You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Essential The Africa the Media Doesn't Tell You About

- Thread starter TommyHilltrigga

- Start date

More options

Who Replied?loyola llothta

☭☭☭

Yemi Osinbajo on the hypocrisy of rich countries’ climate policies

Nigeria’s vice-president says they cannot demand more stringent actions than they will commit to themselves

May 14th 2022

AFRICA NEEDS more energy. Total electricity use for more than a billion people, covering all 48 sub-Saharan African countries except South Africa, is less than that used by Spain (home to just 47m). The dearth of power hurts livelihoods and destroys the dreams of hundreds of millions of young people.

We must close the global energy inequality gap. Africans need more than just lights at home. We want abundant energy at scale so as to create industrial and commercial jobs. To participate fully in the global economy, we will need reliable low-cost power for facilities such as data centres and, eventually, for millions of electric vehicles.

If our continent’s unmet energy needs are already huge, future demand will be even greater as populations expand, urbanisation accelerates and more people move into the middle class. By 2050, Nigeria will surpass America in population with over 400m people on current forecasts, with the vast majority of citizens in cities. Lagos’s population alone will surpass 30m people.

The Nigerian government remains committed to universal energy access, and all Nigerians deserve to enjoy the benefits of modern energy that are taken for granted in the rich world. We should aim to generate a national average power output of at least 1,000 kilowatt-hours per person which, combined with population growth, means that by 2050 we will need to generate 15 times more electricity than we do today. That ambitious goal will require vast resources.

President Muhammadu Buhari has also pledged that Nigeria will reach net-zero emissions by 2060. We are currently implementing power sector initiatives and reforms focused at expanding our grid, increasing generation capacity, and deploying renewable energy to rural and underserved populations. We aim to end wasteful gas flaring by 2030, instead leveraging this domestic resource for our own economic growth. Reaching both our development and climate ambitions, however, will require far more external support and the same policy flexibility that rich nations claim for themselves in the energy transition. We cannot achieve our goals otherwise.

Despite the tremendous energy gaps, global policies are increasingly constraining Africa’s energy technology choices. Rich countries, especially in Europe, have repeatedly called for African states to use only renewable power sources. This is partly because of a naive belief in leapfrogging, the assumption that, like skipping landlines for mobile phones, Africa can ‘leap’ to new energy technologies. The renewables-only mantra is also driven by unjustified fears of the continent’s future emissions. Yet under no plausible scenario is Africa a threat to global climate targets. Such demands extend even to cooking, where some funders will not support any gas projects although they bring immediate and substantial benefits. The vast majority of Africans still use charcoal or wood to cook, leading to deforestation, early death from indoor air pollution and avoidable carbon emissions.

Instead of viewing Africa’s emergence as a threat to be blocked, the continent should be seen as a tremendous opportunity. The challenge for the continent is to transition to net-zero emissions while at the same time building sustainable power systems to drive development and economic opportunity. The EU’s recent decision to label natural gas and nuclear power as green investments recognises a critical truth: different countries will follow different paths in the energy transition. If this is true for Europe, it’s even more true for diverse African nations.

A promising step was announced last year in Scotland at COP26, the annual UN climate talks, when South Africa received an $8.5bn package to accelerate its energy transition. It is high time to extend that kind of support to the rest of the continent. Nigeria has four times South Africa’s population and yet uses just one-eighth as much electricity. COP27 will be held in Egypt in November. Now is the ideal time to reset global policy so as to bolster Africa’s plans for producing clean energy. Wealthy countries have contributed the most to climate change, and they cannot demand more stringent actions than they will commit to themselves.

First, developed nations should commit to funding in full Africa’s energy transition. This is both a moral imperative and an environmental necessity. We estimate that Nigeria requires $400bn of new investment above business-as-usual spending to meet its net-zero pledge. A green energy package, akin to South Africa’s, should offer at least $10bn per year over the next two decades. Investments would cover not only new renewable generation projects, but also transmission infrastructure, smart grids, data management systems, storage capacity, electric vehicles, clean cooking, and the costs of integrating new distributed energy systems.

Second, there must be a hiatus on blanket bans for fossil-fuel financing in developing countries. Coal investment is already dead in most of Africa and any future oil investment will come from private sources. But financing rules on natural gas will greatly affect our development and our energy transition to net zero. Though solar will provide most of our power in the future, we still need natural gas for baseload power and balance. We insist that liquefied petroleum gas (LPG) be included as a clean cooking alternative to save the lives of our women and girls and to protect our own natural environment. Europe says it needs a decade more of gas investment to meet its 2050 climate targets. Africa—with our greater challenges—should have at least two more decades in order to meet our climate targets.

The world cannot tackle collective challenges if poor nations are treated as second class, or their aspirations are ignored. After enduring colonialism, decades of unfair economic practices and covid-19 vaccine apartheid, we cannot accept regressive climate policy as another injustice. Tackling the dual crises of poverty and climate change can only succeed if all countries play their fair part–and all of humanity is lifted up together.

Yemi Osinbajo is the vice-president of Nigeria.

Yemi Osinbajo on the hypocrisy of rich countries’ climate policies

Y'all love to say "focus on the message, not the messenger"... IDK about the Nigerian government but breh is right and exact as far as pointing out how first-world nations weaponize climate change rhetoric against development in third-world nations.

loyola llothta

☭☭☭

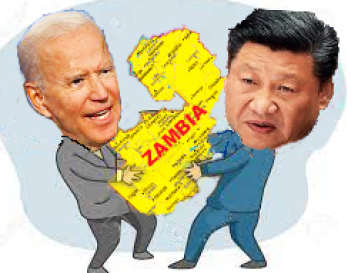

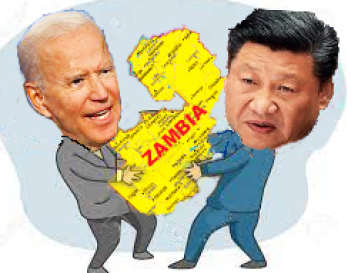

The Sun Never Sets: Why Is AFRICOM Expanding in Zambia?

Jeremy Kuzmarov

17 May 2022

Image: Covert Action Magaine

Image: Covert Action Magaine

Why Is AFRICOM Expanding in Zambia? Because of Zambia’s Copper and to Thwart the Chinese.Originally published in Covert Action Magaine . Also available in ML Today .

On April 25, the U.S. government announced that U.S. African Command (AFRICOM) will open an Office of Security Cooperation at the U.S. Embassy in Zambia.

Brigadier General Peter Bailey, AFRICOM’s Deputy Director for Strategy, Engagement, and Programs, made the announcement in Zambia during a meeting with Zambian President Hakainde Hichilema (HH), who took office on August 21, 2021.

Jeremy Kuzmarov

17 May 2022

Image: Covert Action Magaine

Image: Covert Action MagaineWhy Is AFRICOM Expanding in Zambia? Because of Zambia’s Copper and to Thwart the Chinese.Originally published in Covert Action Magaine . Also available in ML Today .

On April 25, the U.S. government announced that U.S. African Command (AFRICOM) will open an Office of Security Cooperation at the U.S. Embassy in Zambia.

Brigadier General Peter Bailey, AFRICOM’s Deputy Director for Strategy, Engagement, and Programs, made the announcement in Zambia during a meeting with Zambian President Hakainde Hichilema (HH), who took office on August 21, 2021.

According to AFRICOM, the new Office of Security Cooperation will “enhance military-to-military relations [between AFRICOM and Zambian armed forces] and expand areas of cooperation in force management, modernization and professional military education for the Zambian security forces.”

The U.S. government possesses a giant embassy in Lusaka and, since 2014, has invested more than $8 million in assistance for Zambian battalions deployed to a United Nations peacekeeping mission in the Central African Republic (CAR).

The U.S. is also rumored to possess secret spy facilities in Zambia, which borders on the mineral-rich Democratic Republic of Congo (DRC).

Betrayal of Non-Aligned Policy

Emmanuel Mwamba, Zambia’s former representative to the African Union (AU), had tried to block AFRICOM’s expansion into Zambia , following the precedent of Zambia’s last four presidents (Levy Mwanawasa, Rupiah Banda, Michael Sata and Edgar Lungu).

Mwamba emphasized that, since obtaining its independence from Great Britain in 1964, Zambia has promoted a non-aligned policy and cooperated with all powers, including Russia and China as well as the U.S.

Mwamba further noted that the AU and Southern African Development Community (SADC) have tried to resist the establishment of U.S. and other foreign military bases and security offices in Africa, and have been developing their own standby military forces and security architecture designed to prevent a return to the era of colonialism.

“Copper is the New Oil”

The U.S. interests and motivations underlying the AFRICOM expansion in Zambia are not hard to discern.

As CAM previously reported , Zambia is one of the world’s leading producers of copper, which according to a recent Goldman Sachs report, Copper is the New Oil , is crucial in the transition to a clean energy economy.

Copper is a key electrical conductor and component for solar and wind power plants, electric vehicles and batteries, and energy-efficient buildings.

Hichilema was favored by the U.S. State Department in Zambia’s August 2021 election because of his pledge to boost domestic refining capabilities and loosen regulations and lower taxes on foreign mining companies operating in Zambia to enable a $2 billion expansion of copper production .

One of the big beneficiaries of the new policies is Barrick Gold, a Canadian company which owns the $735 million Lumwana copper mine in Solwezi and is poised to expand its operations.

A major investor in Barrick Gold is BlackRock , the world’s largest asset manager operating out of Wall Street.

Its founder and CEO, Laurence Fink, was a donor to Barack Obama, Hillary Clinton, Chuck Schumer and John Kerry , along with Paul Ryan and other Republican and Democratic Party politicians who supported the expansion of AFRICOM.

BlackRock is also a major investor with J. P. Morgan Chase in First Quantum Minerals , which owns 80% of the Kansanshi mine in Zambia’s Copperbelt, the largest mine in Africa, along with the Sentinel mine in Kalumbila .

BlackRock further invested in Glencore and Vedanta Resources, which own additional Zambian copper mines and, like the others, have checkered records when it comes to workers’ rights and the environment.

Protecting the Free Flow of Natural Resources

AFRICOM was established in 2007 with the official purpose of promoting a “stable and secure African environment in support of U.S. foreign policy.”

Today, AFRICOM sustains ties with 53 African nations and provides a cover for an estimated 9,000 U.S. troops stationed in Africa and at least 27 military bases .

AFRICOM founder Vice Admiral Robert Moeller admitted that one of AFRICOM’s guiding principles was “protecting the free flow of natural resources from Africa to the global market.” That description applies very well in the Zambian case.

Great Game Struggle with Chinese

Tied to the motive of natural resources exploitation underlying AFRICOM’s expansion into Zambia is the growing geopolitical competition with China.

Zambia has been a significant recipient of China’s Belt and Road Initiative and, in 2018, the volume of China-Zambia bilateral trade reached $5 billion in U.S. dollars , with a year-on-year growth of 33.9%.

As of December 2020, more than 600 Chinese companies operated in Zambia , the majority in the Copperbelt. Zambia even boasts two Chinese-built special economic zones and allowed banking in the Chinese renminbi instead of the kwacha, dollar, or euro to facilitate trade with China .

The latter is unacceptable to U.S. policy-makers who have attempted something drastic in response.

The danger of the AFRICOM expansion for Zambians is palpable not only in its function in protecting foreign control of its economy but aso in generating potential political instability.

According to Black Agenda Report, troops trained by AFRICOM have been behind nine coup d’états in Africa since AFRICOM’s formation.

Zambia could be next, particularly if Hichilema reverses his current policies in the mining sector, or if copper prices fluctuate because of some unforeseen event and Zambia’s economy falters more than it already has.

Last edited:

Why Did Chinese Loans to Africa Fall So Much in 2020?

Of course the COVID-19 pandemic played a role, but there is another factor at play: pressure from international organizations to avoid debt.

By Etsehiwot Kebret and Yike Fu

May 05, 2022

Just $1.9 billion.

According to a recent report published by Boston University`s Global Development Policy (GDP) Center, that’s the number of new loan commitments made from China to African countries in 2020. That’s a startlingly low figure, particularly in the context of the fact that, according to the same database, between 2000 and 2020, Chinese financiers made loan commitments worth $160 billion to African countries – that’s an average of $8 billion annually.

So why such a huge drop, and what does this mean for the future? Is this era of Chinese lending to Africa over?

Based on conversations with several Chinese and African stakeholders, there are two key reasons for the drop.

First and foremost, the most obvious reason for the 2020 drop was the impact of COVID-19 in China. The pandemic essentially eliminated travel by leaders and other dignitaries to and from China, usually crucial for surveying and brokering new financial agreements. The evidence for this is twofold. First, the $1.9 billion was the result of just 11 new loan agreements with eight countries (Uganda, Ghana, DRC, Mozambique, Burkina Faso, Madagascar, Rwanda, and Lesotho) and one regional organization (African Export-Import Bank or Afreximbank). In comparison, there were 43 loan agreements in 2019 and 66 in 2018, and an all-time high of 144 projects in 2016.

Second, of the eight 2020 borrowing countries, only Ghana was a previous top ten borrower of Chinese loans (between 2000-2020, the top recipients of Chinese loans were Angola, Ethiopia, Zambia, Kenya, Egypt, Nigeria, Cameroon, South Africa, Republic of Congo, and Ghana). In other words, the countries China usually lends to didn’t manage to secure agreements in 2020. Clearly, the number of deals was cut short as COVID-19 took hold in China and spread out.

But there is another reason for the drop: Since at least mid-2019, the external pressure on African governments to reduce debt levels has been rising, from organizations such as the IMF, credit rating agencies, as well as non-governmental organizations such as the Jubilee Debt Campaign. Much of this pressure has been unwarranted and indicates bias. For instance, in 2019, 64 countries around the world had public debt over a threshold of 60 percent of GDP, but only a third of these were African. However, at the time, the IMF and World Bank classified 12 of the 64 countries as being in debt distress; the only unifying feature of these 12 countries was that they were all African.

Due to this pressure, and despite huge remaining infrastructure gaps, African governments have become reluctant to take on new debt. The increased expenditures necessary to manage the health and economic impacts of the COVID-19 pandemic have been used as a means to further cement international narratives of “African debt risk,” despite many African countries having managed the pandemic very well.

The evidence for this reasoning – and Chinese lenders in 2020 at least remaining skeptical of these international narratives – is that the 11 loan agreements were not made with countries with low-debt ceilings. In fact, all eight countries, apart from Uganda, at the time were either classified as having moderate or higher levels of debt distress by the IMF. Ghana, which received the most loans from China (three projects) in 2020 was labelled as being in a high level of debt distress (and still is). Nevertheless, our understanding is that even in 2019, other African countries were concerned about the debt distress label, and thus sought to promote other financial structures to meet infrastructure gaps, such as Public Private Partnerships (PPPs).

So if these two factors – COVID-19 and narratives of African debt distress – are the two primary reasons for the drop, what does this mean for the future?

First, contrary to some other analysis, the 2020 drop does not signify that China is changing the way it lends to Africa by focusing on smaller projects. The average size of the loans in 2020 was fairly stable. Overall, the loans were $172 million on average in 2020 versus $234 million in 2019 and $178 million in 2018. And specifically for the eight countries over the period 2016-2020, there was only a drop for Madagascar and DRC (versus their 2019 loans). The Afreximbank loan, the one regional project loan in 2020, was also fairly “normal” at $200 million – building on a 2019 loan of $75 million and two separate loans of $500 million and $350 million in 2018. Indeed, in 2018 there was also a $300 million loan to the African Finance Corporation (AFC) and in 2017 a $250 million loan to the African Trade and Development Bank (TDB). The drop therefore provides no evidence that the “era of big lending” from China (if there ever was one) is over. In terms of project size, the status quo remains.

Second, the drop suggests that the appetite for Chinese financing in Africa is strongly dependent on African demand, rather than other factors such as China’s domestic financial situation. Although the recent Forum on Africa-China Cooperation (FOCAC) in 2021 in Dakar signaled that Chinese lenders are open to exploring alternative financing means such as PPPs and expanding Foreign Direct Investment (FDI) if requested by African counterparts, the same documents also reiterated that China remains open to providing concessional loans. Indeed, in a tweet in April 2022, the director general for Africa at the Chinese Ministry of Foreign Affairs wrote, “Will China stop lending to Africa? Our answer is a NO.”

The fact is cheap, concessional loans are badly needed for infrastructure in Africa, particularly to spur efficient cross-border logistics under the newly established African Continental Free Trade Area (AfCFTA). The alternative is a vicious cycle of debt servicing with no economic return. China, as a development partner, understands these dynamics.

To borrow a Chinese idiom, African countries must avoid 临渴掘井 – “digging the well while thirsty.” To do so, African governments will need to maintain the confidence to continue to put forward proposals to China, including online or through ambassadorial representatives in China, and withstand poorly evidenced pressures to cut budgets. Only then will the $1.9 billion rise back up again.

Why Did Chinese Loans to Africa Fall So Much in 2020?

Buhari signs health insurance bill into law

President Muhammadu Buhari [PHOTO CREDIT: @Buharisallau1]

The new bill repeals the National Health Insurance Scheme (NHIS) Act which has been in existence since 2004.

By Nike Adebowale | May 19, 2022 | 2 min read

Nigeria’s President Muhammadu Buhari has signed into law the National Health Insurance Authority Bill 2022.

Mr Buhari, who disclosed this on his Twitter handle at exactly 5:04 p.m on Thursday, said the development is part of his administration’s efforts to ensure health coverage for Nigerians.

He said the new bill repeals the National Health Insurance Scheme (NHIS) Act which has been in existence since 2004.

“As part of our healthcare reforms, I have signed into law the recently passed National Health Insurance Authority Bill 2022, which repeals the National Health Insurance Scheme Act. We will ensure the full implementation of the new Act, to provide coverage for all Nigerians,” he said.

He said the new National Health Insurance Authority will collaborate with state government health insurance schemes to accredit primary and secondary healthcare facilities and ensure the enrollment of Nigerians.

The chairman of the country’s Senate committee on health, Ibrahim Oloriegbe, has consistently advocated the signing of the bill into law since it was passed by the two chambers of the National Assembly.

According to Mr Oloriegbe, who represents Kwara Central in the upper legislative chamber, the new bill makes health insurance mandatory for all Nigerians.

To reduce huge out-of-pocket spending for health services, which often leaves average and vulnerable Nigerians in penury, the government established the NHIS in 2004.

Despite billions pumped into the scheme since its inception 18 years ago, millions of Nigerians still lack access to quality healthcare services.

About eight out of 10 Nigerians do not have health insurance cover in Africa’s largest economy, according to a 2021 survey by NOI Polls.

The few persons enrolled in the scheme complain of inadequate service delivery. They say the scheme fails to cover key treatments for serious ailments such as cancer which is very expensive and has left many patients and their families with no option than to sell properties to raise funds.

The health insurance scheme is one mostly described as fraudulent and an agency that lacks transparency and accountability. As of 2018, two past heads of the agency were accused of fraud.

Meanwhile, in a statement subsequently issued by presidential spokesperson, Garba Shehu, Mr Buhari said a fund will be set up to ensure coverage of 83 million Nigerians who cannot afford to pay premiums as recommended by the Lancet Nigeria Commission.

He said the “vulnerable group fund” will be financed through the basic health care provision fund, health insurance levy, special intervention fund, as well as any investment proceeds, donations, and gifts to the authority.

He said this will cover the large number of vulnerable individuals who are not able to pay health insurance premiums.

Buhari signs health insurance bill into law

President Muhammadu Buhari [PHOTO CREDIT: @Buharisallau1]

The new bill repeals the National Health Insurance Scheme (NHIS) Act which has been in existence since 2004.

By Nike Adebowale | May 19, 2022 | 2 min read

Nigeria’s President Muhammadu Buhari has signed into law the National Health Insurance Authority Bill 2022.

Mr Buhari, who disclosed this on his Twitter handle at exactly 5:04 p.m on Thursday, said the development is part of his administration’s efforts to ensure health coverage for Nigerians.

He said the new bill repeals the National Health Insurance Scheme (NHIS) Act which has been in existence since 2004.

“As part of our healthcare reforms, I have signed into law the recently passed National Health Insurance Authority Bill 2022, which repeals the National Health Insurance Scheme Act. We will ensure the full implementation of the new Act, to provide coverage for all Nigerians,” he said.

He said the new National Health Insurance Authority will collaborate with state government health insurance schemes to accredit primary and secondary healthcare facilities and ensure the enrollment of Nigerians.

The chairman of the country’s Senate committee on health, Ibrahim Oloriegbe, has consistently advocated the signing of the bill into law since it was passed by the two chambers of the National Assembly.

According to Mr Oloriegbe, who represents Kwara Central in the upper legislative chamber, the new bill makes health insurance mandatory for all Nigerians.

Health Insurance scheme

To reduce huge out-of-pocket spending for health services, which often leaves average and vulnerable Nigerians in penury, the government established the NHIS in 2004.

Despite billions pumped into the scheme since its inception 18 years ago, millions of Nigerians still lack access to quality healthcare services.

About eight out of 10 Nigerians do not have health insurance cover in Africa’s largest economy, according to a 2021 survey by NOI Polls.

The few persons enrolled in the scheme complain of inadequate service delivery. They say the scheme fails to cover key treatments for serious ailments such as cancer which is very expensive and has left many patients and their families with no option than to sell properties to raise funds.

The health insurance scheme is one mostly described as fraudulent and an agency that lacks transparency and accountability. As of 2018, two past heads of the agency were accused of fraud.

Vulnerable group fund

Meanwhile, in a statement subsequently issued by presidential spokesperson, Garba Shehu, Mr Buhari said a fund will be set up to ensure coverage of 83 million Nigerians who cannot afford to pay premiums as recommended by the Lancet Nigeria Commission.

He said the “vulnerable group fund” will be financed through the basic health care provision fund, health insurance levy, special intervention fund, as well as any investment proceeds, donations, and gifts to the authority.

He said this will cover the large number of vulnerable individuals who are not able to pay health insurance premiums.

Buhari signs health insurance bill into law

Africa: Nigerian Tech Startup Pricepally Tackles Rising Food Costs With Bulk-Buying Platform

DW/PricePally Nigerian entrepreneur Luther Lawoyin's cooperative platform, PricePally, enables multiple households to order groceries jointly and benefit from lower prices.

19 MAY 2022

By Nontobeko Mlambo

Johannesburg — Shopping for food in Nigeria's largest cities can be a challenge. After battling the notorious traffic of Lagos or Abuja to reach open-air markets, many shoppers are frustrated to find that the foods on offer are very expensive and that prices are rising all the time.

The Nigerian tech startup Pricepally offers another option. It connects customers in two of Nigeria's largest cities with farm-fresh food at lower prices, delivered to their homes within a day or two.

Through a website and mobile app, Pricepally allows people to buy quality produce and wholesale products directly from producers or local farmers. Customers also have the option to pool their resources and share bulk purchases with other users for additional savings.

The service has been a hit. Now the company is working with Prosper Africa —the U.S. Government initiative to increase trade and investment between African nations and the United States—to connect with U.S. investors and fuel additional growth.

Rapid Growth

Pricepally launched in late 2019 and quickly proved its worth. Customers recognized the service's value and convenience, especially in the face of high inflation.

Only a few months later, when the COVID-19 pandemic hit, users also valued having a safe, affordable way to get the essentials they needed.

"People were scared to go out because of COVID-19," says Pricepally COO Jummai Abalaka, and the company's model met the needs of the moment. "The business was able to get the license from the government to be able to move around during COVID-19 lockdowns and restrictions," she says.

The company rapidly expanded to operate in both Lagos and Abuja, doubled its workforce from seven to 14 employees, and grew its user base to serve more than 5,000 customers each month.

With its next round of investment, Pricepally seeks to improve its warehousing and processing facilities and hire additional tech talent so it can serve more customers.

"In the next five to ten years, we are looking to be working in many African countries," says Pricepally Co-Founder Monsunmola Lawoyin. "We want to make fresh food available for everyone."

A Win-Win For Farmers and Shoppers

For Nigeria's smallholder farmers, Pricepally offers a way to get their products into the hands of customers—even in faraway cities—for a fair price. And, over time, the company hopes to help address other challenges that small farmers face.

"Farmers in Nigeria just farm to make ends meet, but going forward, we are looking at speaking to these farmers and young people to look into farming as a career," says Lawoyin. "In the future, we hope to train farmers and give them the necessary tools needed to succeed in farming."

In addition, because Pricepally connects shoppers directly to farmers, people who use the service can trust that the food they buy is fresh and healthy.

"For transparency, Pricepally has started putting farmer's faces and short bios on the website. Transparency gives a level of trust to the consumers," says Abalaka. "We make sure that what they are consuming is of good quality. We reach out to mostly farmers who grow their products organically. A lot of people are becoming aware of their health, and they are making sure they are eating organic produce and are careful of what they eat."

Pricepally is well positioned to meet the changing needs and shopping behaviors of its customer base. By bridging the gap between farmers and consumers, it offers a smarter and safer way to shop. As it grows, it could help transform the food and agriculture sector in Nigeria and beyond. The big question is: Which investors want to come along for the ride?

Africa: Nigerian Tech Startup Pricepally Tackles Rising Food Costs With Bulk-Buying Platform

loyola llothta

☭☭☭

This is why I always opposed Gates’ push for Miracle rice in Ghana some years back. Once a private non domestic entity controls your food production, you are at their whim and mercy.

Ghana needs to fight this tooth and nail.

Kenyan entrepreneurs welcome Google’s product development centre but could struggle to hold on to talent

by Chimgozirim Nwokoma | Apr 21, 2022

On Monday, April 19, 2022, Google announced the opening of its first product development centre in Nairobi, the Kenyan capital.

Over the next two years, Google plans to hire over 100 employees across software engineering, research, and design roles and, with this launch, joins Visa and Microsoft in setting up shop in Nairobi.

In October 2021, Sundar Pichai, Google CEO, announced that the company planned to invest $1 billion in projects that will “provide fast, reliable, affordable internet across the continent; build helpful, local products; and support the entrepreneurs and small businesses that underpin Africa’s economies.” This product development centre is just one of such projects.

As the global battle for tech talent heats up, African tech talents have been thrust into the spotlight. With record-breaking sums pumped into startups on the continent, who can blame Big Tech companies for hustling to get a piece of the pie.

However, while this development bodes well for local talents, it affects the ability of local startups or businesses to hire suitable talents.

Per Financial Times, following the opening of Microsoft’s African Development Center in 2019 and its subsequent hiring push, some local startups lost their best hands to Microsoft.

According to Caine Wanjau, Twiga Foods CTO, “Microsoft’s entry changed the dynamics of the software engineer market overnight. The company liked what they saw not only in software engineers but product managers and designers, and still now they are actively recruiting.”

With Microsoft offering significantly higher salaries, local startups lost some employees. While Twiga Foods lost four employees, Lori Systems — another startup — lost six employees.

But with Google and Visa joining the fray, the competition for local talent will only increase. And some local entrepreneurs admit as much.

Speaking to Techpoint Africa, June Odongo, Senga Technologies Founder and CEO, said, “In the short term, this will be a strain for startups such as ours, particularly from a compensation perspective given that we are not only competing with the world’s largest technology companies but are also doing so in an ecosystem with different macroeconomic variables from the US.”

Jesse Forrester, Mazi Mobility CEO and Founder, believes that while local entrepreneurs cannot compete on pricing, the presence of Big Tech companies will benefit the local ecosystem in the long run.

“The tech giants have a penchant for snatching up top talent, which in turn affects the ecosystem negatively for startups who can’t compete on pricing. Therefore, they have an opportunity to bring up the collective technological skills whilst still enabling top-class developers to be within reach for startups.

“It’s great for the local ecosystem; more talent and hubs will lead to better software products and development across the country. Hopefully, this will increase the number of highly skilled developers.”

Bilhah Muriithi, Autochek Africa Kenya Country Manager, also believes that the business landscape will benefit in the long run.

“Beyond new job opportunities for Kenyans, the spillover of new technology, culture and processes that have become synonymous with these organizations will ultimately improve the Kenyan business landscape. It will force many local companies to raise the bar in order to attract and retain talent, and that is certainly a good thing.”

On the other hand, Kagure Wamunyu, Jumba Founder and CEO, believes that this will allow local developers to contribute to the local economy while working for global companies.

“The recent launch by these global companies will certainly make the talent market a bit more competitive. However, this also gives an opportunity for talent to work for global companies and still contribute to the local economy, as opposed to having to relocate to the West,” she said.

Odongo and Wamunyu both have experience working for global companies and believe that such developments are good for the long-term growth of the local ecosystem.

“Longer term, this is good for the ecosystem, both for developers and companies. Large companies nurture talent, which further seeds and has a multiplier effect on an ecosystem. Outsourcing talent to Indian companies such as Tata and Wipro by Microsoft, EMC and such is arguably the biggest contributor to India’s current tech boom; we’ll see the same here.

“I had the opportunity to work for such firms learning industry-leading skills, and I’m now here in Kenya with a startup; I think more Kenyans should have those opportunities if they desire such environments,” Odongo added.

Similarly, Wamunyu sees this as validation for the local ecosystem’s growth.

“Having major tech companies invested in Kenya should help shine more of a spotlight on what African companies have achieved over the years, with the help and support of employees, as well as provide an enabling environment for more partnerships and investment opportunities.”

Forrester also hopes that the arrival of companies like Google will encourage local non-traditional investors to step forward.

“The investment singles out Africa as the next frontier for development. A true testament to Africa taking on a more central role in the startup scene globally. I think this will allay fears of the quality of talent we have on the continent, which is great and encourage non-traditional investors in Africa to come forward,” he remarked.

Unable to compete on salaries and benefits, Kenyan startups need to find ways to attract and retain talent. Building great products that provide employees with more autonomy and the feeling of being on a mission might be one way to go, and Odongo agrees.

“We hope to retain our developers by building more interesting and game-changing products and are motivated to scale faster so that we can pay better. Startups, of course, also have their own dynamics which are preferred by a certain set, so that will always remain true.”

Kenyan entrepreneurs welcome Google’s product development centre but could struggle to hold on to talent

Nkrumah Was Right

Superstar

Abiy’s war aims meet geopolitics

As a two-months-old ceasefire with fighters in the northern Tigray region risks unravelling, Prime Minister Abiy Ahmed is grappling with multiple national and international contradictions.

At home, he is trying to balance ethnic Oromo interests against those of the Amhara militias, who are bridling at the ceasefire. Internationally, he generally supports Russia's President Vladimir Putin but is also trying to regain some backing from the West. That has become much harder in the current geopolitics. Not only does Abiy's government face financial restrictions and strong criticism over human rights from the European Union and the United States over its war in Tigray, western officials have also criticised Ethiopia's stance on Moscow's invasion of Ukraine.

During the first Cold War, Ethiopia often played off the US against the Soviet Union, getting support from both Washington and Moscow. But Ethiopia's relations with the US and the EU crashed following the outbreak of war in the Tigray region in November 2020.

Abiy was deeply angered by western criticism of his policies towards Tigray and of the war. Western aid flows were frozen or cancelled, including €90 million (US$96m) of EU budgetary support in December 2020. In the face of international criticism of his blockade of Tigray in 2021, he accused international aid agencies of collaborating with 'terrorists', by which he means the Tigray People's Liberation Front (TPLF) and the Oromo Liberation Army-Shene...

ConCourt hears of ‘human catastrophe’ after Eskom cuts off municipalities owing billions

(Photo: Adobe Stock / Rawpixel)

By Ray Mahlaka

29 May 2022

Eskom has cut the electricity supply of two local municipalities that collectively owe R2.8bn, causing devastation for municipalities at the forefront of employment and economic activity.

Was Eskom justified in disconnecting power to local municipalities that owe it billions of rands in unpaid electricity bills and, in the process, causing harm to households and businesses that are not at fault and are being thrown into darkness?

And can Eskom unilaterally reduce power supply to municipalities in arrears or refuse them more electricity despite both parties being bound by long-standing electricity supply agreements?

These are questions that were before the Constitutional Court on 23 May as Eskom sought to overturn an earlier court’s ruling that forced it to fully restore electricity to two municipalities that collectively owe it R2.8-billion. The heavily indebted municipalities are the Ngwathe Municipality in the Free State (owing Eskom R1.3-billion) and the Lekwa Municipality in Mpumalanga (owing R1.5-billion).

The Ngwathe and Lekwa local municipalities are deeply dysfunctional, Eskom has argued, as they haven’t paid for the electricity they have received, even though their customers/residents pay electricity bills on time. So, residents pay electricity fees on time via pay-as-you-go meters or monthly post-paid arrangements, but the municipalities are not handing over these payments to Eskom.

Ratepayers in the municipalities have argued at the Constitutional Court that Eskom’s “irrational and unreasonable” decision to disconnect their power has caused “human and environmental catastrophes”, even though they were not at fault. In court papers, Herman van Eeden, who acts for associations representing ratepayers in the Ngwathe and Lekwa municipalities, says power disruptions have impacted essential services such as water supply and the functioning of sewage works, throwing the economies of the municipalities into a tailspin.

Crumbling economy and quality of life

In Lekwa (Standerton) alone, which has a population of about 115,000 and whose economy depends on agricultural activity, large employers are threatening to withdraw from the town because of power disruptions, which “will increase the already staggering unemployment rate”. At last count, the official youth unemployment rate in Lekwa was 35%, according to Statistics South Africa. An abattoir in the town faces permanent closure, putting 54 jobs at risk.

The short supply of water owing to Eskom power disruptions (also affecting the functioning of water pumps) has forced Lekwa residents to extract water from the raw sewage-filled Vaal River, which is the main water source for the whole of Gauteng.

Van Eeden says the quality of life for Lekwa residents has deteriorated.

“The Standerton Hospital does not have sufficient standby capacity [generator] to allow the facility to provide medical services in a Covid hot spot. The medicine in the local pharmacy may be lost. People in old-age homes, inter alia 43 people in frail care, may suffer inhumane deaths owing to the short supply of electricity.

“The 62 schools are unable to maintain standards of hygiene. The fire brigade cannot function. Shops are closing down and real-estate development is adversely affected…”

Efforts by Ngwathe and Lekwa residents to initiate talks with officials of Eskom, municipalities and respective provinces to restore electricity supply have been unsuccessful, says Van Eeden.

Test of Eskom’s reform process

The case at the top court will be a litmus test for Eskom’s ability to recover unpaid debt from municipalities, which stood at R40.9-billion by the end of September 2021. Without collecting debt from municipalities, which forms a crucial part of its revenue, Eskom cannot service its smothering debt load of more than R360-billion. And the power utility will be pushed to ask the government for more bailouts.

The debt by local municipalities has accumulated because, over the past decade, Eskom has been lax in its collection methods and continued to supply offending municipalities with electricity. This entrenched a culture of nonpayment among municipalities, households and businesses. Political leaders – too afraid to upset their voter base – have also refused to tell people they must pay for electricity.

But since he was appointed as Eskom CEO two years ago, André de Ruyter has intensified collection efforts, going to the extent of dragging municipalities to court to have their bank accounts and assets (such as furniture) attached to recover outstanding payments. De Ruyter has also taken a less adversarial approach, opting to stay out of court by entering into payment agreements with municipalities. In 2021, Eskom engaged with 45 municipalities to engineer a payment agreement. But the Maluti-A-Phofung municipality in the Free State, Eskom’s largest defaulter owing it R5.9-billion by the end of September 2021, snubbed the power utility’s payment plan proposal. Eskom has since dragged the Maluti-A-Phofung municipality to court.

Constitutional Court case

At the Constitutional Court, Eskom has argued that it should not be compelled to provide the Ngwathe and Lekwa municipalities with more electricity than what it has already provisioned for in its supply agreement with the municipalities.

On 28 September 2008, Eskom concluded an agreement with Ngwathe municipality that details the power utility’s responsibility of supplying bulk electricity to the municipality. This agreement, known as the Notified Maximum Demand (NMD) agreement, sets a maximum amount of power a municipality can draw from Eskom. NMD agreements can only be renegotiated if municipalities do not owe Eskom any money. The Lekwa municipality also has a similar agreement with Eskom. The municipality later renegotiated with Eskom to increase the maximum amount of electricity it can draw from the power utility to 22,260 kilowatts.

But the Lekwa and Ngwathe municipalities demanded and used more electricity from Eskom for many years, exceeding the maximum amount of electricity under their NMD agreements. Now both municipalities owe Eskom billions of rands, and the power utility is not prepared to give them more electricity until they settle their debt. In 2020, Eskom reduced the amount of electricity it supplies to Lekwa and Ngwathe municipalities, resulting in power cuts.

Ratepayers for the two municipalities took Eskom to the High Court in Pretoria in August 2020 to urgently block it from cutting power. The ratepayers won their case and Eskom was ordered to provide them with “full power”. Eskom is challenging the interdict at the ConCourt, saying energy regulator Nersa, and not the courts, has the legislative powers to resolve the dispute. Judgment is yet to be delivered.

To restore electricity to Lekwa and Ngwathe municipalities, Eskom says it would have to spend at least R21-million to improve the electricity infrastructure of the municipalities, which had deteriorated owing to a lack of investment and maintenance, and as a result of illegal connections. DM168

ConCourt hears of ‘human catastrophe’ after Eskom cuts off municipalities owing billions

(Photo: Adobe Stock / Rawpixel)

By Ray Mahlaka

29 May 2022

Eskom has cut the electricity supply of two local municipalities that collectively owe R2.8bn, causing devastation for municipalities at the forefront of employment and economic activity.

Was Eskom justified in disconnecting power to local municipalities that owe it billions of rands in unpaid electricity bills and, in the process, causing harm to households and businesses that are not at fault and are being thrown into darkness?

And can Eskom unilaterally reduce power supply to municipalities in arrears or refuse them more electricity despite both parties being bound by long-standing electricity supply agreements?

These are questions that were before the Constitutional Court on 23 May as Eskom sought to overturn an earlier court’s ruling that forced it to fully restore electricity to two municipalities that collectively owe it R2.8-billion. The heavily indebted municipalities are the Ngwathe Municipality in the Free State (owing Eskom R1.3-billion) and the Lekwa Municipality in Mpumalanga (owing R1.5-billion).

The Ngwathe and Lekwa local municipalities are deeply dysfunctional, Eskom has argued, as they haven’t paid for the electricity they have received, even though their customers/residents pay electricity bills on time. So, residents pay electricity fees on time via pay-as-you-go meters or monthly post-paid arrangements, but the municipalities are not handing over these payments to Eskom.

Ratepayers in the municipalities have argued at the Constitutional Court that Eskom’s “irrational and unreasonable” decision to disconnect their power has caused “human and environmental catastrophes”, even though they were not at fault. In court papers, Herman van Eeden, who acts for associations representing ratepayers in the Ngwathe and Lekwa municipalities, says power disruptions have impacted essential services such as water supply and the functioning of sewage works, throwing the economies of the municipalities into a tailspin.

Crumbling economy and quality of life

In Lekwa (Standerton) alone, which has a population of about 115,000 and whose economy depends on agricultural activity, large employers are threatening to withdraw from the town because of power disruptions, which “will increase the already staggering unemployment rate”. At last count, the official youth unemployment rate in Lekwa was 35%, according to Statistics South Africa. An abattoir in the town faces permanent closure, putting 54 jobs at risk.

The short supply of water owing to Eskom power disruptions (also affecting the functioning of water pumps) has forced Lekwa residents to extract water from the raw sewage-filled Vaal River, which is the main water source for the whole of Gauteng.

Van Eeden says the quality of life for Lekwa residents has deteriorated.

“The Standerton Hospital does not have sufficient standby capacity [generator] to allow the facility to provide medical services in a Covid hot spot. The medicine in the local pharmacy may be lost. People in old-age homes, inter alia 43 people in frail care, may suffer inhumane deaths owing to the short supply of electricity.

“The 62 schools are unable to maintain standards of hygiene. The fire brigade cannot function. Shops are closing down and real-estate development is adversely affected…”

Efforts by Ngwathe and Lekwa residents to initiate talks with officials of Eskom, municipalities and respective provinces to restore electricity supply have been unsuccessful, says Van Eeden.

Test of Eskom’s reform process

The case at the top court will be a litmus test for Eskom’s ability to recover unpaid debt from municipalities, which stood at R40.9-billion by the end of September 2021. Without collecting debt from municipalities, which forms a crucial part of its revenue, Eskom cannot service its smothering debt load of more than R360-billion. And the power utility will be pushed to ask the government for more bailouts.

The debt by local municipalities has accumulated because, over the past decade, Eskom has been lax in its collection methods and continued to supply offending municipalities with electricity. This entrenched a culture of nonpayment among municipalities, households and businesses. Political leaders – too afraid to upset their voter base – have also refused to tell people they must pay for electricity.

But since he was appointed as Eskom CEO two years ago, André de Ruyter has intensified collection efforts, going to the extent of dragging municipalities to court to have their bank accounts and assets (such as furniture) attached to recover outstanding payments. De Ruyter has also taken a less adversarial approach, opting to stay out of court by entering into payment agreements with municipalities. In 2021, Eskom engaged with 45 municipalities to engineer a payment agreement. But the Maluti-A-Phofung municipality in the Free State, Eskom’s largest defaulter owing it R5.9-billion by the end of September 2021, snubbed the power utility’s payment plan proposal. Eskom has since dragged the Maluti-A-Phofung municipality to court.

Constitutional Court case

At the Constitutional Court, Eskom has argued that it should not be compelled to provide the Ngwathe and Lekwa municipalities with more electricity than what it has already provisioned for in its supply agreement with the municipalities.

On 28 September 2008, Eskom concluded an agreement with Ngwathe municipality that details the power utility’s responsibility of supplying bulk electricity to the municipality. This agreement, known as the Notified Maximum Demand (NMD) agreement, sets a maximum amount of power a municipality can draw from Eskom. NMD agreements can only be renegotiated if municipalities do not owe Eskom any money. The Lekwa municipality also has a similar agreement with Eskom. The municipality later renegotiated with Eskom to increase the maximum amount of electricity it can draw from the power utility to 22,260 kilowatts.

But the Lekwa and Ngwathe municipalities demanded and used more electricity from Eskom for many years, exceeding the maximum amount of electricity under their NMD agreements. Now both municipalities owe Eskom billions of rands, and the power utility is not prepared to give them more electricity until they settle their debt. In 2020, Eskom reduced the amount of electricity it supplies to Lekwa and Ngwathe municipalities, resulting in power cuts.

Ratepayers for the two municipalities took Eskom to the High Court in Pretoria in August 2020 to urgently block it from cutting power. The ratepayers won their case and Eskom was ordered to provide them with “full power”. Eskom is challenging the interdict at the ConCourt, saying energy regulator Nersa, and not the courts, has the legislative powers to resolve the dispute. Judgment is yet to be delivered.

To restore electricity to Lekwa and Ngwathe municipalities, Eskom says it would have to spend at least R21-million to improve the electricity infrastructure of the municipalities, which had deteriorated owing to a lack of investment and maintenance, and as a result of illegal connections. DM168

ConCourt hears of ‘human catastrophe’ after Eskom cuts off municipalities owing billions

FEC approves NNPC, ECOWAS deal on Nigeria-Morocco gas pipeline

Vice President Yemi Osinbajo presided over the meeting of the Federal Executive Council(FEC)

The pipeline would traverse 15 West African countries to Morocco and Spain.

by Agency Report

June 1, 2022 | 2 min read

The Federal Executive Council (FEC) has given approval for the NNPC to enter into an agreement with ECOWAS for the construction of the Nigeria-Morocco Gas Pipeline.

Minister of State for Petroleum Resources, Timipre Sylva, briefed State House correspondents after the FEC meeting presided over by Vice President Yemi Osinbajo on Wednesday at the Presidential Villa, Abuja.

Mr Sylva said the project was still at the point of the front end engineering design after which the cost would be determined.

The pipeline would traverse 15 West African countries to Morocco and Spain.

“The Ministry of Petroleum Resources presented three memos to Council.

“The first memo, Council approved for the NNPC Ltd to execute MoU with ECOWAS for the construction of the Nigeria-Morocco Gas Pipeline.

“This gas pipeline is to take gas to 15 West African countries and to Morocco and through Morocco to Spain and Europe,’’ he said.

The minister said the council also approved the construction of a switchgear room and installation of power distribution cables and equipment for the Nigeria oil and gas park in Ogbia, Bayelsa, in the sum of N3.8billion.

He said the park was to support local manufacturing of components for the oil and gas industry.

More so, Mr Sylva said that FEC approved various contracts for the construction of an access road with bridges to the Brass Petroleum Product Deport in Inibomoyekiri in Brass Local Government in the sum of N11billion plus 7.5 per cent VAT.

The News Agency of Nigeria (NAN) reports that Nigeria-Morocco Gas Pipeline was proposed in a December 2016 agreement between the Nigerian National Petroleum Corporation (NNPC) and the Moroccan Office National des Hydrocarbures et des Mines (National Board of Hydrocarbons and Mines) (ONHYM).

The pipeline would connect Nigerian gas to every coastal country in West Africa (Benin, Togo, Ghana, Cote d’Ivoire, Liberia, Sierra Leone, Guinea, Guinea-Bissau, Gambia, Senegal and Mauritania), ending at Tangiers, Morocco, and Cádiz, Spain.

(NAN)

FEC approves NNPC, ECOWAS deal on Nigeria-Morocco gas pipeline

Vice President Yemi Osinbajo presided over the meeting of the Federal Executive Council(FEC)

The pipeline would traverse 15 West African countries to Morocco and Spain.

by Agency Report

June 1, 2022 | 2 min read

The Federal Executive Council (FEC) has given approval for the NNPC to enter into an agreement with ECOWAS for the construction of the Nigeria-Morocco Gas Pipeline.

Minister of State for Petroleum Resources, Timipre Sylva, briefed State House correspondents after the FEC meeting presided over by Vice President Yemi Osinbajo on Wednesday at the Presidential Villa, Abuja.

Mr Sylva said the project was still at the point of the front end engineering design after which the cost would be determined.

The pipeline would traverse 15 West African countries to Morocco and Spain.

“The Ministry of Petroleum Resources presented three memos to Council.

“The first memo, Council approved for the NNPC Ltd to execute MoU with ECOWAS for the construction of the Nigeria-Morocco Gas Pipeline.

“This gas pipeline is to take gas to 15 West African countries and to Morocco and through Morocco to Spain and Europe,’’ he said.

The minister said the council also approved the construction of a switchgear room and installation of power distribution cables and equipment for the Nigeria oil and gas park in Ogbia, Bayelsa, in the sum of N3.8billion.

He said the park was to support local manufacturing of components for the oil and gas industry.

More so, Mr Sylva said that FEC approved various contracts for the construction of an access road with bridges to the Brass Petroleum Product Deport in Inibomoyekiri in Brass Local Government in the sum of N11billion plus 7.5 per cent VAT.

The News Agency of Nigeria (NAN) reports that Nigeria-Morocco Gas Pipeline was proposed in a December 2016 agreement between the Nigerian National Petroleum Corporation (NNPC) and the Moroccan Office National des Hydrocarbures et des Mines (National Board of Hydrocarbons and Mines) (ONHYM).

The pipeline would connect Nigerian gas to every coastal country in West Africa (Benin, Togo, Ghana, Cote d’Ivoire, Liberia, Sierra Leone, Guinea, Guinea-Bissau, Gambia, Senegal and Mauritania), ending at Tangiers, Morocco, and Cádiz, Spain.

(NAN)

FEC approves NNPC, ECOWAS deal on Nigeria-Morocco gas pipeline

Gas starved Europe looks to Africa for new supplies as E&Ps reconsider shelved projects

May 12, 2022

Africa is conservatively forecast to reach peak gas production at 470 billion cubic meters (Bcm) by the late 2030s, equivalent to about 75% of the expected amount of gas produced by Russia in 2022, according to Rystad Energy research. In early March, the European Union announced it aims to reduce its dependence on Russian gas by two-thirds by the end of this year alone and is currently headed for a supply crunch that will reverberate around the globe.

Even with the number of gas projects being developed or currently delayed, Africa still has significant production potential. The continent is forecast to increase its gas output from about 260 Bcm in 2022 to as much as 335 Bcm by the end of this decade. If oil and gas operators decide to up the ante on their gas projects on the continent, near and mid-term natural gas production from Africa could surpass the above conservative forecasts.

Russia has historically been the dominant natural gas supplier to Europe, with an average of about 62% of overall gas imports to the continent over the past decade. Africa has also been a consistent gas exporter to Europe during that time, with an average of 18% of European gas imports coming from Africa.

Projects in Africa are, however, historically seen as having increased risk and can be delayed or go unsanctioned due to high development costs, challenges accessing financing, issues with fiscal regimes and other above-the-ground risks. Recent signals from oil and gas majors such as BP, Eni, Equinor, Shell, ExxonMobil and Equinor indicate a shift, however, in strategy towards further investment in Africa, with several projects that were previously on ice – including liquefied natural gas (LNG) projects – as they consider restarting or accelerating previously shelved projects in response to rising global demand.

“The geopolitical situation in Europe is changing the landscape for risk globally. While LNG flows from the US are substantial, demand is much higher. Asian and European importers will need to consider African priorities as they develop projects, as many African producers are focusing on supplying energy locally as well as to intra-African markets along with catering to global markets. Existing pipeline infrastructure from Northern Africa to Europe and historical LNG supply relationships make Africa a strong alternative for European markets, post the ban on Russian imports,” says Siva Prasad, senior analyst at Rystad Energy

Learn more with Rystad Energy’s GasMarketCube.

African nations that have historically been gas suppliers to Europe are well placed to scale up their exports. Africa’s advantage is that it already has existing pipelines connected with the wider European gas grid. Current pipeline exports from Africa to Europe run through Algeria into Spain and from Libya into Italy. Talks of long-distance pipelines connecting gas fields in Southern Nigeria to Algeria via the onshore Trans Saharan Gas Pipeline (TSGP) and the offshore Nigeria Morocco Gas Pipeline (NMGP) have picked up in recent months. While the TSGP aims to utilize existing pipelines from Algeria to tap into European markets, NMGP aims to extend the existing West Africa Gas Pipeline (WAGP) all the way to Europe via West African coastal nations and Morocco. Further afield, African LNG exports have predominantly come from Nigeria and Algeria, with smaller volumes from Egypt, Angola, and a fraction from Equatorial Guinea. In addition, large-scale discoveries offshore in Mozambique, Tanzania, Senegal, Mauritania, and South Africa have the potential to yield additional natural gas exports once developed.

Europe is now considering how gas-rich African nations can be helped to scale up production and exports in the years to come. The European Union’s decision earlier this year that all natural gas investments are equivalent to investments in “green” energy signal that African gas is considered sustainable. The supply crisis driven by security interests may push Europe to fund projects that will also help with energy affordability back home. For instance, Europe could be a key financer of the proposed $13-billion TSGP project.

BP’s Russia exit: A boost for uncontracted gas in Senegal-Mauritania

BP chief executive Bernard Looney has said the decision to exit Russia is not only the right thing to do but is also in the company's long-term interests. The UK giant recently booked pre-tax charges of $24 billion and $1.5 billion in its first-quarter 2022 financial results due to its decision to pull out of Russia. The company is now looking to African projects to seize the opportunity to target European markets with gas supplies.

BP has several big gas projects in Senegal and Mauritania – the Greater Tortue Ahmeyim (GTA), Yakaar-Terenga and BirAllah LNG projects. LNG volumes from the 2.5 million tonnes-per-annum (tps) GTA floating LNG (FLNG) Phase 1 have already been sold, and some gas from Yakaar will be used as feedstock for Senegal’s gas-to-power plant. Meanwhile, gas from GTA LNG Phase 2, the remaining gas from Yakaar–Teranga and BirAllah are still uncontracted and these volumes could benefit from what is expected to be a supply-constrained LNG market in the coming years. GTA FLNG Phase 2 has a planned capacity of 2.5 million tpa, while the Yakaar–Teranga and BirAllah LNG facilities could have capacity of 10 million tpa. However, front-end engineering and design (FEED) on Yakaar–Teranga, which was kicked off in November 2021, will determine the final capacity for the project, and BP is also currently carrying out studies to see whether to accelerate development of the Bir Allah project targeting sales to Europe. Like BP, other major companies might also look towards their African gas portfolios to address the likely gas supply deficit.

Eni plans ramp up of African gas to Italy

Italian major Eni has said that it can alleviate Europe’s dependence on Russian gas to an extent through supply from its African projects, including in Algeria, Egypt, Nigeria, Angola and Congo-Brazzaville. In the past month, Italy, in association with Eni, signed deals to boost gas imports from the North African nations of Algeria and Egypt, and then more recently, two more gas supply agreements with two Sub-Saharan African nations, Congo-Brazzaville and Angola. Other African nations where Eni holds important upstream portfolios on the back of which the Italian authorities could potentially sign gas-related deals include Mozambique, Nigeria, Ghana, Cote d’Ivoire and Libya. Nigeria is currently in the process of ramping up capacity at the Nigeria LNG project from 22 million to 30 million tpa through its Train 7 scheme and debottlenecking, and Eni is a stakeholder in many upstream fields that provide feed gas to the LNG plant as well as in the processing plant.

Equinor, Shell and ExxonMobil exit Russia: Re-focus for Mozambique and Tanzania LNG assets

Equinor, ExxonMobil and Shell, like BP, have significant LNG portfolios in Africa that are yet to be developed, and they can look to these massive gas resources to counter the potential gas supply deficit in the future. ExxonMobil has a 25% stake in Area 4 in Mozambique, with significant potential to add further expansion trains. Mozambique was expected to benefit from the EU’s move to classify gas investments as green, even after an Islamist insurgency in the gas-rich Cabo Delgado province had paralyzed planned investments. The current scenario of a potential gas supply crunch could see the country accelerate the development of its gas resources. The US major’s pullback from Russia could lead to it finally sanctioning its envisaged Rovuma LNG scheme in Mozambique.

The announced exits from Russia by Anglo-Dutch major Shell and Norwegian state-controlled giant Equinor could see the pair refocus on the long-stalled Tanzania LNG development. The increased demand for natural gas driven by the ongoing war in Ukraine and pullbacks from Russian supplies could also drive a renewed focus on exploration and development in Nigeria to feed these LNG exports over an extended period. Numerous other projects on the continent could also be fast-tracked to increase gas exports.

Gas starved Europe looks to Africa for new supplies as E&Ps reconsider shelved projects

Coca Cola sets up mega factory in Ethiopia, biggest in Africa

Published 3 days ago on June 3, 2022

By Akanimoh Etim

World’s biggest beverage manufacturers, Coca Cola, has inaugurated a new mega factory in the Sebta City of Ethiopia, which is reported to be the largest of such factories in Africa.

The $100 million factory which was inaugurated on Wednesday, is located 25 km from the capital, Addis Ababa, and is equipped with state of the art machinery and is expected to create 30,000 job opportunities for the youths of the country.

“Coca-Cola is 60-years-old in this country and plays an irreplaceable role as a factory in Ethiopia. Today, the establishment of this factory in this city is a testament to the development activities in Ethiopia,” the country’s Minister of Industry, Melaku Alebel, said at the inauguration of the factory.

The factory which has a daily production potential of 70,000 racks of 24 bottles, according to Bruno Pietracci, President of Africa for the Coca-Cola company, will bring the group’s total manufacturing capacity in the country to 100 million cases per year and will make the country a stronghold of the group’s presence on the continent.

“We have a project to better water usage across 41 countries in Africa; we benefit more than 6, 000 families today. The second area that I want to touch on is package recycling.

“We have the ambition that by 2030, we’ll take back every single bottle that we put into the market,” said Pietracci.

Coca-Cola has operated for more than 60 years in Ethiopia and now has a total of four factories in the country while on the African continent, the group has factories carrying out its bottling activities in 13 countries and employs nearly 16,000 people.

Coca Cola sets up mega factory in Ethiopia, biggest in Africa