You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boiler Room: The Official Stock Market Discussion

More options

Who Replied?Futuristic Eskimo

All Star

You think there is any chance the Fed junks the plan to raise rates this month? There's no way we can overshoot on inflation with a collapse across commodities and it would provide some real support to risk markets. The consensus seems to be that its set and next year's hikes are the ones in question, but I think the market might be wrong. I'll be putting a trade on if everything else stays relatively stable.Well oil has been getting killed. Trade tensions have been creating some problems for defense companies. Especially names like boeing.

If we're talking recession i would suggest discount retailers and "sin" industries like smoking.

Domingo Halliburton

Handmade in USA

You think there is any chance the Fed junks the plan to raise rates this month? There's no way we can overshoot on inflation with a collapse across commodities and it would provide some real support to risk markets. The consensus seems to be that its set and next year's hikes are the ones in question, but I think the market might be wrong. I'll be putting a trade on if everything else stays relatively stable.

It seems a lot of the fed officials keep calling for a hike this month. Hard to say.

Domingo Halliburton

Handmade in USA

Decided to give Robinhood a try last week. Been going ok I guess. Glad this thread is here. Can anyone explain how VIX funds work in a short practical sense?

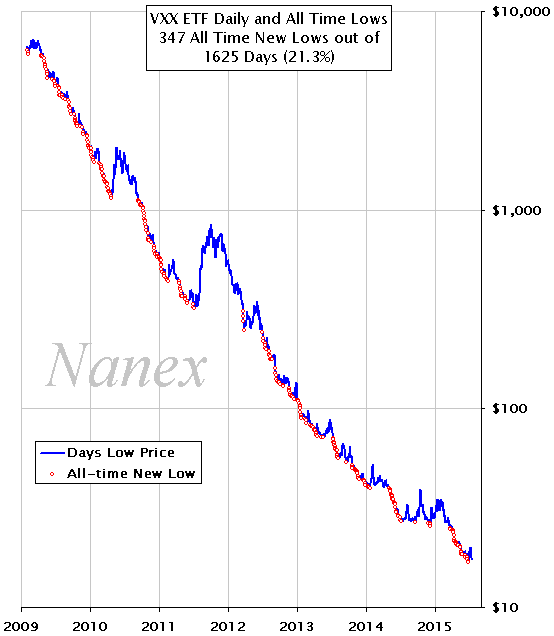

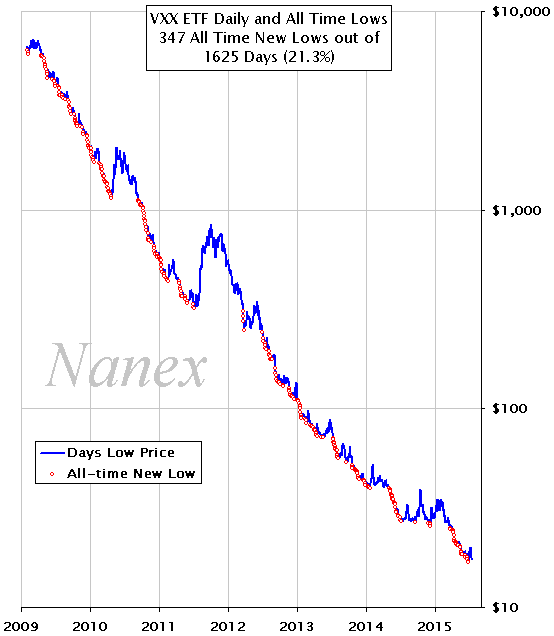

Well vix is a measure of volatility in the market. So it's not like a typical stock you would buy. Typically these funds are either buying (if they're long) or selling (short) vix futures. This creates a lot of carry (i.e. they have to spend a bunch of money buying the next month's futures) so these funds almost always are going down in price. Look at an all time chart for VXX or something like that, you'll see it just goes down in price. I would be careful with these funds and make sure you're always looking at the vix futures.

Edit:

This is a post of mine from 2015 in here:

You see how VXX is making all time lows like a fifth of the trading days? Long vol funds are hard to be long. You have to get the timing right.

Last edited:

Domingo Halliburton

Handmade in USA

I know i was just saying how hard it is to be long volatility but honestly i dont know how you make a bull case for the rest of the year. Unless you just think banks are so oversold that there's nowhere to go but up.

Well vix is a measure of volatility in the market. So it's not like a typical stock you would buy. Typically these funds are either buying (if they're long) or selling (short) vix futures. This creates a lot of carry (i.e. they have to spend a bunch of money buying the next month's futures) so these funds almost always are going down in price. Look at an all time chart for VXX or something like that, you'll see it just goes down in price. I would be careful with these funds and make sure you're always looking at the vix futures.

So basically you buy it and sit on it until it spikes, even if it happens every 5-10 years right?

Domingo Halliburton

Handmade in USA

So basically you buy it and sit on it until it spikes, even if it happens every 5-10 years right?

No, they almost all say in their prospectuses that they are for short term trades. I mean something like VXX is going to go to zero. How they avoid that is by doing reverse splits on you. I would wait until the market calms down more before if you want to be long volatility. The time to buy something like VXX is when the stock market is at all time highs and volatility is at lows. If you think theres some big macro event going to happen that is going to cause the market to drop dramtically, that's when you want to buy it.

Thanks @Domingo Halliburton

Futuristic Eskimo

All Star

They are but I'm but I'm not seeing it in the data and Powell is making a point of being data dependant. It's probably foolish of me to bet against their guidance but at the very least I see the language in their statement becoming very dovish.It seems a lot of the fed officials keep calling for a hike this month. Hard to say.

dora_da_destroyer

Master Baker

learned this lesson the hard way, was trying to play with one of these (TVIX) with ZERO understanding. lost about $1000 on itWell vix is a measure of volatility in the market. So it's not like a typical stock you would buy. Typically these funds are either buying (if they're long) or selling (short) vix futures. This creates a lot of carry (i.e. they have to spend a bunch of money buying the next month's futures) so these funds almost always are going down in price. Look at an all time chart for VXX or something like that, you'll see it just goes down in price. I would be careful with these funds and make sure you're always looking at the vix futures.

Edit:

This is a post of mine from 2015 in here:

You see how VXX is making all time lows like a fifth of the trading days? Long vol funds are hard to be long. You have to get the timing right.

Domingo Halliburton

Handmade in USA

learned this lesson the hard way, was trying to play with one of these (TVIX) with ZERO understanding. lost about $1000 on it

Did the same in college. They did a reverse split on me.

Domingo Halliburton

Handmade in USA

So it looks like big names like apple going to sell and some boring staple like clorox or some shyt might do well.