The Racial Wealth Gap in America: Asset Types Held by Race

Published

4 months ago

on

June 12, 2020

By

Jenna Ross

Tweet

Share

Share

Reddit

Email

The Racial Wealth Gap

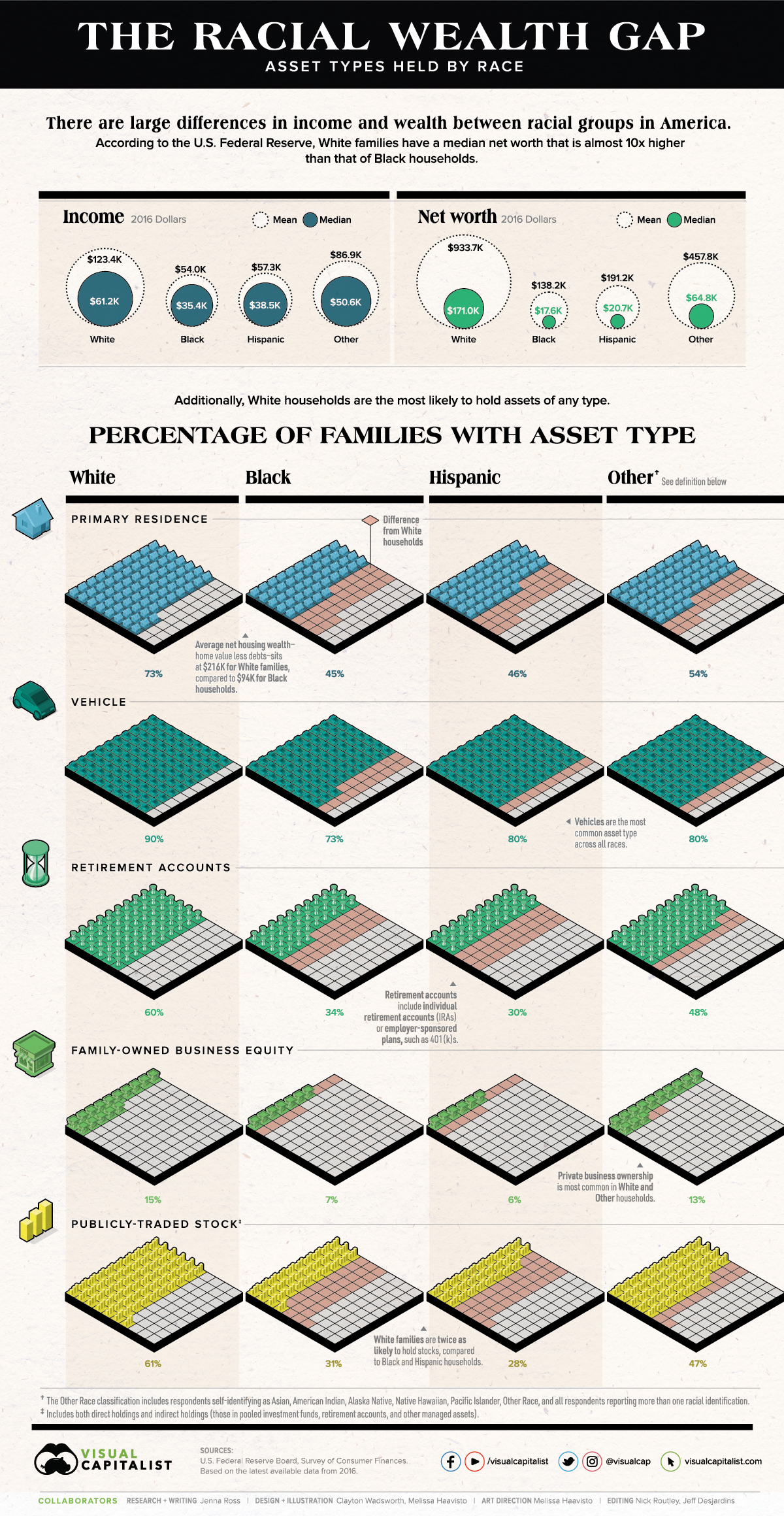

People of color have faced economic inequality for generations, and the recent wave of Black Lives Matter protests has renewed discussions on these disparities.

Compared to White families, other races have lower levels of income and net worth. They are also less likely to hold assets of any type. In fact, 19% of Black families have zero or negative net worth, while only 9% of White households have no wealth.

Today’s chart uses data from the U.S. Federal Reserve’s triennial Survey of Consumer Finances to highlight the racial wealth gap, and the proportion of households that own different kinds of assets by racial group.

Asset Types Held By Race

The financial profile between racial groups varies widely. Below is the percentage of U.S. families with each type of asset, according to the most recent survey from 2016.

White Black Hispanic Other

Primary Residence 73% 45% 46% 54%

Vehicle 90% 73% 80% 80%

Retirement Accounts 60% 34% 30% 48%

Family-owned Business Equity 15% 7% 6% 13%

Publicly-traded Stocks 61% 31% 28% 47%

Vehicles are the most common asset across all racial groups, followed by a primary residence.

However, the level of equity—or home value less debts—families have in their houses differs by race. White families have equity of $215,800, whereas Black and Hispanic households have net housing wealth of $94,400 and $129,800 respectively.

In addition, White households are more likely to hold financial assets such as retirement accounts, family businesses, and stocks. These assets are instrumental in building wealth, and are prominent in the wealth composition of America’s richest families.

With fewer people of color holding these assets, they miss out on higher average returns than low-risk assets, as well as the power of compound interest. These portfolio differences are striking, but they are not the most important contributing factor in the racial wealth gap.

Demographic and Economic Variations

White households are also more likely to have demographic characteristics that are associated with wealth. According to the U.S. Federal Reserve, they are:

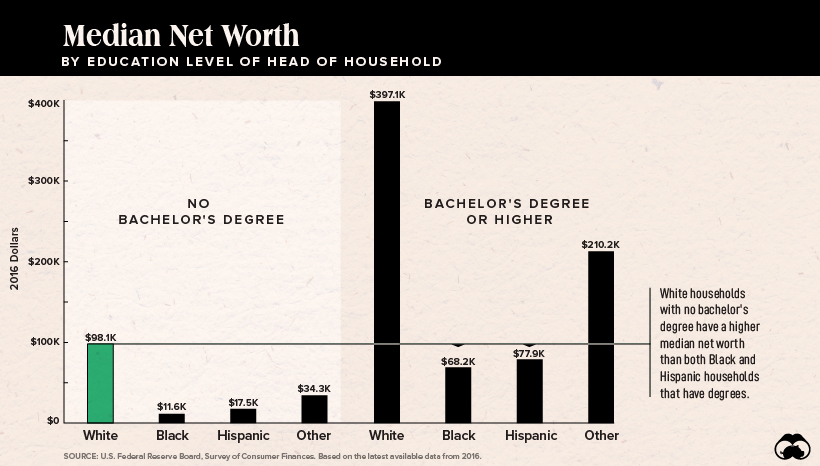

Enormous wealth disparities exist between families with the same education level. Even in cases where Black and Hispanic household heads have obtained a bachelor’s degree, their families’ median wealth of $68,000 and $78,000 respectively is still lower than the $98,000 median wealth for White families where the head has no bachelor’s degree.

After accounting for demographic factors, researchers still found there were considerable inequities. What, then, could be primarily responsible for the racial wealth gap?

The Income Gap

While previous research found that the wealth gap is “too big” to be explained by a difference in income, a recent study from the Federal Reserve Bank of Cleveland offers a new perspective. Focusing on White and Black U.S. households only, researchers analyzed the dynamics of wealth accumulation over time, as opposed to previous studies that considered short time periods.

They found that income inequality was the primary contributor to the racial wealth gap. According to the model, if Black and White households had earned the same labor income from 1962 onwards, the Black-to-White wealth ratio would have reached 0.9 by 2007.

Moving forward, the study concludes that policy changes will likely have a positive impact if they address issues contributing to income gaps. This includes reducing racial discrimination in the labor market, and creating programs, such as mentorships, that improve environments for specific racial subgroups.

The Racial Wealth Gap in America: Asset Types Held by Race

Published

4 months ago

on

June 12, 2020

By

Jenna Ross

Tweet

Share

Share

The Racial Wealth Gap

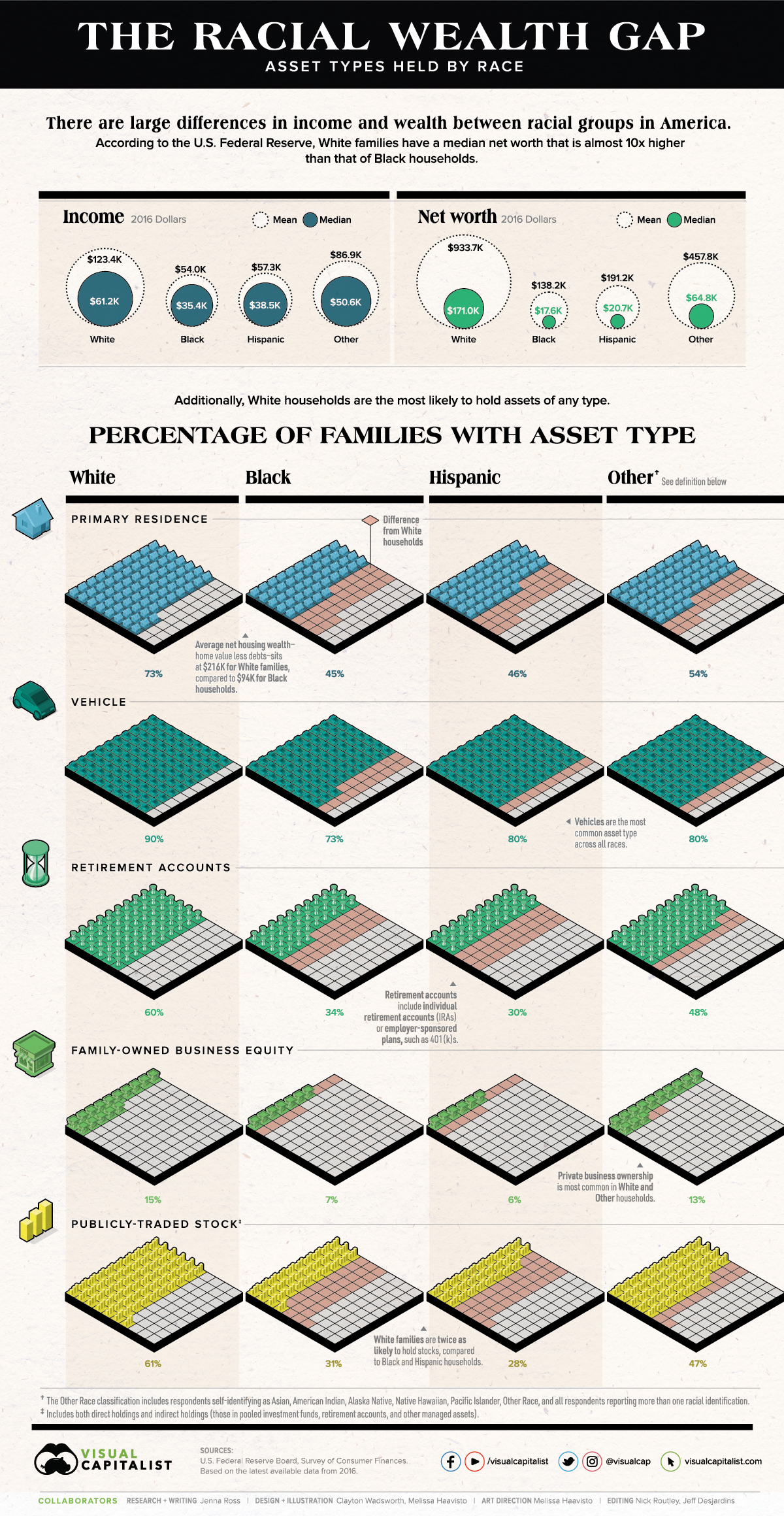

People of color have faced economic inequality for generations, and the recent wave of Black Lives Matter protests has renewed discussions on these disparities.

Compared to White families, other races have lower levels of income and net worth. They are also less likely to hold assets of any type. In fact, 19% of Black families have zero or negative net worth, while only 9% of White households have no wealth.

Today’s chart uses data from the U.S. Federal Reserve’s triennial Survey of Consumer Finances to highlight the racial wealth gap, and the proportion of households that own different kinds of assets by racial group.

Asset Types Held By Race

The financial profile between racial groups varies widely. Below is the percentage of U.S. families with each type of asset, according to the most recent survey from 2016.

White Black Hispanic Other

Primary Residence 73% 45% 46% 54%

Vehicle 90% 73% 80% 80%

Retirement Accounts 60% 34% 30% 48%

Family-owned Business Equity 15% 7% 6% 13%

Publicly-traded Stocks 61% 31% 28% 47%

Vehicles are the most common asset across all racial groups, followed by a primary residence.

However, the level of equity—or home value less debts—families have in their houses differs by race. White families have equity of $215,800, whereas Black and Hispanic households have net housing wealth of $94,400 and $129,800 respectively.

In addition, White households are more likely to hold financial assets such as retirement accounts, family businesses, and stocks. These assets are instrumental in building wealth, and are prominent in the wealth composition of America’s richest families.

With fewer people of color holding these assets, they miss out on higher average returns than low-risk assets, as well as the power of compound interest. These portfolio differences are striking, but they are not the most important contributing factor in the racial wealth gap.

Demographic and Economic Variations

White households are also more likely to have demographic characteristics that are associated with wealth. According to the U.S. Federal Reserve, they are:

- Older, with more than half of households age 55 and up

- More highly educated, with 51% having some type of degree

- Less likely to have a single parent

- More likely to have received an inheritance

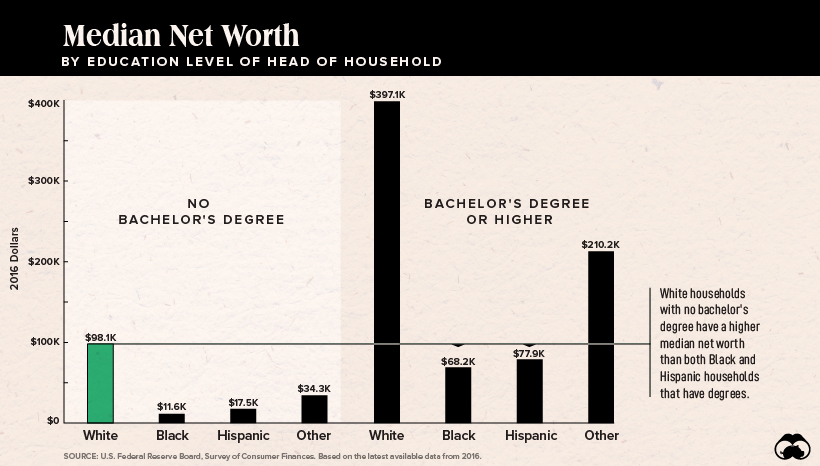

Enormous wealth disparities exist between families with the same education level. Even in cases where Black and Hispanic household heads have obtained a bachelor’s degree, their families’ median wealth of $68,000 and $78,000 respectively is still lower than the $98,000 median wealth for White families where the head has no bachelor’s degree.

After accounting for demographic factors, researchers still found there were considerable inequities. What, then, could be primarily responsible for the racial wealth gap?

The Income Gap

While previous research found that the wealth gap is “too big” to be explained by a difference in income, a recent study from the Federal Reserve Bank of Cleveland offers a new perspective. Focusing on White and Black U.S. households only, researchers analyzed the dynamics of wealth accumulation over time, as opposed to previous studies that considered short time periods.

They found that income inequality was the primary contributor to the racial wealth gap. According to the model, if Black and White households had earned the same labor income from 1962 onwards, the Black-to-White wealth ratio would have reached 0.9 by 2007.

Moving forward, the study concludes that policy changes will likely have a positive impact if they address issues contributing to income gaps. This includes reducing racial discrimination in the labor market, and creating programs, such as mentorships, that improve environments for specific racial subgroups.

The Racial Wealth Gap in America: Asset Types Held by Race