I use Fidelity, Robinhood, SoFi, and M1 Finance. All of them allow fractional shares.where do you buy partial shares of Tesla and Google?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boiler Room: The Official Stock Market Discussion

More options

Who Replied?its2late2hate

Pro

thanks for the quick info fellas, Just opened a Fidelity account. I will use that to grab some fractional shares of the blue chips (Google, Amazon, and TSLA,)

I will stick with Etrade for the smaller level plays. (basically any stock that is under $200 per share

I will stick with Etrade for the smaller level plays. (basically any stock that is under $200 per share

Slim

Superstar

I thought companies took much longer to do stock splits. Isn't doing it twice in 2 years a bit much?

Leading up to, and during the dot com bubble, tech companies were splitting stocks every year. It was all good until it came crashing down.

Not saying the splits and a crash are correlated.

Stock splitting the new pump and dump for 2022

BlaxOps

Pro

Wow, even more bag holders will be able to get out if they avg cost was around $200.

Stock splitting the new pump and dump for 2022

you misunderstand

short sellers are required to pay out dividends even on naked shorts.

Last edited:

I Really Mean It

Veteran

Wow, even more bag holders will be able to get out if they avg cost was around $200.

Nobody is trying to sell GME after this news. People are trying to buy in before the cost is more prohibitive than it arguably already is.

I use Fidelity, Robinhood, SoFi, and M1 Finance. All of them allow fractional shares.

have you used public or moomoo and if you have how is it?

Rickdogg44

RIP Charmander RIP Kobe

How you have a split via dividend ?

How you have a split via dividend ?

Stock Splits And Stock Dividends - principlesofaccounting.com

Stock Dividends

In contrast to cash dividends discussed earlier in this chapter, stock dividends involve the issuance of additional shares of stock to existing shareholders on a proportional basis. Stock dividends are very similar to stock splits. For example, a shareholder who owns 100 shares of stock will own 125 shares after a 25% stock dividend (essentially the same result as a 5 for 4 stock split). Importantly, all shareholders would have 25% more shares, so the percentage of the total outstanding stock owned by a specific shareholder is not increased.

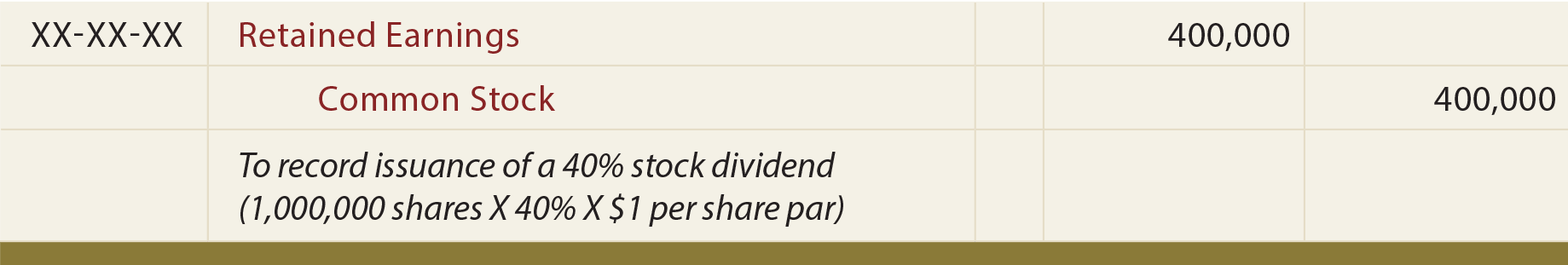

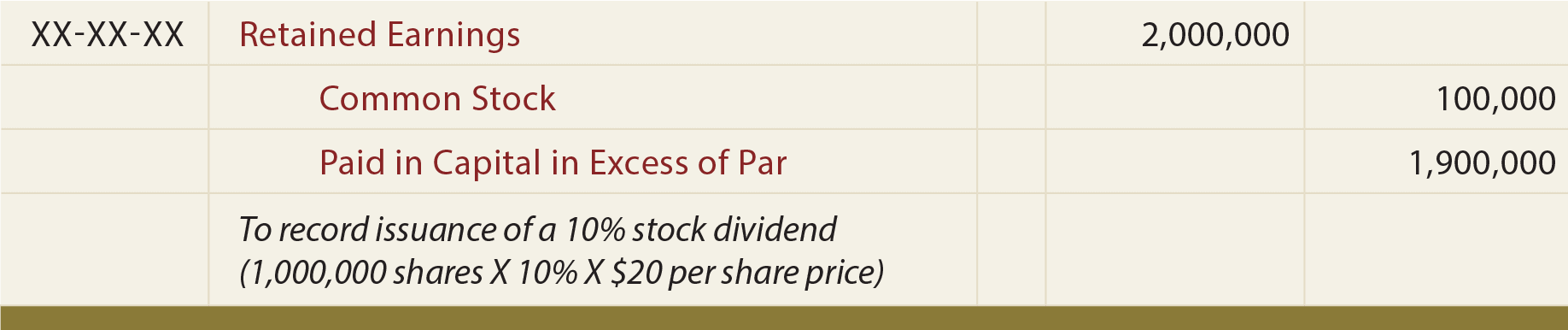

Although shareholders will perceive very little difference between a stock dividend and stock split, the accounting for stock dividends is unique. Stock dividends require journal entries. Stock dividends are recorded by moving amounts from retained earnings to paid-in capital. The amount to move depends on the size of the distribution. A small stock dividend (generally less than 20-25% of the existing shares outstanding) is accounted for at market price on the date of declaration. A large stock dividend (generally over the 20-25% range) is accounted for at par value.

To illustrate, assume that Childers Corporation had 1,000,000 shares of $1 par value stock outstanding. The market price per share is $20 on the date that a stock dividend is declared and issued:

Small Stock Dividend: Assume Childers Issues a 10% Stock Dividend

Large Stock Dividend: Assume Childers Issues a 40% Stock Dividend