You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2020 Democratic Primary Thread: Focus on House & Senate races

- Thread starter mc_brew

- Start date

More options

Who Replied?Armchair Militant

Stay woke

Get your mans

Get your manslook, just for the record...I'm not opposed to UBI. Do you think I'm turning down a thousand a month?

Does it just seem like it wouldn't work to meif we can just print money then why run a deficit at all? why run a trillion dollar deficit when we can just "give" 2.5 trillion to ourselves?

Pretty sure they wouldn't have to print it. Just take it from somewhere else if he follows what he says. But if they did print it would be a drop in the bucket compared to what's coming at the end of the tunnel.

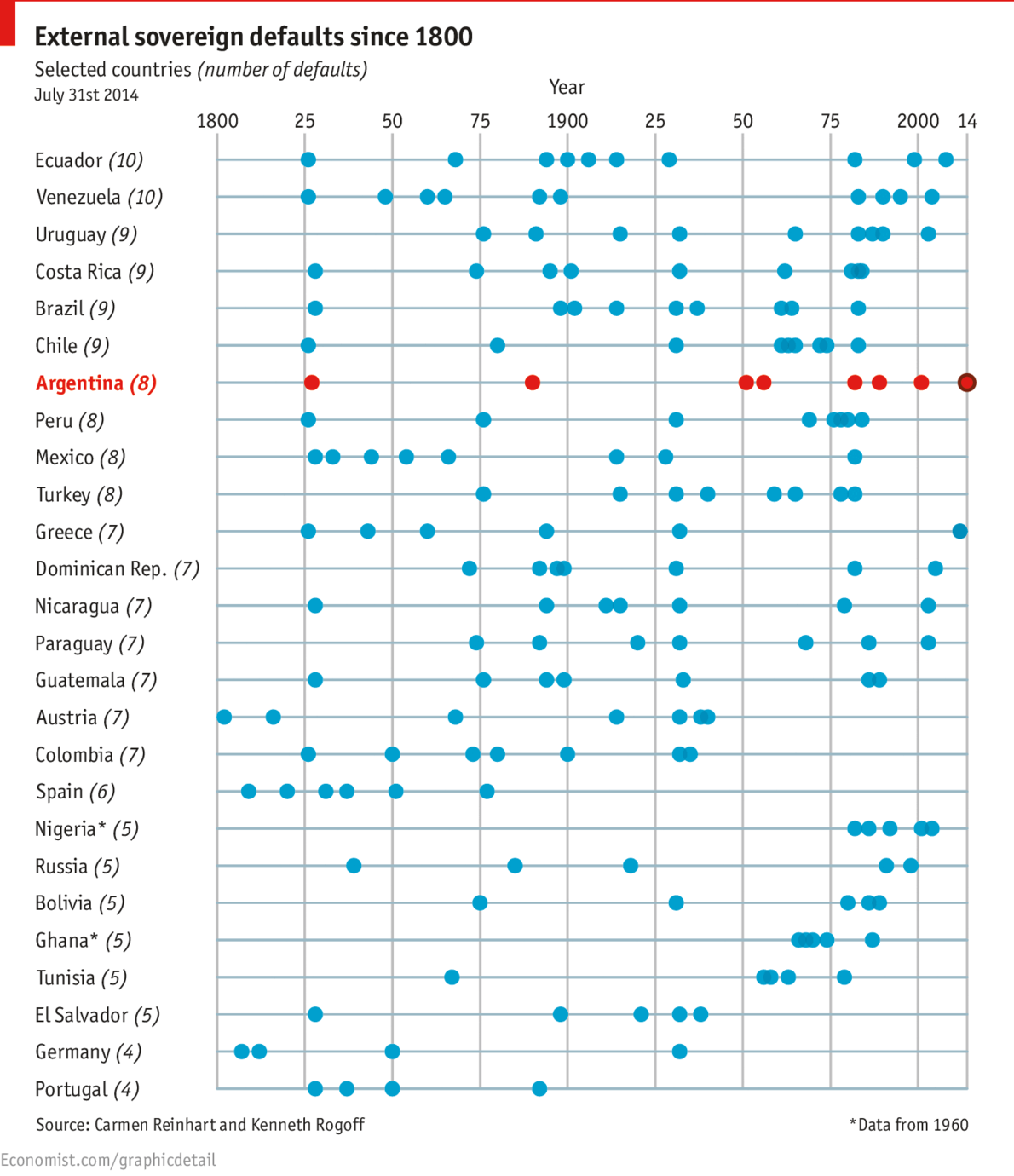

At the same time, that deficit now with never be repaid in full ever! Every other country that has that kind of debt to GDP level just called it a day and restructured the debt. Just have to have the balls to do it. But same time they have a printing press so

.

.Then can restructure the debt owed to other countries and start America 2.0.

1st world countries have been restructuring debt since the1300s. More data out there but too lazy to look for it now. But it's one of those hard conversations America never really has or honestly just doesn't want to have.

Last edited:

Secure Da Bag

Veteran

Then can restructure the debt owed to other countries and start America 2.0.

For those of us who don't know what restructuring debt actually is:

Debt Restructuring: Realignment of Debt to Make It More Manageable

What Is Debt Restructuring?

Debt restructuring is a process used by companies to avoid the risk of default on existing debt or to take advantage of lower available interest rates. Debt restructuring can be carried out by individuals on the brink of insolvency as well, and by countries that are heading for default on national debt.

How Debt Restructuring Works

Some companies seek to restructure debts when they're facing bankruptcy. They might have several loans are structured in such a way that some are subordinate in priority to other loans. The senior debtholders would be paid before the lenders of subordinated debts if the company were to go into bankruptcy. Creditors are sometimes willing to alter these and other terms to avoid dealing with a potential bankruptcy or default.

The debt restructuring process is typically carried out by reducing the interest rates on loans, by extending the dates when the company’s liabilities are due to be paid, or both. These steps improve the firm’s chances of paying back the obligations. Creditors understand that they would receive even less should the company be forced into bankruptcy and/or liquidation.

Restructuring debt can be a win-win for both entities. The business avoids bankruptcy and the lenders typically receive more than what they would through a bankruptcy proceeding.

...

Countries can face default on their sovereign debt, and this has been the case throughout history. In modern times, they sometimes opt to restructure their debt with bondholders. This can mean moving the debt from the private sector to public sector institutions that might be better able to handle the impact of a country default.

Sovereign bondholders might also have to "take a haircut" by agreeing to accept a reduced percentage of the debt, perhaps 25% of the full value of the bond. The maturity dates on bonds can also be extended, giving the government issuer more time to secure the funds needed to repay its bondholders. Unfortunately, this type of debt restructuring doesn't have much in the way international oversight, even when restructuring efforts cross borders.

Debt restructuring provides a less expensive alternative to bankruptcy when a company, individual, or country is in financial turmoil. It's a process through which an entity can receive debt forgiveness and debt rescheduling to avoid foreclosure or liquidation of assets.

Secure Da Bag

Veteran

Republicans got Democrats worrying about debt again. Groundhog’s day again.

Nah. We're good. We're asking for too much to be worried about that.

intra vires

Glory to Michigan

Sorry Dora you know I adore ya but I have to post this poll...

Buttigieg?

Buttigieg?

Pete rising, Gillibrand not going anywhere... I've got money riding on this.

Buttigieg?

Buttigieg?

Pete rising, Gillibrand not going anywhere... I've got money riding on this.

JoogJoint

In my own league.

Sorry Dora you know I adore ya but I have to post this poll...

Buttigieg?

Pete rising, Gillibrand not going anywhere... I've got money riding on this.

I'm not surprised. There's a lot of buzz around him in the media and well he is part of the LGBTQ community and we all know that's what Democrats care about...and immigration.

She had more name recognition than everyone but Bernie, Booker, Warren, Beto and Harris and still needs more donors. Not to mention she also had the Bernie bros. How she going to let Yang and Pete beat her to 65k

the next guy

Superstar

beto is ironing out wrinkles why is there no movement for him?

Secure Da Bag

Veteran

JoogJoint

In my own league.

She had more name recognition than everyone but Bernie, Booker, Warren, Beto and Harris and still needs more donors. Not to mention she also had the Bernie bros. How she going to let Yang and Pete beat her to 65k

She needs more charismatic energy.

JoogJoint

In my own league.

beto is ironing out wrinkles why is there no movement for him?

Movement for what exactly? In order to have a movement, you have to have a purpose and a platform. He's in this for self-serving reasons.

the next guy

Superstar

poll wise i mean.Movement for what exactly? In order to have a movement, you have to have a purpose and a platform. He's in this for self-serving reasons.

intra vires

Glory to Michigan

I'm not surprised. There's a lot of buzz around him in the media and well he is part of the LGBTQ community and we all know that's what Democrats care about...and immigration.

True and given the MOE (6.2%) I expect him to fall, but it's interesting to see him climb to 3rd place in Iowa.

beto is ironing out wrinkles why is there no movement for him?

He's not in running Texas anymore and we don't love him like that. He's not Kobe.

It's just one poll in Iowa, I've seen O'Rourke ranging from 3-5 in earlier polls... he's doing fine.