You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boiler Room: The Official Stock Market Discussion

More options

Who Replied?Domingo Halliburton

Handmade in USA

ECONOMIC REPORTS

Domestic economic reports scheduled for today include:

Dallas Fed manufacturing activity index for January at 10:30--consensus 4.0

ANALYST RESEARCH

Upgrades

American Axle (AXL) upgraded to Overweight from Neutral at JPMorgan

Bed Bath & Beyond (BBBY) upgraded to Outperform from Perform at Oppenheimer

DRDGOLD (DRD) upgraded to Neutral from Underweight at JPMorgan

DealerTrack (TRAK) upgraded to Buy from Hold at Stifel

DreamWorks Animation (DWA) upgraded to Buy from Neutral at B. Riley

First Niagara (FNFG) upgraded to Buy from Hold at Jefferies

Fortinet (FTNT) upgraded to Buy from Neutral at Citigroup

Garmin (GRMN) upgraded to Outperform from Sector Perform at RBC Capital

Harmony Gold (HMY) upgraded to Overweight from Neutral at JPMorgan

McDonald's (MCD) upgraded to Overweight from Equal Weight at Stephens

Monro Muffler (MNRO) upgraded to Neutral from Reduce at SunTrust

Pier 1 Imports (PIR) upgraded to Outperform from Perform at Oppenheimer

Randgold (GOLD) upgraded to Overweight from Neutral at JPMorgan

Triumph Group (TGI) upgraded to Sector Perform from Underperform at RBC Capital

Downgrades

Aluminum Corp. of China (ACH) downgraded to Underweight from Neutral at JPMorgan

AmeriGas (APU) downgraded to Hold from Buy at Jefferies

B2Gold (BTG) downgraded to Neutral from Buy at Goldman

CenterPoint Energy (CNP) downgraded to Neutral from Buy at Citigroup

CommScope (COMM) downgraded to Sector Perform from Outperform at RBC Capital

Derma Sciences (DSCI) downgraded to Neutral from Overweight at Piper Jaffray

Fortress (FIG) downgraded to Market Perform from Outperform at Keefe Bruyette

Gold Fields (GFI) downgraded to Neutral from Overweight at JPMorgan

Graco (GGG) downgraded to Perform from Outperform at Oppenheimer

Gran Tierra (GTE) downgraded to Neutral from Outperform at Credit Suisse

HCP (HCP) downgraded to Neutral from Buy at Mizuho

IGM Financial (IGIFF) downgraded to Underweight from Equal Weight at Barclays

Insulet (PODD) downgraded to Market Perform from Outperform at William Blair

KCG Holdings (KCG) downgraded to Sell from Neutral at Goldman

Knight Transportation (KNX) downgraded to Hold from Buy at KeyBanc

Maxim Integrated (MXIM) downgraded to Neutral from Positive at Susquehanna

Praxair (PX) downgraded to Neutral from Outperform at RW Baird

Qualys (QLYS) downgraded to Market Perform from Outperform at JMP Securities

State Street (STT) downgraded to Underperform from Market Perform at Bernstein

Tandem Diabetes (TNDM) downgraded to Market Perform from Outperform at William Blair

Trinseo (TSE) downgraded to Neutral from Buy at Citigroup

UPS (UPS) downgraded to Equal Weight from Overweight at Barclays

UPS (UPS) downgraded to Neutral from Outperform at Credit Suisse

VeriSign (VRSN) downgraded to Underperform from Neutral at Credit Suisse

Initiations

Aruba Networks (ARUN) initiated with a Neutral at Citigroup

KapStone (KS) initiated with an Outperform at RBC Capital

Lear (LEA) resumed with a Neutral at JPMorgan

Paramount Group (PGRE) initiated with a Neutral at UBS

QAD Inc (QADB) initiated with a Buy at Canaccord

Ruckus Wireless (RKUS) initiated with a Buy at Citigroup

Ubiquiti Networks (UBNT) initiated with a Neutral at Citigroup

COMPANY NEWS

AT&T (T) to acquire Nextel Mexico for $1.88B, less outstanding net debt

Post Holdings (POST) to acquire MOM brands for $1.15B

RockTenn (RKT) and MeadWestvaco (MWV) entered into a definitive combination agreement to create a global provider of consumer and corrugated packaging in a transaction with a combined equity value of $16B

Endo (ENDP) to replace Covidien (COV) in S&P 500 as of 1/26 close, HCA Holdings (HCA) to replace Safeway (SWY) in S&P 500 as of 1/26 close

Gilead Sciences (GILD) expanded its hepatitis C generic licensing agreements to include the investigational NS5A inhibitor GS-5816. The expanded agreements will allow Gilead’s India-based partners to manufacture GS-5816 and the single tablet regimen of sofosbuvir/GS-5816, once approved, for distribution in 91 developing countries

AXIS Capital (AXS), PartnerRe (PRE) to combine in $11B merger

EARNINGS

Companies that beat consensus earnings expectations last night and today include:

Provident Financial (PROV), RockTenn (RKT)

Post Holdings (POST) reports preliminary Q1 sales $1.07B, consensus $1.07B

PartnerRe (PRE) sees Q4 EPS $4.20-$4.60, may not compare to consensus $3.04

AXIS Capital (AXS) sees Q4 EPS $1.15-$1.21, consensus $1.21

NEWSPAPERS/WEBSITES

Apple (AAPL) to report China iPhone sales topped U.S. iPhone sales, Financial Times reports

Teva (TEVA) rebuffed Pfizer (PFE) approach late last year, Bloomberg reports

Yahoo (YHOO) may absorb Tumblr sales force, Re/code reports

FXCM (FXCM) to consider selling assets to repay rescue loan, WSJ reports

Private equity firm 'seriously' considered buying Herbalife (HLF), NY Post reports (NUS, AVP)

PepsiCo's (PEP) new director nominee could ease tensions with Trian, Barron's says

Twitter (TWTR) still has problems, Barron's says

Urban Outfitters (URBN) could be more attractive, Barron's says

Oracle (ORCL) shares could climb over 20%, Barron's says

Domingo Halliburton

Handmade in USA

well they got the snow to blame now when all the economic reports come in looking shytty.

88m3

Fast Money & Foreign Objects

lolwell they got the snow to blame now when all the economic reports come in looking shytty.

Domingo Halliburton

Handmade in USA

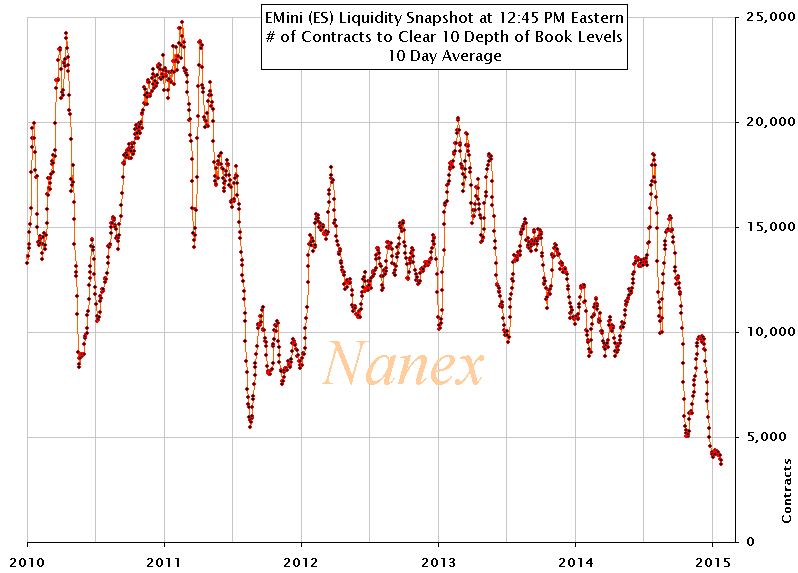

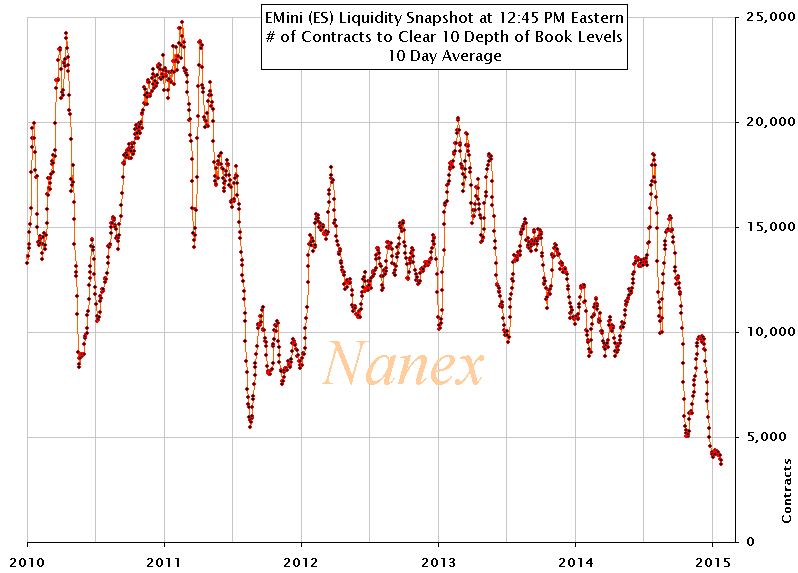

I know volume isn't necessarily an indicator of liquidity but eMini volume has fallen off a cliff....

Domingo Halliburton

Handmade in USA

China Property Agony Deepens as Trust-Loan Lifelines Cut

China's investment trusts are pulling financing for the real estate industry as Kaisa Group Holdings Ltd. (1638) 's missed payments heighten default concerns.

Issuance of property-related products, which channel money from wealthy individual investors, tumbled 62 percent from a year earlier to 38.5 billion yuan ($6.2 billion) in the fourth quarter, data compiled by research firm Use Trust show. Builders must repay 241 billion yuan of trusts in 2015, up from 178 billion yuan last year. Kaisa, which missed a bond coupon payment this month, failed to repay a 2.5 billion yuan trust last week, people familiar with the matter said.

"The record amount of trust products due is adding to the agony of property developers as they face a withering funding lifeline," said Shuai Guorang, an analyst based in the southeastern city of Nanchang at Use Trust. "Investor demand for property trusts has declined as they are concerned about developers' cash supply."

While Premier Li Keqiang's relaxation of property curbs has helped underpin a rebound in home sales, investors are speculating more developers may be caught up in an anti-corruption drive. Kaisa, Agile Property Holdings Ltd. (3383) and Hydoo International Holding Ltd., which builds large-scale trade centers, have been linked to probes. Local authorities in Handan, southwest of Beijing, sent work teams into 13 developers after failure to repay funds, Xinhua News Agency reported.

Crunch Risk

"A big portion of shadow bank funding, including trust financing, is borrowed by property developers," said David Cui, China strategist at Bank of America Corp. "If there is a sharp rise of defaults by the developers, it may cause a shock to investor confidence in shadow banking, which will raise risks of a credit crunch."

Jim Chanos might be right....

http://finance.yahoo.com/news/china-property-agony-deepens-trust-024426712.html

Futuristic Eskimo

All Star

in at 61.18. bet on bum ass Europe brehsLooking at taking a position in HEDJ. That QE money should boost asset prices in Europe and its hedged for currency moves.

AMCX already up 6% since that post.CBS might be a good buy right now if it has good news this earnings release. AMCX is a very good buy to me at these levels. But I havent done research on the media industry in a long time. Fedex will benefit well from the drop in oil prices too. I'll keep you posted.

Was gonna buy in next paycheck

AMCX already up 6% since that post.

Was gonna buy in next paycheck

moaarrr picks bruh, next one ima buy in.

Domingo Halliburton

Handmade in USA

need more turmoil

Greece is on it

Domingo Halliburton

Handmade in USA

Rumors are Petrobras may take a charge equal to half its market cap.

Domingo Halliburton

Handmade in USA

damn I don't think there was one stock up on earnings. MSFT, CAT, MMM, DD, PG, FCX, AAL

damn I don't think there was one stock up on earnings. MSFT, CAT, MMM, DD, PG, FCX, AAL

AAL $.01 better than expected, but theyre buying back another 2 billi. Ima hold on for the ride.

My gawd the dives this morning wth is going on