Domingo Halliburton

Handmade in USA

Ruble Jumps on Bets Russia to Act to Stem Rout as Ukraine Flares

The ruble ended a four-day rout as speculation mounts that Russia’s central bank will take new steps to stem the worst weekly rout in five years as tension worsens in Ukraine’s east.

The currency climbed 1.2 percent to 46.30 per dollar at 4:09 p.m. in Moscow, after falling as much as 3.7 percent earlier. The ruble retreated 7.1 percent this week, the most since at February 2009 on a closing basis. Ten-year government bonds fell for a third week, while wagers for interest-rate increases rose for the first time in eight days.

Since the Bank of Russia abandoned its currency-intervention policy on Nov. 5, traders have tested how far the ruble needs to drop before Russia injects cash to prop it up. The ruble slid to a record 48.6495 per dollar today as new fighting in Ukraine and Brent’s longest weekly declining streak since 2001 put pressure on Russian assets. It rebounded as much as 2.6 percent on speculation over central bank plans for an emergency meeting, Citigroup Inc. and OAO Promsvyazbank said.

“The turnaround must be related to speculation about possible CBR actions,” Ivan Tchakarov, the chief economist at Citigroup in Moscow, said by e-mail. “The market is very jittery now and it responds to any rumors, speculations etc. I don’t think what we have been seeing the last couple of days can in any way be linked to market fundamentals.”

The ruble’s 29 percent retreat against the dollar this year has driven the currency’s relative-strength index to the second-most oversold level among 34 emerging markets, according to data compiled by Bloomberg. The selloff was exacerbated in the past month by oil’s slide to four-year lows in London, which curtails revenue for the world’s largest energy exporter.

Ukraine Fighting

While canceling its predictable intervention policy, Russia’s central bank included a caveat reserving the right to sell foreign currency unannounced if it deems there’s a threat to the nation’s financial stability.

“It’s too early to talk about the ruble’s reversal,” Igor Akinshin, a foreign-exchange trader at OAO Alfa Bank, said by phone. “Bigger and smaller players are closing positions today and taking profits.”

The crisis in Ukraine is coming to a head after Ukraine and its allies accused separatists of undermining peace efforts with Nov. 2 elections in Donetsk and Luhansk. Dozens of tanks and other military vehicles crossed the border into Ukraine from Russia, the government in Kiev said, as tensions between the former Soviet republics threatened to escalate into open war.

Extraordinary Meeting

The depreciation has been speculative in nature and the ruble will gain in the near term, RIA Novosti cited Finance Minister Anton Siluanov as saying today. Russia’s foreign-currency reserves are sufficient for a “rapid response,” he said. Reserves stood at $428.6 billion on Oct. 31, down $83 billion this year.

The ruble strengthened 1.4 percent against the central bank’s dollar-euro basket today. Wagers for rate increases in the next three months rose to 85 basis points from 69 basis points yesterday, according to data compiled by Bloomberg.

Under the new exchange-rate rules, the central bank spends $350 million just once a day to support the ruble when it falls past its lower trading band. Previously, it would pour in $350 million each time the ruble fell by 5 kopeks past the boundary before moving the band again and repeating the process, enabling traders to profit from keeping short currency positions.

“There have been rumors that central bank has an extraordinary meeting,” Aleksey Kulakov, a Moscow-based senior derivatives trader at Promsvyazbank, said by e-mail today. “Siluanov says that the ruble will appreciate and the most active participants in the market went to fix profit and close long dollar positions.”

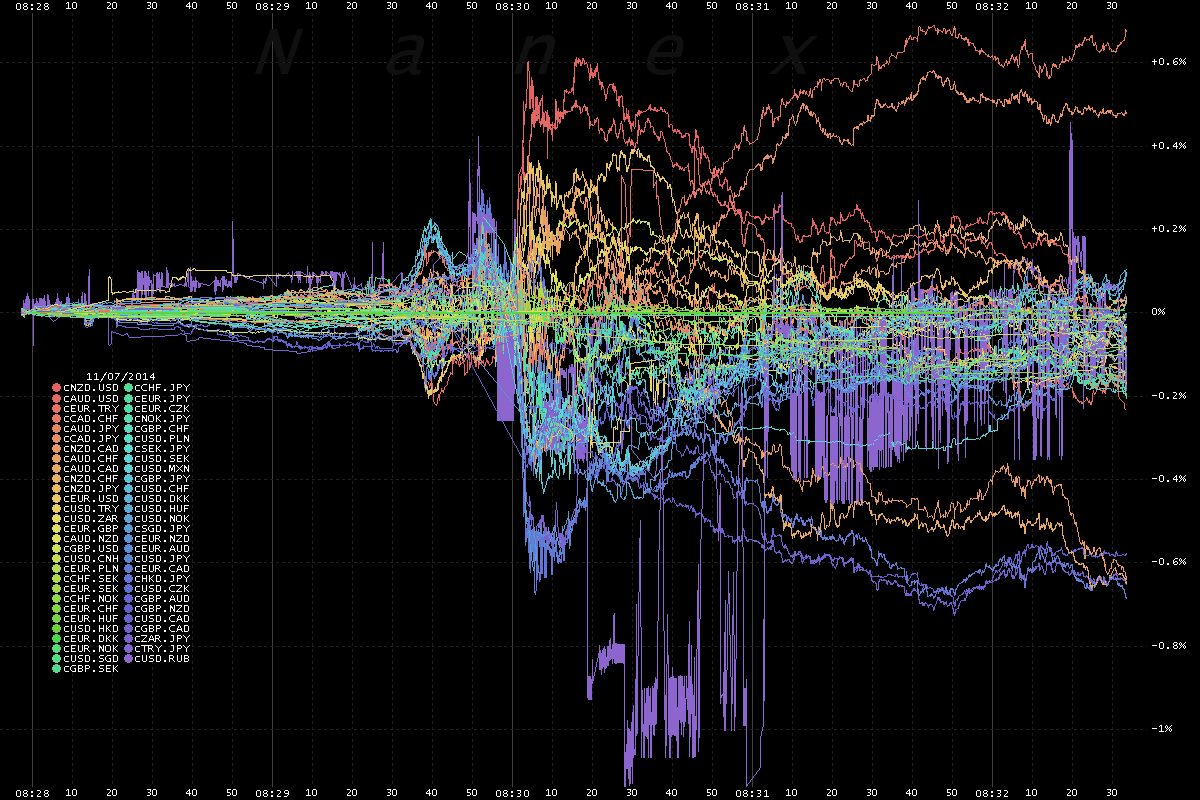

Meanwhile the ruble was all over the place today (purple line):