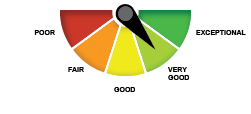

I spend a lot of time getting my FICO score that high. back in November it was like 675 and if i keep it up i'm gonna see an 800+ score.

I used to think credit was such a bad thing but when you have decent credit life is a different ballgame. you can take advantage of all the scams credit card companies use to entice and lure irresponsible people into a cycle of monthly payments cash back and 0 percent apr for a year and a half.

these credit card companies keep trying to get me to get their better cards. Discover It especially.

credit cards often double your manufacture warranty on items and you can earn cash back on purchases. even if you have the cash you're better off charging something and then paying it off just to get those added benefits.fukk credit.

Cash is king my nikka.

fell off man. Beginning of year I was at like 802 then I paid off my mortgage when I sold my condo and took out a credit line against my investment account to use for building my new house. I guess that score will do for now though.

fell off man. Beginning of year I was at like 802 then I paid off my mortgage when I sold my condo and took out a credit line against my investment account to use for building my new house. I guess that score will do for now though.