You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boiler Room: The Official Stock Market Discussion

More options

Who Replied?Domingo Halliburton

Handmade in USA

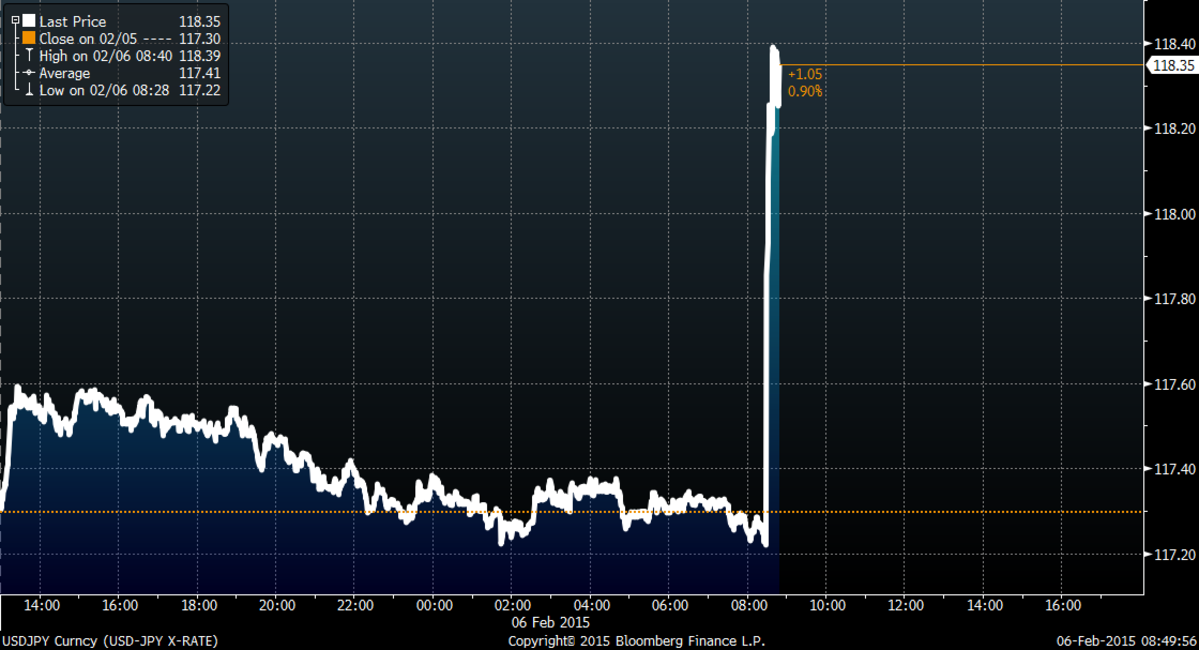

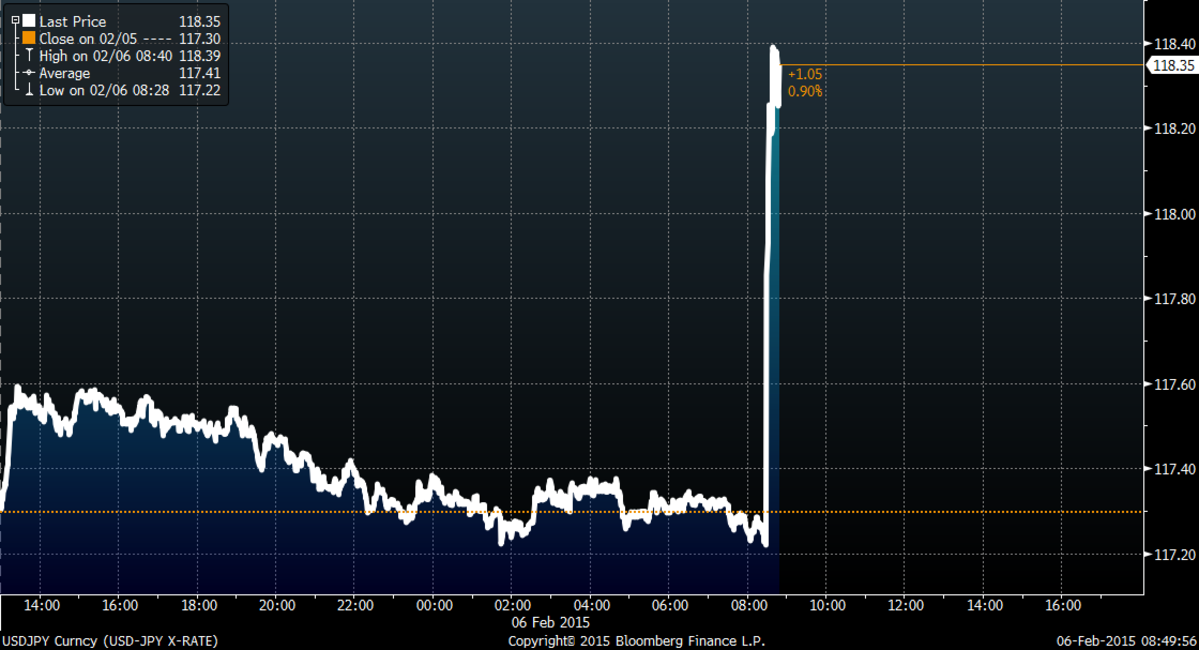

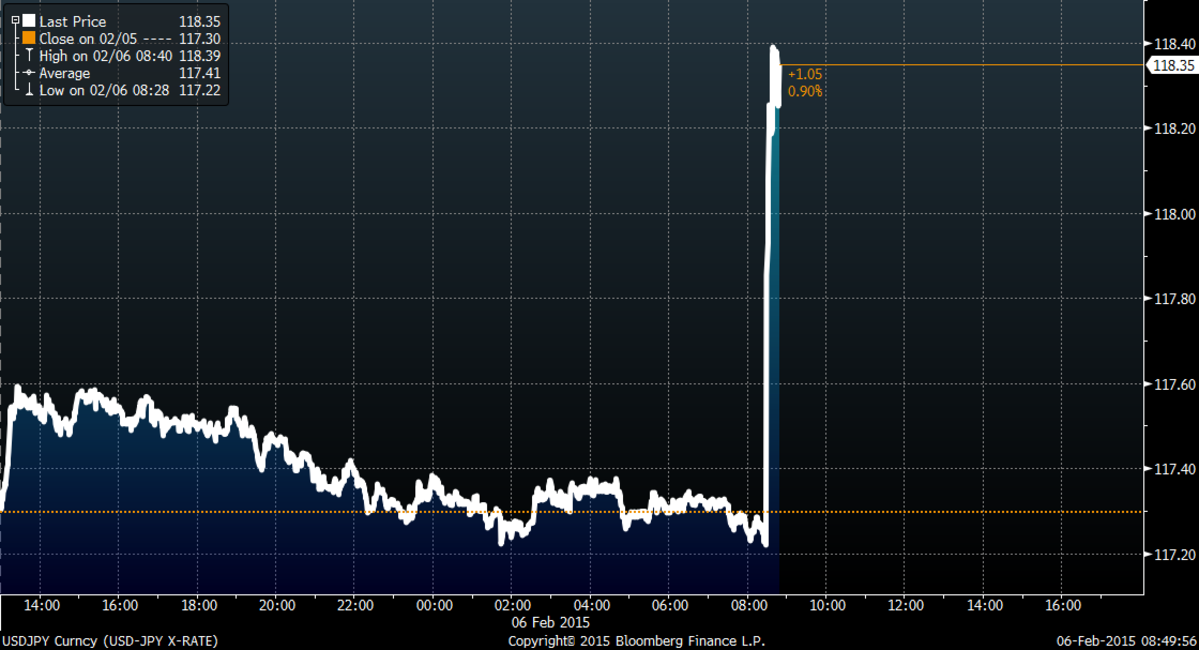

dollar and 10Y yield spiking after jobs report...

Domingo Halliburton

Handmade in USA

ECONOMIC REPORTS

Domestic economic reports scheduled for today include:

Nonfarm payrolls for January at 8:30--consensus up 230K

Unemployment rate for January at 8:30--consensus 5.6%

Consumer credit for December at 15:00--consensus $15.2B

ANALYST RESEARCH

Upgrades

ABB (ABB) upgraded to Overweight from Equal Weight at Barclays

AXIS Capital (AXS) upgraded to Hold from Sell at Deutsche Bank

Best Buy (BBY) upgraded to Outperform from Perform at Oppenheimer

CyberArk (CYBR) upgraded to In-Line from Underperform at Imperial Capital

Everest Re (RE) upgraded to Buy from Hold at Deutsche Bank

First BanCorp (FBP) upgraded to Outperform from Market Perform at Keefe Bruyette

GrubHub (GRUB) upgraded to Buy from Hold at Brean Capital

Hospira (HSP) upgraded to Neutral from Sell at Goldman

Ironwood (IRWD) upgraded to Hold from Sell at Cantor

MEDNAX (MD) upgraded to Buy from Hold at Stifel

Nationstar (NSM) upgraded to Outperform from Market Perform at Wells Fargo

PartnerRe (PRE) upgraded to Hold from Sell at Deutsche Bank

PennantPark (PNNT) upgraded to Outperform from Neutral at RW Baird

PennantPark (PNNT) upgraded to Overweight from Neutral at JPMorgan

Prudential plc (PUK) upgraded to Neutral from Underweight at JPMorgan

RenaissanceRe (RNR) upgraded to Hold from Sell at Deutsche Bank

Santander Chile (BSAC) upgraded to Neutral from Sell at Goldman

Staples (SPLS) upgraded to Neutral from Sell at Goldman

Synchronoss (SNCR) upgraded to Neutral from Underperform at RW Baird

Downgrades

Apollo Global (APO) downgraded to Market Perform from Outperform at Keefe Bruyette

Apollo Investment (AINV) downgraded to Neutral from Overweight at JPMorgan

BioMed Realty (BMR) downgraded to Neutral from Buy at Mizuho

Broadridge (BR) downgraded to Market Perform from Outperform at Keefe Bruyette

Digital Realty (DLR) downgraded to Sell from Neutral at UBS

DuPont Fabros (DFT) downgraded to Sell from Neutral at UBS

Empresas ICA (ICA) downgraded to Equal Weight from Overweight at Barclays

Expedia (EXPE) downgraded to Perform from Outperform at Oppenheimer

Gilead (GILD) downgraded to Neutral from Outperform at Credit Suisse

Goodrich Petroleum (GDP) downgraded to Market Perform from Outperform at Cowen

National Bank of Greece (NBG) downgraded to Neutral from Buy at Goldman

OFG Bancorp (OFG) downgraded to Market Perform from Outperform at Keefe Bruyette

Pandora (P) downgraded to Market Perform from Outperform at Raymond James

Pandora (P) downgraded to Market Perform from Outperform at Wells Fargo

Pandora (P) downgraded to Neutral from Buy at B. Riley

Post Properties (PPS) downgraded to Hold from Buy at Stifel

Prestige Brands (PBH) downgraded to Market Perform from Outperform at Raymond James

Sprint (S) downgraded to Hold from Buy at Evercore ISI

Telenor (TELNY) downgraded to Sell from Neutral at Citigroup

Teradata (TDC) downgraded to Underperform from Neutral at Credit Suisse

USG (USG) downgraded to Equal Weight from Overweight at Barclays

Viacom (VIAB) downgraded to Underweight from Neutral at Atlantic Equities

Wesco Aircraft (WAIR) downgraded to Sector Perform from Outperform at RBC Capital

Yelp (YELP) downgraded to Sector Perform from Outperform at Pacific Crest

Yelp (YELP) downgraded to Sell from Neutral at B. Riley

Initiations

ACADIA (ACAD) coverage resumed with a Buy at Roth Capital

AmSurg (AMSG) initiated with a Buy at Jefferies

BB&T (BBT) initiated with an Outperform at Credit Suisse

Citizens Financial (CFG) initiated with a Neutral at Credit Suisse

Comerica (CMA) initiated with a Neutral at Credit Suisse

Fifth Third Bancorp (FITB) initiated with an Underperform at Credit Suisse

Huntington Bancshares (HBAN) initiated with a Neutral at Credit Suisse

Inphi (IPHI) initiated with an Outperform at Imperial Capital

KeyCorp (KEY) initiated with an Outperform at Credit Suisse

M&T Bank (MTB) initiated with a Neutral at Credit Suisse

Regions Financial (RF) initiated with a Neutral at Credit Suisse

Sunoco Logistics (SXL) initiated with an Overweight at JPMorgan

Sunoco (SUN) initiated with an Overweight at JPMorgan

Zions Bancorp (ZION) initiated with a Neutral at Credit Suisse

COMPANY NEWS

Frontier Communications (FTR) announced a definitive agreement with Verizon (VZ) under which Frontier will acquire Verizon’s wireline operations that provide services to residential, commercial and wholesale customers in California, Florida and Texas, for $10.54B in cash

Verizon (VZ) lease rights to over 11,300 towers to American Tower (AMT) for $5B

Verizon (VZ) to return $5B to holders through share repurchase

Harris (HRS) to acquire Exelis (XLS) for $23.75 per share, or approximately $4.75B

Twitter (TWTR) reported Q4 Average Monthly Active Users up 20% to 288M, sees Q1 net user adds similar to rate of first three quarters of 2014

Trian said DuPont (DD) "appears to be acknowledging” the need to upgrade its board with individuals that have “fresh, independent, highly relevant perspectives"

GoPro (GPRO) COO Nina Richardson resigning to pursue other opportunities, board roles

Activision Blizzard (ATVI) announced a new $750M share repurchase program

EARNINGS

Companies that beat consensus earnings expectations last night and today include:

Twitter (TWTR), LinkedIn (LNKD), GoPro (GPRO), Sirona Dental (SIRO), Aon plc (AON), Sensient (SXT), Silicon Image (SIMG), ACETO (ACET), Simpson Manufacturing (SSD), AptarGroup (ATR), Audience (ADNC), Evans Bancorp (EVBN), Rentrak (RENT), Endurance Specialty (ENH), SPS Commerce (SPSC), Sierra Wireless (SWIR), SMART Technologies (SMT), Iteris (ITI), Universal Technical (UTI), Paylocity (PCTY), LeapFrog (LF), Marin Software (MRIN), Brightcove (BCOV), ON Semiconductor (ONNN), ChannelAdvisor (ECOM), Control4 (CTRL), McKesson (MCK), Standard Pacific (SPF), Tempur Sealy (TPX), Activision Blizzard (ATVI), Axcelis (ACLS), Maxwell (MXWL), Ubiquiti Networks (UBNT), News Corp. (NWSA), athenahealth (ATHN), Mettler-Toledo (MTD), FleetCor (FLT), Outerwall (OUTR), Yelp (YELP), Pixelworks (PXLW), Symantec (SYMC), Kemper (KMPR), Haynes (HAYN), Fluidigm (FLDM), FBL Financial (FFG), Nuance (NUAN), ePlus (PLUS), bebe stores (BEBE), Netgear (NTGR), Echo Global (ECHO), Lionsgate (LGF)

Companies that missed consensus earnings expectations include:

Intrawest Resorts (SNOW), Olin Corp. (OLN), Bristow Group (BRS), Post Holdings (POST), Badger Meter (BMI), ARC Group (ARCW), Craft Brew (BREW), Aspen Insurance (AHL), eGain (EGAN), Amtech Systems (ASYS), Cardica (CRDC), Moelis (MC), Wesco Aircraft (WAIR), DeVry (DV), VeriSign (VRSN), Cutera (CUTR), Elizabeth Arden (RDEN), Fairway Group (FWM), PDF Solutions (PDFS), Brooks Automation (BRKS), pSivida (PSDV), Expedia (EXPE), Pandora (P), Buffalo Wild Wings (BWLD), NIC Inc. (EGOV)

Companies that matched consensus earnings expectations include:

Empire District Electric (EDE), Capstone Turbine (CPST), Q2 Holdings (QTWO), SciQuest (SQI), TeleCommunication Systems (TSYS), Imperva (IMPV), Callidus Software (CALD), Solera (SLH), Stericycle (SRCL)

GoPro (GPRO) sees Q1 EPS 15c-17c, consensus 17c

Yelp (YELP) sees FY15 revenue $538M-$543M, consensus $537.98M

Twitter (TWTR) sees Q1 revenue $440M-$450M, consensus $449.68M, sees FY15 revenue $2.3B-$2.35B, consensus $2.3B

LinkedIn (LNKD) sees FY15 adjusted EPS approximately $2.95, consensus $2.73

NEWSPAPERS/WEBSITES

RadioShack (RSH) files for bankruptcy protection, Bloomberg reports

SEC investigating insider trading of BlackBerry (BBRY) options, Reuters reports

Expedia (EXPE) may see $847M tax fine from State governments, Bloomberg reports

Anthem (ANTM) did not encrypt information prior to hack, WSJ reports

United Steelworkers reject offer from oil refiners, WSJ reports (MPC, TSO, LYB, RDS.A, RDS.B)

SYNDICATE

Activision Blizzard (ATVI) files to sell 41.5M shares of common stock for Vivendi (VIVHY)

Columbia Pipeline (CPPL) 46.81M share IPO priced at $23.00

Dave & Busters (PLAY) 6.6M share Secondary priced at $29.50

Easterly Government Properties (DEA) 12M share IPO priced at $15.00

Emerald Oil (EOX) files to sell $25M of common stock

M/A-COM (MTSI) 7.8M share Secondary priced at $30.00

Navios Maritime Partners (NMM) files to sell 4M common units for limited partners

Ohr Pharmaceutical (OHRP) files automatic common stock shelf

Oncothyreon (ONTY) files to sell common stock and series B convertible preferred stock

Oncothyreon (ONTY) files to sell common stock, Series B Convertible Preferred Stock

One Horizon Group (OHGI) files to sell 3.28M shares of common stock for holders

Prologis (PLD) files to sell $750M of common stock 'at-the-market'

Sterling Bancorp (STL) 6M share Secondary priced at $13.00

Trovagene (TROV) files automatic common stock shelf

WashingtonFirst Bankshares (WFBI) files to sell 1.37M shares of common stock for holder

non-farm payrolls came in at 257k. November revised up to 423k jobs added.

Futuristic Eskimo

All Star

well those revisions sure did blow up my no rate hike thesis very quicklydollar and 10Y yield spiking after jobs report...

Domingo Halliburton

Handmade in USA

well those revisions sure did blow up my no rate hike thesis very quickly

Yeah people are coming out and saying they expect a change in monetary policy at the testimony later this month

Futuristic Eskimo

All Star

I'm surprised energy job cuts haven't moved these numbers to the downside. Maybe things are actually improving. Next month's wage numbers are going to be very telling.Yeah people are coming out and saying they expect a change in monetary policy at the testimony later this month

Edit: Right after I post this, zero hedge drops a nice little nugget:

suspicious

Last edited:

yup. graduated last april...been working a financial reporting contract gig for Best buy.You still at the same spot? I think I saw you had an interview at kpmg

had a kpmg in person and phone interview. another interview on monday. hopefully its the last

BBY wants me back but theres too much of a ceiling in this small office. I'm too expensive for them to stay

Futuristic Eskimo

All Star

What's the job at KPMG?yup. graduated last april...been working a financial reporting contract gig for Best buy.

had a kpmg in person and phone interview. another interview on monday. hopefully its the last

BBY wants me back but theres too much of a ceiling in this small office. I'm too expensive for them to stay

Congrats breh.Turned down a job at very sizeable asset manager in fixed income research after busting my ass to get research interviewsWould've started in July.

Ended up taking one at Ernst and young. Working on the (redacted)account doing capital projections for their ccar efforts. fukk an end of year bonus

Same firm as my girl though

i got a friend doing his first MBA year. Had some good consulting interviews but didnt land anything

Why did you turn down the Fixed Income jawn though...didnt wanna wait that long?

Financial Analyst position. It's more internal as opposed to client based though...I'd be working under controllers for KPMG's Financial Management Division...communicating and reporting financial results to them/partners across Canada. It's good because it would be helpful towards me getting my CPA work experience and I'd be making 50% more than my classmates who went the traditional auditing route are makingWhat's the job at KPMG?

.

. Hopefully i get it

Futuristic Eskimo

All Star

Sounds solid. If you're in the third round already, they already like you. At this point, it's about not fukking it up yourselfFinancial Analyst position. It's more internal as opposed to client based though...I'd be working under controllers for KPMG's Financial Management Division...communicating and reporting financial results to them/partners across Canada. It's good because it would be helpful towards me getting my CPA work experience and I'd be making 50% more than my classmates who went the traditional auditing route are making.

Hopefully i get it

I couldn't wait that long breh. I figured, by starting earlier, the extra money in my pocket would make up for the lack of bonuses for staff. My analyst was going to be a cranky Asian bytch too, so I doubt I would have enjoyed being there. I met her twice and she spent an hour telling me to basically not talk to anyone ever because it would reflect poorly on her if I said something that deviated from her view

Taking cfa in June. I'm gonna be busy as fukk for the next few months. No time for active management

Domingo Halliburton

Handmade in USA

flash dash in 49 stocks at 11:06 EST

edit: "flash-dash not crash"

edit: "flash-dash not crash"

Sounds solid. If you're in the third round already, they already like you. At this point, it's about not fukking it up yourself

I couldn't wait that long breh. I figured, by starting earlier, the extra money in my pocket would make up for the lack of bonuses for staff. My analyst was going to be a cranky Asian bytch too, so I doubt I would have enjoyed being there. I met her twice and she spent an hour telling me to basically not talk to anyone ever because it would reflect poorly on her if I said something that deviated from her view

Taking cfa in June. I'm gonna be busy as fukk for the next few months. No time for active management

You made the right choice then based on the bolded. Most people would've agreed to both, and then taken the 6 months of E&Y experience before bolting in July but with a nazi manager it aint worth it.

You made the right choice then based on the bolded. Most people would've agreed to both, and then taken the 6 months of E&Y experience before bolting in July but with a nazi manager it aint worth it.In any case it sounds like youre on the right track. You can get through that CFA, get the lauded Big 4 experience and then make the move in the corp finance/research through networking. Does the account you working on present a good networking opp?

Domingo Halliburton

Handmade in USA

utilities and REITs are down hard but telecoms are up. strange

Domingo Halliburton

Handmade in USA

UNG (nat gas ETF) at lifetime low