People live in their own realities and what they don't see in their life they assume it isn't true.The most amazing thing online is people's full blown obsessive belief that exceptions are rules. I am sure we all know a good amount of people making more than 100k. I know some, too. But I know waaaayyyyy more that clearly don't. I don't know them personally but I interact with them daily. Servers. Stockers. Cashiers. Gas station clerks. Grass cutters. Construction workers. That list can go on and on and on. 6% likely isn't that far off the mark.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

6% Of Black Americans Make $100K or More

- Thread starter Stick Up Kid

- Start date

More options

Who Replied?cornercommission2k12

so this were u dudes went

Kinda sad this has to be said. Really speaks to how social media can turn people into bird brains with delusional views on the worldBrehs out here making 60k a yr and expected to pay all the bills

It's white dudes out here making 150k+ and even they goin' 50/50 with no qualms from the wife

I challenged 1 woman who was talking that only blk men want to go 50/50 crap to carry her ass to a Walmart target kohls etc in a predominantly white neighborhood and tell me why all those middle aged white women are working. Think they doing it just to have something to do?

Go to the Chinese restaurant and check out all those women working

Go to Mexican neighborhoods and look at all those women with elote stands lol

50/50 is the life for most Americans.

Secure Da Bag

Veteran

so almost half despite being 13% of the population?

No, 6% of the 15% are black.

Secure Da Bag

Veteran

Keep that weird shyt to yourself, mayne.Fixed det for ya, boss

Tribal Outkast

Veteran

You should feel bad if you’re only making 60k at 30But 60k is doing bad

Givethanks

Superstar

I'm making 100k, if you count the 37K I didn't makeYou should feel bad if you’re only making 60k at 30

It makes zero sense to compare Black Americans to immigrants. Be serious

why would they do that?

Why don’t you do that research and publish it?

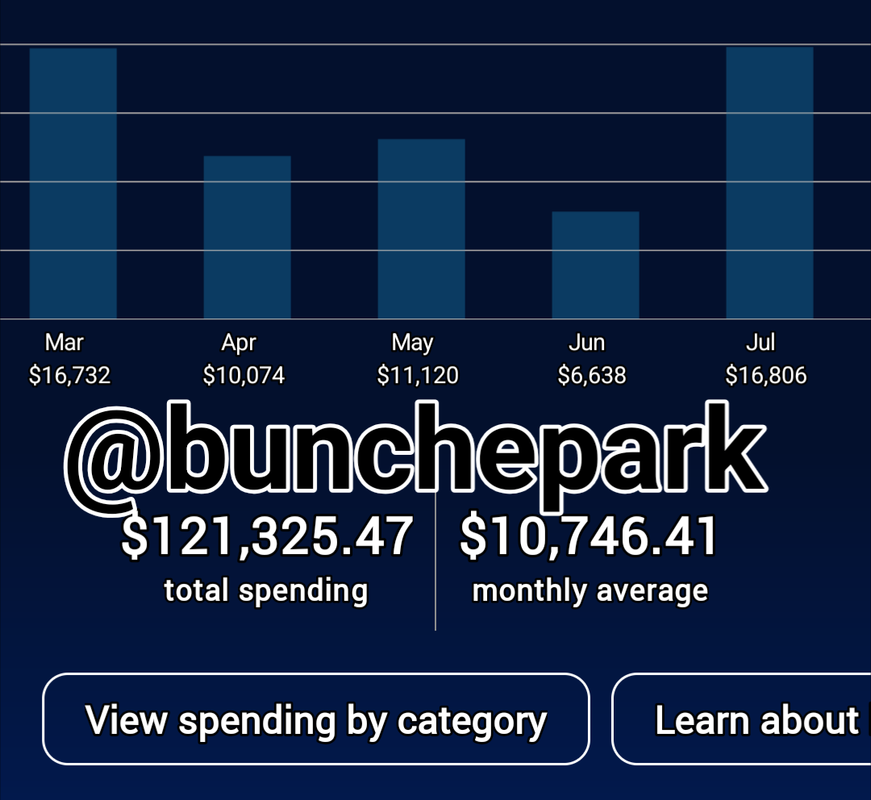

BunchePark

Coli N Calisthenics

I make a base of 95k.

I really didn't "feel" like I was making a lot of money till I sold my house and house hacked.

Don't get me wrong, I knew 95 was better than most, but after you take taxes, medical, retirement, mortgage, and all house hold related bills....95 doesn't feel like a lot of money.

I didn't even include a car payment in that because my car has been paid off for some years now.

Yet, it's folks making way less than 95 paying $700+ on a monthly car payment.

I really didn't "feel" like I was making a lot of money till I sold my house and house hacked.

Don't get me wrong, I knew 95 was better than most, but after you take taxes, medical, retirement, mortgage, and all house hold related bills....95 doesn't feel like a lot of money.

I didn't even include a car payment in that because my car has been paid off for some years now.

Yet, it's folks making way less than 95 paying $700+ on a monthly car payment.

AStrangeName

Member of Snitch Syndication

Damn should I feel privileged?

But seriously after making 100k yearly it really isn't all that much. Its just enoughto splurge a little from time to time.

Also I don't see how people w kids are making it out here with less than 70k.

But those posts, you ARE shytting on other black people

These brehs in this thread are on that Birdman wave, stunting on poor blacks.

White City Black

Ol’ Basquiat head ass

Coli Brehs in this thread: “Hide the money y’all, there’s poor people around!”

“With y’all broke asses!!”

“With y’all broke asses!!”

Last edited:

BunchePark

Coli N Calisthenics

But those posts, you ARE shytting on other black people

These brehs in this thread are on that Birdman wave, stunting on poor blacks.

Man come on

This the Internet

And my posting style is required amongst all the cap on here

I've also posted my taxes on here from when I made 35k the whole year

Its just money I'm not shytting on anyone

Insensitive

Superstar

Also, while I'm talkin' about investing in your Real Estate business.idk.

I only have five sources of debt (I know where all of my debt is at any given time).

Car note - Will be done by the end of the next year.

Personal Loan. - Will be done by next summer

Credit Card. - by the end of this year.

Education. - Not paying this off right now, I'm in school.

Home loan on Investment property. - Paying this down with my tenants money.

Knowing your debts.

Knowing your credit score.

Saving a lot of money.

Knowing your networth at any given time is incredibly important, you need to be cognizant of this.

(I'm approaching $200k as I said before, obviously the market is taking a hit but whatever, I'm getting there at SOME POINT).

For anyone on here who doesn't know their actual networth right now I recommend:

Empower - You can track assets you own, your retirement account balances, all outstanding debt etc.

I would also recommend

YNAB (You need a budget) - You should have budget, I've been slacking all year but I'm tightening up because I don't want to wash out

if I'm hit with an unexpected business expense (which is very likely to happen).

Also if you decide to diversify and get out of JUST owning stocks.

GET A fukkING ATTORNEY.

GET A fukkING ACCOUNTANT.

GET A fukkING LLC.

And make sure all of these are in order as you scale your real estate venture.

Don't go into this shyt lookin' dumb because you aren't paying your property taxes or you aren't deducting

things that you SHOULD be deducting.

For the love of god.

DO NOT spend your profits (this is advice for myself as well!).

Treat the house like a big dividend stock.

The rent is your dividend, don't invest into early debt paydown, instead put anything (after rent, insurance, property tax, property management

expenses) else to the side.

Set a number you can for sure live off of, for me that's roughly $4k a month.

Anything outside of that number, put it into the business, have patience and continue to grow it.

Once your business grows to a sufficient size, you THEN turn your focus to debt paydown

If you can't cover the cost of your insurance deductible for an emergency, you've officially fukked yourself before

an emergency ever comes around and you're definitely impacting your growth because the money isn't being

set aside for the next down payment.

Kingofthereal

King of kings

damn I’m in that 6%. Idk if this is true though.

Similar threads

- Replies

- 55

- Views

- 4K