bigsausagepizzapapi

Rookie

Either:

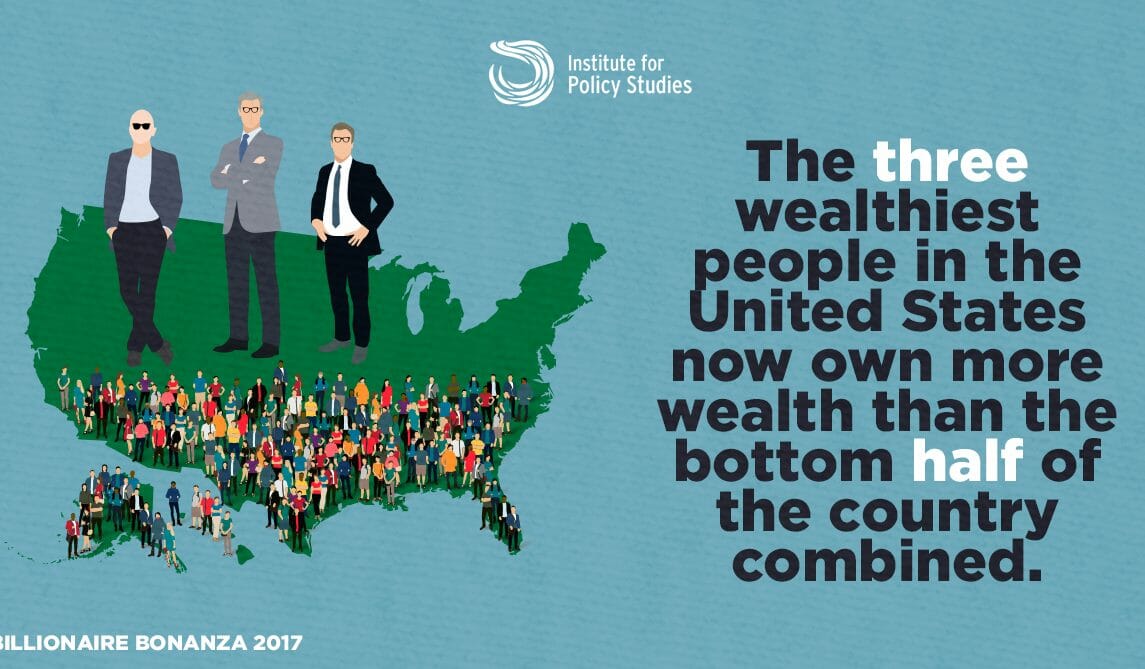

Securities based borrowing needs to be taxed

or

Unrealized gains of some excess needs to be taxed

Because the wealthy don't generate income or have capital gains they just borrow against their wealth to avoid paying taxes.

You will never win support of unrealized gains tax because homeowners will clutch their pearls even though they are way below the threshold.

Securities based borrowing needs to be taxed

or

Unrealized gains of some excess needs to be taxed

Because the wealthy don't generate income or have capital gains they just borrow against their wealth to avoid paying taxes.

You will never win support of unrealized gains tax because homeowners will clutch their pearls even though they are way below the threshold.

Sounds like we tax big business and give all the sweetheart deals to small business. Offset some of the costs a higher minimum wage would bring to small businesses.

Sounds like we tax big business and give all the sweetheart deals to small business. Offset some of the costs a higher minimum wage would bring to small businesses.