'm fancy. It's just me and my girl. So I don't know how it would work with family (kids) and shyt.

I learned the game from some books and some people who do lil things like buy and spend their. Cashback rewards in a way that really benefits them as in free groceries because you have an extra $200 from rewards.

CinnaSlim

Queen of Swords

Basically, you seem like you are on it already. For 5 bucks, Id still support them. If you want you can skip the BKF book and grab the Investing or Business book.Quick question for those who have read the book.

Is it just guidelines or is he does he tell you what to do or what moves to make?

Financially I've made some simple moves that increased my style of living tenfold. Basically I paid off 10 gs of debt (credit cards) then I modified my credit card and debit card game to where it financially makes sense to spend money by earning cash back. Then I've split my paycheck into a couple different accounts so some I'll never touch other gains interest and the rest is checking. Then I buy in bulk therefore I never have to go to the store unless I need something absolutely fresh and then it's a beeline in , grab what I need and out.

Every dollar counts. I'm not month to month on anything. Basically by bulking my accounts for instance my power bill was at zero I paid $200 credit got Cashback bonus on it too, the next bill comes it's $103, I autopsy $100 every month regardless and minimum due if it's more. Basically I never end up late and since my power fluctuates after 5-6 months, tone it down to $50 bucks regardless or minimum due. Now when summer comes I'm spending more but I always have money and I'm adding a little more to pad it. Therefore if I have an emergency I can cancel the auto pay and not "pay" for a couple months if needed.

Pay the car insurance for 6 months or a year and save a fortune. Keep in mind any money I spend regardless I get Cashback bonuses at the end of the month.

When I buy in bulk I split it up, toiletries and food. I probably spend 600 a year maybe less on toiletries soap, toothpaste, paper towels, garbage bags, deodorant, dishwasher soap, hand soap and laundry detergent. If I didn't use name brands I could easily save more but I'm fancy. It's just me and my girl. So I don't know how it would work with family (kids) and shyt.

I learned the game from some books and some people who do lil things like buy and spend their. Cashback rewards in a way that really benefits them as in free groceries because you have an extra $200 from rewards.

I will say the BKF book covers not only credit cards but also, car loans/purchases and mortgages, insurance, etc.

Best thing to do would be to get whichever book you feel best interests you. With your purchase, you get access to their online classes and there's also his blog: Thisiswhyubroke.wordpress.com

This looks great, I'm gonna contact them and see if I can sell them at Sankofa the customers been dying for more business books and I've been dying to find more business books written by Black people. We've also sold these books in the past, very popular:

I make 15 bucks an hour have student loans, rent, and car note....but i will try lol

After reading this, I actually sat down and plotted out all my expenses. Not even including food, toiletries, etc. I'm doing terrible lol. I'm trying to save more money but at the rate I'm at now it's looking impossible.

I just need to hurry up and finish school. It's really hindering me money wise. I remember my grandma telling me hurry and finish so you don't get so caught up in making money and I doubted that statement. I agree now...I'm getting caught up

I just need to hurry up and finish school. It's really hindering me money wise. I remember my grandma telling me hurry and finish so you don't get so caught up in making money and I doubted that statement. I agree now...I'm getting caught up

Basically, you seem like you are on it already. For 5 bucks, Id still support them. If you want you can skip the BKF book and grab the Investing or Business book.

I will say the BKF book covers not only credit cards but also, car loans/purchases and mortgages, insurance, etc.

Best thing to do would be to get whichever book you feel best interests you. With your purchase, you get access to their online classes and there's also his blog: Thisiswhyubroke.wordpress.com

I'll cop. A lot of stuff I listen to while at work and to get rid of the little debt I had, I was working about 16 hours a day only taking Sundays off. It was easy to do because putting down 1500 on a bill was like "yeah this is going down super fast". In hindsight over the years and the time I was putting 100 and 200 payments I would have been in debt for years. I could afford to pay my bills and still have fun so I didn't care that I was basically in a self created debt that would last years at the rate I was paying. I didn't care that I had a $6000 credit card and I'd pay it down to like 2500 then spend it back up like 5000 then slowly pay it back down. But looking at all the bills every month I was getting pissed off with the ritual of logging in and paying (my water bill doesn't have autopay).

I'll put whatever on it now for the Cashback, and pay it off with my income.

Too many people just get comfortable where they are in life, financially or otherwise, even if it's a shyt position. Those ones who fear being at their worst, or losing, are the ones putting in superhuman work to not end up in that position. Look at a Floyd Mayweather as an example.

I never thought of it from that angle.